|

市场调查报告书

商品编码

1684075

印尼干混砂浆:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Indonesia Dry Mix Mortar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

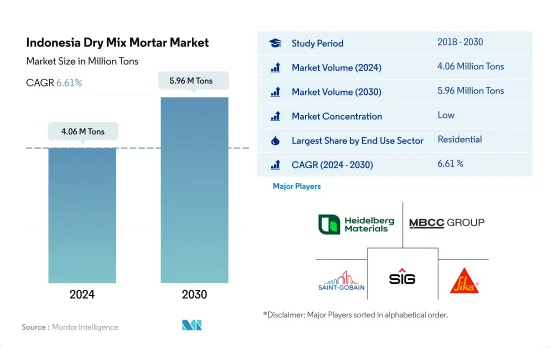

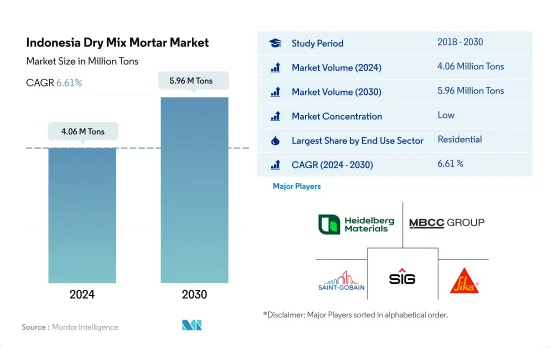

预计 2024 年印尼干混砂浆市场规模为 406 万吨,预计 2030 年将达到 596 万吨,预测期内(2024-2030 年)的复合年增长率为 6.61%。

工业和机构部门对干混砂浆的需求正在快速成长

- 2022年印尼干混砂浆消费量与前一年同期比较去年同期成长1.98%。值得注意的是,工业、机构和住宅部门的消费量增幅最大。 2023年干混砂浆消费量平均成长6.3%,其中印尼年消费量较2022年成长6.46%。

- 印尼对干混砂浆的需求主要来自住宅领域,尤其是全国住宅中的灰泥涂料和粉刷应用。这些应用将占2022年该产业干混砂浆消费量的63%。随着国家都市化的提高,该领域的需求预计将继续呈上升趋势。

- 继住宅领域之后,基础设施领域成为印尼干混砂浆的主要消费领域。至2022年,基础设施领域将占国内干混砂浆需求的15.97%。干混砂浆的主要用途是抹灰、灰泥和防水浆料,占该行业干混砂浆需求的78%。

- 预计工业和机构部门将成为干混砂浆需求成长最快的部门,预测期内复合年增长率为 8.45%。这一成长归功于印尼对扩大製造业的战略重点。为此,印尼推出了「打造印尼4.0」倡议,以推动製造业发展,实现2045年成为高所得国家的目标。这些努力预计将推动工业和设施领域的建设活动与前一年同期比较增长。

印尼干混砂浆市场趋势

预计到 2028 年,印尼的商业房地产市场规模将达到 1.39 兆美元,这可能会刺激商业领域的需求

- 2022年,印尼新增零售占地面积与前一年同期比较%。这一下降是由于新冠疫情期间建筑活动下降后恢復正常所致。疫情爆发前,印尼商业建筑的年能耗强度就已呈现下降趋势,年均下降率为2.64%。然而,2023年将出现復苏,新的商业占地面积将成长 5.7%,这得益于对新的办公室、仓库和零售空间的需求激增的外国直接投资 (FDI)。

- 在新冠疫情期间,印尼 2020 年和 2021 年新增商业占地面积大幅增加,达到约 960 万平方英尺。政府致力于振兴经济,采取了多项措施,例如放宽私人和公共计划建筑相关的检疫规定。这使得员工可以返回现场工作,企业可以继续运作。值得注意的是,印尼2020年完工建筑量预计将达到约1.32兆印尼盾,2021年将增加至1.42兆印尼盾。

- 预计到 2030 年,印尼的新商业占地面积将比 2023 年大幅成长约 58.72%。这一增长是由于对购物中心、办公室和其他商业空间的需求不断增加。零售房地产领域已成为该国特别有吸引力的行业。例如,商业房地产市场预计到2028年将达到1.39兆美元。印尼新的商业占地面积预计将保持稳定成长,预测期内复合年增长率为6.82%。

住宅需求的增加可能会推动住宅产业的成长

- 2022 年,印尼新建住宅占地面积较 2021 年成长了 7.10%。这一增长是由于人口增长、富裕程度提高和都市化加快。政府主导的住宅支持预计将在 2022 年达到 29 兆印度卢比,在住宅融资流动性工具计画下,到 2023 年将增加至 32 兆印度卢比。该倡议旨在建造至少 220,000 套住宅。住宅建筑业将经历显着的成长。预计到 2023 年,这一数字与前一年同期比较增加到约 5,600 万平方英尺。

- 2020年,印尼新建住宅占地面积较2019年成长7.06%。这是政府的策略性倡议,优先发展建筑业,以缓解景气衰退并支持收入减少的家庭。因此,包括检疫在内的建设活动限制已大大放宽。然而,2021年趋势出现逆转,住宅开工占地面积下降约12.54%。这主要是由于建筑业的外国直接投资(FDI)下降。 2021年建筑业外国直接投资与前一年同期比较减51%。

- 预测期内,印尼新建住宅占地面积预计将以 6.08% 的复合年增长率成长。这一增长归功于该国日益加快的都市化,这得益于政府倡议以及国内外投资。这些因素直接或间接地加剧了该国日益增长的住宅需求,并最终促进了住宅建设。一些预测表明,到 2030 年,每年将需要建造 82 万至 100 万套新住宅才能满足不断增长的需求。

印尼干混砂浆产业概况

印尼干混砂浆市场较为分散,前五大公司占了28.81%的市占率。该市场的主要企业是:海德堡材料、MBCC集团、圣戈班、SIG和西卡股份公司(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 终端使用领域趋势

- 商业的

- 业/设施

- 基础设施

- 住宅

- 主要基础设施计划(目前和已宣布)

- 法律规范

- 价值链与通路分析

第 5 章。市场区隔(包括市场规模、2030 年预测、成长前景分析)

- 最终用途领域

- 商业的

- 业/设施

- 基础设施

- 住宅

- 应用

- 混凝土保护与维修

- 水泥浆

- 绝缘和饰面系统

- 石膏

- 使成为

- 磁砖胶

- 防水泥浆

- 其他用途

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 业务状况

- 公司简介

- Heidelberg Materials

- MAPEI SpA

- MBCC Group

- PT Adiwisesa Mandiri

- PT. POWERBLOCK INDONESIA

- PT. RAPI Hijau Perkasa.

- Saint-Gobain

- SIG

- Sika AG

- Triputra Group

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50002028

The Indonesia Dry Mix Mortar Market size is estimated at 4.06 million Tons in 2024, and is expected to reach 5.96 million Tons by 2030, growing at a CAGR of 6.61% during the forecast period (2024-2030).

There is a rapidly growing demand for dry mix mortar from the industrial and institutional sector

- In 2022, Indonesia witnessed a 1.98% uptick in its consumption of dry mix mortar compared to the previous year. Notably, the industrial and institutional, as well as the residential sectors, saw the most significant surge in consumption. The consumption of dry mix mortar grew by an average of 6.3% in 2023, setting Indonesia's overall consumption for the year to be 6.46% higher than in 2022.

- The residential sector dominates Indonesia's dry mix mortar demand, particularly for plaster and render applications in residential buildings nationwide. These applications accounted for 63% of the sector's dry mix mortar consumption in 2022. With the country's urbanization rate on the rise, the demand from this sector is expected to continue its upward trajectory.

- Following the residential sector, the infrastructure sector stands out as the primary consumer of dry mix mortar in Indonesia. In 2022, the infrastructure sector accounted for 15.97% of the nation's dry mix mortar demand. Render, plaster, and waterproofing slurries were the prominent applications for dry mix mortar, collectively representing a 78% share in the sector's dry mix mortar demand.

- The industrial and institutional sector is poised to witness the fastest growth in dry mix mortar demand, with a projected CAGR of 8.45% during the forecast period. This growth can be attributed to Indonesia's strategic emphasis on expanding its manufacturing sector. In line with this, the country launched the Making Indonesia 4.0 initiative, aiming to propel its manufacturing sector and achieve its goal of becoming a high-income nation by 2045. These efforts are expected to fuel construction activities in the industrial and institutional sectors Y-o-Y.

Indonesia Dry Mix Mortar Market Trends

Indonesian commercial real estate market volume is projected to reach USD 1.39 trillion by 2028 and is likely to augment the demand for commercial sector

- In 2022, Indonesia witnessed a 9.7% decline in the volume of new commercial floor area compared to the previous year. This drop was a result of a return to normalcy following a decline in building activities during the COVID-19 pandemic. Even before the pandemic, commercial buildings in Indonesia were already showing a downward trend in annual energy intensity, accounting for a rate of 2.64% per year. However, in 2023, the country saw a rebound, registering a 5.7% increase in the volume of new commercial floor area, driven by a surge in foreign direct investment (FDI) necessitating new offices, warehouses, and retail spaces.

- Amidst the COVID-19 pandemic, in 2020 and 2021, Indonesia witnessed a significant surge in the volume of new commercial floor area, accounting for approximately 9.6 million square feet. The government's focus on revitalizing the economy led to measures such as easing construction-related quarantines, both in private and public projects. This allowed employees to resume work on-site and companies to continue their operations. Notably, the value of completed constructions in Indonesia stood at around IDR 1.32 quadrillion in 2020 and rose to IDR 1.42 quadrillion in 2021.

- The volume of new commercial floor area in Indonesia is projected to witness a robust growth of around 58.72% by 2030 compared to 2023. This surge is driven by a rising demand for shopping malls, offices, and other commercial spaces. The retail real estate segment is emerging as a particularly captivating sector in the country. For instance, the volume of the commercial real estate market is anticipated to reach USD 1.39 trillion by 2028. The commercial new floor area in Indonesia is expected to maintain steady growth, registering a CAGR of 6.82% during the forecast period.

Increase in demand for housing units is likely to augment the residential sector's growth

- In 2022, Indonesia witnessed a 7.10% volume growth in residential new floor area compared to 2021. This surge can be attributed to increased population, wealth, and urbanization. The government-led housing aid reached IDR 29 trillion in 2022, which was projected to increase to IDR 32 trillion in 2023 under the Housing Financing Liquidity Facility scheme. This initiative aims to construct at least 220 thousand houses. The residential construction sector is poised to witness a significant growth rate. It was estimated to increase to approximately 56 million square feet in 2023 compared to the preceding year.

- In 2020, the volume of residential new floor areas in Indonesia grew by 7.06% compared to 2019. This was a strategic move by the government, prioritizing construction to mitigate the economic downturn and support households grappling with reduced incomes. Consequently, restrictions on construction activities, including quarantines, were significantly eased. However, in 2021, the trend reversed, with a decline of about 12.54% in residential new floor area, primarily attributed to a dip in foreign direct investment (FDI) in the construction sector. FDI for construction plummeted by 51% in 2021 compared to the previous year.

- The residential new floor area in Indonesia is projected to witness a CAGR of 6.08% in volume during the forecast period. This growth stems from the country's increasing urbanization, bolstered by government initiatives and foreign and domestic investments. These factors, directly and indirectly, underscore the mounting housing needs in the nation, ultimately driving residential building construction. Projections indicate that to meet the escalating demand, the country would require between 820,000 and 1 million housing units annually by 2030.

Indonesia Dry Mix Mortar Industry Overview

The Indonesia Dry Mix Mortar Market is fragmented, with the top five companies occupying 28.81%. The major players in this market are Heidelberg Materials, MBCC Group, Saint-Gobain, SIG and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End Use Sector Trends

- 4.1.1 Commercial

- 4.1.2 Industrial and Institutional

- 4.1.3 Infrastructure

- 4.1.4 Residential

- 4.2 Major Infrastructure Projects (current And Announced)

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size, forecasts up to 2030 and analysis of growth prospects.)

- 5.1 End Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 Application

- 5.2.1 Concrete Protection and Renovation

- 5.2.2 Grouts

- 5.2.3 Insulation and Finishing Systems

- 5.2.4 Plaster

- 5.2.5 Render

- 5.2.6 Tile Adhesive

- 5.2.7 Water Proofing Slurries

- 5.2.8 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Heidelberg Materials

- 6.4.2 MAPEI S.p.A.

- 6.4.3 MBCC Group

- 6.4.4 PT Adiwisesa Mandiri

- 6.4.5 PT. POWERBLOCK INDONESIA

- 6.4.6 PT. RAPI Hijau Perkasa.

- 6.4.7 Saint-Gobain

- 6.4.8 SIG

- 6.4.9 Sika AG

- 6.4.10 Triputra Group

7 KEY STRATEGIC QUESTIONS FOR CONCRETE, MORTARS AND CONSTRUCTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219