|

市场调查报告书

商品编码

1683958

中东和非洲户外 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Middle East and Africa Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

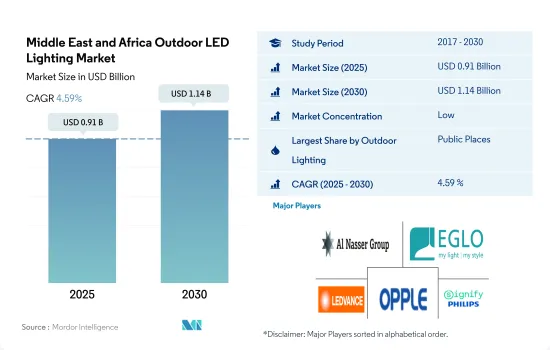

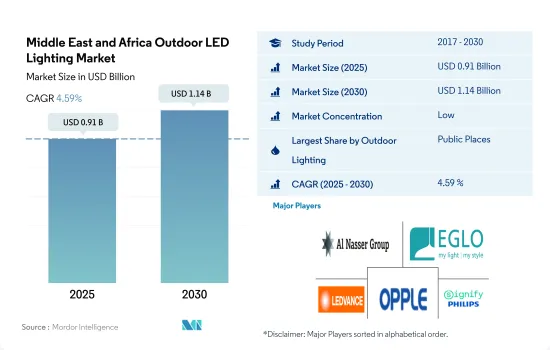

中东和非洲户外 LED 照明市场规模预计在 2025 年为 9.1 亿美元,预计到 2030 年将达到 11.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.59%。

道路网络不断扩大和体育场升级推动市场成长

- 从金额份额来看,2023年公共场所将占多数(55.1%),其次是道路和街道(44.9%)。未来几年,我们预计公共场所的份额会降低,而街道和道路上的份额会升高。 2020年,为了遏制新冠肺炎疫情的传播,全部区域的体育场、海滩和堡垒等公共场所都被关闭。公园和体育场设施的建设也已停止。 2021 年,中东和非洲放宽了 COVID 规则。 《镜报》透露,阿布达比海洋世界预计将于 2023 年开幕。亚斯岛新一代海洋生物公园已完成 90%,建设工作预计将于 2022年终完成。

- 道路基础设施的发展一直是该地区成长的主要动力,政府继续对其社会和经济发展进行大量投资。该地区的重点计划包括杜拜拨款 150 亿迪拉姆(48 亿美元)用于完成 2020 年世博会的重点计划,包括升级道路和高架桥。沙乌地阿拉伯的道路计划投资已超过1.14兆美元。

- 过去几年,体育领域发生了很大变化。例如,2015 年,Clay Pakhee 使用 LED 点亮了沙乌地阿拉伯的一个足球场。 2022年,哈利法国际体育场将配备飞利浦照明的LED照明。这些改进对于卡达主办 2022 年 FIFA 世界杯四分之一决赛至关重要。 2022 年,拉斯阿布阿布德体育场内安装了 4,000 多台照明设备,包括紧急照明和出口标誌。上述案例预计将促进该地区户外照明产业的发展。

中东和非洲户外 LED 照明市场趋势

体育场馆维修和新建推动 LED 照明成长

- 体育场馆数量将从 2022 年的 227 个增加到 2030 年的 255 个,复合年增长率为 1.4%。近年来,体育领域发生了许多变化。例如,克莱帕基 (Clay Paky) 于 2015 年在沙乌地阿拉伯的法赫德国王国际体育场使用了 LED 照明。哈利法国际体育场将于 2022 年使用飞利浦照明的 LED 照明。进行升级是为了确保体育场能够举办 2022 年卡达世界杯四分之一决赛之前的比赛。 2022 年,拉斯阿布阿布德体育场内安装了 4,000 多个照明设备,包括紧急照明和出口标誌。这些因素正在支持该地区 LED 市场的扩张。

- 沙乌地阿拉伯体育部在发展体育基础设施方面取得了显着进展。该国计划到 2023 年投资 101 亿沙特里亚尔(合 27 亿美元),建造先进的体育场馆,举办广受认可的体育赛事国际足总。利雅德的新体育场计划因其永续性措施而脱颖而出,例如在体育场照明中使用 LED。

- 沙乌地阿拉伯体育部启动了一项耗资 101 亿沙乌地里亚尔(27 亿美元)的 2023 年计划,用于建造新的体育设施和维修现有的体育设施。根据沙乌地阿拉伯体育部介绍,该倡议是沙乌地阿拉伯与埃及和希腊联合申办2030年世界杯的一部分。沙乌地阿拉伯足球联合会(SAFF)于2023年宣布,沙乌地阿拉伯将在2027年亚洲杯前在利雅德、阿尔科巴尔和达曼建造三座新体育场。因此,随着新体育场馆的建设和体育赛事的增多,预计全国范围内的 LED 照明销售额将会增加。

家庭数量的增加将推动该地区 LED 使用量的成长

- 截至 2018 年,中东和非洲人口为 4.84 亿,预计到 2030 年将成长到约 5 亿。 2020 年,阿布达比酋长国将建造超过 92,800 套住宅,其次是沙迦(41,000 套)和杜拜(35,000 套)。预计未来几年阿联酋将建造 231,200 套住宅。新房间的建设可能会导致 LED 销售的成长。

- 在中东和非洲,典型的家庭规模超过五人。在沙乌地阿拉伯,大约一半的人口拥有自己的住房,数量达到 546 万户。截至 2020 年,以色列有 681,500 个家庭,其中有 5 人或 5 人以上。如果五个人住在一间房子里,那至少要有两个房间。以色列大多数人居住在单间公寓。随着家庭人口的增加,LED的销售量也在上升。

- 预计2022年中东和非洲的汽车总合将达233万辆,2023年将达到245万辆。儘管中东和非洲的电动车(EV)市场仍处于早期阶段,但已显示出令人鼓舞的成长迹象。随着地方政府越来越意识到减少碳排放的必要性,各国纷纷推出法律鼓励使用电动车。例如,阿拉伯联合大公国、沙乌地阿拉伯、巴林和阿曼已宣布净零目标。此外,该地区的一些国家正在提供税收优惠和补贴以鼓励购买电动车。由于电动车在该地区具有巨大的潜力,预计 LED 照明的需求将会上升。

中东和非洲户外 LED 照明产业概况

中东和非洲户外LED照明市场较为分散,前五大公司占比为20.13%。市场的主要企业是:Al Nasser Group、EGLO Leuchten GmbH、LEDVANCE GmbH(MLS)、OPPLE Lighting 和 Signify Holding(飞利浦)(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均收入

- LED进口总量

- 照明耗电量

- 家庭数量

- LED渗透率

- 体育场数量

- 法律规范

- 波湾合作理事会

- 南非

- 价值链与通路分析

第五章 市场区隔

- 户外照明

- 公共设施

- 道路照明

- 其他的

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ACUITY BRANDS, INC.

- Al Nasser Group

- ams-OSRAM AG

- Current Lighting Solutions, LLC.

- Dialight PLC

- EGLO Leuchten GmbH

- LEDVANCE GmbH(MLS Co Ltd)

- Nardeen Lighting Company Limited

- OPPLE Lighting Co., Ltd

- Signify Holding(Philips)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The Middle East and Africa Outdoor LED Lighting Market size is estimated at 0.91 billion USD in 2025, and is expected to reach 1.14 billion USD by 2030, growing at a CAGR of 4.59% during the forecast period (2025-2030).

The increasing road network and the upgradation of stadiums drive the market's growth

- In terms of value share, in 2023, public places accounted for the majority of the share (55.1%), followed by streets and roads (44.9%). The market share is expected to be low in public places and high in streets and roads in the coming years. In 2020, public places such as stadiums, beaches, and forts were shut down throughout the region to limit the spread of COVID-19. There was a halt in the construction of parks and stadium facilities. In 2021, the Middle East & Africa relaxed COVID rules. The Miral revealed that in 2023, SeaWorld Abu Dhabi is expected to open. The new next-generation marine life park on Yas Island was 90% complete, with building work set to finish by the end of 2022.

- Spending on road infrastructure has been a major driver of growth in the region, and the government continues to make critical investments for social and economic development. Major regional projects included Dubai's allocation of AED 15 billion (USD 4.8 billion) to complete key projects for the Expo 2020, including road and viaduct upgrades. More than USD 1.14 trillion has been invested in Saudi Arabia's road projects.

- Over the last few years, there have been many changes in the sports sector. For example, in 2015, Clay Paky lit up Saudi Arabia's soccer stadium with LEDs. In 2022, Khalifa International Stadium was equipped with LED lights of Philips lighting. These improvements were needed to host games in the quarter-finals of Qatar's 2022 FIFA World Cup. In 2022, more than 4,000 lighting devices, including emergency lights and exit signs, were put in place within the stadium of Ras Abu Aboud. The above instances are expected to boost the outdoor lighting segment in the region.

Middle East and Africa Outdoor LED Lighting Market Trends

Renovation and construction of new sports stadiums to facilitate the growth of LED lights

- The number of stadiums witnessed a growth from 227 units in 2022 to 255 units in 2030, registering a CAGR of 1.4%. The sports sector has undergone several changes in recent years. For instance, Clay Paky lit up the King Fahd International Stadium in Saudi Arabia using LEDs in 2015. The Khalifa International Stadium used LED lighting by Philips Lighting in 2022. To host games up to the quarterfinals of the Qatar 2022 FIFA World Cup, the upgrades were necessary. Within Ras Abu Aboud Stadium, more than 4,000 different luminaires, including emergency luminaires and exit signs, were erected in 2022. These elements support the expansion of the LED market in the area.

- The Sports Ministry of Saudi Arabia is making impressive progress in building sports infrastructure. The country planned to invest SAR 10.1 billion (USD 2.7 billion) in constructing advanced stadiums to host FIFA, a widely recognized sporting event, by 2023. The new stadium project in Riyadh stands out for its sustainability measures, which include using LED lights in the stadiums.

- The Saudi Arabian Sports Ministry started a SAR 10.1 billion (USD 2.7 billion) program in 2023 to construct new sporting facilities and renovate those that already exist. According to the Saudi Arabian Ministry of Sports, the initiatives will be a part of Saudi Arabia's joint candidature with Egypt and Greece to host the FIFA World Cup in 2030. The Saudi Arabian Football Federation (SAFF) announced in 2023 that Saudi Arabia would construct three new stadiums in Riyadh, Al-Khobar, and Dammam in time for the 2027 Asian Cup. Thus, LED light sales are anticipated to increase nationwide as a result of the building of new stadiums and an increase in athletic events.

Increase in household size to bolster the growth of LED usage in the region

- The Middle East & Africa had a population of 484 million people as of 2018, with that number predicted to climb to around 500 million by 2030. In 2020, over 92.8 thousand homes were built in the emirate of Abu Dhabi, followed by 41 thousand in the emirate of Sharjah and 35 thousand in the emirate of Dubai. There are expected to be 231.2 thousand residences in the entire United Arab Emirates over the coming years. The building of new rooms will consequently boost sales of LEDs.

- In the Middle East and Africa, the typical household size exceeds five people. In Saudi Arabia, about half of the population owns a home, with 5.46 million households counted in the country. In Israel, there were 681.5 thousand homes with five or more people as of 2020. There must be more than two rooms in a house to accommodate five people. The majority of people in Israel live in studio apartments. Sales of LEDs have increased as a result of the growth in household sizes.

- In the Middle East and Africa, 2.33 million automobiles were produced in total in 2022, and 2.45 million were anticipated to be produced in 2023. Although it is still in its early stages, the electric vehicle (EV) market across the Middle East and African countries is already showing hopeful signs of growth. As local governments become more aware of the need to reduce their carbon footprint, they are passing legislation to promote the use of EVs. The United Arab Emirates, Saudi Arabia, Bahrain, and Oman, for instance, have announced their net-zero targets. Several countries in the region are also offering tax incentives and subsidies to promote the purchase of electric vehicles. Due to the enormous potential that EVs present in this region, it is projected that demand for LED lighting will rise.

Middle East and Africa Outdoor LED Lighting Industry Overview

The Middle East and Africa Outdoor LED Lighting Market is fragmented, with the top five companies occupying 20.13%. The major players in this market are Al Nasser Group, EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), OPPLE Lighting Co., Ltd and Signify Holding (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 Gulf Cooperation Council

- 4.8.2 South Africa

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 Al Nasser Group

- 6.4.3 ams-OSRAM AG

- 6.4.4 Current Lighting Solutions, LLC.

- 6.4.5 Dialight PLC

- 6.4.6 EGLO Leuchten GmbH

- 6.4.7 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.8 Nardeen Lighting Company Limited

- 6.4.9 OPPLE Lighting Co., Ltd

- 6.4.10 Signify Holding (Philips)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms