|

市场调查报告书

商品编码

1683882

南美洲电动公车电池组:市场占有率分析、产业趋势与统计、成长预测(2023-2029 年)South America Electric Bus Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2023 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

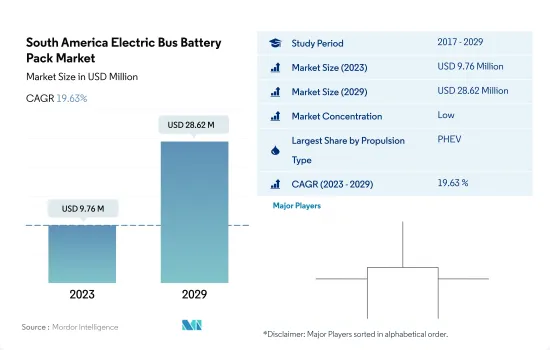

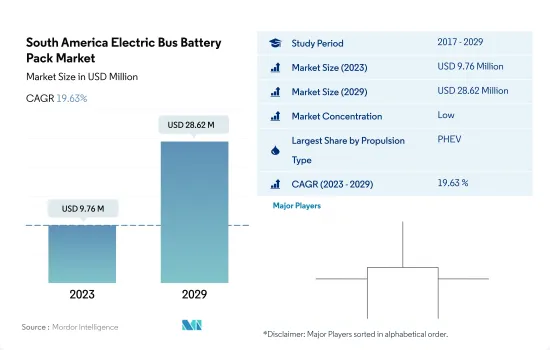

南美电动公车电池组市场规模预计在 2023 年为 976 万美元,预计到 2029 年将达到 2,862 万美元,预测期内(2023-2029 年)的复合年增长率为 19.63%。

- 在许多南美国家,公车是主要公共交通工具之一。近年来,巴西、智利、哥伦比亚等南美国家对电动公车的需求逐渐增加,因为传统旧款公车采用内燃机,排放大量二氧化碳。

- 该地区国家的电动公车正在逐渐增加。截至 2022 年,智利是南美洲对各种类型的电动公车及其动力电池组需求最高的国家之一。智利拥有庞大的电池市场,持有超过 800 辆公车。

- 各公司已收到该地区各国的电动公车订单。 2022年11月,中国汽车製造商比亚迪宣布将在2023年上半年向巴西圣保罗交付100辆电动公车底盘。这些底盘将进一步组装成电动公车,这也将增加各种类型公车对电池组的需求,例如电池电动公车或PHEB。预计此类发展将在预测期内推动南美洲对电池组的需求。

南美洲电动公车电池组市场趋势

不断增长的需求和政府奖励推动南美洲电动车市场的发展

- 巴西、阿根廷等南美洲各国汽车市场潜力大,近年来南美洲汽车产业成长显着。近年来,由于人们对电动车认识的不断提高、对环境的日益关注以及政府对引入电动车的支持等因素,该地区对电动车,尤其是乘用车的需求不断增加。由于这些因素,消费者逐渐转向电动车,2022 年电动车销量较 2021 年成长了 17.95%。

- 南美洲有各种潜在的电动车市场,而巴西专注于引入可再生能源发电,这意味着对电动公车有潜在的需求。此外,2022 年 12 月,圣保罗宣布将禁止购买柴油公车,并在 2024 年底年终部署 2,600 辆电动公车。预计其他国家的类似因素将在预测期内推动南美的汽车电气化。

- 预计南美汽车电气化将受到该地区政府实施的政策和奖励计画的推动。为了解决碳排放问题,哥伦比亚政府正在采取奖励和补贴措施,以实现到 2030 年拥有 60 万辆电动车上路的雄心勃勃的目标,其中税收优惠是主要动力。因此,由于类似因素,预计预测期内南美其他国家的电动车销量也将增加。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 电动公车销量

- 电动公车销售(依OEM)

- 最畅销的电动车车型

- 具有首选电池化学成分的OEM

- 电池组价格

- 电池材料成本

- 每种电池化学成分的价格表

- 谁供给谁?

- 电动车电池容量和效率

- 发布的电动车车型数量

- 法律规范

- 价值链与通路分析

第五章 市场区隔

- 推进类型

- BEV

- PHEV

- 电池化学

- LFP

- NCA

- NCM

- NMC

- 其他的

- 容量

- 15 kWh~40 kWh

- 40 kWh~80 kWh

- 超过80度

- 少于15千瓦时

- 电池形状

- 圆柱形

- 小袋

- 方块

- 方法

- 雷射

- 金属丝

- 成分

- 阳极

- 阴极

- 电解

- 分隔符

- 材料类型

- 钴

- 锂

- 锰

- 天然石墨

- 镍

- 其他材料

第六章 竞争格局

- 重大策略倡议

- 市场占有率分析

- 业务状况

- 公司简介

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001534

The South America Electric Bus Battery Pack Market size is estimated at 9.76 million USD in 2023, and is expected to reach 28.62 million USD by 2029, growing at a CAGR of 19.63% during the forecast period (2023-2029).

- In many of the countries falling under the South America region, buses are one of the main modes of public transit. Old traditional buses emit a lot of carbon dioxide due to ICE engines, therefore during the recent years, demand for electric buses has gradually grown in various South American countries such as Brazil, Chile, colombia etc.

- Electric buses are gradually increasing in countries under the region. As of 2022 in South America, Chile has one of the highest demands of various type of electric buses and battery packs to power them. Chile has more than 800 buses being the major contributor to the battery market, some of the other countries such as Brazil, Colombia, Peru is also contributing to the growth of battery packs owing to the growing demand for electric buses in these countries gradaully.

- Various companies are getting orders of electric buses from different countries falling under the region. In November 2022, the Chinese automaker BYD has announced to deliver 100 electric buses chassis in Sap Paulo, Brazil by the 1st half of 2023. These chassis will be further assembled to electric buses, which will also increase the demand of the battery packs for various types of buses such as battery electric and PHEB. Such developments are expected to enhance the demand for the battery packs during the forecast period in South America.

South America Electric Bus Battery Pack Market Trends

Growing Demand and Government Incentives Drive Electric Vehicle Market in South America

- Various countries falling under the South America region such as Brazil and Argentina etc. have great potential for the automobile market, and the South American vehicle industry has experienced substantial growth over the past few years. In recent years, the demand for electric vehicles, primarily passenger cars, has increased in the region owing to the factors such as rising awareness of electric vehicles, growing environmental concern, governmental push towards the adoption of electric vehicles. These factors are gradually shifting consumers to electric vehicles and the sales of the EVs have grown to 17.95% in 2022 over 2021.

- South America has various potential electric vehicle markets and Brazil holds potential demand for electric buses as the country is focusing on the adoption of more renewable power generation, which may utilize the country's large niobium and lithium reserves, a crucial factor for EV batteries' development. Moreover, In December, 2022, Sao Paulo bans the purchasing of diesel buses and has announced to deploy 2600 electric buses by the end of 2024. Similar factors in other countries are expected to boost the electrification of vehicles in the South America during the forecast period.

- The electrification of vehicles in South America is anticipated to be fueled by the policies and incentive programs implemented by the governments of the various countries in the region. Tax benefits are the main motivation, as the Government of Colombia is using incentives and subsidies to reach an ambitious goal of 600,000 EVs on the road by 2030 to address the carbon emission issues. As a result, similar factors in other countries in South America is anticipated to increase the sales of the EVs during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Bus Sales

- 4.2 Electric Bus Sales By OEMs

- 4.3 Best-Selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 BEV

- 5.1.2 PHEV

- 5.2 Battery Chemistry

- 5.2.1 LFP

- 5.2.2 NCA

- 5.2.3 NCM

- 5.2.4 NMC

- 5.2.5 Others

- 5.3 Capacity

- 5.3.1 15 kWh to 40 kWh

- 5.3.2 40 kWh to 80 kWh

- 5.3.3 Above 80 kWh

- 5.3.4 Less than 15 kWh

- 5.4 Battery Form

- 5.4.1 Cylindrical

- 5.4.2 Pouch

- 5.4.3 Prismatic

- 5.5 Method

- 5.5.1 Laser

- 5.5.2 Wire

- 5.6 Component

- 5.6.1 Anode

- 5.6.2 Cathode

- 5.6.3 Electrolyte

- 5.6.4 Separator

- 5.7 Material Type

- 5.7.1 Cobalt

- 5.7.2 Lithium

- 5.7.3 Manganese

- 5.7.4 Natural Graphite

- 5.7.5 Nickel

- 5.7.6 Other Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219