|

市场调查报告书

商品编码

1683961

北美汽车 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)North America Automotive LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

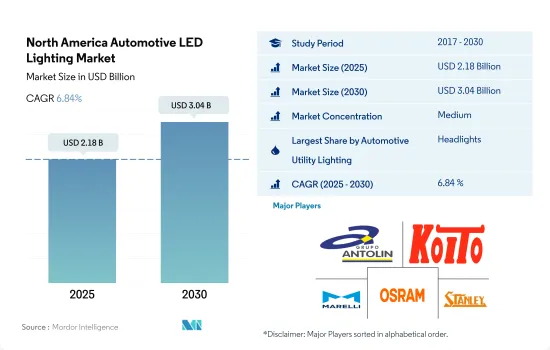

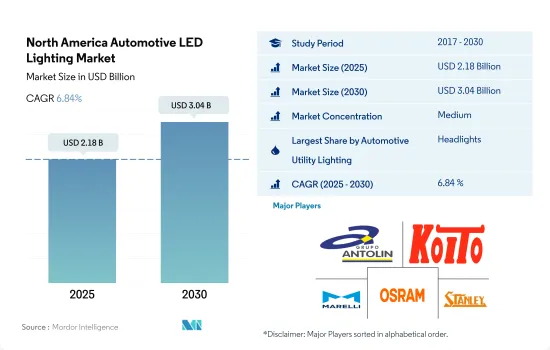

北美汽车 LED 照明市场规模预计在 2025 年为 21.8 亿美元,预计到 2030 年将达到 30.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.84%。

事故率上升、 LED灯普及率上升、电动车销售成长,推动市场成长

- 就以金额为准,2022 年前照灯将占据最大份额,其次是其他(小型 LED 灯、LED 牌照灯、雾灯、内部 LED 灯)、方向灯(DSL)、日间行车灯和煞车灯。预计 All Lite 的市场占有率将保持平稳,其他和 DSL 的市场份额将略有下降,而 Headlight 的市场份额将增长。随着事故趋势的上升, LED灯的普及率也预计将增加。在美国,2022 年机动车死亡人数预计将达到 46,000 人,与大流行前相比增加近 22%。

- 从出货量来看,2022年方向灯将占最大份额,其次是头灯、其他(小型LED灯、LED牌照灯、雾灯、车内LED灯)和煞车灯。户外灯是任何类型车辆的主要部件,在轻微至重大事故中都可能受到影响并需要更换。

- 2022年新型轻型汽车销量达1370万辆。预计 2022 年新车销售量将与前一年同期比较减 8.2%,主要原因是微晶片短缺持续以及供应链进一步中断。混合动力汽车、插电混合动力汽车混合动力车和电池电动车(BEV)将占2022年所有新车销量的12.3%,比2021年成长2.7%。因此,汽车销售的增加导致对LED照明的需求增加。

新兴国家电动车的发展以及有利于发展当地汽车产业的立法将推动 LED 照明的需求

- 以以金额为准,美国LED照明市场将在2022年占据大部分市场份额,其次是北美地区(RONA)。预计未来几年市场占有率将保持相对稳定,美国份额将下降,而北美其他地区的市场份额将上升。美国国内汽车产量将从2021年的910万辆增加至2022年的1,006万辆。汽车产量包括乘用车和商用车。在加拿大,预计 2022 年汽车产量将比 2021 年增加 10.2%,达到 120 万辆。国内汽车产量的增加,将带动市场对车用LED的需求增加。

- 许多北美国家对电动车的需求不断增长。 2022 年墨西哥新车销量将达到 108 万辆,比 2021 年成长 7%,而 2022 年美国电动车销量将成长 65%。

- 在汽车行业子部门中,美国和墨西哥的商业服务在原始设备零件、售后市场和电动车(EV)零件方面经历了强劲机会。墨西哥为OEM和售后市场生产的汽车零件预计将从 2020 年的 784 亿美元增加到 2021 年的 947 亿美元,2022 年将达到 1,010 亿美元以上。

- 《美国-墨西哥-加拿大协定》(USMCA)于2020年7月1日生效。 USMCA要求汽车75%的零件必须在北美生产,核心汽车零件原产于美国、加拿大或墨西哥。考虑到上述因素,例如电动车的采用和发展当地汽车产业的有利立法,预计未来几年 LED 将在北美地区蓬勃发展。

北美汽车 LED 照明市场趋势

电动车和电池製造商的投资推动了 LED 市场的发展,以提高汽车产量

- 预计2022年北美汽车总产量将达1,454万辆,2023年将达1,506万辆。汽车业是北美最大的製造业部门之一。然而,新冠疫情为该地区的汽车产业带来了两次重大衝击,对2020年和2021年的生产、销售和对外贸易产生了显着的负面影响。因此,汽车供应链和生产的中断对该地区的LED照明业务产生了负面影响。

- 3月美国轻型汽车产量与去年同期相比下降了近31%。由于 4 月底只有一家工厂运作一周,因此需要更高水准的轻型汽车生产。汽车业也对供应炼錶示担忧。德国供应商ZF在美国设有工厂,并宣布计画在2020年5月底前在全球裁员10%。全球供应链中断影响了美国製造业:梅赛德斯-奔驰于4月27日重新开放其位于阿拉巴马州万斯的工厂,但由于零件短缺,于5月15日被迫停产。此次动盪导致汽车业使用的半导体价格下跌。

- 此外,在政府的主导,北美对电动车的需求正在激增。 《通膨削减法案》将于2022年8月签署成为法律,从法案签署到2023年3月,主要电动车和电池製造商已宣布向北美电动车供应链投资至少520亿美元。这些有利于消费者和製造商的倡议预计将促进该地区的 LED 照明业务发展。

政府投资推动电动车销售和LED照明成长

- 北美地区电动车销量大部分来自美国、加拿大和墨西哥。 2022 年,美国纯电动车销量预计将比 2021 年成长 65%,特斯拉将继续主导电动车市场。 2022年,墨西哥109万辆汽车的总销量中仅有0.5%是纯电动车,这一比例明显低于中国、欧洲和美国等其他市场。在加拿大,2022 年第四季新註册的电池电动车 (BEV) 数量为 27,754 辆,新註册的插电式混合动力车 (PHEV) 数量为 5,645 辆。

- 为了进一步扩大规模,美国政府于 2021 年宣布了一项 1 兆美元的基础设施法案,其中拨款 75 亿美元用于在 2030 年前额外建造 50 万个公共电动车充电桩,同时透过为购买在美国组装的电动车提供 7,500 美元的税收优惠来投资电动汽车製造业。此外,主要企业之一特斯拉承诺到年终为美国所有品牌的电动车提供约 3,500 个超级充电站和 4,000 个二级充电座。

- 通用汽车加拿大公司正在加拿大投资超过 20 亿美元,将位于英格索尔和奥沙瓦的製造工厂改造为 2022 年底年终生产电动车。到 2030 年,乔治亚、肯塔基州和密西根州预计将占据美国电动车电池製造的大部分份额。这种电动车电池製造能力将促进每年生产 1,000 万至 1,300 万个全电动汽车电池,使美国成为全球电动车竞争对手。因此,上述案例将由于电动车需求的增加而引发新发电厂的开发和生产,从而推动该地区对汽车 LED 的需求。

北美汽车 LED 照明产业概况

北美汽车LED照明市场呈现中度整合态势,前五大厂商合计占52.69%的市占率。该市场的主要企业有:GRUPO ANTOLIN IRAUSA,SA、KOITO MANUFACTURING、Marelli Holdings、OSRAM GmbH。以及史丹利电气(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 汽车产量

- 人口

- 人均收入

- 汽车贷款利率

- 充电站数量

- 汽车持有量

- LED进口总量

- 家庭数量

- 道路网络

- 渗透率

- 法律规范

- 美国

- 价值链与通路分析

第五章 市场区隔

- 汽车实用照明

- 日间行车灯 (DRL)

- 转向指示灯

- 头灯

- 倒车灯

- 红绿灯

- 尾灯

- 其他的

- 汽车照明

- 二轮车

- 商用车

- 搭乘用车

- 国家名称

- 美国

- 北美其他地区

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA(FORVIA)

- Hyundai Mobis

- KOITO MANUFACTURING CO., LTD.

- Marelli Holdings Co., Ltd.

- Nichia Corporation

- OSRAM GmbH.

- Stanley Electric Co., Ltd.

- Valeo

- ZKW Group

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The North America Automotive LED Lighting Market size is estimated at 2.18 billion USD in 2025, and is expected to reach 3.04 billion USD by 2030, growing at a CAGR of 6.84% during the forecast period (2025-2030).

Rising accident trend, penetration rate of fog LED lamps, and increasing sales of electric vehicles drive market growth

- In terms of value, in 2022, headlights accounted for a major share, followed by others (miniature LED lights, LED license plate lights, fog lights, and interior LED lights), directional signal lights (DSLs), daytime running lights, and stop lights. The market share is expected to remain the same for all lights, with a small reduction in others and DSLs, and grow for headlights. With the rising accident trend, the penetration rate of fog LED lamps is anticipated to rise. In the US, the number of motor vehicle deaths reached an estimated 46,000 in 2022 compared to the pre-pandemic death rate, an increase of nearly 22%.

- In terms of volume, in 2022, directional signal lights accounted for a major share, followed by headlights, others (miniature LED lights, LED license plate lights, fog lights, and interior LED lights), and stop lights. External lights are the prime parts that have a high probability of getting affected in minor to major accidents in all types of vehicles and require replacement.

- The year 2022 ended with new light-vehicle sales reaching 13.7 million units. The Y-o-Y 2022 sales decreased by 8.2% compared to 2021, with the decrease primarily attributed to the ongoing microchip shortage and additional supply chain disruptions. With sales of hybrid, plug-in hybrid, and battery electric vehicles (BEVs) accounting for 12.3% of all new vehicle sales in 2022, an increase of 2.7% from 2021, alternative fuel vehicles gained market share. Thus, the increase in vehicle sales resulted in an increase in the requirement for LED lights.

Adoption of EVs across countries and favorable laws to develop local automotive industry drive the demand for LED lighting

- In terms of value, in 2022, the US LED light market accounted for the majority of the share, followed by the Rest of North America (RONA). The market share is expected to decline for the US and increase for the Rest of North America, with less fluctuation in the coming years. The domestic vehicle production in the US increased from 9.1 million units in 2021 to 10.06 million units in 2022. The vehicle production includes cars and commercial vehicles. In Canada, in 2022, vehicle production increased by 10.2% compared to 2021, accounting for 1.2 million units. The increase in domestic vehicle production creates more demand for automotive LEDs in the market.

- The demand for EVs grew across many countries in North America. Mexico saw 1.08 million new car sales in 2022, a 7% improvement from 2021, and US EV sales increased by 65% in 2022.

- In sub-sectors of the automotive industry, the US and Mexican commercial services experienced strong opportunities in OE parts, aftermarket, and electric vehicle (EV) parts. The value of Mexican automotive parts for OEMs and aftermarket production increased from USD 78.4 billion in 2020 to USD 94.7 billion in 2021, and it is expected to reach more than USD 101 billion by 2022.

- The United States, Mexico, Canada Agreement (USMCA) went into effect on July 1, 2020. The USMCA requirement stated that 75% of a vehicle's content must be produced in North America and that core auto parts originate from the United States, Canada, or Mexico. Considering the above-mentioned factors, such as the adoption of EVs and favorable laws to develop the local automotive industry, the growth of LEDs is expected across North America in the coming years.

North America Automotive LED Lighting Market Trends

The LED market is driven by investments by EVs and battery producers to increase automotive production

- The total automobile vehicle production in North America was 14.54 million units in 2022, and it is expected to reach 15.06 million units in 2023. One of the biggest manufacturing sectors in North America is the automotive sector. However, the COVID-19 pandemic caused two significant shocks to the region's automobile industry, which had a significant negative impact on production, sales, and foreign trade in 2020 and 2021. Thus, the disruption in the supply chain and production of automotive vehicles negatively affected the LED lighting business in the region.

- March saw an almost 31% year-over-year fall in the US light car production. Only one plant was operating for one week at the end of April, so there needed to be a higher level of light vehicle production. The auto industry also voiced concerns regarding its supply networks. ZF, a German supplier, has facilities in the United States and revealed plans to reduce its global employment by 10% by the end of May 2020. Several worldwide supply chain disruptions impacted manufacturing in the United States: Mercedes-Benz resumed its Vance, Alabama, facility on April 27; however, due to a scarcity of parts, production had to be briefly halted on May 15. This disruption created a downfall in semiconductors used in the automotive industry.

- Further, the demand for EVs is rapidly increasing in North America due to government initiatives. The Inflation Reduction Act was passed in August 2022, and between that time and March 2023, major EV and battery producers announced investments in North American EV supply chains worth at least USD 52 billion. Such initiatives in the interest of consumers and manufacturers will boost the LED lighting business in the region.

Government investments to drive the sales of electric vehicle and propel the growth of LED lighting

- Most of the EV sales in the North American region come from the US, Canada, and Mexico. In 2022, US BEV sales increased by 65% compared to 2021, and Tesla continues to dominate the EV market. In 2022, Mexico sales were only 0.5% of 1,090,000 total vehicle sales were fully electric, a percentage that falls well below other markets, such as China, Europe, and the United States. In Canada, during Q4 2022, battery electric vehicles (BEVs) alone had 27,754 new registrations, and plug-in hybrid electric vehicles (PHEVs) had 5,645 new registrations.

- To expand further, the US government issued a trillion-dollar infrastructure bill in 2021 that allocates USD 7.5 billion toward building 500,000 more public EV chargers by 2030 and also made investments in EV manufacturing by providing tax benefits of USD 7,500 for purchasing an EV assembled in the US. Also, Tesla, one of the significant players in EVs, committed to delivering around 3,500 of its US Supercharger stations and 4,000 Level 2 charging docks available to all brands of electric vehicles by the end of 2024.

- GM Canada invested more than USD 2 billion in Canada to transform manufacturing facilities in Ingersoll and Oshawa and expects electric vehicle production by the end of 2022. By 2030, Georgia, Kentucky, and Michigan are expected to dominate electric vehicle battery manufacturing in the United States. This EV battery manufacturing capacity will facilitate the production of 10 to 13 million batteries for all-electric vehicles per year, positioning the United States as a global EV competitor. Thus, the above instances lead to the development and production of new power stations because of the growing demand for EVs, which boosts the demand for automotive LEDs in the region.

North America Automotive LED Lighting Industry Overview

The North America Automotive LED Lighting Market is moderately consolidated, with the top five companies occupying 52.69%. The major players in this market are GRUPO ANTOLIN IRAUSA, S.A., KOITO MANUFACTURING CO., LTD., Marelli Holdings Co., Ltd., OSRAM GmbH. and Stanley Electric Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 # Of Households

- 4.9 Road Networks

- 4.10 Led Penetration

- 4.11 Regulatory Framework

- 4.11.1 United States

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Automotive Utility Lighting

- 5.1.1 Daytime Running Lights (DRL)

- 5.1.2 Directional Signal Lights

- 5.1.3 Headlights

- 5.1.4 Reverse Light

- 5.1.5 Stop Light

- 5.1.6 Tail Light

- 5.1.7 Others

- 5.2 Automotive Vehicle Lighting

- 5.2.1 2 Wheelers

- 5.2.2 Commercial Vehicles

- 5.2.3 Passenger Cars

- 5.3 Country

- 5.3.1 United States

- 5.3.2 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.2 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.3 Hyundai Mobis

- 6.4.4 KOITO MANUFACTURING CO., LTD.

- 6.4.5 Marelli Holdings Co., Ltd.

- 6.4.6 Nichia Corporation

- 6.4.7 OSRAM GmbH.

- 6.4.8 Stanley Electric Co., Ltd.

- 6.4.9 Valeo

- 6.4.10 ZKW Group

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms