|

市场调查报告书

商品编码

1683935

中国户外 LED 照明:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)China Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

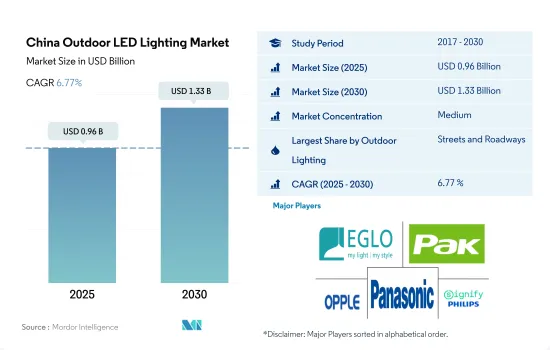

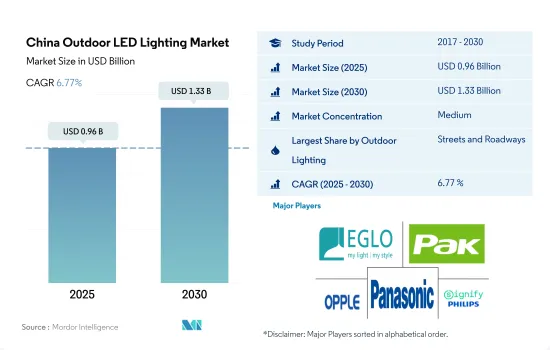

预计2025年中国户外LED照明市场规模为9.6亿美元,到2030年将达到13.3亿美元,预测期间(2025-2030年)的复合年增长率为6.77%。

道路和机场的不断扩建正在推动对LED照明产品的需求。

- 2023年,街道和道路将占据大部分金额份额,其次是公共场所和其他区域。截至2021年,全国高速公路总里程约16.91万公里,较上年增加0.81万公里。 13年来,中国高速公路里程由2009年的65055公里增加了1.6倍。截至2020年,中国13个省份的高速公路网里程超过20万公里,其中四川省高速公路里程最长,超过39.4万公里。公路网络不断扩大,促进了物流业的发展,江苏已成为物流中心。 2020年,江苏省驾驶人数位居全国第一,约有6.77亿驾驶员使用高速公路,超越广东省,成为中国车流量最大的省份。

- 2023年,街道和道路将占据车辆数量的大部分份额,其次是公共场所和其他区域。飞利浦、东芝、欧司朗等主要企业均已推出计划,推动LED照明的使用。飞利浦照明参与了贵阳计划,该项目是气候组织和壹基金主导的「千村太阳能 LED 照明计划」的一部分。该计划旨在将太阳能LED路灯引入中国农村地区。

- 在中国,新机场建设正在稳步推进,预计到2022年,中国当地将开设6个新货运机场和29个新多用途机场。因此,预计未来几年市场发展将增加对户外照明产品的需求。

中国户外LED照明市场趋势

由于体育赛事增加以及政府采取措施维修体育场馆,LED 照明预计将会成长

- 体育场数量预计将从 2022 年的 129 个增长到 2030 年的 143 个,复合年增长率为 1.4%。近年来,体育领域发生了许多变化。例如,2010 年,Enfis Group plc 获得了一份合同,为中国广州的 NBA 体育场提供 LED 阵列和驱动器。目前,2022年上海体育场建筑面积为17万平方公尺,曾承办第八届全锦赛、2007年女足世界杯、2008年奥运等重要赛事。上海三思为本次维修计划供应LED座舱罩,展示面积约1万平方公尺。 LED照明的安装和升级可能会在未来几年推动这一成长。

- 国家支持体育场馆建设,为各类运动提供投资机会。例如,中国已投入超过135亿元建设体育设施,升级基础设施和服务,增加人们体育运动的参与。 2020年终,全国体育设施新建数量将比2017年增加89.7%。在「十四五」规划期间(2021-2025年),体育局承诺在全国范围内开放或维修1000个以上的体育设施,以增加能够参加体育比赛的人数。因此,新体育场馆的建设和体育赛事的增加预计将增加全国的 LED 照明销售。

稳定的出生率与住宅、小型企业和电动车的积极成长相辅相成

- 2022年,中国总人口为14.1175亿人。 2022年,中国每1,000名成年人出生6.77名婴儿。随着年轻人口的稳定成长,2021年中国每年新建商业地产面积约1.4105亿平方公尺,2022年3月工工业部将再支持孵化3,000家小巨人企业。到2025年,中国希望拥有1,000家单品冠军企业和10,000家小巨人企业。商业和企业的成长推动了对更多 LED 的需求。

- 在中国社会经济底层,截至2019年,超过60%的居民拥有自己的房屋。与大城市的居民相比,拥有率相当高。在二线城市和城镇,41%的房主没有房屋抵押贷款。 2019年农村和都市区平均家庭户面积分别为48.9平方公尺和39.8平方公尺。 LED 使用量的上升可能受到住宅购买量增加的影响。

- 由于人口成长,截至2021年9月,中国的汽车持有为2.97亿辆。 2021年第三季机动车註册量为883万辆。 2021年,超过85%的电动车销量发生在中国。 2021年,中国电动车销量比全球其他地区(300万辆)多330万辆。到 2021 年,中国的电动车持有将达到 780 万辆,仍将是全球最大电动车保有量国家。随着电动车数量的不断增长,中国 LED 照明市场也将随之成长,带动对 LED 的需求增加。

中国户外LED照明产业概况

中国户外LED照明市场格局适度整合,前五大企业占比达61.99%。市场的主要企业是:EGLO Leuchten GmbH、广东百威集团有限公司、欧普照明、松下控股株式会社和 Signify Holding (飞利浦)(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均收入

- LED进口总量

- 照明耗电量

- 家庭数量

- LED渗透率

- 体育场数量

- 法律规范

- 中国

- 价值链与通路分析

第五章 市场区隔

- 户外照明

- 公共设施

- 道路照明

- 其他的

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ams-OSRAM AG

- EGLO Leuchten GmbH

- Guangdong PAK Corporation Co.,Ltd.

- Hangzhou Hpwinner Opto Corporation

- NVC INTERNATIONAL HOLDINGS LIMITED

- OPPLE Lighting Co., Ltd

- Panasonic Holdings Corporation

- Shenzhen Snc Opto Electronic Co., Ltd

- Signify Holding(Philips)

- Zhejiang Yankon Group Co.,Ltd

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001633

The China Outdoor LED Lighting Market size is estimated at 0.96 billion USD in 2025, and is expected to reach 1.33 billion USD by 2030, growing at a CAGR of 6.77% during the forecast period (2025-2030).

The continued demand for road and airport expansion has increased the demand for LED lighting products.

- In 2023, streets and roadways accounted for the majority of the value share, followed by public places and other areas. China's total highway length as of 2021 was about 169,100 kilometers, which increased by 8,100 kilometers from the previous year. Over the past 13 years, China's highway length has increased by 1.6 times, from 65,055 kilometers in 2009. As of 2020, 13 provinces in China had over 200,000 kilometers of expressway networks, with Sichuan having the longest at more than 394,000 kilometers. The road network is expanding to promote the development of the logistics industry, with Jiangsu Province functioning as a distribution center. In 2020, Jiangsu Province had the highest number of drivers, with about 677 million drivers using the highways, surpassing Guangdong to become the busiest province in China.

- In 2023, streets and roadways accounted for the majority of the volume share, followed by public places and other areas. Companies like Philips, Toshiba, and Osram are launching projects to promote the use of LED lighting. Philips Lighting has joined the Guiyang Project, which is part of the 1000 Villages of Solar LED Lighting Program, an initiative of the Climate Group and One Foundation. The project aims to bring solar-powered LED street lighting to rural areas in China.

- The construction of a new airport was planned to progress steadily in China by 2022, with six new cargo airports and 29 new multi-purpose airports to open in mainland China. Therefore, the advancements in the market are expected to lead to increased demand for outdoor lighting products in the coming years.

China Outdoor LED Lighting Market Trends

Rising sport events and government efforts to refurbish the country's sports stadium would lead to an increase in LED lighting

- The number of stadiums is expected to witness growth from 129 units in 2022 to 143 units in 2030, exhibiting a CAGR of 1.4%. The sports sector has undergone a number of changes in recent years. For example, Enfis Group plc was awarded a contract in 2010 to provide LED arrays and drivers for the NBA Stadium in Guangzhou, China. Currently, in 2022, Shanghai Stadium will have a surface size of 170,000 m2, and it will have held important occasions like the 8th National Games, the 2007 Women's World Cup, and the 2008 Olympic Games. Shanghai Sansi provided an LED canopy with a display area of around 10,000 square meters for use in this refurbishment project. The installation and upgrading of LED lights will encourage their rise in the upcoming years.

- The nation supports the building of stadiums and provides investment opportunities for different sports. For instance, China has spent more than CNY 13.5 billion building sports facilities and upgrading its infrastructure and services to increase the country's participation in sports. By the end of 2020, there will be 89.7% more national sports venues than there were in 2017. For the 14th Five-Year Plan period (2021-25), the sports administration promises to open or renovate more than 1,000 sports facilities nationwide in order to increase the number of individuals who can engage in sporting events. Thus, it is anticipated that LED light sales will increase in the nation as a result of the building of new stadiums and an increase in athletic events.

A steady birth rate is complementing the positive growth of homeowners, small and medium-sized businesses, and electric vehicles

- In 2022, China had a total population of 1,411.75 million. In China, 6.77 children were born for every 1,000 adults in 2022. With the steady growth of the youth, around 141.05 million sq. m of commercial real estate was being built each year in China in 2021. The incubation of an additional 3,000 small giant enterprises in the year was supported by the Ministry of Industry and Information Technology in March 2022. By 2025, China wants to have 1,000 single-product champion enterprises and 10,000 tiny giant businesses. The demand to use more LEDs will be driven by the growth in businesses and enterprises.

- In China's lower socioeconomic strata, as of 2019, more than 60% of residents were homeowners. In comparison to citizens of big cities, the ownership rate was substantially greater. In lower-tier cities and towns, 41% of homeowners did not have a mortgage on their home. In 2019, the average household size in rural and urban areas was 48.9 sq. m and 39.8 sq. m, respectively. The increased use of LEDs may be influenced by the rise in home purchases.

- Owing to the growing population, China had 297 million cars as of September 2021. Motor vehicle registrations totaled 8.83 million in the third quarter of 2021. In 2021, more than 85% of all electric vehicle sales took place in China. In 2021, China sold 3.3 million more electric vehicles than the rest of the world (3.0 million). With 7.8 million vehicles, China's electric car fleet continued to be the largest in the world in 2021. The requirement for additional LEDs will be facilitated by the rise in the LED lighting market in China due to the rise in the number of EVs.

China Outdoor LED Lighting Industry Overview

The China Outdoor LED Lighting Market is moderately consolidated, with the top five companies occupying 61.99%. The major players in this market are EGLO Leuchten GmbH, Guangdong PAK Corporation Co.,Ltd., OPPLE Lighting Co., Ltd, Panasonic Holdings Corporation and Signify Holding (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 China

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ams-OSRAM AG

- 6.4.2 EGLO Leuchten GmbH

- 6.4.3 Guangdong PAK Corporation Co.,Ltd.

- 6.4.4 Hangzhou Hpwinner Opto Corporation

- 6.4.5 NVC INTERNATIONAL HOLDINGS LIMITED

- 6.4.6 OPPLE Lighting Co., Ltd

- 6.4.7 Panasonic Holdings Corporation

- 6.4.8 Shenzhen Snc Opto Electronic Co., Ltd

- 6.4.9 Signify Holding (Philips)

- 6.4.10 Zhejiang Yankon Group Co.,Ltd

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219