|

市场调查报告书

商品编码

1683885

美国电动公车电池组:市场占有率分析、行业趋势和统计、成长预测(2025-2029 年)US Electric Bus Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

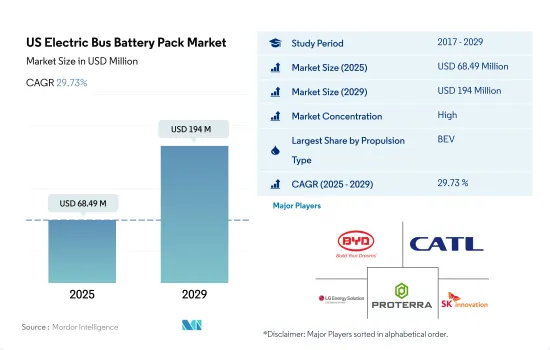

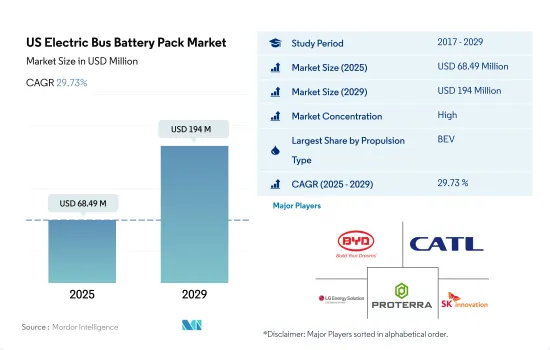

预计 2025 年美国电动公车电池组市场规模为 6,849 万美元,到 2029 年将达到 1.94 亿美元,预测期间(2025-2029 年)的复合年增长率为 29.73%。

不断增长的需求和政府的大力支持将推动美国电动公车的普及。

- 2017年至2023年,美国的电动公车销量和采用量将激增。根据彭博新能源财经的报告,2020 年电池电动公车 (BEB) 占所有新公车销量的 16%,高于 2015 年的 1%。同年,加州、纽约州和华盛顿州成为电动公车普及率领先的州,总合占全国销售量的 57%。美国国家可再生能源实验室 (NREL) 指出,2017 年美国上有大约 2,200 辆电动公车,到 2020 年这一数字将增长到 5,500 多辆。

- 电动公车的激增主要是由于人们对更清洁、更永续的交通运输的需求不断增长。在雄心勃勃的气候变迁目标的推动下,许多城市和州正在增加政府资金和奖励,以鼓励人们使用电池式电动车。随着电池成本下降,BEB 与柴油汽车相比更具成本竞争力。各国政府也正在製定法规来推动电动公车的普及。例如,加州空气资源委员会的目标是到 2040 年将所有州内公车转变为零排放汽车。

- 预计到2030年,电动公车将占美国新车销量的50%以上。纽约、洛杉矶和温哥华等北美主要城市已经开始转型为电动公车。随着电池技术的进步,电动公车将变得更有效率和经济。为满足日益增长的电动公车队的充电站网路可能会进一步刺激全部区域对电动公车的需求。

美国电动公车电池组市场趋势

特斯拉、丰田、福特、现代和本田主导美国电动车电池组市场

- 电动车市场高度整合,五大主要参与者——特斯拉、丰田集团、福特集团、现代汽车和本田——预计到2023年将占据近75%的市场份额。特斯拉是美国最大的电动车销售商,控制着约30%的市场份额。该公司专注于创新技术,并与各种电动车零件(例如电池)製造商建立了强大的策略伙伴关係。作为一家美国公司,我们在美国拥有强大的基本客群,为他们提供优质的产品和服务。

- 丰田集团是美国第二大电动车销售商,约占美国电动车总销量的28%。该公司拥有强大的供应和分销网络,透过提供各种不同的电动车,成为客户信赖的品牌。福特集团在美国电动车整体销售中排名第三,市场占有率约 10%。作为本土品牌,其在美国拥有广泛的产品和服务网络,赢得了客户的强烈信赖。

- 现代汽车则位居第四,约占美国电动车总销量的 5.4%。该公司拥有强大的生产和供应链网络,使其能够以比其他品牌更合理的价格提供广泛的创新产品。本田是电动车市场第五大参与者,市场占有率约 5%。在美国销售电动车的其他公司包括起亚、吉普、宝马和沃尔沃。

特斯拉占据主导地位,并为美国电池组的需求做出了巨大贡献。

- 美国是北美最受欢迎的国家之一,2017 年至 2023 年间对电动车的需求稳定成长。随着消费者偏好逐渐转向更具运动感、更具冒险精神的驾驶体验和其他优势,且价格分布与轿车等其他电动车相当,电动 SUV 市场正在稳步扩大。 SUV 吸引顾客是因为它们提供了更多的腿部和余量,而舒适的乘坐体验是其优先考虑因素之一。

- 在美国电动车电池组市场,特斯拉Model Y的销售量大幅成长。这款车吸引了那些寻求续航里程长、座位多、行李容量大的电动车的客户。提供电动轿车的公司也获得了美国民众的良好反应。特斯拉 Model 3 也凭藉其全电动技术、高性能、快速充电技术和良好的续航里程,被评为 2023 年美国电动车电池组市场最畅销车款之一。

- 在美国电动车电池组市场,国际品牌也提供电动 SUV 和轿车。 Toyota RAV4 插电式混合动力车是受欢迎的车辆之一,在 2023 年表现出强劲的销售势头。良好的服务网络、比其他品牌更低的价格以及值得信赖的品牌形像是丰田汽车销售不断增长的原因。丰田在美国电动车电池组市场的另一个畅销产品是配备混合动力传动系统的 Sienna。那些想要购买七人座汽车的大家庭消费者对于丰田 Sienna 的反应非常好。美国电动车电池组市场的其他竞争对手包括丰田汉兰达、吉普牧马人、丰田凯美瑞、本田雅阁和福特野马 Mach-E。

美国电动大巴电池组产业概况

美国电动公车电池组市场相当集中,前五大公司占88%的市场。该市场的主要企业是:比亚迪股份有限公司、宁德时代新能源科技股份有限公司(CATL)、LG 能源解决方案有限公司、Proterra Operating Company Inc. 和 SK Innovation(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 电动公车销量

- 电动公车销售(依OEM)

- 最畅销的电动车车型

- 首选电池化学OEM

- 电池组价格

- 电池材料成本

- 不同电池化学成分的价格表

- 谁供给谁?

- 电动车电池容量和效率

- 发布的电动车车型数量

- 法律规范

- 美国

- 价值链与通路分析

第五章 市场区隔

- 推进类型

- BEV

- PHEV

- 电池化学

- LFP

- NCA

- NCM

- NMC

- 其他的

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超过80度

- 少于15千瓦时

- 电池形状

- 圆柱形

- 小袋

- 方块

- 方法

- 雷射

- 金属丝

- 成分

- 阳极

- 阴极

- 电解

- 分隔符

- 材料类型

- 钴

- 锂

- 锰

- 天然石墨

- 镍

- 其他材料

第六章 竞争格局

- 重大策略倡议

- 市场占有率分析

- 业务状况

- 公司简介

- BYD Company Ltd.

- Contemporary Amperex Technology Co. Ltd.(CATL)

- Econtrols LLC

- Imperium3 New York(IM3NY)

- LG Energy Solution Ltd.

- NFI Group Inc.

- Proterra Operating Company Inc.

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- TOSHIBA Corp.

- XALT Energy

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The US Electric Bus Battery Pack Market size is estimated at 68.49 million USD in 2025, and is expected to reach 194 million USD by 2029, growing at a CAGR of 29.73% during the forecast period (2025-2029).

Rising demand and robust government backing propel the adoption of battery electric buses in the United States

- From 2017 to 2023, electric bus sales and adoption surged in the US. A Bloomberg NEF report highlighted that in 2020, battery electric buses (BEBs) constituted 16% of all new bus sales, a significant jump from a mere 1% in 2015. In the same year, California, New York, and Washington emerged as the leading states for electric bus uptake, collectively accounting for 57% of the national sales. The National Renewable Energy Laboratory (NREL) noted that the US had around 2,200 electric buses in operation in 2017, a figure that swelled to over 5,500 by 2020.

- A key driver behind the electric bus surge is the mounting demand for cleaner and sustainable transportation. Driven by ambitious climate targets, numerous cities and states have ramped up government funding and incentives to encourage the adoption of battery electric vehicles. As battery costs decline, BEBs are becoming increasingly cost-competitive with their diesel counterparts. Governments are also enacting regulations to spur electric bus adoption. For instance, the California Air Resources Board aims to transition all transit buses in the state to zero-emission vehicles by 2040.

- Projections indicate that by 2030, electric buses will make up over 50% of new bus sales in the US. Major North American cities like New York City, Los Angeles, and Vancouver have already embarked on the electric bus transition. Electric buses are poised to become more efficient and economical as battery technology advances. The burgeoning network of charging stations, catering to the rising fleet of electric buses, may further fuel the demand for these vehicles across the region.

US Electric Bus Battery Pack Market Trends

Tesla, Toyota, Ford, Hyundai, and Honda dominate the US electric vehicle battery pack market

- The electric vehicle market is highly consolidated, with five major players, Tesla, Toyota Group, Ford Group, Hyundai, and Honda, accounting for almost 75% of the market in 2023. Tesla is the largest seller of electric vehicles in the United States, accounting for around 30% of the market. The company focuses on innovative technologies and has strong strategic partnerships with manufacturers of various EV components (such as batteries). Being a US-based company, it has a strong customer base with great product and service offerings across the United States.

- Toyota Group is the second largest seller of electric vehicles, accounting for around 28% across the United States. The company has a strong supply and distribution network and operates as a reliable brand among customers with wide product offerings of various electric cars. The Ford Group holds 3rd place in EV sales across the United States, with around 10% of the market share. Being a domestic brand, the company has strong goodwill among customers with a wide product and service network in the United States.

- Hyundai is the fourth-largest player, accounting for around 5.4% of the market share in EV sales across the United States. The company has a strong production and supply chain network, with wide innovative products offered at reasonable prices over other brands. Honda is the fifth-largest player in the EV market, maintaining its market share at around 5%. Other players selling EVs in the United States include Kia, Jeep, BMW, and Volvo.

Tesla maintains dominance, holding the majority share, and contributes to the major demand for battery packs in the United States

- The United States is one of the most popular countries in North America, where the demand for EVs steadily increased during 2017-2023. The market for electric SUVs is steadily increasing as consumer preferences gradually move to a more sporty and adventurous drive and other benefits at a comparable price point as other EVs like sedans. SUVs offer more leg and headroom, which attracts customers as a comfortable ride is one of the main priorities.

- In the US EV battery pack market, sales of the Tesla Model Y have grown significantly. The car attracts customers seeking an electric car with long-range, good seating capacity, and large cargo capacity. Companies offering electric sedans are also getting good responses from the US population. Tesla Model 3 was also among the best sellers in the US EV battery pack market in 2023, owing to its full electric technology, high-performance capabilities, fast charging technology, and good range offerings.

- International brands also offer electric SUVs and sedans in the US EV battery pack market. Toyota RAV4 plug-in hybrid is one of the popular cars and witnessed good sales in 2023. A good service network, lower prices than other brands, and a reliable brand image are reasons for the growing sales of Toyota cars. Another good-selling car by Toyota in the US EV battery pack market is the Sienna, offered with a hybrid powertrain; consumers with big families looking for 7-seater cars have positively responded to the Toyota Sienna. Other vehicles competing in the US EV battery pack market include the Toyota Highlander, Jeep Wrangler, Toyota Camry, Honda Accord, and Ford Mustang Mach-E.

US Electric Bus Battery Pack Industry Overview

The US Electric Bus Battery Pack Market is fairly consolidated, with the top five companies occupying 88%. The major players in this market are BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), LG Energy Solution Ltd., Proterra Operating Company Inc. and SK Innovation Co. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Bus Sales

- 4.2 Electric Bus Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 US

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 BEV

- 5.1.2 PHEV

- 5.2 Battery Chemistry

- 5.2.1 LFP

- 5.2.2 NCA

- 5.2.3 NCM

- 5.2.4 NMC

- 5.2.5 Others

- 5.3 Capacity

- 5.3.1 15 kWh to 40 kWh

- 5.3.2 40 kWh to 80 kWh

- 5.3.3 Above 80 kWh

- 5.3.4 Less than 15 kWh

- 5.4 Battery Form

- 5.4.1 Cylindrical

- 5.4.2 Pouch

- 5.4.3 Prismatic

- 5.5 Method

- 5.5.1 Laser

- 5.5.2 Wire

- 5.6 Component

- 5.6.1 Anode

- 5.6.2 Cathode

- 5.6.3 Electrolyte

- 5.6.4 Separator

- 5.7 Material Type

- 5.7.1 Cobalt

- 5.7.2 Lithium

- 5.7.3 Manganese

- 5.7.4 Natural Graphite

- 5.7.5 Nickel

- 5.7.6 Other Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Company Ltd.

- 6.4.2 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.3 Econtrols LLC

- 6.4.4 Imperium3 New York (IM3NY)

- 6.4.5 LG Energy Solution Ltd.

- 6.4.6 NFI Group Inc.

- 6.4.7 Proterra Operating Company Inc.

- 6.4.8 Samsung SDI Co. Ltd.

- 6.4.9 SK Innovation Co. Ltd.

- 6.4.10 TOSHIBA Corp.

- 6.4.11 XALT Energy

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms