|

市场调查报告书

商品编码

1683944

德国汽车 LED 照明:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Germany Automotive LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

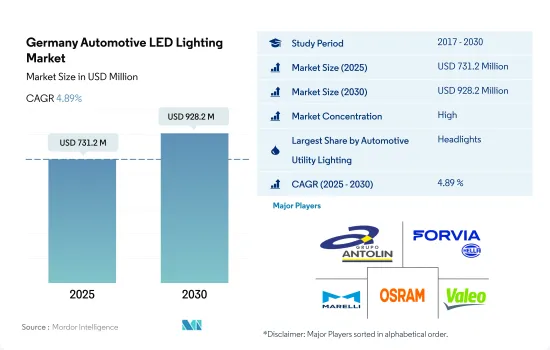

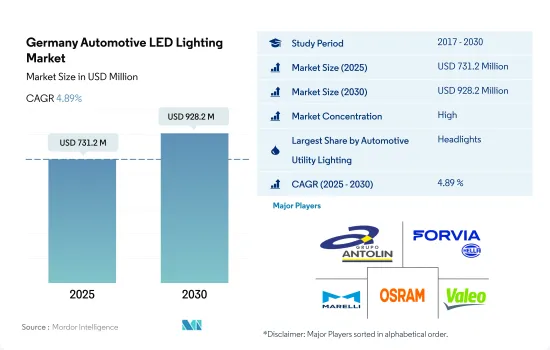

预计 2025 年德国汽车 LED 照明市场规模为 7.312 亿美元,到 2030 年将达到 9.282 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.89%。

政府对 LED 晶片製造商的津贴和汽车 LED 照明的技术创新推动市场需求

- 就金额份额而言,头灯将在 2023 年占据市场主导地位,其次是其他灯光和转向信号灯。预计预测期内方向灯和煞车灯的市场占有率将保持不变。国内汽车LED灯厂商也为国内LED灯的成长不断进行产品创新。 2020年10月,欧司朗成为德国市场第一家获得LED汽车改装照明认证的公司。这一发展具有真正的独创性,因为用于车头灯的 LED 替换灯泡从未获得官方批准。

- 从销售份额来看,2023年转向信号灯将占多数,其次是头灯和其他灯光。未来几年,预计每种灯的市场份额将保持稳定,波动不大。前三名的汽车製造商分别为福斯、宝马和戴姆勒,而博世、舍弗勒和采埃孚则是全球前三大供应商。该产业预计未来几年将在数位化、电动车和氢能技术方面投入 1,500 亿欧元(1,644.8 亿美元)。

- 此外,德国政府也向本土LED晶片製造商提供资金支持。德国当局正试图透过提供 140 亿欧元(147 亿美元)的财政援助来吸引晶片製造商进入该国。此前,欧盟委员会推出了《欧洲晶片法》,英特尔也决定在 2022 年在德国建立新的製造工厂。因此,政府的支持力度加大,汽车製造商为推动电动车和整体汽车生产而增加的投资,预计将增加 LED 照明在汽车产业的使用。

德国汽车 LED 照明市场趋势

主要汽车製造商的技术进步和电动汽车行业的成长正在推动 LED 市场的成长

- 预计2022年德国汽车总产量将达353万辆,2023年将达363万辆。新冠疫情对德国汽车市场产生了重大影响。全球需求下滑导致所有德国汽车製造商的生产线陷入停顿。疫情也导致大陆、宾利、麦格纳等供应商暂停生产。在德国,2020年4月汽车销量下降了61%。这表明汽车製造和汽车零件供应链的整体放缓导致汽车LED灯使用量下降。

- 德国是一些世界领先汽车製造商的所在地,包括奥迪、大众、梅赛德斯-奔驰、宝马和保时捷。这些製造商成功的一个主要驱动力是技术进步。奥迪于 2023 年 5 月首次发现了在其尾灯中使用有机发光二极体技术的潜力,并一直致力于加强数位化。我们是唯一一家特意系统性地开发这项照明技术,为我们的车辆提供更多照明功能的汽车製造商。这些发展总体上支持了 LED 照明在汽车领域的扩张。考虑到德国是汽车工业的中心,电动车在该国有着光明的前景。根据联邦汽车运输局(KBA)的数据,2023年初德国註册的乘用车数量将达到约4,880万辆。到 2025 年,许多车型无论是否配备内燃机,预计价格都会相同。随着电动车的大规模扩张,LED在汽车中的使用预计会增加。

政府主导的车辆登记和电动车转型将推动 LED 市场成长

- 2022年,德国电动车市场成长132.2%,零排放乘用车註册量为470,502辆。自 2020 年以来,德国一直在向电动车领域迈进,註册量从 1.75% 增长至 6.65%。电动车将在2021年占据13.6%的市场份额,2022年将占据17.7%的市场份额。在德国,汽油和柴油汽车占所有註册量的一半,下降了12.1%。 2022 年乘用车註册情况如下:汽油(32.6%)、柴油(17.8%)、BEV(17.7%)、PHEV(13.7%)、HEV(17.5%)及其他(0.7%)。

- 该倡议于 2020 年 7 月生效,在说服德国人放弃市场占有率给电动车方面发挥了关键作用。德国新政府计划加快向电动车转型。政府表示,2022 年将继续为购买电动车提供高达 9,000 欧元(9,706.36 美元)的补贴。插电式混合动力汽车可能有资格获得高达 6,750 欧元(7,279.77 美元)的补贴。 2022 年 5 月,福斯将把生产电动 ID.4 汽车的埃姆登工厂推出德国第二家专门生产电动车的工厂。

- 2022年10月,德国政府宣布了加强电动车充电基础设施的计画。该计划包括一项耗资 63 亿欧元(61.7 亿美元)的提案,旨在到 2030 年将全国的充电站数量增加到 100 万个。因此,由于电动车需求的不断增长,上述案例正在推动新发电厂的开发和生产,从而推动该国对汽车 LED 的需求。

德国汽车LED照明产业概况

德国汽车LED照明市场比较集中,前五大厂商的市占率合计达到79.94%。该市场的主要企业有:GRUPO ANTOLIN IRAUSA, SA、HELLA GmbH & Co. KGaA (FORVIA)、Marelli Holdings、OSRAM GmbH。以及 Valeo(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 汽车产量

- 人口

- 人均收入

- 汽车贷款利率

- 充电站数量

- 行驶车辆数

- LED进口总量

- 家庭数量

- 道路网络

- 渗透率

- 法律规范

- 德国

- 价值链与通路分析

第五章 市场区隔

- 汽车实用照明

- 日间行车灯 (DRL)

- 转向指示灯

- 头灯

- 倒车灯

- 红绿灯

- 尾灯

- 其他的

- 汽车照明

- 二轮车

- 商用车

- 搭乘用车

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA(FORVIA)

- Marelli Holdings Co., Ltd.

- OSRAM GmbH.

- PHOTON AUTOMOTIVE LIGHTING

- Signify(Philips)

- Stanley Electric Co., Ltd.

- Valeo

- VIGNAL GROUP

- ZKW Group

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The Germany Automotive LED Lighting Market size is estimated at 731.2 million USD in 2025, and is expected to reach 928.2 million USD by 2030, growing at a CAGR of 4.89% during the forecast period (2025-2030).

Government funding to LED chip manufacturers and the growing innovation in automotive LED lighting drive the market demand

- In terms of value share, in 2023, headlights accounted for the majority of the market, followed by other lights and directional signal lights. The market share is expected to remain the same for directional signal lights and stop lights during the forecast period. Automotive LED light manufacturers in the country are continuously innovating products for the growth of LED lights in the country. In October 2020, Osram was the first company to offer authorized LED-based automobile retrofit lighting in the German market. Since there have never been authorized LED replacement bulbs for headlight applications, this development was truly original.

- In terms of volume share, in 2023, directional signal lights accounted for the majority, followed by headlights and other lights. The market share is expected to remain the same with less to no fluctuation for all the lights in coming years. The top three automakers are Volkswagen, BMW, and Daimler, while Bosch, Schaffler, and ZF are among the top suppliers globally. The sector anticipates spending EUR 150 billion (USD 164.48 billion) over the next few years on digitalization, electric mobility and hydrogen technologies.

- Additionally, the German government offers funding to local manufacturers of LED chips. German officials are attempting to entice chipmakers to the nation by providing EUR 14 billion (USD 14.7 billion) in financial assistance. The action follows the European Commission's European Chips Act and Intel's decision in 2022 to establish a new manufacturing facility in Germany. Thus, the rising government support and increasing investment from automotive manufacturers to promote EV and overall vehicle production are expected to increase the use of LED lights in the automotive industry.

Germany Automotive LED Lighting Market Trends

Technological advancements by major automotive manufacturers and promising growth by EV industry to drive the growth of LED market

- The total automobile vehicle production in Germany was 3.53 million units in 2022, and it was expected to reach 3.63 million units in 2023. The COVID-19 pandemic had a significant effect on the German automotive market. The manufacturing lines of all German automobile OEMs were at a standstill due to the low global demand. The pandemic also caused suppliers, including Continental, Benteler, and Magna, to halt manufacturing briefly. Germany saw a 61% decline in car sales in April 2020. This shows that the overall drop in auto car manufacturing and the supply chain of automotive parts resulted in the decline in LED light usage in automotive vehicles.

- The country is home to some of the best automakers in the world, including Audi, Volkswagen, Mercedes-Benz, BMW, Porsche, and others. The major forces behind these manufacturers' success are technological advancements. Audi first saw the possibilities of using OLED technology in rear lights in May 2023 and has since worked to enhance its digitization. It is the only automaker that has deliberately and methodically developed this lighting technology to provide more lighting features to vehicles. These developments are the main forces behind the expansion of LED lights, generally in the automotive sector. Given that Germany is the center of the automobile sector, EVs have a promising future in this nation. At the start of 2023, according to the Federal Motor Transport Authority (KBA), there were about 48.8 million registered passenger automobiles in Germany. In addition, many car models are anticipated to cost the same by 2025, whether they have an internal combustion engine or not. The use of LEDs in automotive vehicles is expected to increase due to the enormous expansion in EVs.

Car registration and shift toward electric mobility through government initiatives to drive the growth of the LED market

- In 2022, the German electric car market grew by 132.2% in 2021, with 470,502 zero-emission passenger car registrations. Since 2020, when registrations increased from 1.75% to 6.65%, Germany has significantly shifted toward electric mobility. Electric automobiles accounted for 13.6% of the market in 2021 and 17.7% in 2022. In Germany, petrol and diesel automobiles accounted for half of all sales, a 12.1% decrease. In 2022, passenger auto registrations included Petrol (32.6%), Diesel (17.8%), BEV (17.7%), PHEV (13.7%), HEV (17.5%), and others (0.7%).

- The initiative, which took effect in July 2020, has played a significant role in persuading Germans to weigh in on the market share of electrified vehicles. Germany's new administration plans to hasten the transition to more electric vehicles on its roadways. The government announced that purchasing an electric car will continue to be subsidized for up to EUR 9,000 (USD 9706.36) in 2022. The assistance might be worth up to EUR 6,750 (USD 7279.77) for plug-in hybrid vehicles. In May 2022, Volkswagen launched a second German manufacturing plant dedicated to the production of electric vehicles, following the conversion of a facility in Emden that produces the all-electric ID.4.

- In October 2022, the German government unveiled plans to boost charging infrastructure for electric vehicles. The plan consists of a EUR 6.3 billion (USD 6.17 billion) proposal that would increase the number of charging points across the country to 1 million by 2030. Thus, the above instances lead to the development and production of new power stations because of the growing demand for EVs, which boosts the demand for automotive LEDs in the country.

Germany Automotive LED Lighting Industry Overview

The Germany Automotive LED Lighting Market is fairly consolidated, with the top five companies occupying 79.94%. The major players in this market are GRUPO ANTOLIN IRAUSA, S.A., HELLA GmbH & Co. KGaA (FORVIA), Marelli Holdings Co., Ltd., OSRAM GmbH. and Valeo (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 # Of Households

- 4.9 Road Networks

- 4.10 Led Penetration

- 4.11 Regulatory Framework

- 4.11.1 Germany

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Automotive Utility Lighting

- 5.1.1 Daytime Running Lights (DRL)

- 5.1.2 Directional Signal Lights

- 5.1.3 Headlights

- 5.1.4 Reverse Light

- 5.1.5 Stop Light

- 5.1.6 Tail Light

- 5.1.7 Others

- 5.2 Automotive Vehicle Lighting

- 5.2.1 2 Wheelers

- 5.2.2 Commercial Vehicles

- 5.2.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.2 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.3 Marelli Holdings Co., Ltd.

- 6.4.4 OSRAM GmbH.

- 6.4.5 PHOTON AUTOMOTIVE LIGHTING

- 6.4.6 Signify (Philips)

- 6.4.7 Stanley Electric Co., Ltd.

- 6.4.8 Valeo

- 6.4.9 VIGNAL GROUP

- 6.4.10 ZKW Group

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms