|

市场调查报告书

商品编码

1683445

东南亚国协干混砂浆市场:市场占有率分析、产业趋势与成长预测(2025-2030 年)ASEAN Dry Mix Mortar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

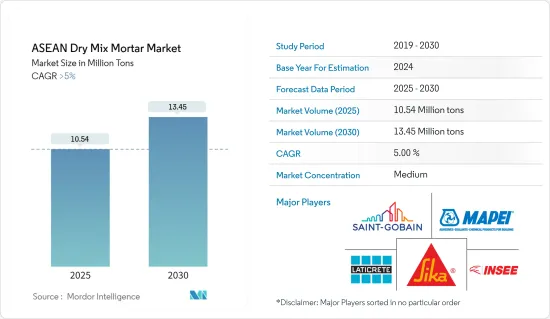

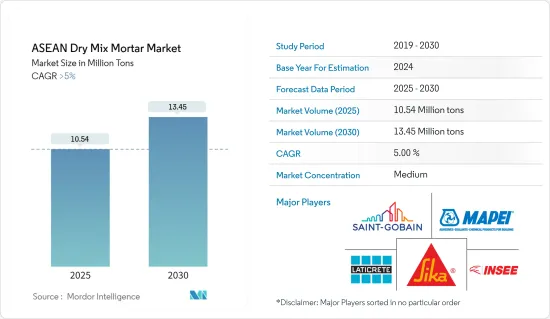

预计 2025 年东南亚国协干混砂浆市场规模为 1,054 万吨,到 2030 年将达到 1,345 万吨,预测期内(2025-2030 年)的复合年增长率将超过 5%。

新冠肺炎疫情为东南亚国协带来严重衝击。疫情影响了印尼、泰国和菲律宾的建设活动,衝击了干混砂浆市场。然而,在新冠疫情爆发后,由于东协地区对住宅和基础设施建设活动的需求增加,市场实现了显着的成长率。

关键亮点

- 预计建筑业的长期成本效益和东南亚国协建设活动的增加将推动市场成长。

- 然而,与传统砂浆相比,铺设干混砂浆的成本预计会阻碍市场成长。

- 印尼工业混合干混砂浆生产能力的不断提高预计将为干混砂浆市场创造机会。

- 由于建筑终端用户产业对干混砂浆的需求不断增加,预计印尼将占据市场主导地位。预计在预测期内,其复合年增长率也将达到最高。

东南亚国协干混砂浆市场趋势

非住宅终端用户市场占据主导地位

- Drymix 产品具有卓越的技术性能,能够满足当前建筑领域普遍存在的严格性能要求。此外,使用干混砂浆产品经济实惠,简单的材料方法可以减少与结构长期完整性相关的潜在施工问题。

- 干混砂浆含有精确混合的成分,只需要添加水就可以形成适当的砂浆。它由特殊添加剂组成,可以改善渲染的可操作性,有助于黏附背景并降低开裂的风险。它也可以用作装饰面漆。

- 几乎在每个建筑应用中都会使用渲染来实现光滑或有意纹理的表面。预计预测期内泰国、菲律宾和越南等国家建设活动的增加将推动干混砂浆在建筑製造业的需求。

- 泰国是最大的旅游基地之一,在购物中心、豪华酒店等方面投入了大量资金进行扩建和建设。芭堤雅万豪侯爵酒店是泰国正在筹备的最大计划,预计将于 2024 年开业,拥有超过 900 间客房。新建的万豪侯爵酒店将成为两个房地产开发项目的一部分,包括拥有 398 间客房的 JW 万豪酒店和芭堤雅海滩度假村及水疗中心。到 2027 年,万豪可能会在泰国曼谷和芭达雅开设三个品牌的四家新酒店。万豪在泰国的投资组合包括 45 家酒店和度假村,其中包括与 Asset World Corporation 合作的 9 家酒店。

- 同样,菲律宾的基础建设建设活动也在增加。 2022年12月,菲律宾与韩国签署协议,将在2022年至2026年期间获得高达30亿美元的贷款,用于基础设施和道路计划。据外交部称,新签署的合约价值是2017年至2022年期间签署合约价值的三倍。该合约表明该国计划增加建筑业的支出,从而对该国对干混砂浆的需求产生积极影响。

- 此外,根据预算和管理部的数据,菲律宾公共基础设施投资将从 2017 年占 GDP 的 4.4% 增加到 2022 年的 GDP 的 6.3%。因此,预计公共基础设施投资的增加将推动该国对干混砂浆的需求。

- 因此,上述因素可能会影响预测期内对干混砂浆的需求。

印尼占据市场主导地位

- 印尼是东协地区最大的建筑市场。印尼政府投入大量资金改善基础设施和都市化,这推动了对住宅和商业房地产的需求。这推动了该国对干混砂浆的需求。

- 印尼的高层建筑数量显着增加。印尼政府近日透露,将投资466兆印尼币(约3005万美元),在婆罗洲岛建设新首都,建设工期为10年。此外,大多数住宅和房地产开发商都在印尼投资各种建筑计划,从而推动了对干混砂浆的需求。

- 2022 年 5 月,公共工程和公共住宅部 (PUPR) 要求增加使用「源自国民内容的总公里数 (TKDN)」住宅产品。 PUPR 在印尼 19 个省份设有住宅供应实施中心 (P2P),在印尼 34 个省份设有住宅供应工作单位 (Satker),致力于开发国内住宅产品。

- 据印尼财政部称,政府基础设施投资预算预计将在 2024 年达到 4,300 亿美元,而 2022 年为 3,658 亿美元。因此,预计增加基础设施投资将推动该国对干混砂浆的需求。

- 作为这些努力的一部分,印尼-德国绿色基础设施倡议得到达成。该计画旨在建立为期五年的金融合作(FC)机制,提供高达 27.3 亿美元的软贷款和促销贷款,以支持基础设施计划。预计这些因素将提振该国市场的需求,目前正在调查中。

- 因此,预计住宅和基础设施建设活动的活性化将推动该国干混砂浆市场的发展。

东南亚国协干混砂浆产业概况

东南亚国协的干混砂浆市场本质上是部分细分的。该市场的主要企业包括(不分先后顺序)Sika AG、MAPEI SpA、LATICRETE International, Inc.、Saint Gobain 和 Siam City Cement Group。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 建筑业的长期成本效益

- 东南亚国协建设活动增加

- 其他驱动因素

- 限制因素

- 干混砂浆与传统砂浆的安装成本对比

- 其他限制因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(以金额为准))

- 最终用户产业

- 住宅

- 非住宅

- 商业

- 基础设施

- 产业

- 应用

- 石膏

- 使成为

- 磁砖胶

- 水泥浆

- 防水泥浆

- 混凝土保护与维修

- 绝缘和饰面系统

- 其他用途(黏结砂浆、外墙石膏等)

- 地区

- 马来西亚

- 印尼

- 泰国

- 新加坡

- 菲律宾

- 越南

- 缅甸

- 其他东南亚国协

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Ardex Group

- BASF SE

- Greco Asia Sdn Bhd

- Henkel AG & Co. KGaA

- HOLCIM

- Knauf Gips KG

- LATICRETE International, Inc.

- MAPEI SpA

- PT INDOCEMENT TUNGGAL PRAKARSA Tbk.

- Saint Gobain

- Siam City Cement Group

- Sika AG

第七章 市场机会与未来趋势

- 提高印尼工业干混砂浆产能

- 其他机会

The ASEAN Dry Mix Mortar Market size is estimated at 10.54 million tons in 2025, and is expected to reach 13.45 million tons by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The COVID-19 pandemic severely affected the ASEAN countries. The pandemic affected the construction activities in Indonesia, Thailand, and the Philippines, thereby affecting the market for dry mix mortar. However, post-COVID pandemic, the market registered a significant growth rate due to rising demand from residential and infrastructural construction activities in the ASEAN region.

Key Highlights

- The long-term cost-effectiveness in the construction industry and the increasing construction activities in ASEAN countries are expected to drive the market's growth.

- However, the laying cost of dry mix mortars, in comparison to conventional mortar, is expected to hinder the market growth.

- The increasing production capacity of industrially mixed dry mix mortar in Indonesia is expected to create opportunities for the dry mix mortar market.

- Indonesia is expected to dominate the market due to the rising demand for dry mix mortar in the construction end-user industry. It is also expected to register the highest CAGR during the forecast period.

ASEAN Dry Mix Mortar Market Trends

Non-residential End-user segment to Dominate the Market

- Dry mix products provide excellent technical properties to meet the stringent performance requirements that are common in the current construction scenario. Additionally, the use of dry mix mortar products is economical, as they reduce potential construction problems with the long-term integrity of structures with a simple materials approach.

- Dry mix mortar contains a precise blend of materials and only requires the addition of water to produce a suitable render. It comprises special additives that improve the workability of renders, help them bond to the background, and reduce the risk of cracking. They can also be used for decorative finishes.

- Rendering is done in almost all construction applications to achieve a smooth or deliberately textured surface. The increasing construction activities in countries like Thailand, the Philippines, and Vietnam are likely to drive the demand for dry mix mortar in manufacturing render during the forecast period.

- Thailand is one of the largest hubs for tourists and is witnessing considerable investments in the expansion and construction of malls, luxury hotels, etc. The Pattaya Marriott Marquis Hotel is the largest project in Thailand's pipeline, which may be in operation by 2024, with over 900 guest rooms. This new Marriott Marquis will be part of a dual-property development, which will also include the 398 rooms in the JW Marriott and the Pattaya Beach Resort & Spa. Marriott may add four new hotels under three of its brands across Bangkok and Pattaya in Thailand by 2027. Marriott's portfolio in Thailand includes 45 hotels and resorts, including nine properties with Asset World Corporation.

- Similarly, in the Philippines, the infrastructural construction activities are increasing. In December 2022, the Philippines signed an agreement with South Korea for a loan of up to USD 3 billion for infrastructure and road projects from 2022 to 2026. According to the Ministry of Foreign Affairs, the newly signed contract is worth three times the contract value from 2017 to 2022. This agreement showcases plans for an increment in spending in the construction sector, thereby positively influencing the demand for dry-mix mortar in the country.

- Furthermore, according to the Department of Budget and Management, public infrastructure investment increased from 4.4% of GDP in 2017 to 6.3% of GDP in the year 2022 in the Philippines. Thus, the increasing public infrastructure investments are expected to drive the demand for dry-mix mortar in the country.

- Hence, the factors mentioned above are likely to affect the demand for dry mix mortar during the forecast period.

Indonesia to Dominate the Market

- Indonesia is the largest construction market in the ASEAN region. The Indonesian government is spending more on better infrastructure and urbanization, as there is more demand for residential and commercial properties. It is driving the demand for dry mix mortar in the country.

- The number of high-rise buildings in Indonesia is growing significantly. Recently, the government of Indonesia revealed that the new capital city will be built on the island of Borneo with an investment of IDR 466 trillion (USD 30.05 million), and construction will take ten years. Further, most housing and real estate developers are investing in various construction projects in Indonesia, which is fueling the demand for dry-mix mortar.

- In May 2022, the Ministry of Public Works and Public Housing (PUPR) requested an increase in the usage of Domestic Component Level (TKDN) housing products. PUPR includes Housing Provision Implementation Centers (P2P) in 19 provinces and Housing Provision Work Units (Satker) spread across 34 provinces in Indonesia for the development of domestic housing products.

- According to the Ministry of Finance, Indonesia, the government budget for infrastructure investment is expected to reach USD 430 billion by 2024, compared to USD 365.8 billion invested in the year 2022. Thus, the growth in infrastructure investment is expected to drive the demand for dry-mix mortar in the country.

- The Indonesian-German Initiative for Green Infrastructure was agreed as part of these efforts. It aims to set up a five-year financial cooperation (FC) facility providing low-interest loans and promotional loans of up to USD 2.73 billion to support infrastructure projects. These factors will drive the demand for the currently studied market in the country.

- Thus, the rising residential and infrastructural construction activities are expected to drive the market for dry-mix mortar in the country.

ASEAN Dry Mix Mortar Industry Overview

The ASEAN dry mix mortar market is partially fragmented in nature. Some of the major players in the market include (not in any particular order) Sika AG, MAPEI S.p.A., LATICRETE International, Inc., Saint Gobain, and Siam City Cement Group., amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Long-term Cost-effectiveness in the Construction Industry

- 4.1.2 Increasing Construction Activities in ASEAN Countries

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Laying Cost of Dry Mix Mortar, in Comparison to Conventional Mortar

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 End-user Industry

- 5.1.1 Residential

- 5.1.2 Non-residential

- 5.1.2.1 Commercial

- 5.1.2.2 Infrastructure

- 5.1.2.3 Industrial

- 5.2 Application

- 5.2.1 Plaster

- 5.2.2 Render

- 5.2.3 Tile Adhesive

- 5.2.4 Grout

- 5.2.5 Water Proofing Slurry

- 5.2.6 Concrete Protection and Renovation

- 5.2.7 Insulation and Finishing Systems

- 5.2.8 Other Applications (Bonding Mortar, External plaster, etc.)

- 5.3 Geography

- 5.3.1 Malaysia

- 5.3.2 Indonesia

- 5.3.3 Thailand

- 5.3.4 Singapore

- 5.3.5 Philippines

- 5.3.6 Vietnam

- 5.3.7 Myanmar

- 5.3.8 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Ardex Group

- 6.4.3 BASF SE

- 6.4.4 Greco Asia Sdn Bhd

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 HOLCIM

- 6.4.7 Knauf Gips KG

- 6.4.8 LATICRETE International, Inc.

- 6.4.9 MAPEI S.p.A.

- 6.4.10 PT INDOCEMENT TUNGGAL PRAKARSA Tbk.

- 6.4.11 Saint Gobain

- 6.4.12 Siam City Cement Group

- 6.4.13 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Production Capacity of Industrially Mixed Dry Mix Mortar in Indonesia

- 7.2 Other Opportunities