|

市场调查报告书

商品编码

1842651

中国汽车租赁:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)China Vehicle Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

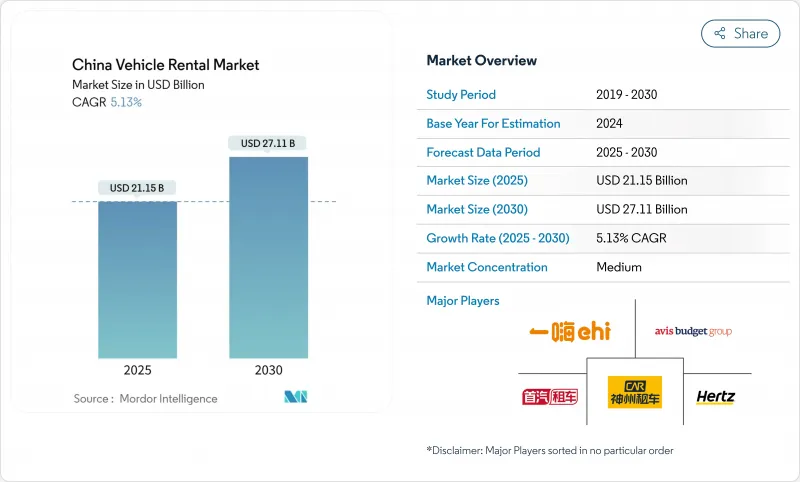

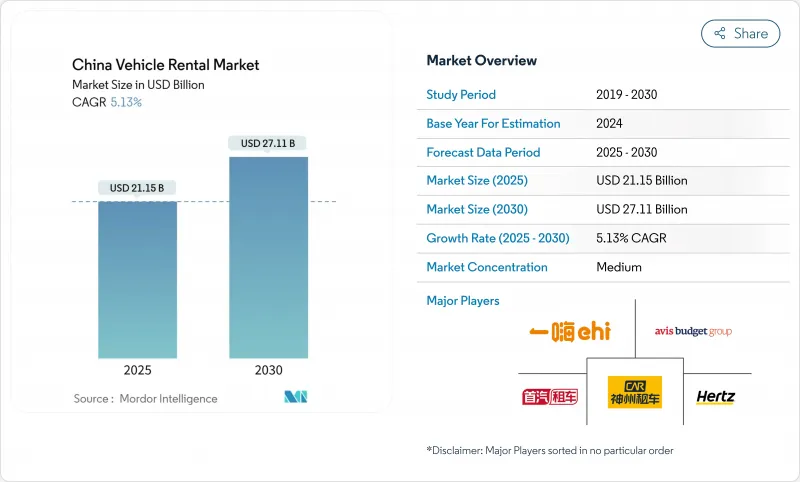

预计 2025 年中国汽车租赁市场价值将达到 211.5 亿美元,到 2030 年预计将达到 271.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.13%。

国内休閒旅游的復苏、一线城市车牌配额的收紧以及全国范围内80%新能源汽车的强制要求,将推动消费者和企业管道的需求。二、三线城市中阶驾照持有者数量的增长、人工智慧租车应用程式的快速普及以及政策向电动车型倾斜,正在以过去五年来最快的速度重塑汽车结构。

中国汽车租赁市场趋势与洞察

国内旅游业復苏推动休閒租赁市场

根据相关部门报告,2024年五一假期期间,国内旅客达2.95亿人次,消费超过200亿美元。休閒预订量激增,推动了县级旅游目的地的汽车需求。柳州和淄博等城市吸引了首次出行的游客,他们更倾向于选择私家车而非公共交通,导致许多内陆地区的平均租车时间超过四天。租车在四个月内获得了3000家国内供应商合作伙伴,彰显了其数位市场平台的扩充性优势。文化遗产地的夜间旅游活动即使在深夜也保持着高利用率,支撑了高端定价。文化和旅游部预测,到2025年,国内游客数量将超过60亿人次,证实了休閒是中国汽车租赁市场的支柱。

一线城市车牌分配刺激租赁需求

北京每年的私家车牌照摇号限额为10万个,其中70%预留给电动车。这些限制使得许多通勤者选择日租车辆比购买车辆更便宜。天津计画每年发放8万个绿色牌照,但仍维持对石化燃料的限制以缓解成本压力。牌照配额制已使受影响城市的消费量和废气排放减少了近50%,同时也催生了一群稳定的租车者,他们将汽车视为偶尔使用的公共设施,而非资产。该政策也使租车公司向电动车倾斜,从而强化了政府的碳排放目标,并重塑了中国的汽车租赁市场。

叫车和自动驾驶计程车替代风险

百度Apollo Go在2023年第四季成功完成83.9万次自动驾驶出行,票价比传统计程车低60%至70%,展现了颠覆性的定价策略。小马智行的目标是到2025年拥有1000辆自动驾驶汽车,而文远知行则于2025年2月推出了连接北京大兴国际机场的无人驾驶服务。机器人计程车业者拥有全天候服务以及较低的驾驶人相关费用的优势,吸引了那些先前选择租车接送机场和市区出行的人潮。顾问公司预测,到2030年,机器人计程车产业的规模将达到约760亿美元,这意味着除非现有企业能够获得自动驾驶领域的伙伴关係,否则中国汽车租赁市场将面临竞争阻力。

細項分析

2024年,休閒旅游将占中国汽车租赁市场份额的51.27%,这得益于度假出行增长7.6%以及人们对县级文化景点重新燃起的兴趣。自驾车是短程自驾游和家庭聚会的首选,尖峰时段平均入住率可达74%。商务旅行预计将以5.22%的复合年增长率成长,这将受益于边境重新开放以及企业ESG目标倾向于租赁而非拥有汽车。

休閒旅客的预订时间比疫情前平均时间延长了2.1天,而商务旅客也越来越多地选择捆绑了远端资讯处理和排放气体仪錶板报告的专车套餐。平台与景点的整合实现了一键式车辆和门票捆绑,从而扩大了每次租赁的收益窗口。

到2024年,线上预订将占总收益的64.38%,证明无摩擦移动旅行已成为主流,到2030年,其复合年增长率将达到5.41%。预测定价引擎将搜寻到预订的时间缩短至平均四分钟,辅助提升销售增加18%,并提升每位客户的终身价值。此外,全通路交接站允许顾客透过QR码领取钥匙,无需店员协助,缩小了便利性差距。

持续投资于云端客户关係管理和车载物联网感测器,将使用数据反馈至平台,从而实现跨区域的当日库存週转。因此,使用动态线上叫车服务的车队营运商比依赖静态线下预订的同业每辆车的收入高出12%,预计这一差距将在中国汽车租赁市场进一步扩大。

受自由行文化和日益增长的驾驶信心的推动,到2024年,自驾合约将占总销售额的71.32%。然而,企业采购团队正以每年5.45%的比例转向带司机套餐,因为他们认为这种套餐更安全,更符合ESG审核。带司机车辆的新能源汽车渗透率超过60%,高于整体平均水平,非常适合北京和深圳中央商务区的低排放气体区域。

自动驾驶持续强劲成长,这得益于家庭友善行程、户外露营趋势以及在陌生地区使用应用程式导航的便利性。同时,专车服务产品也正在多元化发展,涵盖活动物流和往返香港的跨境接驳车,从而扩大了中国汽车租赁市场的潜在需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 国内旅游业復苏推动休閒租赁市场

- 一线城市车牌分配推动租赁需求

- 拥有驾照的中阶日益壮大

- 强制车辆电气化开启零排放区

- 转向数位和行动预订平台

- 企业 ESG 目标推动长期绿色合约

- 市场限制

- 被叫车和自动驾驶计程车取代的风险

- 车辆购置和资金筹措成本上升

- 各州牌照分配波动扰乱车队物流

- 电动车残值的不确定性会对盈利造成压力

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测

- 按用途

- 休閒/旅游

- 商务旅行

- 按预订类型

- 离线访问

- 线上查询

- 按最终用户

- 自己

- 包括司机

- 按车辆类别

- 经济

- 中檔

- 奢华

- SUV/MPV

- 按动力传动系统

- 内燃机(ICE)

- 混合动力汽车(HEV)

- 纯电动车(BEV)

- 按租赁期限

- 短期(少于一週)

- 中期(1週至1个月)

- 长期(1个月或以上)

- 按服务管道

- 机场内

- 机场/市中心外

- 按地区

- 华东地区

- 中国中南部

- 中国北方

- 中国西部

- 中国东北地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Beijing China Auto Rental(CAR Inc.)

- eHi Car Service

- Shouqi Car Rental

- Avis Budget Group

- Hertz Corporation

- Shenzhen Topone Car Rental

- Didi Car Rental

- EVCard

- Gofun Travel

- Xiangdao Chuxing

- UCAR Inc.

- Zuzuche

- Caocao Mobility

- PonyCar

- T3 Go Mobility

- Shenzhou Joy Travel

- Tongcheng-Elong Car Rental

- Huizuche

- Hello Chuxing Car Rental

- Meituan Car Rental

第七章 市场机会与未来展望

The China Vehicle Rental Market size is estimated at USD 21.15 billion in 2025, and is expected to reach USD 27.11 billion by 2030, at a CAGR of 5.13% during the forecast period (2025-2030).

A rebound in domestic leisure travel, stricter license-plate quotas in tier-1 cities, and a nationwide 80% new-energy fleet mandate are aligning to keep demand elevated across consumer and corporate channels. Rising middle-class licensed-driver numbers in tier-2 and tier-3 cities, the rapid diffusion of AI-enabled booking apps, and a policy tilt toward electric models are reshaping fleet composition faster than in any prior five-year period.

China Vehicle Rental Market Trends and Insights

Domestic Tourism Rebound Fuels Leisure Rentals

Leisure bookings surged after authorities reported 295 million domestic trips during the 2024 May Day holiday, spending more than 20 billion and lifting vehicle demand in county-level destinations. Cities such as Liuzhou and Zibo attracted first-time visitors who preferred self-drive access over public transport, pushing average rental duration above four days in many inland locations. Zuzuche responded by onboarding 3,000 domestic supplier partners inside four months, demonstrating the platform scalability advantage of digital marketplaces. Cultural-nighttime tourism at heritage sites kept utilization high into late evenings, supporting premium pricing windows. Momentum remains intact as the Ministry of Culture and Tourism forecasts domestic trips to exceed 6 billion in 2025, cementing leisure as the backbone of the China vehicle rental market.

License-Plate Quotas in Tier-1 Cities Spur Rental Demand

Beijing's annual lottery caps private cars at 100,000 new plates, 70% reserved for EVs, while Shanghai auctions often exceed CNY 95,000 per plate. These restrictions make daily rental cheaper than ownership for many commuters. Tianjin plans to issue 80,000 more green plates yearly but retains fossil-fuel limits, keeping cost pressure in place. Plate quotas have cut fuel consumption and tailpipe emissions by nearly 50% in affected cities, but they have simultaneously created a reliable flow of renters who view cars as occasional utilities rather than assets. The policy also skews fleets toward EVs, reinforcing government carbon goals and reshaping the China vehicle rental market.

Ride-Hailing & Robotaxi Substitution Risk

Baidu's Apollo Go completed 839,000 autonomous rides in Q4 2023 at fares 60-70% beneath traditional taxis, illustrating a disruptive price gap. Pony.ai targets a 1,000-vehicle fleet by 2025, while WeRide launched unmanned services linking Beijing Daxing International Airport in February 2025. Robotaxi operators benefit from 24/7 availability and lower driver-related expenses, diverting demand that historically favored rentals for airport transfers and intra-city errands. Consultancy forecasts place the robotaxi segment at nearly USD 76 billion by 2030, signalling competitive headwinds for the China vehicle rental market if incumbents cannot secure autonomous partnerships.

Other drivers and restraints analyzed in the detailed report include:

- Growing Licensed-Driver Middle Class

- Shift to Digital & Mobile Booking Platforms

- Rising Vehicle Acquisition & Financing Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Leisure and tourism held 51.27% of China vehicle rental market share in 2024, underpinned by a 7.6% jump in holiday trips and renewed interest in county-level cultural sites. Short road vacations and family reunions make self-drive cars the preferred option, driving average utilization to 74% during peak weeks. Business travel trails in absolute size but records the highest growth; its projected 5.22% CAGR benefits from border reopenings and corporate ESG targets favoring rental over owned fleets.

Second-order effects are already visible in spending patterns: leisure customers reserve 2.1 days longer than pre-pandemic averages, while business travelers increasingly opt for chauffeur-driven packages that bundle telematics and emissions dashboards for reporting purposes. Platform integrations with tourist attractions enable one-click car plus ticket bundles, extending the monetization window per rental.

Online reservations captured 64.38% of revenue in 2024-proof that frictionless mobile journeys have become table stakes, it is also growing at a CAGR of 5.41% through 2030. Predictive pricing engines reduce search-to-booking windows to four minutes on average and increase ancillary upselling by 18%, raising lifetime value per customer. Offline stores still matter in lower-tier cities where walk-in foot traffic remains notable, but omnichannel hand-over stations now allow QR-code key retrieval without staff, closing the convenience gap.

Investment continues to tilt toward cloud CRM and in-car IoT sensors that feed usage data back to the platform, enabling same-day inventory rotation across multiple districts. As a result, fleet operators using dynamic online allocation achieve 12% higher revenue-per-vehicle than peers relying on static offline reservations, a differential expected to expand in the China vehicle rental market.

Self-drive contracts controlled 71.32% of total revenue in 2024, fuelled by the cultural preference for independent travel and growing confidence behind the wheel. Yet chauffeur-driven packages advance at 5.45% annually because corporate procurement teams view them as safer and more compliant with ESG audit trails. Chauffeur fleets feature NEV penetration above 60%, exceeding the broader average and positioning them well for low-emission zones in Beijing or Shenzhen Central Business Districts.

Self-drive growth remains robust through family-oriented itineraries, outdoor camping trends, and the ease of app-based navigation in unfamiliar provinces. Simultaneously, chauffeur products diversify into event logistics and cross-border shuttles into Hong Kong, expanding addressable demand inside the China vehicle rental market.

The China Vehicle Rental Market Report is Segmented by Application (Leisure/Tourism and Business Travel), Booking Type (Offline Access and Online Access), End-User Type (Self-Driven and Chauffeur-Driven), Vehicle Class (Economy and More), Powertrain (ICE, HEV and BEV), Rental Duration (Short-Term and More), Service Channel (On-Airport and More), and Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Beijing China Auto Rental (CAR Inc.)

- eHi Car Service

- Shouqi Car Rental

- Avis Budget Group

- Hertz Corporation

- Shenzhen Topone Car Rental

- Didi Car Rental

- EVCard

- Gofun Travel

- Xiangdao Chuxing

- UCAR Inc.

- Zuzuche

- Caocao Mobility

- PonyCar

- T3 Go Mobility

- Shenzhou Joy Travel

- Tongcheng-Elong Car Rental

- Huizuche

- Hello Chuxing Car Rental

- Meituan Car Rental

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Domestic tourism rebound fuels leisure rentals

- 4.2.2 License-plate quotas in Tier-1 cities spur rental demand

- 4.2.3 Growing licensed-driver middle class

- 4.2.4 Fleet-electrification mandates open zero-emission zones

- 4.2.5 Shift to digital & mobile booking platforms

- 4.2.6 Corporate ESG targets drive long-term green subscriptions

- 4.3 Market Restraints

- 4.3.1 Ride-hailing & robotaxi substitution risk

- 4.3.2 Rising vehicle acquisition & financing costs

- 4.3.3 Provincial plate-quota volatility disrupts fleet logistics

- 4.3.4 EV residual-value uncertainty pressures profitability

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Application

- 5.1.1 Leisure / Tourism

- 5.1.2 Business Travel

- 5.2 By Booking Type

- 5.2.1 Offline Access

- 5.2.2 Online Access

- 5.3 By End-User Type

- 5.3.1 Self-Driven

- 5.3.2 Chauffeur-Driven

- 5.4 By Vehicle Class

- 5.4.1 Economy

- 5.4.2 Mid-Scale

- 5.4.3 Luxury

- 5.4.4 SUV / MPV

- 5.5 By Powertrain

- 5.5.1 Internal Combustion Engine (ICE)

- 5.5.2 Hybrid Electric Vehicle (HEV)

- 5.5.3 Battery Electric Vehicle (BEV)

- 5.6 By Rental Duration

- 5.6.1 Short-Term (Less than or equal to 1 Week)

- 5.6.2 Medium-Term (1 Week to 1 Month)

- 5.6.3 Long-Term (More than 1 Month)

- 5.7 By Service Channel

- 5.7.1 On-Airport

- 5.7.2 Off-Airport / Downtown

- 5.8 By Region

- 5.8.1 East China

- 5.8.2 South-Central China

- 5.8.3 North China

- 5.8.4 West China

- 5.8.5 Northeast China

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Beijing China Auto Rental (CAR Inc.)

- 6.4.2 eHi Car Service

- 6.4.3 Shouqi Car Rental

- 6.4.4 Avis Budget Group

- 6.4.5 Hertz Corporation

- 6.4.6 Shenzhen Topone Car Rental

- 6.4.7 Didi Car Rental

- 6.4.8 EVCard

- 6.4.9 Gofun Travel

- 6.4.10 Xiangdao Chuxing

- 6.4.11 UCAR Inc.

- 6.4.12 Zuzuche

- 6.4.13 Caocao Mobility

- 6.4.14 PonyCar

- 6.4.15 T3 Go Mobility

- 6.4.16 Shenzhou Joy Travel

- 6.4.17 Tongcheng-Elong Car Rental

- 6.4.18 Huizuche

- 6.4.19 Hello Chuxing Car Rental

- 6.4.20 Meituan Car Rental

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment