|

市场调查报告书

商品编码

1683965

南美户外 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)South America Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

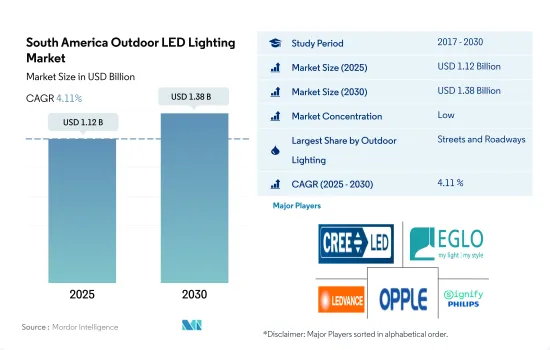

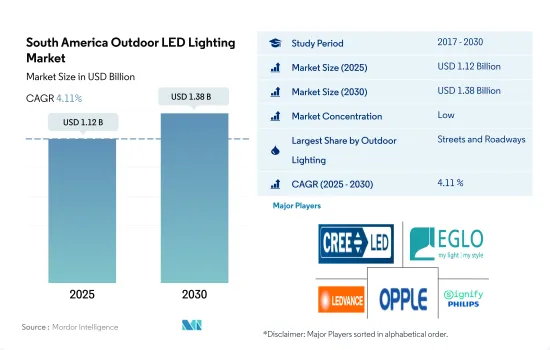

南美户外 LED 照明市场规模预计在 2025 年为 11.2 亿美元,预计到 2030 年将达到 13.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.11%。

道路扩建、新游乐园和零售店的增加正在推动市场成长

- 就金额份额而言,2023年道路和公路(S&R)将占据大部分份额(59.5%),其次是公共场所(40.5%)和其他。预计未来几年 S&R市场占有率将略有下降,而公共的份额将上升。为了遏制新冠肺炎疫情的蔓延,全部区域的体育场、游泳池、海滩和堡垒等公共场所都已关闭。公园和体育场设施的建设也已停止。此外,2021年,南美洲放宽了新冠疫情限制措施。巴西计划在2023年至2026年期间在高速公路上投资超过600亿美元。目前的竞标预计将涉及四条高速公路的约200亿美元投资:两条在巴拉那州,一条在米纳斯吉拉斯州,一条在里约热内卢。预计这将增加高速公路照明并为该地区的 LED 市场做出贡献。

- 从数量份额来看,到2023年,公共设施将占大多数,达到65.4%,其次是S&R(34.6%)和其他。在接下来的几年里,我们预计 S&R 的份额将略有下降,而公共场所的份额将增加。当新的景点于 2023 年在巴西的贝託卡雷罗世界开放时,这将是该公司成立 53 年来首次建造体现 NERV 品牌的主题公园。

- 此外,随着全部区域零售店的增加,停车需求也随之增加。例如,时尚零售商 H&M 计划于 2023 年 7 月在巴西开始在店内和线上开展业务,具体时间是 2025 年。 H&M 正在与拉丁美洲 10 个国家的领先零售商之一 Dorben Group 合作,扩大其在巴西的业务。预计这些市场进步将在未来几年推动户外 LED 的需求。

南美洲户外 LED 照明市场趋势

体育场馆的维修和新建推动 LED 照明的广泛使用

- 南美洲的体育场数量预计将从 2022 年的 182 座增长到 2029 年的 212 座,复合年增长率为 2.2%。最近,该地区的体育产业取得了一些进展。例如,博卡青年队在2020年南美解放者杯和美洲杯赛前维修了布宜诺斯艾利斯阿尔贝托·J·阿曼多足球场的泛光灯。新设计的体育场使用了大约 248 盏 Thorn Lighting Altis 3- Brick泛光灯。作为一座获得 EDGE 认证的体育场,拉普拉塔大学生新体育场计划总面积约为 290,000 平方英尺,于 2019 年 11 月首次开放。该体育场融入了 EDGE 法规中的某些永续标准,例如在整个计划中使用室内和室外 LED 照明。这些因素正在支持当地LED市场的扩张。

- 为了2015年举办的赛事,智利体育部长投资1.56亿美元兴建新体育场,并投资1.13亿美元维修体育场。该国目前正在为多项体育项目的体育场馆建设和投资机会提供资金。例如,智利圣地牙哥的圣卡洛斯德阿波金多体育场正在由 IDOM维修。该建设预计于2024年底完工。墨西哥于2020年确认了尤卡坦州的这座体育场的建设,计划于2023年开放,并获得LEED(能源与环境设计先锋)认证,成为一座永续建筑。该地区即将举办的体育赛事之一是泛美运动会,该运动会将于 2024 年在智利举行。这些发展将推动未来几年南美洲户外 LED 照明市场的成长。

汽车製造推动 LED 照明市场

- 截至 2021 年,拉丁美洲人口为 6.56 亿,约占世界人口的 8.37%。 2022 年拉丁美洲人口与 2021 年相比成长了近 0.9%。与 2019 年相比,2020 年拉丁美洲和加勒比地区的总合生育率没有显着变化,仍维持在每位妇女约 1.99 个孩子。随着人口的增长,许多人为了寻求更好的就业和教育机会而搬到大都会圈。随着城市人口的成长,拉丁美洲城市的住宅需求不断增加。一些拉丁美洲政府正在努力发展城市基础设施以支持贫困阶级,特别是在住宅方面。预计住宅需求的增加将推动南美洲对 LED 的需求。

- 预计2022年南美洲汽车产量将达963总合,2023年将上升至983万辆。拉丁美洲道路上的电动车数量正在增加。例如,电动车销量的成长是由拉丁美洲的高檔汽车购买者推动的。 2021 年该地区将售出约 25,000 辆电动车,是 2020 年销量的两倍多。虽然各地区存在差异,但 2021 年电动车销量占从墨西哥到智利所有汽车销量的 0.7%。销量最高(13,000 辆)且占比最高(售出的所有汽车中 2.7% 配有插头)的国家是哥斯达黎加。因此,预计汽车产业对 LED 照明的需求将会增加。

南美洲户外 LED 照明产业概况

南美户外LED照明市场较为分散,前五大企业占比为13.34%。市场的主要企业是:Cree LED(SMART Global Holdings, Inc.)、EGLO Leuchten GmbH、LEDVANCE GmbH(MLS)、OPPLE Lighting 和 Signify Holding(飞利浦)(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均收入

- LED进口总量

- 照明耗电量

- 家庭数量

- LED渗透率

- 体育场数量

- 法律规范

- 阿根廷

- 巴西

- 价值链与通路分析

第五章 市场区隔

- 户外照明

- 公共设施

- 道路照明

- 其他的

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ACUITY BRANDS, INC.

- ams-OSRAM AG

- Cree LED(SMART Global Holdings, Inc.)

- Current Lighting Solutions, LLC.

- Dialight PLC

- EGLO Leuchten GmbH

- LEDVANCE GmbH(MLS Co Ltd)

- NVC INTERNATIONAL HOLDINGS LIMITED

- OPPLE Lighting Co., Ltd

- Signify Holding(Philips)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The South America Outdoor LED Lighting Market size is estimated at 1.12 billion USD in 2025, and is expected to reach 1.38 billion USD by 2030, growing at a CAGR of 4.11% during the forecast period (2025-2030).

Expansion of roads, new amusement parks, and increasing number of retail stores drive the market growth

- In terms of value share, in 2023, streets and roadways (S&R) accounted for the majority of the share (59.5%), followed by public places (40.5%) and others. The market share is expected to witness a small reduction in S&R and a gain in public places in the coming years. To limit the spread of COVID-19, public places such as stadiums, pools, beaches, and forts were shut down throughout the region. There has been a halt in the construction of parks and stadium facilities. Further, in 2021, South America relaxed COVID-19 restrictions. Brazil aimed to invest more than USD 60 billion in highways by 2023 and 2026. The auctions are expected to attract approximately USD 20 billion in investments for four highways, two in Parana, one in Minas Gerais, and one in Rio de Janeiro. These instances are expected to increase highway lighting, thus contributing to the LED market in the region.

- In terms of volume share, in 2023, public places accounted for the majority of the share (65.4%), followed by (S&R) (34.6%) and others. The market share is expected to be a small reduction in S&R and a gain in public places in the coming years. With the opening of a new attraction in 2023 at Beto Carrero World in Brazil, the iconic Nerf brand will have its first theme park in its 53 years of existence.

- The demand for parking lots is also increasing with the rise of retail stores across the region. For instance, in July 2023, Fashion retailer H&M planned to launch stores and online trade in Brazil by 2025. H&M has partnered with Dorben Group, one of the prominent retailers in 10 Central and South American countries, to expand its presence in Brazil. Such advancements in the market are expected to fuel the demand for outdoor LEDs in the coming years.

South America Outdoor LED Lighting Market Trends

Renovation and construction of new sports stadiums to facilitate the growth of LED lighting usage

- The number of stadiums in South America is expected to witness a growth from 182 units in 2022 to 212 units in 2029, exhibiting a CAGR of 2.2%. In recent years, there have been several developments in the regional sports industry. For instance, Boca Juniors renovated the floodlighting for The Alberto J. Armando football stadium in Buenos Aires ahead of the 2020 Copa Libertadores and the Copa America. About 248 Thorn Lighting Altis 3-brick floodlights are used across the stadium in the new design. A stadium with EDGE accreditation, the new Estudiantes de La Plata Stadium project has a total size of around 290,000 sq. ft. Its doors first opened in November 2019. The stadium has incorporated certain sustainable standards into the EDGE rules, including the use of interior and external LED lighting throughout the project. Such factors support the expansion of the regional LED market.

- For an event in 2015, the Chilean Minister of Sports invested USD 156 million in new stadium construction and USD 113 million in stadium renovations. The nation is currently providing funding for stadium development and investment opportunities for a variety of sports. For instance, The San Carlos de Apoquindo stadium in Santiago, Chile, is being renovated by IDOM. Work is expected to wrap up in the second half of 2024. Mexico confirmed the Yucatan sports stadium in 2020, which was scheduled to open in 2023 and be certified by LEED (Leadership in Energy and Environmental Design) as a sustainable building. One of the upcoming sports events in the region is the Pan-American Games in Chile in 2024. These developments will drive the growth of the South American outdoor LED lighting market over the coming years.

Automobile production to boost the LED lighting market

- With 656 million people as of 2021, Latin America made up around 8.37% of the world's population. The population of Latin America increased by almost 0.9% in 2022 compared to 2021. Compared to 2019, the total fertility rate in Latin America and the Caribbean did not significantly change in 2020 and stayed at about 1.99 children per woman. Many people are relocating to metropolitan regions as the population grows in search of better employment and educational possibilities. The demand for residential properties in Latin American cities is rising as a result of the growing urban population. Some Latin American governments have taken action to support pro-poor urban infrastructure, particularly with respect to housing. The increase in the demand for residential properties will increase the demand for LED in South America.

- In South America, a total of 9.63 million cars were produced in 2022, and that number is projected to rise to 9.83 million in 2023. The number of EVs is rising in Latin America. For instance, a rise in the sales of electric vehicles is being driven by premium car purchasers in Latin America. In the region, about 25,000 EVs were sold in 2021, more than twice as many as were sold in 2020. With regional differences, EV sales in 2021 were 0.7% of all auto sales from Mexico to Chile. The country with the biggest sales (13,000 units) and the highest percentage (2.7% of all sold automobiles had a plug) was Costa Rica. As a result, it is predicted that the demand for LED lighting is expected to increase in the automotive industry.

South America Outdoor LED Lighting Industry Overview

The South America Outdoor LED Lighting Market is fragmented, with the top five companies occupying 13.34%. The major players in this market are Cree LED (SMART Global Holdings, Inc.), EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), OPPLE Lighting Co., Ltd and Signify Holding (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 Argentina

- 4.8.2 Brazil

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 ams-OSRAM AG

- 6.4.3 Cree LED (SMART Global Holdings, Inc.)

- 6.4.4 Current Lighting Solutions, LLC.

- 6.4.5 Dialight PLC

- 6.4.6 EGLO Leuchten GmbH

- 6.4.7 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.8 NVC INTERNATIONAL HOLDINGS LIMITED

- 6.4.9 OPPLE Lighting Co., Ltd

- 6.4.10 Signify Holding (Philips)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms