|

市场调查报告书

商品编码

1683956

中东和非洲汽车 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Middle East and Africa Automotive LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

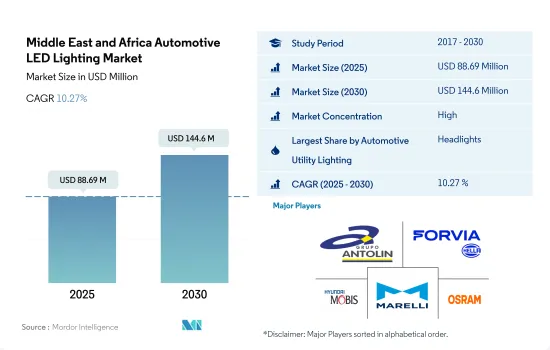

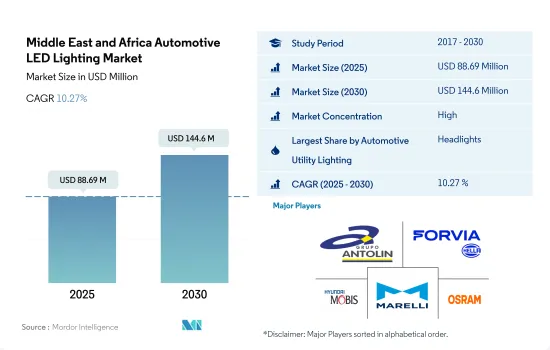

中东和非洲汽车 LED 照明市场规模预计在 2025 年为 8,869 万美元,预计到 2030 年将达到 1.446 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.27%。

头灯领域预计将占据最大的市场占有率

- 就金额份额而言,头灯将在 2023 年占据大部分市场占有率,其次是雾灯(其他部分)和转向灯。预测期内,头灯的市场占有率预计将会扩大。采用它们的主要原因是政府政策、提高能源效率和预防事故。儘管非洲大陆持有的汽车数量不到全球的 2%,但其道路交通死亡人数却占全球的四分之一。根据阿联酋联邦交通法第95条规定,使用更白或更亮的头灯将被处以200迪拉姆的罚款。这就是LED越来越受关注的原因。

- 就2023年的销售份额而言,转向信号灯(DSL)将占据大多数,其次是头灯和雾灯。目前,由于事故率高,DSL 和雾灯的大部分需求来自于乘用车。在阿联酋,事故数量从 2021 年的 3,488 起增加 13% 至 2022 年的 3,945 起。这些因素表明对此类照明的需求很大,预计未来几年还会增加。

- 该地区的电动车政策将鼓励电动车的采用并增加对 LED 照明的需求。联合国环境规划署目前正积极致力于在九个非洲国家引进电动两轮车和三轮车。儘管燃料价格低廉,海湾合作委员会国家目前正缓慢地推广电动车。在杜拜,电动车充电站正受到越来越多的关注,Regeny 和 EvGateway 于 2023 年 1 月宣布建立合作伙伴关係,到 2030 年在阿联酋各地部署 10,000 个电动车充电站网路。这些因素预计将推动市场发展。

中东和非洲汽车 LED 照明市场趋势

政府鼓励购买电动车的法规和倡议将推动 LED 市场的发展

- 预计2022年中东和非洲汽车总产量将达233万辆,2023年将达245万辆。中东和非洲也未能倖免于新冠肺炎疫情的影响,汽车产业受到严重衝击。 2020年3月,沙乌地阿拉伯汽车销量下降35-40%。受停工和油价下跌影响,阿联酋汽车产业同期也遭遇大幅下滑,2020年3月汽车销量下降了45-50%。在海湾合作委员会地区,光是2020年3月,定期维修就下降了70%,同月汽车零件销量也下降了惊人的50%。南非汽车市场销量下跌2.8%至536,626辆,证实了近十年的下降趋势。总体而言,汽车和汽车零件产量下降对汽车产业的LED灯使用产生了负面影响。

- 中东和非洲的电动车(EV)市场仍处于早期阶段,但已经显示出积极的扩张迹象。该地区的各国政府认识到减少碳排放的必要性,并正在製定法规鼓励使用电动车。例如,阿拉伯联合大公国、沙乌地阿拉伯、巴林和阿曼已经承诺实现净零目标。此外,该地区的一些国家正在提供补贴和税收减免,以鼓励购买电动车。电动车为该地区市场提供了巨大的成长潜力,因此对 LED 照明的需求预计会增加。

政府措施和战略伙伴关係关係推动该地区电动汽车产业发展

- 整个中东地区电动车的普及正在迅速成长。到 2023 年初,阿拉伯联合大公国 (UAE) 的电动车充电站与前一年同期比较年增近 60%。阿联酋的电动车销售蓬勃发展,电动车目前占该国汽车市场总量的 1% 以上。 Adnoc Distribution 和阿布达比国家能源公司 (TAQA) 已同意于 2023 年初建立一家行动合资企业 E2GO,以在阿布达比和阿联酋建设和营运电动车基础设施。到 2028 年,电动车的需求预计每年将增加 30%。

- 根据“2030 愿景”,沙乌地阿拉伯宣布将于 2021 年实施绿色倡议(SGI)。该倡议的主要目标之一是促进该国电动车的销量,并确保到 2030 年至少有 30% 的汽车实现电气化。此外,根据 SGI,政府于 2022 年宣布与美国汽车製造商 LUCID Group 达成协议,购买至少 50,000 辆电动车(未来十年将购买多达 100,000 辆),旨在使其车队实现电气化。

- 2023年第一季南非的电动车销量已达到去年总销量的一半以上。此外,2022 年南非将售出 4,764 辆新能源汽车,而 2021 年为 896 辆,2020 年为 324 辆,2019 年为 407 辆。非洲的电动车市场尚处于起步阶段,但各大主要企业在寻求建立新的充电站,以支持该地区电动车的普及。 2023 年 2 月,奥迪南非公司与电动车充电解决方案供应商 Rubicon 合作,在全国推出 43 个电动车充电站。因此,上述案例正由于电动车需求的成长而推动新发电厂的开发和生产,从而推动该地区对汽车 LED 的需求。

中东和非洲汽车LED照明产业概况

中东和非洲汽车LED照明市场相当集中,前五大公司占据了81.73%的市场份额。市场的主要企业有:GRUPO ANTOLIN IRAUSA, SA、HELLA GmbH & Co. KGaA (FORVIA)、HYUNDAI MOBIS、Marelli Holdings 和 OSRAM GmbH。 (按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 汽车产量

- 人口

- 人均收入

- 汽车贷款利率

- 充电站数量

- 道路上汽车数量

- LED进口总量

- 家庭数量

- 道路网络

- 渗透率

- 法律规范

- 波湾合作理事会

- 南非

- 价值链与通路分析

第五章 市场区隔

- 汽车实用照明

- 日间行车灯 (DRL)

- 转向指示灯

- 头灯

- 倒车灯

- 红绿灯

- 尾灯

- 其他的

- 汽车照明

- 二轮车

- 商用车

- 搭乘用车

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- Auxbeam Lighting

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA(FORVIA)

- HYUNDAI MOBIS

- Marelli Holdings Co., Ltd.

- OSRAM GmbH.

- Signify(Philips)

- Valeo

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The Middle East and Africa Automotive LED Lighting Market size is estimated at 88.69 million USD in 2025, and is expected to reach 144.6 million USD by 2030, growing at a CAGR of 10.27% during the forecast period (2025-2030).

The headlights segment is expected to hold the highest market share

- In terms of value share, in 2023, headlights accounted for the majority of the market share, followed by fog lights (other segmentations) and directional signal lights. The market share for headlights is expected to increase during the forecast period. The major reason for their adoption is the government policy, more energy efficiency, and accident prevention. In Africa, traffic deaths account for about a quarter of the global number of victims, even though the continent has barely 2% of the world's vehicle fleet. According to Article No 95 of the Federal Traffic Act in the UAE, whiter and brighter headlamps can attract an AED 200 fine. This has given more consideration to LED.

- In terms of volume share, in 2023, directional signal lights (DSL) accounted for the majority share, followed by headlights and fog lights. Currently, passenger cars accounts for the majority share in DSL and fog lights demand due to their high rate of accidents. In the UAE, the number of crashes increased by 13% in 2022 to 3,945, up from 3,488 in 2021. Such factors indicate a major volume demand for such lighting, which is expected to increase in the coming years.

- The EV policy in the region promotes EV adoption, which also increases the demand for LED lighting. The UN Environment Programme is currently active in nine African countries, working on introducing electric two and three-wheelers. Despite low fuel prices, GCC countries are now focusing on EV adoption at a slow pace. In Dubai, commercially, there has been an increasing focus on EVSE, demonstrated through the January 2023 announcements of the partnership by Regeny and EvGateway to deploy 10,000 EV charging networks throughout the UAE by 2030. Such factors are expected to boost the market.

Middle East and Africa Automotive LED Lighting Market Trends

The LED market is driven by government regulations and initiatives to encourage the purchase of EVs

- The total automobile vehicle production across Middle East and African countries was 2.33 million units in 2022, and it was expected to reach 2.45 million units in 2023. The Middle East and Africa were not exempt from the COVID-19 pandemic's effects, with the automobile industry seriously impacted. In March 2020, sales of automobiles in Saudi Arabia fell by 35-40%. As a result of shutdowns and falling oil prices, the UAE's auto industry also experienced a steep decline in the same period, with car sales falling by 45-50% in March 2020. The GCC region had a 70% reduction in periodic maintenance in March 2020 alone and a staggering 50% decline in automotive part sales in the same month. The automotive market in South Africa declined by 2.8% to 536,626 vehicles, confirming a nearly ten-year trend of continuous declines. Overall, the auto industry's use of LED lights was negatively impacted by the fall in output of vehicles and auto parts.

- The Middle East and African electric vehicle (EV) market is still in its early phases but is already exhibiting encouraging signs of expansion. Governments of regional countries are enacting regulations to encourage the use of EVs as they realize the need to minimize their carbon footprints. For instance, the United Arab Emirates, Saudi Arabia, Bahrain, and Oman have already declared their net-zero goals. In addition, several nations in the region are providing subsidies and tax breaks to encourage the purchase of electric vehicles. The demand for LED lighting is anticipated to increase because EVs offer tremendous potential for growth in the regional market.

Government initiatives and strategic partnerships to boost the EV industry in the region

- EV adoption across the Middle East is growing rapidly. EV charging stations in the UAE had risen by nearly 60% Y-o-Y by the start of 2023. Electric vehicle sales are increasing rapidly in the UAE, with EVs making up more than 1% of the country's overall car market. Adnoc Distribution and Abu Dhabi National Energy Company (TAQA) agreed to form E2GO, a mobility joint venture, in early 2023 to build and operate EV infrastructure in Abu Dhabi and the wider UAE. By 2028, EV demand is expected to increase by 30% each year.

- In Line with Vision 2030, the Saudi Green Initiative (SGI) was announced in 2021. Some of the primary goals of this initiative are to boost sales of EVs in the country and ensure that at least 30% of cars are electrified by 2030. Further, in alignment with SGI, the government announced an agreement with US automaker LUCID Group in 2022 to purchase at least 50,000 EVs (up to 100,00 over the next ten years) with a goal of electrifying its fleet.

- Electric vehicle sales in South Africa in Q1 2023 had already surpassed more than half of the previous year's total sales. Further, 4,764 NEVs were sold in South Africa in 2022, compared to 896, 324, and 407 in 2021, 2020, and 2019, respectively. Although the electric vehicle market in Africa is at a nascent stage, various key players are trying to establish new charging stations to support EV adoption in the region. In February 2023, Audi South Africa, in partnership with Rubicon, an EV charging solution provider, brought 43 additional EV charging stations online across the country. Thus, the above instances lead to the development and production of new power stations because of the growing demand for EVs, which boosts the demand for automotive LEDs in the region.

Middle East and Africa Automotive LED Lighting Industry Overview

The Middle East and Africa Automotive LED Lighting Market is fairly consolidated, with the top five companies occupying 81.73%. The major players in this market are GRUPO ANTOLIN IRAUSA, S.A., HELLA GmbH & Co. KGaA (FORVIA), HYUNDAI MOBIS, Marelli Holdings Co., Ltd. and OSRAM GmbH. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 # Of Households

- 4.9 Road Networks

- 4.10 Led Penetration

- 4.11 Regulatory Framework

- 4.11.1 Gulf Cooperation Council

- 4.11.2 South Africa

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Automotive Utility Lighting

- 5.1.1 Daytime Running Lights (DRL)

- 5.1.2 Directional Signal Lights

- 5.1.3 Headlights

- 5.1.4 Reverse Light

- 5.1.5 Stop Light

- 5.1.6 Tail Light

- 5.1.7 Others

- 5.2 Automotive Vehicle Lighting

- 5.2.1 2 Wheelers

- 5.2.2 Commercial Vehicles

- 5.2.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Auxbeam Lighting

- 6.4.2 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.3 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.4 HYUNDAI MOBIS

- 6.4.5 Marelli Holdings Co., Ltd.

- 6.4.6 OSRAM GmbH.

- 6.4.7 Signify (Philips)

- 6.4.8 Valeo

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms