|

市场调查报告书

商品编码

1685745

数位资产管理-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Digital Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

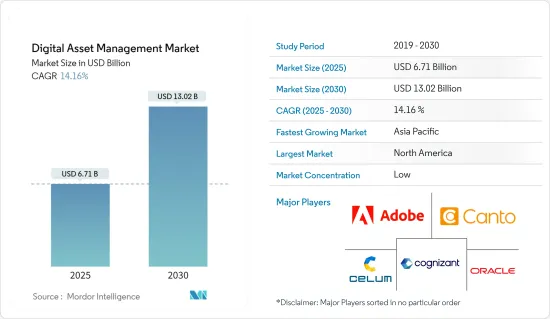

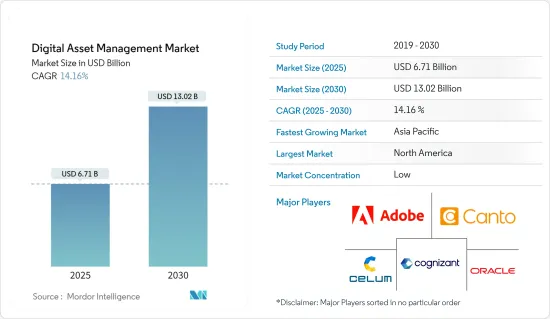

预计 2025 年数位资产管理市场规模为 67.1 亿美元,到 2030 年将达到 130.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.16%。

主要亮点

- 近年来,由于自动化和连网型设备的兴起,数位内容大幅增加。不断增长的资料量正在创造数位资产。数位资产已经变得足够重要,以至于数位资产管理公司已经进入市场。 DAM 为企业提供数位安全,使数位资产能够被安全储存、组织和即时存取。多个类别对数位资产的需求正在加速成长。在所有主要市场中,传统投资者(避险基金和家族理财室)对数位资产的机会越来越多。大多数投资者对数位资产持正面态度。

- 此外,对数位资产日益增长的需求正在推动解决方案推出和合作等策略发展,预计这些发展将在预测期内促进市场成长率。

- 例如,2024 年 2 月,Situation 与 Archax 建立策略伙伴关係关係,旨在塑造数位资产管理格局。 Obligate 先进的链上资本市场平台和 Archax 广泛的数位资产管理服务创建了一个强大的生态系统,承诺为客户提供全方位的产品和服务。

- 作为合作的一部分,Obligate 客户将能够利用 Archax 受英国监管的数位资产託管服务,并获得从法定货币到数位资产的无缝接入。两家公司都期望此次合作能产生正面影响,因为它将为客户提供数位资产管理领域更广泛的产品和服务。 Arcax 是第一家受到英国金融监督监理局监管的数位证券交易所、託管人和仲介公司,它将透过 Obligate 的突破性平台将其数位资产产品扩展到私人市场证券。

- 然而,虽然许多公司仍在使用具有类似 DAM 功能的旧企业内容管理平台,但他们不一定拥有针对其组织所需的创新服务和行销用例而构建的专门 DAM 解决方案,并且对市场上可用的解决方案缺乏了解。

- 自疫情爆发以来,世界数位化议程已进入新的阶段,企业纷纷采用数位优先策略。 COVID-19 对世界各地的企业造成了严重破坏,并加速了私人公司和政府机构内部受数位转型推动的网路犯罪活动的成长。

数位资产管理市场趋势

云端部署将占据主要市场占有率

- 随着IaaS、PaaS、SaaS等云端服务的出现,全球所有企业的云端环境的成长,增加了对旨在透过云端基础的SaaS模型实施的数位资产管理(DAM)软体的开发需求,从而促进了市场上DAM软体的云端部署。

- 此外,云端基础的部署允许将组织的数位资产储存在集中的线上资料库中,使用者可以随时随地存取该资料库,而无需现场伺服器或储存设备。

- 随着企业越来越多地采用云端为基础的解决方案,它们将产生大量资料。

- 为了提高数位资产管理的安全性,确定最合适的资产至关重要。公司应该与相关人员和团队成员合作,确定哪些品牌资产应该保留,哪些应该处置。透过品牌资产学习之旅,公司可以为独特且相关的资产创造空间。因此,预计数位资产管理解决方案的需求将大幅成长。

- 云端方法还可以实现跨网路的自动备份和安全资料传输,从而提高资料保护和灾难復原能力。因此,云端基础资产管理成为提高数位资产管理利用率、安全性和效率的创新工具。数位资产管理在数位转型过程中发挥关键作用,它使您能够利用技术简化流程、加强协作、提高生产力并确保资产安全。此外,预计数位资产管理解决方案领域日益增长的合作将在预测期内推动市场成长率。

北美占最大市场占有率

- 美国数位资产管理市场的特点是关键市场供应商的存在、DAM 解决方案中先进技术的整合以及终端用户行业对增强客户数位体验的需求不断增长,占据了主要的市场占有率。

- 此外,美国各终端用户产业日益数位化,正在产生大量资料。此外,由于疫情导致该国云端运算采用率上升,预计将增加企业的数位资产,最终导致采用数位资产管理解决方案。

- 在数位资产管理解决方案中整合人工智慧和机器学习功能是美国DAM 市场的主要趋势之一,市场供应商将产生人工智慧功能整合到他们的解决方案中。

- 2023 年 12 月,Cloudinary 宣布对其企业数位资产管理 (DAM) 解决方案和可程式媒体 API 进行生成式 AI 增强。 Cloudinary 的生成式AI功能提供了最强大、最简单的大规模影像编辑方法,使非技术人员和技术人员能够加快资产的上市时间,同时提高员工的自主性和生产力。

- 加拿大数位资产管理市场正在成长,关键因素包括企业产生的数位资产数量不断增加、企业集中管理所有数位资产的需求不断增长,以及组织之间日益增长的数位转型和云端运算采用。

- 此外,全国各地组织的数位资产的成长进一步推动了对能够有效存取、储存、共用和管理数位资产的数位资产管理解决方案的需求。此外,MediaValet 和 CleanPix 等国内和全球市场供应商的存在也具有重要意义,有助于市场成长。

数位资产管理行业概览

数位资产管理市场高度分散,主要参与者包括 Adobe Inc.、Canto Inc.、CELUM GmbH、Cognizant Technology Solutions Corporation 和 Oracle Corporation。该市场中的公司正在采用伙伴关係、创新和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2023 年 12 月 - Cloudinary 宣布为其企业数位资产管理 (DAM) 解决方案 Cloudinary Assets 提供可程式媒体 API 和生成式 AI 增强功能。 Cloudinary 的生成人工智慧功能提供了最简单但最强大的图像编辑方式,使技术和非技术用户能够缩短其最有价值资产的上市时间,同时提高员工的自主性和生产力。

- 2023 年 9 月 - Canto 宣布推出 AI Visual Search,这是一项新解决方案,使用户能够根据视觉描述搜寻他们的整个内容库。这项创新技术非常适合经常管理内容库中数千个品牌资产的数位资产管理用户。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响

第五章市场动态

- 市场驱动因素

- 数位资产数量不断增加

- 市场挑战

- 缺乏解决方案意识且成本高昂

- 主要产品特点

- 视讯管理

- 创新工具集成

- 资产分析

- Web 内容集成

- 品牌入口网站

- 资产和元资料存檔

- 生命週期和权限管理

第六章市场区隔

- 按部署

- 本地

- 云(SaaS)

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户

- 媒体与娱乐

- BFSI

- 政府

- 卫生保健

- 零售

- 製造业

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 世界其他地区(拉丁美洲、中东和非洲)

- 北美洲

第七章竞争格局

- 公司简介

- Adobe Systems Incorporated(Adobe Experience Manager Assets)

- Canto Inc.(Canto Digital Asset Management)

- CELUM GmbH(CELUM Digital Asset Management)

- Cognizant Technology Solutions Corp.(assetServ)

- Oracle Corporation(Oracle WebCenter Content)

- Cloudinary Ltd(Digital Asset Management)

- OpenText Corporation(Media Management, MediaBin)

- Aprimo LLC(ADAM Software)

- Bynder(Webdam Inc.)

- MediaBeacon Inc.(R3volution)

- IBM Corporation

- Nuxeo(Nuxeo Platform)

- Widen(Digital Asset Management)

- Extensis(Celartem Inc.)

- Digizuite A/S

第八章投资分析

第九章 市场展望

The Digital Asset Management Market size is estimated at USD 6.71 billion in 2025, and is expected to reach USD 13.02 billion by 2030, at a CAGR of 14.16% during the forecast period (2025-2030).

Key Highlights

- With the increasing automation and connected devices trend, digital content has significantly increased over recent years. The growing data volume has created digital assets. Digital assets have become important enough that digital asset management companies are coming on board. DAMs provide digital security for businesses, allowing them to safely store, organize, and instantly access their digital assets. The demand for Digital Assets is growing at an accelerating rate across the different categories. Conventional investors (hedge funds and family offices) in all major markets are increasingly exposed to digital assets. Most investors perceive digital assets positively.

- Further, the growing strategic developments, such as solution launches and collaborations with the growing demand for digital assets, are analyzed to contribute to the market growth rate during the forecast period.

- For instance, in February 2024, Obligate joined forces with Archax in a strategic partnership that was aimed at shaping the digital asset management landscape. A strong ecosystem, promising a complete set of products and services to clients, is created by Obligate's advanced platform for on-chain capital markets in conjunction with Archax's broad range of digital asset management services.

- As part of the collaboration, Obligate clients gain seamless on-ramp access from fiat into digital assets, leveraging Archax's UK-regulated digital asset custody services. The collaboration would offer clients an expanded range of products and services in the field of Digital Asset Management, with both companies expecting a positive impact. Archax, the first company to be regulated by the Financial Conduct Authority as a digital securities exchange, custodian, and broker, will expand its offering of digital assets via Obligate's groundbreaking platform into private market securities.

- However, there is a lack of awareness about the available solutions in the market as many companies still use older enterprise content management platforms with some DAM-like capabilities but do not necessarily have purpose-built DAM solutions for creative services or marketing use cases that are required for their organizations.

- Since the outbreak of the pandemic, the digital agenda worldwide has witnessed a newfound growth in adoption, pushing businesses to adopt digital-first strategies. COVID-19 has caused significant disruption to business on a global scale and accelerated the growth of cyber-criminal activities in private and government enterprises supported by digital transformation.

Digital Asset Management Market Trends

Cloud Deployment to Hold Significant Market Share

- The emergence of cloud services, including IaaS, PaaS, and SaaS, has raised the demand for the development of Digital asset management (DAM) software designed to be implemented through the cloud-based SaaS model implementations in line with the growth of cloud environment in all the businesses worldwide, driving the cloud deployment of the DAM software in the market.

- Additionally, in cloud-based deployment, the digital assets of an organization can be stored in a centralized, online database that users can access anytime, anywhere, without the need for on-site servers or storage devices, which can streamline workflows and improve collaboration, precisely critical aspects in fields such as marketing and sales, product development, and customer service, supporting the organization to have better productivity and operational efficiencies, which would fuel the market growth.

- With the growing adoption of cloud-based solutions in companies, a significant amount of data is generated, and it may take much work to find a company's most valuable digital assets since companies create many digital assets to stay relevant and connected to the audience.

- Identifying the most appropriate assets to strengthen digital asset management security is essential. Companies should identify brand assets to be kept and disposed of with the help of stakeholders and team members. Companies can make space for unique and relevant assets through the learning journey for brand assets. Therefore, the need for digital asset management solutions is expected to grow significantly.

- In addition, the cloud approach enables automatic backup and data transfer security between networks, improving data protection and disaster recovery capabilities. Therefore, cloud-based Digital Asset Management is an innovation tool that provides increased use, security, and efficiency for managing digital assets. It enables organizations to use technology to simplify their processes, foster collaboration, increase productivity, and ensure the security of assets, playing an essential role during the Digital Transformation process. Further, the growing collaborations in Digital Asset Management solutions are analyzed to bolster the market growth rate during the forecast period.

North America to Hold the Largest Market Share

- The United States digital asset management market holds a major market share, characterized by the presence of major market vendors, integration of advanced technologies in DAM solutions, and rising demand from end-user industries to enhance customer digital experience.

- Furthermore, the growth in the digitization of various end-user industries in the United States also leads to large data generation. Additionally, the increased cloud adoption rate in the country due to the pandemic is expected to increase companies' digital assets, ultimately leading to the adoption of digital asset management solutions.

- The integration of AI and machine learning capabilities in digital asset management solutions is one of the key trends in the United States DAM market, with market vendors integrating generative AI capabilities in their solutions.

- In December 2023, Cloudinary announced generative AI enhancements to its enterprise digital asset management (DAM) solution and programmable media API. Cloudinary's generative artificial intelligence capabilities offer the most powerful and easiest way to edit images at scale, thus enabling non-technical and technical users to accelerate time to market for their assets while enhancing employee autonomy and productivity.

- The digital asset management market in Canada is experiencing growth, largely driven by the ever-growing volume of digital assets produced by businesses, the growing need among enterprises to centralize all their digital assets, and the ever-increasing digital transformation and cloud adoption in organizations.

- Additionally, the increasing number of digital assets in organizations nationwide further drives the demand for digital asset management solutions to efficiently access, store, share, and manage digital assets. Furthermore, the significant presence of homegrown market vendors such as MediaValet and CleanPix, coupled with global market vendors, intensifies and supports the market's growth.

Digital Asset Management Industry Overview

The digital asset management market is highly fragmented, with the presence of major players like Adobe Inc., Canto Inc., CELUM GmbH, Cognizant Technology Solutions Corporation, and Oracle Corporation. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2023 - Cloudinary announced generative AI enhancements to its Programmable Media API and enterprise digital asset management (DAM) solution, Cloudinary Assets. Cloudinary's generative Artificial Intelligence capabilities offer the easiest and most powerful way to edit images at scale, thus enabling technical and non-technical users to accelerate time to market for their most valuable assets while enhancing employee autonomy and productivity.

- September 2023 - Canto announced the launch of AI Visual Search, a new solution that allows users to search their entire content library based on visual descriptions. This innovative technology is ideal for digital asset management users, who often manage thousands of brand assets in their content libraries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Number of Digital Assets

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness and Higher Costs of the Solutions

- 5.3 Key Product Features

- 5.3.1 Video Management

- 5.3.2 Creative Tool Integration

- 5.3.3 Asset Analytics

- 5.3.4 Web Content Integration

- 5.3.5 Brand Portals

- 5.3.6 Asset and Metadata Archiving

- 5.3.7 Lifecycle and Rights Management

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud (SaaS)

- 6.2 By Organization Size

- 6.2.1 SMEs (Small and Medium Enterprises)

- 6.2.2 Large Enterprises

- 6.3 By End User

- 6.3.1 Media and Entertainment

- 6.3.2 BFSI

- 6.3.3 Government

- 6.3.4 Healthcare

- 6.3.5 Retail

- 6.3.6 Manufacturing

- 6.3.7 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Rest of the World (Latin America and Middle East and Africa)

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Adobe Systems Incorporated (Adobe Experience Manager Assets)

- 7.1.2 Canto Inc. (Canto Digital Asset Management)

- 7.1.3 CELUM GmbH (CELUM Digital Asset Management)

- 7.1.4 Cognizant Technology Solutions Corp. (assetServ)

- 7.1.5 Oracle Corporation (Oracle WebCenter Content)

- 7.1.6 Cloudinary Ltd (Digital Asset Management)

- 7.1.7 OpenText Corporation (Media Management, MediaBin)

- 7.1.8 Aprimo LLC (ADAM Software)

- 7.1.9 Bynder(Webdam Inc.)

- 7.1.10 MediaBeacon Inc. (R3volution)

- 7.1.11 IBM Corporation

- 7.1.12 Nuxeo (Nuxeo Platform)

- 7.1.13 Widen (Digital Asset Management)

- 7.1.14 Extensis (Celartem Inc.)

- 7.1.15 Digizuite A/S