|

市场调查报告书

商品编码

1683822

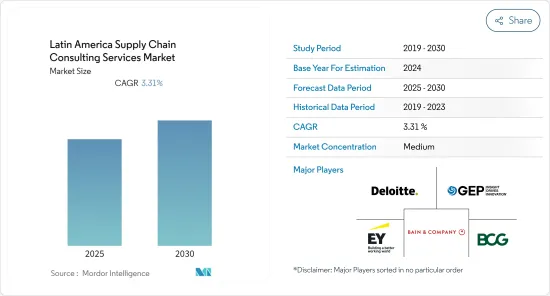

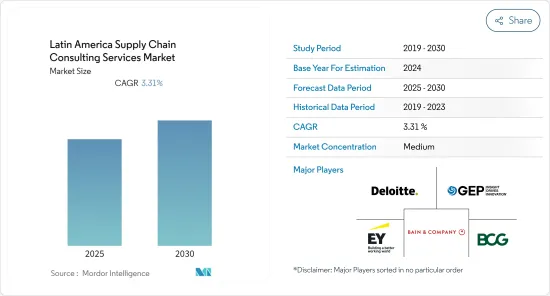

拉丁美洲供应链咨询服务:市场占有率分析、行业趋势和成长预测(2025-2030 年)Latin America Supply Chain Consulting Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计预测期内拉丁美洲供应链咨询服务市场复合年增长率为 3.31%。

主要亮点

- 我们针对进口产品的供应链咨询服务可协助公司管理组织内部原材料的流动、将原材料内部加工成最终产品的过程、以及将最终产品从组织运送到最终消费者的过程。这些服务还可以帮助公司识别潜在的供应链风险,例如供应链中断,并制定解决策略。此外,供应链咨询服务可以帮助您了解与产品进口相关的国际贸易法规和合规要求,并优化物料、资讯和资金流以提高成本效益。

- 根据联合国商品贸易统计资料5月公布的数据,2022年拉丁美洲和加勒比海地区的玩具进口额预计将达到73亿美元以上。墨西哥是2022年拉丁美洲最大的玩具进口国,进口总额超过32.6亿美元。拉丁美洲和加勒比海经济委员会(ECLAC)预测,2022年该地区出口将成长20%,其中出口额成长14%,出口量成长6%。进出口的大幅成长预计将为市场创造成长机会。

- 此外,电子商务严重依赖供应链管理来有效率且有效地向客户交付产品。电子商务供应链咨询服务包括提高物流和履约、库存管理和订单处理效率和降低成本的策略。我们还可以推荐供应链技术解决方案和外包服务,以优化您的供应链营运。与电子商务相关的其他典型应用包括电子资金转帐、网路行销和线上交易处理。重要的是要记住,电子商务供应链咨询策略和解决方案并不是一刀切的,必须根据每个公司独特的需求和挑战进行量身定制。

- 拉丁美洲的咨询定价取决于多种因素,包括所需咨询服务的类型、计划的复杂性以及咨询公司和/或顾问的经验和专业知识。影响定价的其他因素包括客户所在地、组织规模、计划的紧急程度以及国家或地区的经济状况。此外,由于生活成本、市场竞争和税收制度的差异,拉丁美洲国家和地区的咨询费用可能会有很大差异。与潜在的顾问公司讨论具体的定价因素对于确保透明和公平的定价结构非常重要。

- 新冠肺炎疫情对包括拉丁美洲在内的全球供应链产生了重大影响。儘管疫情在短期内造成了混乱和挑战,但一些专家预测,随着企业寻求替代的供应链合作伙伴,拉丁美洲国家可能会获得长期利益。一些报导称,随着企业从中国转移,东南亚和拉丁美洲正成为全球供应链的重要枢纽。此外,全球经济在疫情后復苏正在增加对来自拉丁美洲的商品的需求,这可能进一步提振该地区的供应链产业。然而,持续的劳动力市场挑战、长期的供应链挑战以及不断上升的通膨压力仍然是该地区令人担忧的问题。

拉丁美洲供应链咨询服务市场趋势

中小企业推动成长

- 中小型企业市场占整个企业应用整合市场的很大一部分,预计在预测期内仍将保持这一地位。其背景是,企业为了在竞争中取得优势与策略优势,加大对供应链咨询的力道。客户求助于供应链咨询来从不同的资料收集新的资讯。该服务非常适合做出与供应链相关的决策,并从大量资料中发现关键的联繫、实体和见解。

- 中小企业的合併为组织提供了显着成长的机会。透过开发和自动化供应链生态系统,中小型企业可以显着提高团队效率并扩大收入。

- 中小型企业利用供应链咨询来处理业务的各个方面,包括生产计画、库存管理、采购计划、需求预测和仓库设计。

- 此外,中小企业和家族企业在拉丁美洲的供应链中发挥关键作用,占公共就业的大多数,并为该地区的GDP贡献了很高的份额。它占该地区企业的99.5%,并创造了60%的工业就业机会。此外,它们占所有价值超过10亿美元的公司的75%,约占该地区国内生产总值的60%。此外,根据阿根廷政府发布的资料,2022年,该国中小微型企业总数为1,633,341家。

- 鑑于该地区前景的不确定性,供应链面临的风险将更大,因此必须考虑该地区的具体情况,并积极寻求避免不利影响的方法。受此影响,中小企业领域对供应链咨询的需求正在成长,预计在预测期内还会成长。

巴西主导供应链咨询服务市场

- 预计巴西将在预测期内实现显着成长,并占据大部分市场份额。

- 供应链咨询服务包括从提高供应链流程效率到确保您拥有适当的资源来满足客户需求以及寻找降低成本的方法等所有内容。供应链咨询的重要性已被证明在供应链业务对于当今全球经济中任何竞争的企业都至关重要。许多企业不断努力削减成本、提高效率,以便将节省的成本转嫁给客户,并在激烈的竞争中生存。因此,对业务流程改进和咨询以提高业务效率的需求日益增加。

- 在物流服务中实施IT解决方案对于整个供应链的顺畅和高效流动至关重要。 IT解决方案为供应链增加了经济价值。 IT解决方案对于供应链中货物的及时交付和追踪发挥着至关重要的作用。因此,预计 IT 解决方案和软体的采用将持续提高供应链咨询服务的效率和顺畅流程,为市场中的主要企业提供巨大的成长机会。

- 随着亚马逊等各类大型零售商的出现,巴西的供应链业务将会显着改善。儘管巴西拥有庞大的各种交通方式网络,但其交通矩阵仍不平衡,需要在多个领域进行现代化改造。针对此,巴西政府实施了多项倡议来改善交通和物流。这可能会在未来几年为巴西创造巨大的投资机会,从新创公司新兴企业到供应链服务。这些努力预计将推动该国供应链咨询服务市场的成长。

- 此外,随着电子商务需求的扩大,预计将成为该国供应链咨询服务进一步成长的补充市场。因此,各种公司都在该国投资并扩大其市场影响力。

- 此外,该地区对数位转型的需求日益增长,以确保企业在各自的市场中保持能力和目的性地创造价值。这些努力带动了该地区併购活动的活跃。预计这些发展将为该地区的供应链咨询服务市场提供成长前景。此外,在预测期内,各个终端用户产业对数位转型的供应链咨询服务的需求不断增长,可能会推动市场的发展。

拉丁美洲供应链咨询服务业概况

拉丁美洲供应链咨询服务市场中等分散,国内外参与者均拥有数十年的产业经验。供应商利用其专业知识采取了强有力的竞争策略,并且在广告上投入了大量资金。市场上一些知名的参与者包括Tohmatsu有限公司、波士顿顾问集团和贝恩公司。

- 2023年4月,安永宣布整合其拉丁美洲地区,使其能够推进其成长和发展计划,预计将加强安永在该地区四大会计师事务所中的市场领导地位。在这个新模式中,安永将汇集阿根廷、玻利维亚、巴西、哥伦比亚、哥斯大黎加、智利、厄瓜多、萨尔瓦多、瓜地马拉、宏都拉斯、墨西哥和其他地区 25,000 多名员工的技能和知识。

- 2022 年 10 月,Capgemini SA与德国和北欧商业智慧和资料科学服务提供者 Braincoat 签署了一份股份购买协议 (SPA)。透过此次收购,Capgemini SA望增强其需求资料和分析能力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 的影响与恢復

第五章 市场动态

- 市场驱动因素

- 供应链营运需要更好的可视性和控制力

- 优化减少浪费和延误

- 市场挑战

- 咨询费高昂,预测不准确

- 新兴使用案例和应用

- 技术简介

- 数位转型如何影响供应链

- 控制塔供应链的上升趋势

第六章 市场细分

- 按组织规模

- 中小型企业

- 大型企业

- 按最终用户产业

- 製造业

- 生命科学和医疗保健

- 资讯科技/通讯

- 政府

- 活力

- 其他最终用户产业

- 按国家

- 巴西

- 墨西哥

- 阿根廷

- 哥伦比亚

- 其他拉丁美洲国家

第七章 竞争格局

- 公司简介

- Deloitte Touche Tohmatsu Limited

- Boston Consulting Group

- Bain & Company

- Ernst & Young Services Limited

- Global Eprocure Limited

- Alvarez & Marsal Inc

- McKinsey & Company

- KPMG

- Infosys Limited

- Capgemini SE

- Tata Consultancy Services

- Accenture PLC

- Cognizant Technology Solutions Corporation

第八章投资分析

简介目录

Product Code: 5000215

The Latin America Supply Chain Consulting Services Market is expected to register a CAGR of 3.31% during the forecast period.

Key Highlights

- Supply chain consulting services on imported products can assist companies in managing the movement of raw materials in their organization, the internal processing of materials into finished goods, and the direction of finished goods out of their organization and toward the end consumer. These services can also help organizations identify potential supply chain risks, such as supply chain disruptions, and develop strategies for addressing them. Additionally, supply chain consulting services can support navigating international trade regulations and compliance requirements related to importing products and optimizing the flow of materials, information, and capital for cost efficiency.

- According to UN Comtrade's data released in May 2023, toy imports in Latin America and the Caribbean were estimated to reach over USD 7.3 billion in 2022. Mexico was the largest toy importer in Latin America in 2022, with imports totaling over USD 3.26 billion. The Economic Commission for Latin America and the Caribbean (ECLAC) forecasted a 20% increase in the value of regional exports in 2022, driven by a 14% increase in prices and a 6% increase in exported volumes. Such a huge rise in imports and exports is expected to create growth opportunities for the market studied.

- Further, e-commerce relies heavily on supply chain management to efficiently and effectively deliver customer products. Supply chain consulting services in e-commerce include strategies for improving efficiency and reducing costs in logistics and fulfillment, inventory management, and order processing. Supply chain technology solutions and outsourcing services might also be recommended to optimize supply chain operations. Other typical applications related to electronic commerce include electronic funds transfer, internet marketing, and online transaction processing. It is important to note that strategies and solutions for e-commerce supply chain consulting are not one-size-fits-all and must be tailored to individual companies' unique needs and challenges.

- Consulting pricing in Latin America is determined by various factors, including the type of consulting services required, the level of complexity of the project, and the experience and expertise of the consulting firm and its consultants. Other pricing factors may include the location and size of the client's organization, the urgency of the project, and the prevailing economic conditions in the country or region. Additionally, consulting rates may differ vastly between countries and regions in Latin America due to variations in the cost of living, market competition, and tax regulations. Discussing specific pricing factors with potential consulting firms is important to ensure a transparent and fair pricing structure.

- The COVID-19 pandemic has significantly impacted supply chains worldwide, including in Latin America. While the pandemic has caused disruptions and challenges in the short term, some experts predict that there may be long-term benefits for countries in Latin America as businesses look for alternative supply chain partners. According to some reports, Southeast Asia and Latin America are becoming key go-to places in the global supply chain as businesses shift away from China. Additionally, the rebound in the global economy following the pandemic has led to increased demand for commodities from Latin America, which could further boost the region's supply chain industry. However, persistent labor market challenges, lingering supply-chain challenges, and rising inflationary pressures continue to be concerns in the region.

Latin America Supply Chain Consulting Services Market Trends

SMEs Segment to Witness the Growth

- The small and medium-sized enterprise segment has a significant proportion of the total enterprise application integration market and is likely to maintain this trend during the forecast period. This is attributed to increased supply chain consulting by businesses seeking a competitive and strategic advantage over their competitors. Customers are using supply chain consulting to gather new information from diversified data. This service is appropriate for making supply chain-related decisions and getting insights over large amounts of data to discover significant connections, entities, and insights.

- Integration of Small and Medium-Sized Enterprises gives opportunities for major organizational growth. They may significantly improve team efficiency and expand their reach to scale their income by developing and automating the supply chain-related ecosystems.

- Small and Medium-Sized businesses utilize supply chain consulting such as in multiple aspects of the business, such as production planning, inventory management control, procurement planning, demand estimation, and warehouse design.

- Furthermore, SMEs and family-run companies play an essential role in the supply chains of the Latin America region, claiming the place for a predominant proportion of official employment and paying its noteworthy share to the GDP of the region. This boils down to 99.5% of the companies in the region, generating 60% of recognized industrious employment. Moreover, they amount to 75% of all companies valued at greater than USD 1 billion, which is around 60% of the region's total GDP (Gross Domestic Product). Moreover, according to the data released by the Government of Argentina, in 2022, the number of MSMEs in the country totaled 1,633,341.

- Given the indeterminate outlook in the region, the jeopardies in supply chains are bigger, and looking for ways to avoid negative effects actively, considering the characteristics of the region, becomes vital. This is why the demand for supply chain consulting has been growing for the small and medium-sized enterprises segment, which is anticipated to grow during the forecast period.

Brazil to Dominate the Supply Chain Consulting Services Market

- Brazil is expected to register significant growth during the forecast period and holds the major share of the market as well.

- Supply chain consulting services can involve anything from improving the efficiency of the supply chain process to ensuring that the organization has the right resources to meet customer demand and finding ways to reduce costs. The importance of Supply Chain Consulting has been proven effective for supply chain operations that are critical for any business competing in today's global economy. Many companies are constantly trying to reduce costs and increase efficiency to transfer the saved expenses to the customer and withstand the intense competition they face. This leads to increased demand for business process improvisations and consulting related to operational efficiency.

- Adopting IT solutions in logistics service is essential for the smooth and efficient flow of the entire supply chain. The IT solution adds economic value to the supply chain. IT solution plays a vital role in the timely delivery and tracing of goods in the supply chain. Thus, an increase in the adoption of IT solutions and software is anticipated to increase the efficiency and smoothen the flow of supply chain consulting services, providing a remarkable growth opportunity for the key players operating in the market.

- Due to the emergence of various large retailers such as Amazon, Brazil is expected to experience considerable improvement in supply chain operations. Irrespective of having a vast network of all modes of transportation, the transportation matrix in the country still needs to be balanced and requires modernization in several sectors. In line with this, the Government of Brazil has been implementing several initiatives to improve its transportation and logistics. This is likely to create immense opportunities for investment in the upcoming years in the country, ranging from the development of new enterprises to supply chain services. These initiatives are expected to promote the supply chain consultancy services market to grow in the country.

- Furthermore, in line with the growing demand for e-commerce, the market is expected to complement further growth of supply chain consultancy services in the country. In line with this, various companies have been investing in the country to strengthen their presence in the market.

- The region is also witnessing constant demand for digital transformation so that businesses can continue having the capacity and purpose to generate value for the respective markets. Such initiatives bring active mergers and acquisitions in the region. Such developments are analyzed to offer growth prospects to the region's supply chain consulting services market. In addition, the increasing demand for supply chain consulting services in various end-user industries for digital transformation will likely drive the market during the forecast period.

Latin America Supply Chain Consulting Services Industry Overview

The Latin America Supply Chain Consulting Services Market is moderately fragmented, with local and international players having decades of industry experience. The vendors are incorporating a powerful competitive strategy by leveraging their expertise and are also spending a large amount on advertising. Some of the prominent players in the market are Deloitte Touche Tohmatsu Limited, BCG/Boston Consulting Group, Bain & Company, etc.

- In April 2023, EY announced that it would be integrating the Latin American region, allowing it to promote growth and development plans that are anticipated to strengthen EY's position as the market leader among the Big 4 in the region. EY incorporates the skills and knowledge of more than 25,000 workers from Argentina, Bolivia, Brazil, Colombia, Costa Rica, Chile, Ecuador, El Salvador, Guatemala, Honduras, Mexico, and other regions in this new model.

- In October 2022, a share purchase agreement (SPA) was signed between Capgemini and Braincourt, a business intelligence and data science services provider in Germany and Northern Europe. Capgemini is looking forward to strengthening its in-demand data and analytics capabilities with this purchase.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of and Recovery from COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for better visibility and Control in Supply Chain Operations

- 5.1.2 Reduction of Wastage and Delays through Optimization

- 5.2 Market Challlenges

- 5.2.1 Heavy Cost of Advisory with Lack of Surety of Accurate Predictions

- 5.3 Emerging Use Cases and Applications

- 5.4 Technology Snapshot

- 5.4.1 Digital Transformations Impact on Supply Chain

- 5.4.2 Increasing Trends of Control Tower Supply Chain

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 SMEs

- 6.1.2 Large Enterprises

- 6.2 By End-user Industry

- 6.2.1 Manufacturing

- 6.2.2 Life Sciences and Healthcare

- 6.2.3 IT and Telecommunication

- 6.2.4 Government

- 6.2.5 Energy

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Argentina

- 6.3.4 Colombia

- 6.3.5 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Deloitte Touche Tohmatsu Limited

- 7.1.2 Boston Consulting Group

- 7.1.3 Bain & Company

- 7.1.4 Ernst & Young Services Limited

- 7.1.5 Global Eprocure Limited

- 7.1.6 Alvarez & Marsal Inc

- 7.1.7 McKinsey & Company

- 7.1.8 KPMG

- 7.1.9 Infosys Limited

- 7.1.10 Capgemini SE

- 7.1.11 Tata Consultancy Services

- 7.1.12 Accenture PLC

- 7.1.13 Cognizant Technology Solutions Corporation

8 INVESTMENT ANALYSIS

02-2729-4219

+886-2-2729-4219