|

市场调查报告书

商品编码

1683926

北美国际快递服务:市场占有率分析、产业趋势与成长预测(2025-2030 年)North America International Express Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

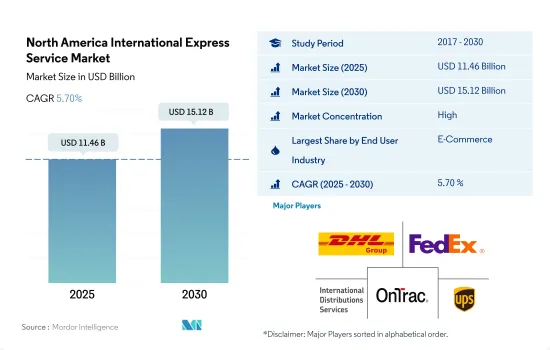

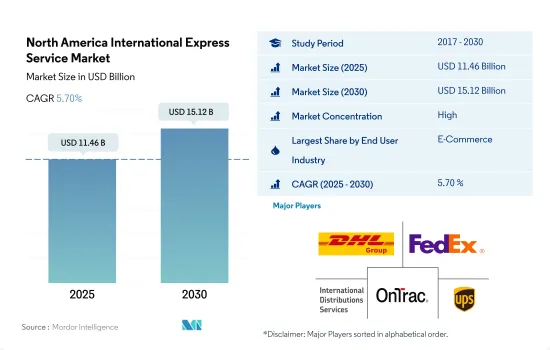

北美国际快递服务市场规模预计在 2025 年为 114.6 亿美元,预计到 2030 年将达到 151.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.70%。

跨境电商带动北美国际快递服务市场成长

- 跨境电子商务推动了对快速可靠的配送解决方案的需求,为北美国际快递服务市场提供了巨大的推动力。 2024年4月,Integrated 3PL与DSV建立伙伴关係,以加强墨西哥和美国之间的跨境物流和电子商务,并开始在蒂华纳开展业务。两家公司致力于简化物流并提供具有成本效益的高品质服务,包括透过蒂华纳国际机场进行的跨境和国内电子商务和空运。

- 2021年,美国向全球的汽车零件出口总值成长6%,达到709亿美元。美国汽车零件出口的前三大市场是墨西哥和加拿大。此外,3D 列印或积层製造(AM) 正成为快递市场最具颠覆性的创新之一。透过 3D 列印,零件可以在订购后的数小时内列印并交付。例如,Quickparts 已与 Roboze 合作,将其基于树脂的系统整合到其 Quickparts Express 产品中。此外,北美 AM 市场预计在 2023 年至 2030 年期间的复合年增长率将达到 20.8%,从而推动终端用户市场的成长。

多伦多-温莎-底特律-芝加哥走廊和泛美公路促进区域小包裹递送

- 美国与加拿大、墨西哥并列引领北美国际快递服务市场。人们对网路购物的偏好日益增长,以及 BFSI 行业、医疗保健和製造业等终端用户的需求正在推动该地区的市场需求。约有50%的美国公司80%以上的电子商务收益来自北美市场。

- 由于客户对优先送货的需求增加,许多美国零售商现在提供当日国际运输服务。该零售商提供国际当日送达服务,特别是透过空运,服务范围涵盖全球 200 多个地点。在加拿大,对时间敏感的货物和其他生鲜产品也正在透过航空方式推动国际快递。墨西哥宣布计划于 2023 年将其仅限航空货运的机场从墨西哥城国际机场 (AICM) 迁至费利佩安吉利斯国际机场 (AIFA),此举可改善国际当天送达服务。

北美国际快递服务市场趋势

美国是该地区GDP的最大贡献者,这得益于加强港口和供应链的基础设施计画。

- 高效可靠的交通系统对经济至关重要。加拿大政府透过国家贸易走廊基金投资改善供应链、减少贸易壁垒和促进业务成长,以创造未来的经济机会。 2024年5月,交通部长宣布该基金将向19个数位基础设施计划提供高达5,120万美元的资金。加拿大政府正在利用创新技术加强供应链,以便为加拿大人提供更快、更便宜的送货服务。该计划将促进与全国各地相关人员在数计划上的合作,以有效解决运输瓶颈、脆弱性和港口拥堵问题。

- 在美国,由于基础设施建设和电子商务的兴起,运输和仓储行业的就业预计将增长。根据美国劳工统计局 (BLS) 的数据,预计该行业从 2022 年到 2032 年将以每年 0.8% 的增长率增长,从而在此期间增加近 57 万个就业机会。预计宅配和信差产业以及仓储和储存业将为该产业预计的就业成长贡献约 80%。

中东地区紧张局势加剧影响了石油供应,导致该地区油价大幅上涨。

- 到2024年10月,也就是总统大选前,美国汽油价格预计将在三年多来首次跌破每加仑3美元。燃料价格下跌主要由于需求放缓和原油价格下跌,为成本上涨而引发通货膨胀的消费者带来了一丝安慰。此类事态发展可能会增强包括副总统卡马拉·哈里斯在内的民主党人的支持,因为他们正在回应共和党对油价飙升的批评。截至2024年9月,普通汽油平均价格为每加仑3.25美元,比上月下降19美分,比去年同期下降58美分。

- 预计2024年加拿大油砂厂的年度维护将照常进行。但工会领导人警告称,由于两个新的行业计划,亚伯达将在 2025 年的转折季节面临劳动力短缺的情况。亚伯达的生产商每年都会僱用数千名技术纯熟劳工,负责油砂升级工厂、火力发电发电工程和炼油厂的关键维护。加拿大是世界第四大石油生产国,每天生产的 490 万桶原油中约有三分之二来自亚伯达北部的油砂。短缺可能导致燃料价格最快在 2025 年上涨。

北美国际快递服务产业概况

北美国际快递服务市场相当集中,主要有五家参与者(按字母顺序排列):DHL集团、联邦快递、国际配送服务公司(包括GLS)、Ontrack和美国联合包裹服务公司(UPS)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的GDP分布

- 按经济活动分類的GDP成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业GDP

- 出口趋势

- 进口趋势

- 燃油价格

- 物流绩效

- 基础设施

- 法律规范

- 加拿大

- 墨西哥

- 美国

- 价值炼和通路分析

第五章 市场区隔

- 运输重量

- 重量运输

- 轻量级运输

- 中等重量运输

- 根

- 区域之间

- 区域内

- 最终用户产业

- 电子商务

- 金融服务(BFSI)

- 卫生保健

- 製造业

- 一级产业

- 批发零售(线下)

- 其他的

- 国家

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Aramex

- Asendia

- DHL Group

- DTDC Express Limited

- FedEx

- International Distributions Services(including GLS)

- OnTrac

- Power Link Expedite

- United Parcel Service of America, Inc.(UPS)

第 7 章 CEO 需要回答的关键策略问题CEO 需要回答的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 技术进步

- 资讯来源和进一步阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001616

The North America International Express Service Market size is estimated at 11.46 billion USD in 2025, and is expected to reach 15.12 billion USD by 2030, growing at a CAGR of 5.70% during the forecast period (2025-2030).

The cross-border e-commerce sector is fueling the international express service market's growth in North America

- Cross-border e-commerce is significantly boosting the international express service market in North America by increasing demand for fast, reliable shipping solutions. In April 2024, Integrated 3PL and DSV formed a partnership to enhance cross-border logistics and e-commerce between Mexico and the United States and launched operations in Tijuana. Their focus is on simplifying logistics and offering cost-effective, high-quality services, including cross-border and domestic e-commerce and air cargo through Tijuana International Airport.

- In 2021, total automotive parts exported from the US to the world increased by 6% to USD 70.9 billion. Mexico and Canada are the top three markets for automotive parts exports from the US. Also, 3D printing, or additive manufacturing (AM), has emerged as one of the most disruptive innovations in the express market. With 3D printing, parts can be printed and delivered within hours after they are ordered. For instance, Quickparts has partnered with Roboze to integrate its resin-based systems into the Quickparts Express offering. Moreover, the AM market in North America is expected to register a CAGR of 20.8% during 2023-2030, driving the growth of the end-user market.

Toronto-Windsor-Detroit-Chicago corridor and Pan-American Highway facilitating regional parcel deliveries

- The United States leads the North American international express service market, along with Canada, Mexico and other countries. The growing preference for online shopping and demand generated by end-users such as BFSI sector, healthcare, manufacturing among others has driven the regional market demand. Around 50% of US-based companies receive more than 80% of e-commerce revenue from the North American market.

- Many retailers in the United States currently provide international same-day delivery services due to increased customer demand with priority delivery requirements. Retailers are providing international same-day delivery services, specifically via air cargo, to more than 200 locations globally. Time-sensitive shipments and other perishables are also driving international express deliveries in Canada via air. Mexico announced its plans to move its air cargo airport from Mexico City International Airport (AICM) to Felipe Angeles International Airport (AIFA) in 2023 for exclusive cargo shipments, which may improve international same-day deliveries.

North America International Express Service Market Trends

The US dominates with maximum regional GDP contribution, fueled by an infrastructure program that boosts ports and supply chains

- An efficient and reliable transportation system is crucial for the economy. Through the National Trade Corridors Fund, the Government of Canada invests in improving supply chains, reducing trade barriers, and fostering business growth for future economic opportunities. In May 2024, the Minister of Transport announced up to USD 51.2 million for 19 digital infrastructure projects under this fund. The Canadian government aims to enhance supply chains with innovative technologies to expedite and reduce costs for Canadians. This initiative will drive collaboration with stakeholders nationwide on digital projects to address transportation bottlenecks, vulnerabilities, and port congestion effectively.

- In United States, infrastructure development and the rise of e-commerce are anticipated to boost employment in the transportation and storage sector. According to the Bureau of Labor Statistics (BLS), this sector is projected to grow at a rate of 0.8% annually from 2022 to 2032, resulting in the addition of nearly 570,000 jobs during that timeframe. The couriers and messengers industry, along with warehousing and storage, are expected to contribute significantly to about 80% of the sector's projected job growth.

Rising tensions in the Middle East are expected to affect crude oil supplies and lead to sudden price hikes in the region

- By October 2024, just ahead of the presidential election, gasoline prices in the US were projected to dip below USD 3 a gallon for the first time in over 3 years. This decline in fuel prices, primarily driven by waning demand and decreasing oil prices, offered a reprieve to consumers who had been grappling with elevated costs contributing to inflation. Such a development could have bolstered Vice President Kamala Harris and other Democrats in addressing Republican critiques regarding soaring gas prices. As of September 2024, regular gas averaged USD 3.25 a gallon, marking a 19-cent drop from the previous month and a 58-cent YoY decrease.

- Annual maintenance on Canada's oil sands plants in 2024 is expected to proceed normally. However, trade union officials warn of a labor shortage in Alberta's 2025 turnaround season due to two new industrial projects. Alberta producers annually hire thousands of skilled workers for essential maintenance on oil sands upgraders, thermal projects, and refineries. As the world's fourth-largest oil producer, Canada gets about two-thirds of its 4.9 million barrels per day of crude from the northern Alberta oil sands. This shortage might raise fuel prices in 2025.

North America International Express Service Industry Overview

The North America International Express Service Market is fairly consolidated, with the major five players in this market being DHL Group, FedEx, International Distributions Services (including GLS), OnTrac and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Canada

- 4.12.2 Mexico

- 4.12.3 United States

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Shipment Weight

- 5.1.1 Heavy Weight Shipments

- 5.1.2 Light Weight Shipments

- 5.1.3 Medium Weight Shipments

- 5.2 Route

- 5.2.1 Inter-Region

- 5.2.2 Intra-Region

- 5.3 End User Industry

- 5.3.1 E-Commerce

- 5.3.2 Financial Services (BFSI)

- 5.3.3 Healthcare

- 5.3.4 Manufacturing

- 5.3.5 Primary Industry

- 5.3.6 Wholesale and Retail Trade (Offline)

- 5.3.7 Others

- 5.4 Country

- 5.4.1 Canada

- 5.4.2 Mexico

- 5.4.3 United States

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aramex

- 6.4.2 Asendia

- 6.4.3 DHL Group

- 6.4.4 DTDC Express Limited

- 6.4.5 FedEx

- 6.4.6 International Distributions Services (including GLS)

- 6.4.7 OnTrac

- 6.4.8 Power Link Expedite

- 6.4.9 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219