|

市场调查报告书

商品编码

1683938

欧洲户外 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

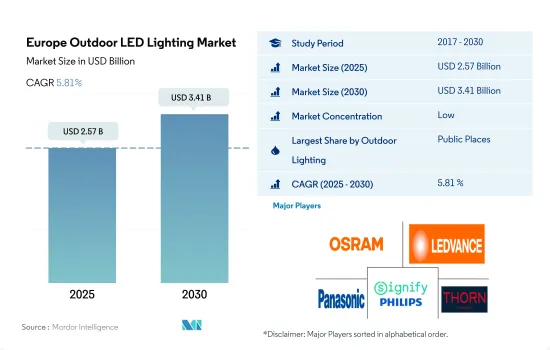

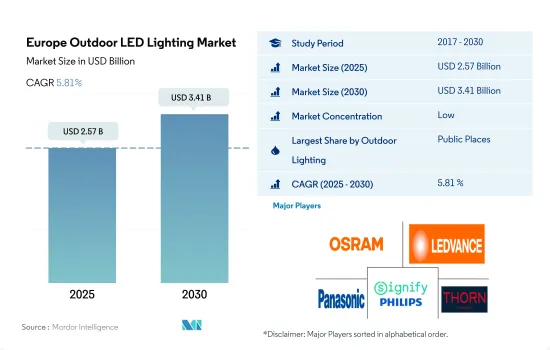

预计 2025 年欧洲户外 LED 照明市场规模为 25.7 亿美元,到 2030 年将达到 34.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.81%。

游乐园和停车场越来越多地使用 LED 照明,以及政府禁止使用传统灯具的规定将推动 LED 照明市场的成长

- 从金额和数量来看,2023 年公共空间将占最大份额,其次是道路和小径。为了遏制新冠肺炎疫情的蔓延,全部区域的体育场、游泳池、海滩和堡垒等公共场所都已关闭。欧洲在2021年放宽了与COVID相关的规定,随着大楼的开放,LED照明市场也稳定成长。德国 Funtasy World Rodental 和俄罗斯普希金主题乐园等新游乐园预计将于 2023 年开放。这些发展预计将对 LED 照明市场产生正面影响。

- 该地区零售业的出现也增加了停车需求。例如,IKEA斥资3.78亿英镑收购了牛津街上的前Topshop旗舰店。宜家计划于 2023 年在该大楼开设第一家商店,专营灯具和窗帘等家居用品。预计此类市场趋势将导致该地区对 LED 零售照明产品的需求增加。这些发展可能包括更多的公共空间,例如专用停车场和增加使用 LED 照明。

- 推动欧洲LED产品需求的主要因素是欧盟禁止销售低效率照明技术的政策。 2009年,欧洲开始逐步淘汰白炽灯的使用。定向卤素灯也于2016年逐步淘汰。 2018年9月,该地区禁止贩售非定向卤素灯。这些政策鼓励消费者逐步以LED技术为基础的产品取代传统照明产品。

体育场馆升级维修、铁路基础设施增加以及街道照明的使用将推动 LED 照明市场成长

- 就金额和数量而言,其他欧洲国家将在 2023 年占据最大份额,其次是英国、法国和德国。未来几年,其他欧洲国家的市场占有率预计将略有下降,而其余国家的市场份额预计将增加。

- 西班牙、巴塞隆纳和瓦伦西亚等国家正在建造新的体育场并维修历史建筑。例如,巴塞隆纳已从多位投资者那里获得了 14.5 亿欧元(16 亿美元)的资金,将于 2023 年开始建造诺坎普球场。布鲁塞尔计划在 2022 年投资 600 万欧元(650 万美元)。未来计划在欧洲举行的体育赛事包括 2024 年欧洲杯和 2025 年欧洲篮球锦标赛。因此,由于新体育场馆的维修和建设以及体育赛事的增加,该国的 LED 照明销售额预计将增加。

- 智慧建筑计划和 LED 平均价格的下降也是 LED 需求的主要驱动力。德国城市已开始测试将 LED 用于建筑和街道照明。乌克兰政府2023年6月计画的新阶段是更换旧灯泡。自2023年1月该计画启动以来,数百万乌克兰人利用机会免费获得了现代灯泡。此外,出于各种社会、经济和流动性相关的原因,对道路网路基础设施的投资非常重要。平均而言,大多数欧洲国家每年将其 GDP 的 0.8% 至 1.2% 左右用于公路网建设。例如,2015年,奥地利实施了奥地利高速公路网投资计画。

欧洲户外 LED 照明市场趋势

体育场馆升级、更换和新建推动 LED 照明成长

- 预计体育场数量将从 2022 年的 1,700 个增长到 2029 年的 1,760 个,复合年增长率为 0.5%。近年来,体育领域发生了许多变化。例如,伦敦体育场和 Musco 于 2020 年合作升级其照明系统,引入 LED 照明。到 2020 年,都柏林的阿维瓦体育场将获得令人讚嘆的照明昇级。红色、绿色、蓝色和白色 (RGBW) LED 灯具具有 52 种变色选项,构成了最近安装的系统。瓦伦西亚城市体育场于 2020 年进行了维修,并增加了 LED 泛光灯。 2021年,欧洲六座体育场将配备由 Signify 提供技术支援的全新照明设备。这些因素正在支持该地区LED市场的扩张。

- 欧洲俱乐部已拨出超过 25 亿欧元(26.9 亿美元)用于维修其设施。西班牙的瓦伦西亚是第二昂贵的俱乐部,他们于 2022 年斥资 3 亿欧元(3.2377 亿美元)建造了诺梅斯塔利亚球场。塞尔维亚足球联合会 (FSS) 在欧足总的支持下,已投资超过 2000 万欧元(2158 万美元)来维修该国的许多体育场,直至 2023 年。巴塞隆纳已从多位投资者处获得 14.5 亿欧元(16 亿美元)融资,诺坎普球场将于 2023 年开始兴建。布鲁塞尔已投资 600 万欧元(647 万美元)在 2022 年建造其主要体育场。 2024 年欧洲杯、2025 年欧洲篮球锦标赛和其他赛事是欧洲即将举办的一些体育赛事。因此,体育场馆维修和新建以及体育赛事的增加预计将推动该国 LED 照明的销售。

住宅和非住宅用途的增加可能推动 LED 照明的成长

- 2022年,欧洲人口为7.435亿。欧盟成员国拥有超过1.31亿栋建筑。欧盟有1.19亿栋住宅和1200万座非住宅。 2022年,住宅需求依然强劲,鼓励该地区住宅,并使当地的LED市场受益。

- 预计家庭数量将从 2020 年的 1.96 亿增加到 2021 年的 1.974 亿。在欧盟,2021 年 49.4% 的家庭有一个孩子,其次是 38.6% 有两个孩子,12% 有三个或三个以上的孩子。 2020年,约70%的欧盟公民拥有自己的住房。 2019年,欧洲平均每人拥有1.6个房间。随着人口和家庭数量的增加,家庭和商业空间中 LED 的使用可能会增加。

- 截至2019年,欧盟道路上共有2.427亿辆汽车,比与前一年同期比较增长1.8%,其中包括2800万多辆货车。目前,法国是持有数量最多的国家,拥有 600 万辆,其次是义大利(420 万辆)、西班牙(380 万辆)和德国(280 万辆)。欧盟道路上有620万辆中型和重型商用车。儘管近期註册量增加,但欧盟所有车辆中只有 4.6% 采用替代能源。混合动力电动车占欧盟道路上所有车辆的 0.8%,而电池电动车和插电式混合动力车仅占 0.2%。汽车销量的成长可能会对该地区的 LED 销售产生积极影响。

欧洲户外 LED 照明产业概况

欧洲户外LED照明市场较为分散,前五大企业占比为39.24%。该市场的主要企业是:ams-OSRAM AG、LEDVANCE GmbH(MLS)、松下控股公司、Signify Holding(飞利浦)和Thorn Lighting Ltd.(Zumtobel Group)(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均收入

- LED进口总量

- 照明耗电量

- 家庭数量

- LED渗透率

- 体育场数量

- 法律规范

- 法国

- 德国

- 英国

- 价值链与通路分析

第五章 市场区隔

- 户外照明

- 公共设施

- 道路照明

- 其他的

- 国家

- 法国

- 德国

- 英国

- 其他欧洲国家

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ACUITY BRANDS, INC.

- ams-OSRAM AG

- Dialight PLC

- EGLO Leuchten GmbH

- LEDVANCE GmbH(MLS Co Ltd)

- Panasonic Holdings Corporation

- Signify Holding(Philips)

- Thorlux Lighting(FW Thorpe Plc)

- Thorn Lighting Ltd.(Zumtobel Group)

- TRILUX GmbH & Co. KG

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The Europe Outdoor LED Lighting Market size is estimated at 2.57 billion USD in 2025, and is expected to reach 3.41 billion USD by 2030, growing at a CAGR of 5.81% during the forecast period (2025-2030).

Increasing use of LED lighting in amusement parks and parking lots and government regulations to ban traditional lamps will drive the growth of the LED lighting market

- In terms of value and volume, public spaces will account for the largest share in 2023, followed by roads and trails. Public places such as stadiums, pools, beaches, and forts were closed across the region to contain the spread of COVID-19. Europe relaxed the COVID-related rules in 2021. With the opening of buildings, the LED lighting market is also growing steadily. New amusement parks, such as Funtasy World Rodental in Germany and Pushkin Theme Park in Russia, will open in 2023. These developments will have a positive impact on the LED lighting market.

- With the emergence of retail outlets in the area, the demand for parking has increased. For example, IKEA bought the former Topshop flagship store on Oxford Street for GBP 378 million. IKEA plans to open its first store in the same building in 2023, specializing in household items such as lamps and curtains. Such instances in the market are expected to lead to increased demand for LED retail lighting products in the region. These developments will increase the number of public spaces, such as private parking spaces, and the use of LED lighting.

- A major factor driving the demand for LED products in Europe is the European Union's policy of banning the sale of inefficient lighting technologies. In 2009, Europe phased out the use of incandescent light bulbs. Directional halogen lamps were also discontinued in 2016. In September 2018, the region banned the sale of non-directional halogen lamps. These policies have facilitated the gradual replacement of traditional lighting products by consumers with those based on LED technology.

Upgradation and renovation of stadiums, rising rail infrastructure, and use of street lights to drive the growth of the LED lighting market

- In terms of value and volume, the Rest of Europe occupied a major share in 2023, followed by the United Kingdom, France, and Germany. The market share is expected to be a small reduction in the Rest of Europe and gain in other remaining countries in coming years.

- Countries such as Spain, Barcelona, and Valencia are working to develop new stadiums and refurbish historical buildings in their countries. For example, Barcelona has secured EUR 1.45 billion (USD 1.6 billion) from multiple investors to begin construction of its Camp Nou stadium in 2023. Brussels planned to invest EUR 6 million (USD 6.5 million) in 2022. UEFA Euro 2024, EuroBasket 2025, and other events are some of the upcoming sporting events in Europe. Therefore, the renovation and construction of new stadiums and the increase in sports tournaments are expected to boost sales of LED lighting in the country.

- The smart building initiatives and falling average LED prices are also key drivers of LED demand. LEDs for building and street lighting have already been tested in German cities. In June 2023, a new phase of the Ukrainian government's program planned to replace old light bulbs. Since the program was launched in January 2023, millions of Ukrainian citizens have taken advantage of the opportunity to receive the latest light bulbs for free. In addition, investments in road network infrastructure are important for a variety of social, economic, and mobility-related reasons. On average, most European countries spend about 0.8% to 1.2% of their annual GDP on road networks. For example, in 2015, Austria implemented a program of investment in the Austrian motorway network.

Europe Outdoor LED Lighting Market Trends

Upgradation, replacement, and construction of new stadiums will drive the growth of LED lights

- The number of stadiums is expected to witness growth from 1,700 units in 2022 to 1,760 units in 2029, exhibiting a CAGR of 0.5%. The sports sector has undergone several changes in recent years. For instance, London Stadium and Musco collaborated in 2020 to upgrade the lighting system and install LED lights. The Aviva Stadium in Dublin had spectacular lighting effects by 2020. Red, green, blue, and white (RGBW) LED fixtures with 52 color-changing options make up the recently installed system. The stadium at Ciutat de Valencia underwent renovation in 2020, and LED floodlights were added. Six stadiums in Europe got new lighting by Signify in 2021. These elements support the expansion of the LED market in the area.

- European clubs set aside more than EUR 2.5 billion (USD 2.69 billion) for facility renovations. Valencia, Spain, which committed EUR 300 million (USD 323.77 million) to constructing the Nou Mestalla stadium in 2022, made the second-most expensive investment. With UEFA's assistance, the Football Association of Serbia (FSS) invested more than EUR 20 million (USD 21.58 million) in 2023 to upgrade a number of the nation's stadiums. Barcelona obtained EUR 1.45 billion (USD 1.6 billion) in financing from several investors to start building the Camp Nou stadium in 2023. Brussels invested EUR 6 million (USD 6.47 million) in building a major stadium in 2022. UEFA Euro 2024, EuroBasket 2025, and other events are a few of the upcoming sporting occasions in Europe. Thus, the renovation and construction of new stadiums and an increase in sporting tournaments are expected to increase sales of LED lights in the country.

Increasing residential housing and non-residential buildings may drive the growth of LED lights

- In 2022, Europe had 743.5 million people. The Member States of the European Union contains over 131 million structures. The European Union has 119 million residential buildings and 12 million non-residential buildings. In 2022, the demand for housing remained high, encouraging the building of new homes in the region, thus benefitting the local LED market.

- There were 197.4 million households in 2021 as opposed to 196.0 million in 2020. In the EU, 49.4% of households had a single child in 2021, followed by 38.6% with two children and 12% with three or more. About 70% of EU citizens were homeowners in 2020. In 2019, European homes had 1.6 rooms per person on average. The use of LEDs in homes and business spaces may increase as the population and the number of households rise.

- As of 2019, there were 242.7 million cars on the road in the European Union, an increase of 1.8% from the previous year, and more than 28 million vans on the road. France has by far the largest fleet of vans, with six million vehicles, followed by Italy (4.2 million), Spain (3.8 million), and Germany (2.8 million). EU roadways have 6.2 million medium and heavy commercial vehicles. Even though registrations have gone up recently, only 4.6% of all EU vehicles are alternatively powered. Hybrid electric vehicles make up 0.8% of all vehicles on EU roads, while battery-electric and plug-in hybrid vehicles each account for only 0.2% of the total. The increase in automotive vehicle sales may positively impact LED sales in the region.

Europe Outdoor LED Lighting Industry Overview

The Europe Outdoor LED Lighting Market is fragmented, with the top five companies occupying 39.24%. The major players in this market are ams-OSRAM AG, LEDVANCE GmbH (MLS Co Ltd), Panasonic Holdings Corporation, Signify Holding (Philips) and Thorn Lighting Ltd. (Zumtobel Group) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 France

- 4.8.2 Germany

- 4.8.3 United Kingdom

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

- 5.2 Country

- 5.2.1 France

- 5.2.2 Germany

- 5.2.3 United Kingdom

- 5.2.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 ams-OSRAM AG

- 6.4.3 Dialight PLC

- 6.4.4 EGLO Leuchten GmbH

- 6.4.5 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.6 Panasonic Holdings Corporation

- 6.4.7 Signify Holding (Philips)

- 6.4.8 Thorlux Lighting (FW Thorpe Plc)

- 6.4.9 Thorn Lighting Ltd. (Zumtobel Group)

- 6.4.10 TRILUX GmbH & Co. KG

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms