|

市场调查报告书

商品编码

1683963

南美汽车 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)South America Automotive LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

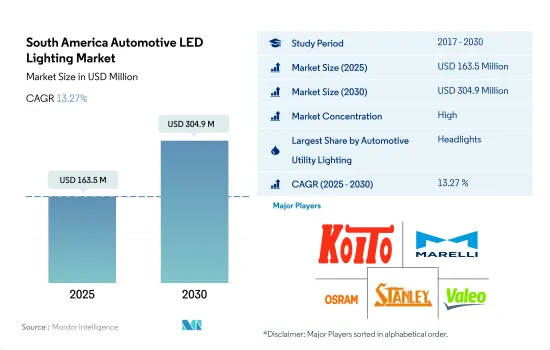

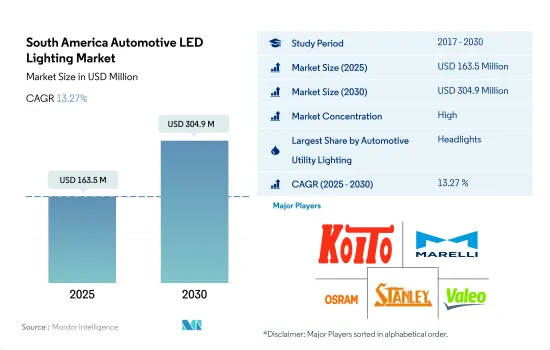

南美汽车 LED 照明市场规模预计在 2025 年为 1.635 亿美元,预计到 2030 年将达到 3.049 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.27%。

车头灯预计将占据最大市场占有率

- 从以金额为准,2023 年前照灯将占据大部分份额,其次是雾灯和方向灯。预测期内,头灯和转向信号灯的市场占有率预计会增加。采用的主要原因是为了提高能源效率和预防事故。儘管价格昂贵,但用作车头灯的 LED 照明将继续获得市场占有率,因为它们可以将消费量降低 60%。里约等城市地区的路面坑洞是造成 90% 交通事故的原因,因此人们使用 LED 头灯来防止这种情况发生。

- 从销售份额来看,2023年转向信号灯(DSL)将占多数,其次是头灯和雾灯。在南美,由于事故率高、购买者数量众多,乘用车目前占据了大部分市场。拉丁美洲和加勒比地区 (LAC) 的道路安全状况不佳,每年导致近 13 万人死亡和 600 万人受伤,包括缺乏足够的 DSL。由于这些因素,对此类照明的需求量庞大,预计未来几年还会出现成长。

- 南美国家的电动车政策是电动车销售的一大趋势,间接带动LED照明的需求。哥斯达黎加的目标是到2050年,实现新销售的轻型汽车、100%的公车和计程车均为零排放汽车。智利的目标是到2035年,新销售的轻型车、城市公车和计程车中100%都将是电动车。这些因素预计将提振市场。

南美洲汽车 LED 照明市场趋势

电动车销售成长推动 LED 市场

- 预计2022年南美汽车总产量将达512万辆,2023年将达543万辆。疫情和小零件短缺对拉丁美洲汽车产业产生了重大影响。受新冠疫情影响,拉丁美洲两大汽车製造国墨西哥和巴西4月产量骤降99%,总合仅生产了5,569辆汽车。墨西哥对美国出口的依赖程度高于其他国家,4 月该国仅向美国出口了 27,889 辆汽车。巴西对国内市场更感兴趣。不过,对阿根廷的出口很多。出口下降了77%。汽车产量下降影响了汽车产业对LED照明的需求。

- 南美汽车製造商包括福特马达、通用汽车、本田、宝马、菲亚特、雪佛兰和标緻。在拉丁美洲,电动车正在兴起。例如,拉丁美洲的高檔汽车购买者正在推动电动车销量的成长。 2021 年该地区售出了近 25,000 辆电动车,是 2020 年销量的两倍多。从墨西哥到智利,电动车销量占 2021 年汽车总销量的 0.7%,但不同地区有所不同。巴西的註册数量最多(13,000 辆),哥斯大黎加所占比例最高(所有註册车辆中 2.7% 为插电式汽车)。因此,随着越来越多的人使用电动车,汽车产业对 LED 照明的需求预计将会成长。

政府为促进该地区电动车销售而采取的措施正在推动 LED 市场的发展

- 预计南美洲电动车市场将大幅成长。 2022年上半年,该地区九个国家的电动和混合动力汽车汽车销量超过6.7万辆。同期拉丁美洲八国销售额成长了37.7%。巴西占南美汽车市场总量的一半以上。 2022 年巴西市场的汽车销量为 917,942 辆,其中 3,843 辆(0.4%)为纯电动车,19,764 辆为混合动力汽车,包括 HEV 和 PHEV。

- 该地区的发展受到多种因素的推动,包括政府奖励计划、传统燃料价格上涨以及电动车车型日益普及。此外,随着充电基础设施的扩大以及对低排放货车和轻型卡车的需求不断增长,南美的电动车销售也得到了推动。 2022年2月,电气化数位化城市基础设施生态系统及能源效率服务供应商Enel X SRL在智利开设了拉丁美洲首个“电动车服务站”,为所有以电力为主要能源来源的车辆提供支援。

- 智利政府正在製定标准来规范电动车的发展。智利政府于 2021 年宣布,从 2035 年起,智利销售的所有汽车都将是电动车。 2022年11月,比亚迪与巴西巴伊亚州卡马萨里市政府签署意向书,成立电动车及电池原料製造厂。其中两条生产线将于 2024 年 10 月运作运作,另一条将于 2025 年 1 月投入营运。因此,上述案例将由于电动车需求的增长而导致新发电厂的开发和生产,从而推动该地区对汽车 LED 的需求。

南美洲汽车LED照明产业概况

南美洲汽车LED照明市场比较集中,前五大公司占了134.33%的市占率。该市场的主要企业是:KOITO MANUFACTURING、Marelli Holdings、OSRAM GmbH.、Stanley Electric 和 Valeo(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 汽车产量

- 人口

- 人均收入

- 汽车贷款利率

- 充电站数量

- 汽车持有量

- LED进口总量

- 家庭数量

- 道路网络

- 渗透率

- 法律规范

- 阿根廷

- 巴西

- 价值链与通路分析

第五章 市场区隔

- 汽车实用照明

- 日间行车灯 (DRL)

- 转向指示灯

- 头灯

- 倒车灯

- 红绿灯

- 尾灯

- 其他的

- 汽车照明

- 二轮车

- 商用车

- 搭乘用车

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ASX Iluminacao

- HELLA GmbH & Co. KGaA

- HYUNDAI MOBIS

- KOITO MANUFACTURING CO., LTD.

- Marelli Holdings Co., Ltd.

- NAOEVO Lighting

- OSRAM GmbH.

- SHOCKLIGHT

- Stanley Electric Co., Ltd.

- Valeo

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The South America Automotive LED Lighting Market size is estimated at 163.5 million USD in 2025, and is expected to reach 304.9 million USD by 2030, growing at a CAGR of 13.27% during the forecast period (2025-2030).

Headlights are expected to hold the highest market share

- In terms of value, in 2023, headlights accounted for the majority share, followed by fog lights and directional signal lights. The market share for headlights and directional signal lights is expected to increase during the forecast period. The major reason for their adoption is the energy efficiency and accident prevention. Irrespective of its high price, the market share will increase as LED lighting used as headlights provides a 60% decrease in energy consumption. Potholes in city streets, such as Rio, are the cause of 90% of traffic accidents, and LED headlights are adopted to prevent them.

- In terms of volume share, in 2023, directional signal lights (DSL) accounted for a majority share, followed by headlights and fog lights. In South America, passenger cars currently have the majority share due to the high accident rate and number of buyers in the region. The lack of road safety in Latin America and the Caribbean (LAC) results in nearly 130,000 deaths and six million injuries per year, which also includes a lack of proper DSL. Such a factor indicates major volume demand for such lighting and is expected to increase in the coming years.

- EV policy in South American countries is the major trend adoption for EV sales, which is indirectly increasing the demand for LED lighting. In Costa Rica, 100% of new light vehicle sales and 100% of buses and taxis will be ZEVs (Zero Emission Vehicles) by 2050. In Chile, 100% of new sales of light-duty vehicles, urban buses, and taxis will be EVs by 2035. Such factors are expected to boost the market.

South America Automotive LED Lighting Market Trends

Increasing EV sales to drive the LED market

- The total automobile vehicle production in South America was 5.12 million units in 2022, and it was expected to reach 5.43 million units in 2023. The pandemic and the lack of micro components have had a significant impact on the automotive sector in Latin America. Due to the COVID-19 pandemic, leading two auto producers in Latin America, Mexico, and Brazil had an astounding 99% drop in April, producing just 5,569 vehicles in total. Only 27,889 vehicles were sent from Mexico in April, which is more reliant on exports to the United States than any other country. Brazil is more concerned with its own local market. However, it exports a lot to Argentina. Exports decreased by 77%. The demand for LED lighting in the automotive business was impacted by the decline in auto production.

- South American automakers include Ford Motor Company, General Motors Company, Honda, BMW, Fiat, Chevrolet, and Peugeot. In Latin America, the number of EVs is increasing. For instance, premium car buyers in Latin America are driving an increase in the sales of electric vehicles. Nearly 25,000 EVs were sold in the area in 2021, more than double the amount sold in 2020. From Mexico to Chile, EV sales made up 0.7% of all automobile sales in 2021, with regional variations. Brazil sold the most units (13,000), and Costa Rica had the highest percentage (2.7% of all vehicles sold had a plug). Therefore, it is anticipated that the need for LED lighting in the automobile industry will expand as more people adopt EVs.

The LED market is driven by government initiatives propelling EV sales in the region

- The South American EV market is predicted to rise significantly. In the first half of 2022, 9 countries in the region saw electric and hybrid vehicle sales of more than 67,000 vehicles. In the same period, sales percentage increased by 37.7% in 8 Latin American countries. Brazil accounts for well over half the entire South American vehicle market. In 2022, the Brazilian market saw 917,942 vehicle sales, of which 3,843 were BEVs (0.4%) and 19,764 were hybrids, including both HEVs and PHEVs.

- The region is driven by a combination of factors that include government incentive programs, rising prices for conventional fuels, and a wider range of available EV models. Also, EV sales in South America have been boosted by an expansion of charging infrastructure and increased demand for low-emission vans and small trucks. In February 2022, Enel X SRL, which provides electrified and digitalized urban infrastructure ecosystem and energy efficiency services, opened the first "EV Service Station" in Latin America, located in Chile, to support any vehicle that uses electricity as its primary energy source.

- The Chilean government is setting the standard for EV development regulations. Chile's government stated in 2021 that all vehicles sold in Chile after 2035 will be electric. In November 2022, BYD signed a statement of intent with the municipal government of Camacari in the Brazilian state of Bahia to establish a manufacturing plant for electric vehicles and raw battery materials. Two of its production lines will be operational by October 2024, and the other line will go live in January 2025. Thus, the above instances lead to the development and production of new power stations because of the growing demand for EVs, which boosts the demand for automotive LEDs in the region.

South America Automotive LED Lighting Industry Overview

The South America Automotive LED Lighting Market is fairly consolidated, with the top five companies occupying 134.33%. The major players in this market are KOITO MANUFACTURING CO., LTD., Marelli Holdings Co., Ltd., OSRAM GmbH., Stanley Electric Co., Ltd. and Valeo (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 # Of Households

- 4.9 Road Networks

- 4.10 Led Penetration

- 4.11 Regulatory Framework

- 4.11.1 Argentina

- 4.11.2 Brazil

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Automotive Utility Lighting

- 5.1.1 Daytime Running Lights (DRL)

- 5.1.2 Directional Signal Lights

- 5.1.3 Headlights

- 5.1.4 Reverse Light

- 5.1.5 Stop Light

- 5.1.6 Tail Light

- 5.1.7 Others

- 5.2 Automotive Vehicle Lighting

- 5.2.1 2 Wheelers

- 5.2.2 Commercial Vehicles

- 5.2.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ASX Iluminacao

- 6.4.2 HELLA GmbH & Co. KGaA

- 6.4.3 HYUNDAI MOBIS

- 6.4.4 KOITO MANUFACTURING CO., LTD.

- 6.4.5 Marelli Holdings Co., Ltd.

- 6.4.6 NAOEVO Lighting

- 6.4.7 OSRAM GmbH.

- 6.4.8 SHOCKLIGHT

- 6.4.9 Stanley Electric Co., Ltd.

- 6.4.10 Valeo

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms