|

市场调查报告书

商品编码

1836456

美国汽车租赁:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)US Car Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

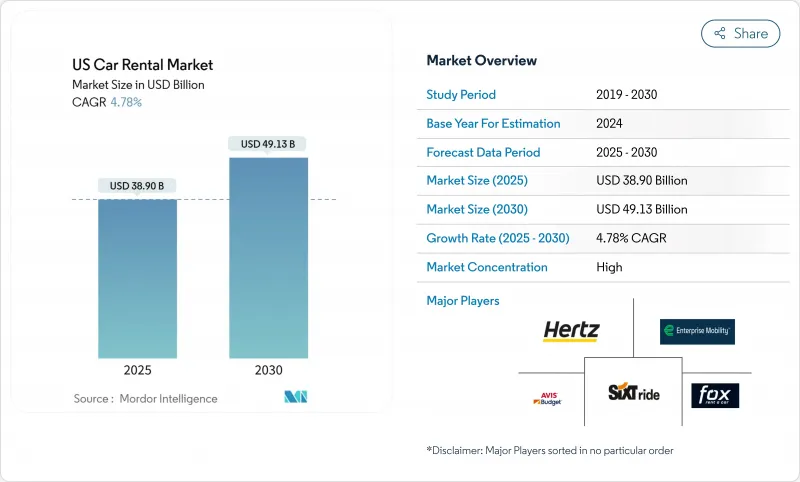

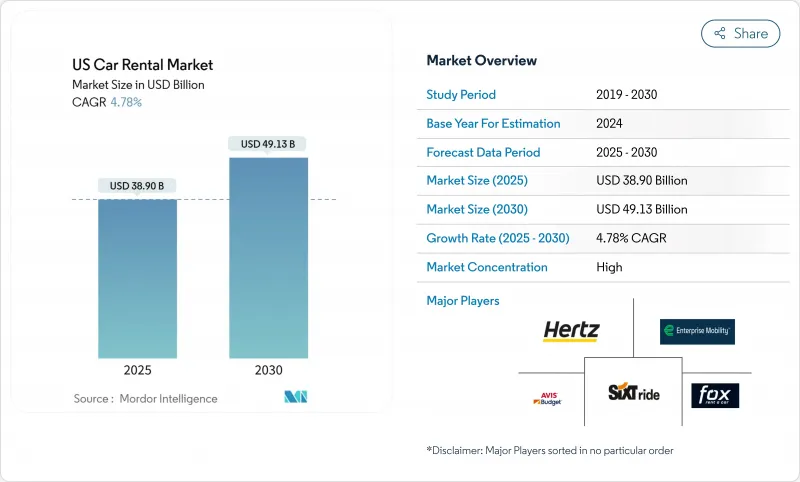

预计到 2025 年美国汽车租赁市场价值将达到 389 亿美元,到 2030 年将达到 491.3 亿美元,复合年增长率为 4.78%。

这一成长轨迹凸显了该行业的韧性,因为国内自驾游文化的回归、混合办公模式和麵对面会议的兴起,恢復了稳定的租赁需求。成长的动力来自72.23%的线上预订管道渗透率、南部地区的高出行量以及加速推进的汽车电气化计划,这些计划吸引了休閒和商务旅客。同时,持续的车辆供应限制和不断上升的资本成本正在限制短期扩张,促使营运商优化车队组合併实施数据主导的定价。来自P2P市场和叫车服务的日益激烈的竞争,正促使现有企业投资于非接触式体验、预测分析和多元化的服务模式。

美国汽车租赁市场趋势与洞察

国内休閒休閒需求快速成长

日益增长的出行需求和精打细算的出行者使得汽车成为休閒出行的首选,从而提升了休閒细分市场的份额。为此,营运商正在增加SUV和跨界车的库存,这些车型的日租金更高,更能满足家庭出行的需求。南部和西部地区仍然是热门目的地,国家公园和风景优美的沿海路线推动稳定的需求。这些大型车辆的燃油效率不断提高,加上诱人的忠诚度计画福利,使得租赁车辆对于休閒出行而言比购车更具吸引力。

线上和行动预订管道快速成长

如今,数位化便利性已成为每一次预订的基础,也印证了App体验的永久转型。早期采用者正在实施非接触式取车、人工智慧聊天机器人和一键支付流程,以推动回头客业务和高附加服务附加率。赫兹租车公司已在美国所有门市推出Apple Pay,显示精简的支付方式能够缩短柜檯时间并提升顾客满意度。行动优先的介面还能根据本地事件进行动态定价,进而增强收益管理。从使用者旅程中收集的数据会输入预测模型,以近乎即时地重新分配车辆,从而提高运转率并降低资本强度。

新车供应持续受限,资本支出高企

由于信贷紧缩增加了借贷成本并挤压了营运商的现金流,到 2024 年,车队采购的融资利率大幅上升。晶片短缺和有利于零售买家的 OEM 配额限制了车队交付,迫使租赁公司延长持有期或以高价争夺二手二手车。不断上升的购买成本挤压了净利率并使定价策略复杂化,尤其是在客户仍然对价格敏感的情况下。经济型车型的稀缺性(OEM 优先考虑利润率更高的车型)正推动租赁客户转向更大的车辆,从而提高了每日费率并降低了折旧免税额。车队经理现在将更多资源投入转售中,因为他们意识到转售时机决定了动盪的批发市场的盈利。

报告中分析的其他驱动因素和限制因素

- 原始设备製造商推动租赁车队电气化

- 混合工作公司对灵活车队租赁的需求

- 低价中国电动车进口带来的残值风险

細項分析

休閒汽车租赁将占 2024 年销售额的 58.32%,成为美国汽车租赁市场最大的收入来源,预计到 2030 年的复合年增长率为 5.32%。公路旅行文化、国家公园旅游以及混合工作政策下的弹性休假时间将增加租赁时长并提高平均每日房价 (ADR) 的表现。

随着专业将商务旅行延长用于个人休閒,延长合约期限并提高盈利,休閒旅行正蓬勃发展。对于现有饭店企业而言,将免费升等忠诚度福利打包出售,可以鼓励顾客留在品牌生态系统内,同时提高平季的运转率。由此带来的利用率提升,即使在购置成本增加的情况下,也能支持其实现投资回报目标。

经济型车型仍占据车队总数的主导地位,占59.87%。然而,SUV和跨界车类别的复合年增长率达到12.48%,由于消费者更重视空间和感知安全性,收益结构。业者利用大型车辆日均房价上涨的优势,抵销车队采购带来的通膨成本。

原厂生产转向高阶车型限制了经济型汽车的供应,迫使租赁公司在客户预算和车辆供应之间寻找平衡。如今,远端资讯处理技术指导着微型车队的配置,将SUV车型部署在家庭出行需求高峰期。这项策略最大限度地提高了车辆利用率,减少了车辆重新部署里程,即使在法定保费上涨的情况下,也有助于降低营运成本。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 国内自驾游/休閒需求快速成长

- 线上和行动预订管道快速成长

- 原始设备製造商电动化租赁车辆

- 混合动力公司对灵活车队租赁的需求

- P2P供应扩张和价格发现

- 透过远端资讯处理优化营运成本

- 市场限制

- 新车供应持续受限,资本支出高企

- 低价中国电动车进口带来的残值风险

- 机场特许经营和地方税收成本上升

- 透过叫车服务和固定费率 MaaS 实现模式替代

- 价值/供应链分析

- 技术展望

- 监管状况

- 五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模与成长预测:价值(美元)

- 按用途

- 休閒旅游

- 商业和企业

- 按车辆类型

- 经济型和廉价型汽车

- 豪华和高级汽车

- SUV与跨界车

- 透过预订管道

- 线上(网页和应用程式)

- 离线(柜檯和电话)

- 按租赁期限

- 短期(30天以内)

- 长期/定期(30天或以上)

- 透过促销

- 内燃机汽车

- 油电混合车

- 纯电动车

- 按服务模式

- 传统企业车队

- P2P平台

- 按地区

- 东北

- 中西部

- 南部

- 西

第六章 竞争态势

- 市场集中度

- 策略倡议和伙伴关係

- 市占率分析

- 公司简介

- Enterprise Holdings Inc.

- Hertz Global Holdings Inc.

- Avis Budget Group Inc.

- Sixt SE

- Fox Rent A Car

- Ace Rent A Car

- Advantage Rent A Car

- U-Save Car & Truck Rental

- Turo Inc.

- Getaround Inc.

- Kyte

- HyreCar Inc.

第七章 市场机会与未来展望

The US Car Rental market is valued at USD 38.90 billion in 2025 and is projected to reach USD 49.13 billion by 2030, expanding at a 4.78% CAGR.

The trajectory underscores the sector's resilience as domestic road-trip culture, hybrid-work patterns, and a swing back toward in-person meetings restore steady rental demand. Growth is reinforced by the 72.23% penetration of online booking channels, the South region's outsized traveler volumes, and accelerated fleet electrification programs that draw leisure and corporate customers. At the same time, persistent vehicle supply constraints and rising capital costs temper near-term expansion, prompting operators to optimize fleet mix and pursue data-driven pricing. Heightened competition from peer-to-peer marketplaces and ride-hailing services is nudging incumbents to invest in contactless experiences, predictive analytics, and diversified service models.

US Car Rental Market Trends and Insights

Surge in Domestic Road-Trip Leisure Demand

Pent-up wanderlust and cost-sensitive travelers have made cars the preferred mode for leisure trips, lifting the leisure segment. In response, operators are broadening their inventories to include more SUVs and crossovers, which command higher daily rental rates and cater better to family travel needs. The South and West remain hotspots, with national parks and scenic coastal routes driving consistent demand. Enhanced fuel efficiency in these larger vehicles, coupled with enticing loyalty program benefits, is making rentals more appealing than ownership for leisure trips.

Rapid Growth of Online & Mobile Booking Channels

Digital convenience now underpins all reservations, confirming a lasting pivot toward app-based experiences. Fast-acting firms introduced contactless pick-up, AI chatbots, and one-tap payment flows, driving repeat usage and higher ancillary-service attachment rates. Hertz's rollout of Apple Pay across US locations shows how streamlined payment options reduce counter time and boost customer satisfaction. Mobile-first interfaces also enable dynamic pricing that reacts to localized events, bolstering yield management. The data captured from user journeys feeds predictive models that reposition fleet units in near real time, lifting utilization ratios and moderating capital intensity.

Persistent New-Vehicle Supply Constraints & High CAPEX

Financing rates for fleet purchases surged during 2024 as monetary tightening raised borrowing costs, squeezing cash flows for operators. Chip shortages and OEM allocations that favor retail buyers have limited fleet deliveries, forcing rental firms to extend holding periods or compete for late-model used cars at premium prices. Elevated acquisition costs compress margins and complicate pricing strategies, especially when customers remain price sensitive. The scarcity of economy trims-OEMs have prioritized higher-margin variants-nudges renters toward bigger vehicles, driving higher daily rates and reducing depreciation. Fleet managers now dedicate more resources to remarketing execution, acknowledging that resale timing can determine profitability in a volatile wholesale market.

Other drivers and restraints analyzed in the detailed report include:

- OEM-Backed Electrification of Rental Fleets

- Flexible Fleet-Leasing Demand from Hybrid-Work Corporations

- Residual-Value Risk from Low-Priced Chinese EV Imports

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Leisure rentals captured 58.32% of 2024 revenue, generating the largest US car rental market income slice and posting a 5.32% CAGR outlook through 2030. Road trip culture, national park tourism, and flexible vacation timing under hybrid work policies lengthen rental durations and boost average daily rate (ADR) performance.

Leisure travel is adding momentum as professionals extend work trips for personal recreation, lengthening contracts and enhancing profitability. For incumbents, packaging loyalty benefits such as free class upgrades encourages customers to stay within the brand ecosystem while reinforcing occupancy during shoulder periods. The resulting utilization gains support capital-return targets even as acquisition outlays rise.

Economy models still dominate fleet counts with a 59.87% share. Yet the SUV and crossover category, noted for 12.48% CAGR, is redefining revenue mix as customers prioritize space and perceived safety. Operators capitalize on higher ADRs for larger vehicles, offsetting inflationary costs in fleet procurement.

OEM production shifts toward premium trims constrain economy-car supply, forcing rental companies to balance customer budgets against availability. Telematics now guides micro-fleet allocation, positioning SUVs where family vacation demand peaks. The strategy maximizes utilization and lowers repositioning miles, contributing to reduced operating expenses even as statutory insurance premiums climb.

The US Car Rental Market Report is Segmented by Application (Leisure and Tourism and Business and Corporate), Vehicle Type (Economy and Budget Cars, and More), Booking Channel (Online and Offline), Rental Duration (Short-Term, and More), Propulsion (ICE Vehicles, and More), Service Model (Traditional Corporate Fleets and Peer-To-Peer Platforms), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Enterprise Holdings Inc.

- Hertz Global Holdings Inc.

- Avis Budget Group Inc.

- Sixt SE

- Fox Rent A Car

- Ace Rent A Car

- Advantage Rent A Car

- U-Save Car & Truck Rental

- Turo Inc.

- Getaround Inc.

- Kyte

- HyreCar Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in domestic road-trip/leisure demand

- 4.2.2 Rapid growth of online & mobile booking channels

- 4.2.3 OEM-backed electrification of rental fleets

- 4.2.4 Flexible fleet-leasing demand from hybrid-work corporates

- 4.2.5 Peer-to-peer supply expansion & price discovery

- 4.2.6 Telematics-driven OPEX optimisation

- 4.3 Market Restraints

- 4.3.1 Persistent new-vehicle supply constraints & high CAPEX

- 4.3.2 Residual-value risk from low-priced Chinese EV imports

- 4.3.3 Escalating airport concession & local taxation costs

- 4.3.4 Modal substitution by ride-hailing & subscription MaaS

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Application

- 5.1.1 Leisure and Tourism

- 5.1.2 Business and Corporate

- 5.2 By Vehicle Type

- 5.2.1 Economy and Budget Cars

- 5.2.2 Luxury and Premium Cars

- 5.2.3 SUVs and Crossovers

- 5.3 By Booking Channel

- 5.3.1 Online (Web & App)

- 5.3.2 Offline (Counter & Phone)

- 5.4 By Rental Duration

- 5.4.1 Short-Term (less than 30 days)

- 5.4.2 Long-Term and Subscription (more than 30 days)

- 5.5 By Propulsion

- 5.5.1 ICE Vehicles

- 5.5.2 Hybrid-Electric Vehicles

- 5.5.3 Battery-Electric Vehicles

- 5.6 By Service Model

- 5.6.1 Traditional Corporate Fleets

- 5.6.2 Peer-to-Peer Platforms

- 5.7 By Geography

- 5.7.1 Northeast

- 5.7.2 Midwest

- 5.7.3 South

- 5.7.4 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves & Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Enterprise Holdings Inc.

- 6.4.2 Hertz Global Holdings Inc.

- 6.4.3 Avis Budget Group Inc.

- 6.4.4 Sixt SE

- 6.4.5 Fox Rent A Car

- 6.4.6 Ace Rent A Car

- 6.4.7 Advantage Rent A Car

- 6.4.8 U-Save Car & Truck Rental

- 6.4.9 Turo Inc.

- 6.4.10 Getaround Inc.

- 6.4.11 Kyte

- 6.4.12 HyreCar Inc.