|

市场调查报告书

商品编码

1683868

法国电动公车电池组市场:市场占有率分析、产业趋势与统计、成长预测(2025-2029 年)France Electric Bus Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

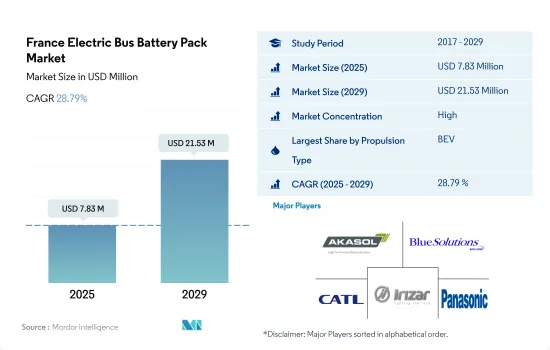

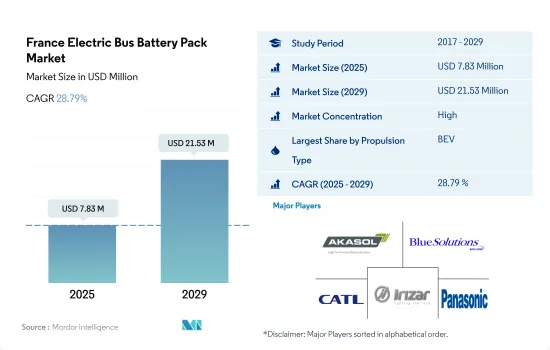

法国电动公车电池组市场规模预计在 2025 年为 783 万美元,预计到 2029 年将达到 2,153 万美元,预测期内(2025-2029 年)的复合年增长率为 28.79%。

绿色交通途径越来越受欢迎,法国电动公车电池组市场蓬勃发展

- 对环保交通途径的需求正在刺激法国电动公车电池组市场的扩张。旨在减少温室气体排放和鼓励使用电动公车的政府计划可能会对该行业产生重大积极影响。电池电动公车的日益普及是推动法国电动公车电池组市场成长的主要因素之一。由于政府的激励和补贴,电池电动公车在法国越来越受欢迎,因为它们被视为柴油公车的更环保的替代品。因此,2017-2022年期间电动公车电池组的需求增加。

- 推动法国电动公车电池组市场成长的另一个因素是对能源效率的日益关注。电池组製造商正在开发新技术和材料,以提高电池组的效率和性能,有助于降低成本并提高电动公车的整体经济性。

- 电动公车电池组市场也面临许多挑战。电池组成本高是最大的障碍之一,并可能成为许多公车业者的重大障碍。此外,一些公车业者可能会发现电动公车的行驶里程有限和充电能力有限是一个障碍。随着消费者对环保交通途径的需求不断增长,法国电动公车电池组市场正在扩大。儘管该领域存在一些障碍,但随着电动公车的接受度不断提高以及对能源节约的重视,预计将在预测期内推动该领域取得重大发展。

法国电动公车电池组市场趋势

雷诺、丰田集团、标緻、现代和起亚是法国电动车市场的主要企业

- 法国电动车电池组市场竞争激烈,但截至 2022 年,五家公司占了 50% 以上的市场份额。这些公司分别是雷诺、丰田集团、标緻、现代和起亚。雷诺在法国电动车电池组市场占有23.12%的份额,是电动车销量最多的品牌。作为一家全国性公司,它在法国消费者中享有盛誉,在全国拥有 500 多家经销商。

- 丰田集团在法国电动车电池组市场占有15.94%的份额,是电动车销售第二大公司。广泛的服务网络、多样化的产品阵容和值得信赖的品牌形象推动着公司的成长。另一法国品牌标緻在法国电动车电池组市场占有第三名,份额为 8.67%。为了满足各种客户需求,公司依靠可靠的供应和分销链蓬勃发展。

- 现代在法国电动车电池组市场排名第四,市场占有率6.28%。其多样化的产品吸引了中檔和豪华汽车客户。起亚是法国电动车电池组市场第五大参与者,市场占有率约 4.90%。法国电动车电池组市场的其他知名参与者包括梅赛德斯-奔驰、达契亚、菲亚特、宝马和大众。

雷诺和丰田在法国销售了 50% 以上的电动车,并且拥有最多的电池组。

- 欧洲对电动车的需求正在成长,在法国,这一趋势也持续成长。随着消费者偏好转向更具运动感、更具冒险精神的驾驶体验,加上可与轿车相媲美的价格优势,对电动紧凑型 SUV 的需求正在上升。

- 在这个快速成长的市场中,雷诺Arkana的销售成长强劲。该车型吸引了那些想要一款兼具高效续航能力和实惠价格的电动紧凑型 SUV 的人。这款小型SUV的积极反响在法国电动车电池组市场也显而易见。因此,雷诺 Captur 也成为了 2022 年最畅销的车款。其销售成功得益于其全混合动力和稍贵的插电式混合动力产品、出色的燃油效率、舒适的座椅和有竞争力的价格。

- 在法国电动车市场,一些国际品牌正在透过一系列电动 SUV 和轿车来实现产品组合多元化。丰田雅力士混合动力车在 2022 年的销售令人印象深刻,成为受欢迎的选择。广泛的服务网络、有竞争力的定价和值得信赖的品牌形像等因素正在推动丰田汽车的成长,例如 2022 年丰田雅力士 Cross,其销量为 23,576 辆。雷诺 Clio、标緻 208、特斯拉 Model 3、达契亚 Spring Electric 和雷诺梅甘娜等竞争对手正在改善法国的电动车市场。

法国电动大巴电池组产业概况

法国电动公车电池组市场相当集中,前五家公司占83%的市场。市场的主要企业有:Akasol AG、Blue Solutions SA (Bollore Group)、宁德时代新能源科技(CATL)、IRIZAR S.COOP。以及松下控股公司(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 电动公车销量

- 电动公车销售(依OEM)

- 最畅销的电动车车型

- 首选电池化学OEM

- 电池组价格

- 电池材料成本

- 不同电池化学成分的价格表

- 谁供给谁?

- 电动车电池容量和效率

- 发布的电动车车型数量

- 法律规范

- 法国

- 价值链与通路分析

第五章 市场区隔

- 推进类型

- BEV

- PHEV

- 电池化学

- LFP

- NCA

- NCM

- NMC

- 其他的

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超过80度

- 少于15千瓦时

- 电池形状

- 圆柱形

- 小袋

- 方块

- 方法

- 雷射

- 金属丝

- 成分

- 阳极

- 阴极

- 电解

- 分隔符

- 材料类型

- 钴

- 锂

- 锰

- 天然石墨

- 镍

- 其他材料

第六章 竞争格局

- 重大策略倡议

- 市场占有率分析

- 业务状况

- 公司简介

- Akasol AG

- Automotive Cells Company(ACC)

- Blue Solutions SA(Bollore Group)

- BYD Company Ltd.

- Contemporary Amperex Technology Co. Ltd.(CATL)

- Elecsys France

- IRIZAR S.COOP.

- LG Energy Solution Ltd.

- Liten CEA Tech(COMMISSARIAT A L'ENERGIE ATOMIQUE ET AUX ENERGIES ALTERNATIVES)

- Microvast Holdings Inc

- Panasonic Holdings Corporation

- Saft Groupe SA

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The France Electric Bus Battery Pack Market size is estimated at 7.83 million USD in 2025, and is expected to reach 21.53 million USD by 2029, growing at a CAGR of 28.79% during the forecast period (2025-2029).

France's electric bus battery pack market surges as eco-friendly transportation gains traction

- The need for eco-friendly transportation options is fueling the expansion of the French electric bus battery pack market. Government programs intended to cut greenhouse gas emissions and encourage the use of electric buses are likely to have a considerable positive impact on the industry. The rising popularity of battery electric buses is one of the major factors propelling growth in the French electric bus battery pack market. Due to government incentives and subsidies, battery electric buses are viewed as a more ecologically friendly alternative to diesel buses and are growing in popularity in France. As a result, there was a rise in demand for battery packs for electric buses during 2017-2022.

- Another factor driving growth in the French electric bus battery pack market is the increasing focus on energy efficiency. Battery pack manufacturers are developing new technologies and materials to improve the efficiency and performance of battery packs, which, in turn, are helping drive down costs and improve the overall economics of electric buses.

- The market for electric bus battery packs also confronts a number of difficulties. The high price of battery packs is one of the largest obstacles and may be an important barrier for many bus operators. Additionally, some bus operators may find the restricted range and recharge capabilities of electric buses to be an obstruction. The market for battery packs for electric buses in France is expanding as a result of the rising consumer demand for eco-friendly transportation options. Although the sector has obstacles, it is anticipated that the growing acceptance of battery electric buses and the emphasis on energy conservation will lead to considerable development over the forecast period.

France Electric Bus Battery Pack Market Trends

Renault, Toyota Group, Peugeot, Hyundai, and Kia are the leading players in the French electric vehicle market

- The electric vehicle battery pack market in France is competitive, although five companies accounted for over 50% of the market as of 2022. These companies are, namely, Renault, Toyota Group, Peugeot, Hyundai, and Kia. Renault has witnessed the largest electric car sales, boasting a 23.12% share of the French electric vehicle battery pack market. As a domestic company, it enjoys a robust reputation among French consumers and has over 500 dealerships nationwide.

- The Toyota Group has a 15.94% share in the French electric vehicle battery pack market, ranking it second in terms of electric vehicle sales. The company's expansive service network, diverse product lineup, and trusted brand image contribute to its growth. Peugeot, another French brand, occupies the third place in the French electric vehicle battery pack market, with an 8.67% share. Catering to various client needs, the company thrives on a dependable supply and distribution chain.

- Hyundai, capturing 6.28% of the market share, stands as the fourth largest player in the French electric vehicle battery pack market. Its diverse offerings appeal to both mid-range and premium customers. Kia, holding roughly 4.90% of the market share, is the fifth largest player in the French electric vehicle battery pack market. Other notable companies in the French electric vehicle battery pack market include Mercedes-Benz, Dacia, Fiat, BMW, and Volkswagen.

Renault and Toyota sell more than 50% of EVs in France while employing the most battery packs

- Demand for electric vehicles in Europe is escalating, and France is witnessing a consistent uptick in this trend. The demand for electric compact SUVs is on the rise as consumer preference shifts toward sportier, adventurous driving experiences, accompanied by benefits comparable in price to sedans.

- In this burgeoning market, Renault Arkana sales have seen significant growth. The model appeals to those desiring an electric compact SUV that combines efficient mileage with affordability. The positive response to compact SUVs is evident in the French electric vehicle battery pack market. Consequently, the Renault Captur also emerged as a best-seller in 2022. Its offerings of a full hybrid and a slightly pricier plug-in hybrid, along with superior fuel efficiency, comfortable seating, and competitive pricing, have fueled its sales success.

- Several international brands are diversifying their portfolios in the French EV market with a range of electric SUVs and sedans. The Toyota Yaris hybrid has been a popular choice, registering impressive sales in 2022. Factors such as an extensive service network, competitive pricing, and a trusted brand image have driven the growth of Toyota models, exemplified by the 23,576 units of Toyota Yaris Cross sold in 2022. Competing alongside are models like Renault Clio, Peugeot 208, Tesla Model 3, Dacia Spring Electric, and Renault Megane, improving the EV landscape in France.

France Electric Bus Battery Pack Industry Overview

The France Electric Bus Battery Pack Market is fairly consolidated, with the top five companies occupying 83%. The major players in this market are Akasol AG, Blue Solutions SA (Bollore Group), Contemporary Amperex Technology Co. Ltd. (CATL), IRIZAR S.COOP. and Panasonic Holdings Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Bus Sales

- 4.2 Electric Bus Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 France

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 BEV

- 5.1.2 PHEV

- 5.2 Battery Chemistry

- 5.2.1 LFP

- 5.2.2 NCA

- 5.2.3 NCM

- 5.2.4 NMC

- 5.2.5 Others

- 5.3 Capacity

- 5.3.1 15 kWh to 40 kWh

- 5.3.2 40 kWh to 80 kWh

- 5.3.3 Above 80 kWh

- 5.3.4 Less than 15 kWh

- 5.4 Battery Form

- 5.4.1 Cylindrical

- 5.4.2 Pouch

- 5.4.3 Prismatic

- 5.5 Method

- 5.5.1 Laser

- 5.5.2 Wire

- 5.6 Component

- 5.6.1 Anode

- 5.6.2 Cathode

- 5.6.3 Electrolyte

- 5.6.4 Separator

- 5.7 Material Type

- 5.7.1 Cobalt

- 5.7.2 Lithium

- 5.7.3 Manganese

- 5.7.4 Natural Graphite

- 5.7.5 Nickel

- 5.7.6 Other Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Akasol AG

- 6.4.2 Automotive Cells Company (ACC)

- 6.4.3 Blue Solutions SA (Bollore Group)

- 6.4.4 BYD Company Ltd.

- 6.4.5 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.6 Elecsys France

- 6.4.7 IRIZAR S.COOP.

- 6.4.8 LG Energy Solution Ltd.

- 6.4.9 Liten CEA Tech (COMMISSARIAT A L' ENERGIE ATOMIQUE ET AUX ENERGIES ALTERNATIVES)

- 6.4.10 Microvast Holdings Inc

- 6.4.11 Panasonic Holdings Corporation

- 6.4.12 Saft Groupe S.A.

- 6.4.13 Samsung SDI Co. Ltd.

- 6.4.14 SK Innovation Co. Ltd.

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms