|

市场调查报告书

商品编码

1685818

北美资料中心冷却:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)North America Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

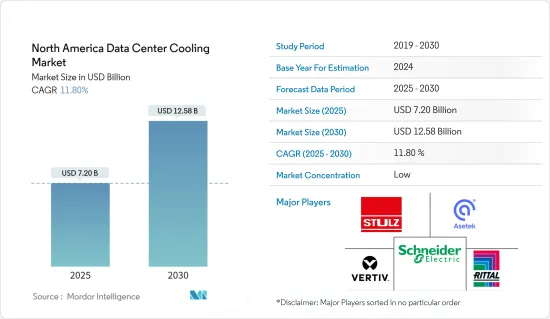

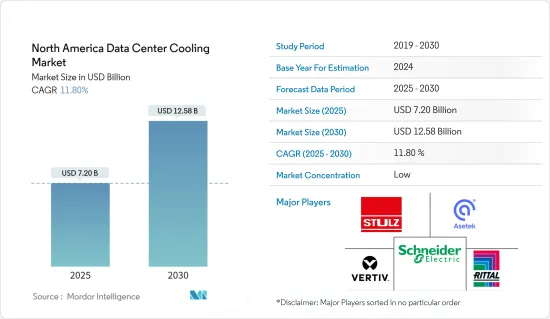

北美资料中心冷却市场规模预计在 2025 年为 72 亿美元,预计到 2030 年将达到 125.8 亿美元,在市场估计和预测期(2025-2030 年)内复合年增长率为 11.8%。

各种货柜化、模组化和性能优化的资料中心(POD)设施的快速发展预计将推动资料中心对各种冷却系统的整体需求,从而广泛推动市场成长。

美国主导整个北美资料中心冷却市场,这得益于超过 100MW 的主机託管和超大规模设施的发展。对具有成本效益和效率的资料中心的需求激增、拥有资料中心的企业的健康成长、各种针对环境友善资料中心解决方案的绿色倡议以及功率密度预计将推动市场成长。

此外,可携式和液体冷却技术的出现以及对模组化资料中心冷却方法的日益增长的需求预计将为北美资料中心冷却市场提供丰厚的机会。北美资料中心冷却市场主要由日益采用的节能、经济、环保的冷却解决方案主导,这些解决方案符合政府机构提供的各种严格的环境安全法规。

此外,市场正在见证积极的产品发布和技术创新,从而极大地推动市场发展。例如,维吉尼亚州 Modine Rockbridge 工厂将于 2023 年 6 月运作5 兆瓦的先进测试实验室,进一步扩展 Modine 为资料中心客户提供的 Airedale 服务,并满足资料中心产业对检验的永续冷却解决方案日益增长的需求。新实验室可容纳高达 2.1 MW 的风冷式冷冻和高达 5 MW 的水冷式冷冻,可对所有空调设备进行测试。

然而,对专门基础设施的需求、高昂的投资成本以及停电期间的各种冷却挑战预计将在整个预测期内限制北美资料中心冷却市场的成长。

COVID-19 疫情让资料中心陷入了未知领域。供应链中断很常见,世界各地的停电对系统的平稳运作产生了重大影响。由于运输中断和工厂关闭影响了资料中心设备的交付,营运商已经找到了应对挑战的解决方法。然而,在 COVID-19 后的预测期内,市场预计将见证各种有利可图的成长机会。

北美资料中心冷却市场趋势

建筑业的成长将推动对家具产品的需求

- 资讯科技(IT)产业主要包括各种营业单位(例如独资企业、组织和伙伴关係)对资讯科技(IT)服务和相关商品的整体销售,主要涉及使用电脑、电脑周边设备和通讯设备搜寻、储存、传输和处理资料。 IT市场还包括电脑网路、系统设计服务、广播和资讯传递技术(如电话和电视)以及在此过程中使用的其他设备。这些巨大的需求正在推动整个资料中心冷却市场的需求,因为设备需要适当的冷却系统才能正常运作。

- 在 IT 产业,各种业务不仅需要内部私有资料存储,还需要超大规模资料中心来满足组织规模的需求。多年来,该地区云端储存的采用呈指数级增长,尤其是由于 SaaS 供应商的成长,预计将最大限度地增加对资料中心冷却系统的需求,因为它使云端储存供应商能够扩展其容量。

- 冷却系统在 IT 和资料中心领域至关重要,主要是因为需要各种增强型和高品质的冷却解决方案,这些解决方案的效率要比传统的风冷解决方案高得多。此外, IT基础设施技术创新的不断增加以及各智慧型手机製造商对温度控管冷却系统的需求不断增加也大大推动了市场的成长。

- 美国在建立推动市场成长率的各种驱动力方面发挥着至关重要的作用。这主要是由于该地区主要市场参与者增加投资和建立资料中心。例如,亚马逊网路服务公司在2023年1月宣布,计画在2040年投资约350亿美元在维吉尼亚建立多个资料中心园区。

亚太地区预计将占据主要市场占有率

- 在北美,由于存在大量服务供应商,以及主机託管提供商和超大规模资料中心营运商的高额投资,预计市场将由美国主导。近年来,资料中心的数量大幅增加。为了提高资料中心的效能,在给定的空间内使用了大量处理器,从而增加了密度。密度的增加带来电力和冷却需求的增加。

- 美国也为银行、IT、金融服务、保险 (BFSI)、零售和医疗保健行业的全球资料中心需求做出了重大贡献。由于资料中心的数量及其扩张,市场利润丰厚,该地区的资料中心服务提供者正在寻求控制其营运成本。

- 资料中心每机架功率密度平均增加1.5kW,导致气流受限、发热量增加。通常,IT 设备每千瓦需要 100-160 cfm 的空气,但在高密度环境中,这一数字会降至 100 以下,导致热量输出增加并显着推动市场成长。

- 行动宽频的扩展、5G的出现、巨量资料分析和云端运算的成长是推动美国新资料中心基础设施需求的关键因素。网路供应商致力于快速部署5G,以实现更好的创新。这些发展进一步推动了美国企业对高效率资料中心冷却解决方案和服务的需求。

- 据Cloudscene称,截至2023年9月,美国共有5,375个资料中心,德国以522个位居第二。就资料中心总数而言,英国以517个位居第三,中国以448个位居第三。预计美国大量资料中心的存在将在整个预测期内加速市场的成长。

北美资料中心冷却产业概况

北美资料中心冷却市场竞争激烈且分散。施耐德电气 SE、Black Box Corporation、Asetek、Nortek Air Solutions LLC、艾默生电气公司、日立有限公司、Rittal GmbH &Co.KG、富士通有限公司、Stulz GmbH 和 Vertiv。随着对创新的关注度不断提高,对液体和可携式冷却技术等新技术的需求也在不断增长,这推动了该地区进一步发展的投资。

2024 年 5 月,Stulz 推出了最新创新:CyberCool 冷却液管理和分配装置 (CDU)。此产品系列包含四种型号,有两种不同尺寸。这些装置的热交换容量范围很广,从 345 kW 到 1,380 kW。 Stulz 将设施供水系统的额定供水温度设定为 32°C,将技术冷却系统的液体供应温度设定为 36°C。

2024 年 3 月,Rittal Private Limited 在其位于印度班加罗尔的製造工厂开设了一个新的整合中心,专门从事冷却装置和液体冷却包 (LCP) 解决方案。这项策略性倡议不仅将增强公司的生产能力,而且还将满足日益增长的工业冷却解决方案的需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况(范围:包括与资料中心冷却相关的当前区域趋势的详细分析。)

- 冷却的主要成本考量

- 分析与资料中心营运相关的主要成本开销,重点关注资料中心冷却

- 资料中心冷却的关键创新和发展

- 资料中心采用的主要节能技术

第五章 市场动态

- 市场驱动因素(关键因素包括日益关注能源消耗以及转向绿色解决方案,这些因素基于未来 5-7 年的相对影响进行绘製)

- 市场动态(根据未来5-7年内监管的动态性质和不断变化的客户需求等关键因素的相对影响绘製市场动态图)

- 市场机会

- 封闭式与非封闭式架空地板

- 产业生态系统分析

6. 区域资料中心足迹现况分析

- 资料中心 IT 负载能力与麵积分布区域分析(2017-2030 年)

- 对北美成熟的 DC 市场和新兴 DC 热点进行区域分析,包括重点介绍主要成熟和新兴 DC 市场。

- 直流冷却法规结构的区域分析

第 7 章资料中心冷却市场细分

- 依冷却技术划分(主要趋势、市场规模、2022-2029 年估计与预测、未来展望)

- 空气冷却

- CRAH

- 冷却器和节热器

- 冷却塔(涵盖直接冷却、间接冷却及双级冷却)

- 其他的

- 液体冷却

- 浸入式冷却

- 晶片直接冷却

- 后门式热交换器

- 空气冷却

- 按行业

- 资讯科技和电信

- 零售和消费品

- 卫生保健

- 媒体与娱乐

- 联邦政府

- 其他最终用户

- 按国家

- 美国

- 加拿大

第八章 竞争格局

- 公司简介

- Vertiv Group Corp.

- Stulz GmbH

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Asetek A/S

- Alfa Laval AB

- Iceotope Technologies Limited

- Green Revolution Cooling Inc.

- Chilldyne Inc.

- Airedale International Air Conditioning Ltd.

第九章投资分析

第十章 市场机会与未来趋势

The North America Data Center Cooling Market size is estimated at USD 7.20 billion in 2025, and is expected to reach USD 12.58 billion by 2030, at a CAGR of 11.8% during the forecast period (2025-2030).

The rapid development of various containerized, modular, and performance-optimized data center (POD) facilities is anticipated to boost the overall demand for various cooling systems that can be utilized in the data centers, driving the market's growth extensively.

The United States dominated the total North American data center cooling market mainly due to the growth in the development of colocation and hyperscale facilities with over 100 MW power capacity. A surge in the need for cost-effective and efficient data centers, healthy growth of enterprises with data centers, various green initiatives for eco-friendly data center solutions, and power density are expected to drive the market's growth.

In addition, the emergence of portable cooling and liquid-based cooling technologies and growth in the need for a modular data center cooling approach are expected to offer lucrative opportunities for the North American data center cooling market. The solution segment had ruled the North American data center cooling market primarily due to the rising adoption of energy-efficient, cost-effective, and environment-friendly cooling solutions in line with various stringent environmental safety rules offered by governmental bodies.

Moreover, the market witnessed significant product launches and innovations, driving the market significantly. For instance, in June 2023, a 5MW, state-of-the-art testing laboratory was commissioned at the Modine Rockbridge facility in Virginia, further expanding the services that Airedale by Modine can provide data center customers and meet growing demand from the data center industry for validated, sustainable cooling solutions. The new lab can test a complete range of air conditioning equipment, accommodating air-cooled chillers up to 2.1MW and water-cooled chillers up to 5MW.

However, the need for specialized infrastructure, higher investment costs, and various cooling challenges during a power outage are expected to restrict the growth of the North American data center cooling market throughout the forecast period.

The COVID-19 pandemic placed data centers in unchartered territory. There were many supply chain disruptions, and due to lockdowns globally, the smooth operations of the systems were hugely impacted. Owing to shipping disruptions and factory closures that affected the delivery of data center equipment, operators found workarounds to meet the challenges. However, during the post-COVID-19 period, the market is expected to witness various lucrative growth opportunities throughout the forecast period.

North America Data Center Cooling Market Trends

Growth in the Construction Sector Boosting the Demand for Furniture Products

- The information technology (IT) industry primarily consists of the overall sales of information technology (IT) services and related goods by various entities such as sole traders, organizations, and partnerships that mainly apply computers, computer peripherals, and telecommunications equipment to retrieve, store, transmit and maneuver data. The IT market also involves computer networking, systems design services, broadcasting, information distribution technologies like telephones and television, and several other equipment used during the process. These huge requirements require a proper cooling system for the devices to perform normally, thereby driving the overall demand for the data center cooling market.

- The IT industry needs on-premise private data storage as well as hyperscale data centers for its various operations according to the organization's size. The rise in the adoption of cloud storage has drastically increased over the years within the region, especially due to growth in SaaS providers, allowing cloud storage providers to extend their capacities, which is anticipated to maximize the demand for data center cooling systems.

- The cooling system is essential in the IT and data center sector, primarily due to the need for various enhanced high-quality cooling solutions that are quite efficient than the traditional air-cooling solution. Also, the rise in technological innovation in the IT infrastructure, coupled with the increase in the demand for cooling systems among the various smartphone manufacturers for thermal management, is also driving the market growth extensively.

- The United States plays a very significant role in terms of establishing various driving the market's growth rate, which is mainly due to the rising investments and establishments of the data center by the key major market players within the region. For instance, in January 2023, Amazon Web Services intends to invest a sum of around USD 35 billion by 2040 to establish various multiple data center campuses across Virginia.

Asia-Pacific is Expected to Hold Significant Market Share

- The United States is poised to dominate the market in North America, owing to the presence of many services and software providers as well as high investments by colocation providers and hyper-scale data center operators. In the last few years, there has been a significant rise in the number of data centers. A considerable number of processors are being utilized in a given space to increase data centers' performance, which results in increased density. The requirement for power and cooling has grown along with increased density.

- The United States also contributes substantially to the global data center requirements from the banking, IT, financial services, and insurance (BFSI), retail, and healthcare industries. Data center service providers in the region are prompted to manage their operating costs, as the region is a lucrative market, considering the number of data centers and their expansions.

- Data centers' power density experiences growth by an average of 1.5 kW per rack, which results in limited air distribution and enhanced heat generation. In general, IT equipment typically needs between 100 and 160 cfm of air per kW, but in a dense environment, it diminishes to less than 100, which results in higher heat generation, driving the market's growth significantly.

- The expansion of mobile broadband, the emergence of 5G, growth in Big Data analytics, and cloud computing are the primary factors driving the demand for new data center infrastructures in the United States. Network providers are working to ensure the rapid implementation of 5G for better innovation. Such developments are further driving the demand for efficient data center cooling solutions and services among United States's enterprises.

- As per Cloudscene, as of September 2023, the total count of data centers in the United States was 5,375, whereas Germany ranked second with an overall count of 522 data centers. The United Kingdom ranked 3rd among countries in terms of the total number of data centers, with 517, while China recorded 448. This possession of a significant number of data centers in the United States is expected to amplify the market's growth throughout the forecast period.

North America Data Center Cooling Industry Overview

The North American data center cooling market is highly competitive and fragmented. Market penetration is growing with a strong presence of major players, such as Schneider Electric SE, Black Box Corporation, Asetek, Nortek Air Solutions LLC, Emerson Electric Co., Hitachi Ltd, Rittal GmbH & Co. KG, Fujitsu Ltd, Stulz GmbH, and Vertiv, in established markets. With the increasing focus on innovation, the demand for new technologies, such as liquid-based cooling and portable cooling technologies, is also growing, which, in turn, is driving investments for further developments in the region.

In May 2024, Stulz unveiled its latest innovation, the CyberCool Coolant Management and Distribution Unit (CDU), specifically engineered to optimize heat exchange efficiency in liquid cooling solutions. The product line comprises four models, available in two distinct sizes. These units boast an impressive heat exchange capacity, ranging from 345 kW to 1,380 kW. Stulz has set the rated water supply temperature for the facility water system at 32°C (89.6°F), with the liquid supply temperature for the technology cooling system pegged at 36°C (96.8°F).

In March 2024, Rittal Private Limited marked the opening of its new Integration Center, specifically tailored for Cooling Units and Liquid Cooling Package (LCP) solutions, at its Bangalore, India manufacturing plant. This strategic move not only bolsters the company's production capabilities but also positions it to cater to the escalating demand for Industrial Cooling Solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview (Coverage: A detailed analysis of the current regional trends related to Data Center Cooling are included in this section)

- 4.2 Key cost considerations for Cooling

- 4.2.1 Analysis of the key cost overheads related to DC operations with an eye on DC Cooling

- 4.2.2 Key innovations and developments in Data Center Cooling

- 4.2.3 Key energy efficiency practices adopted in Data Centers

5 MARKET DYNAMICS

- 5.1 Market Drivers (Key factors such as the increased emphasis on energy consumption, move towards green solutions are mapped based on their relative impact over the next 5-7 years)

- 5.2 Market Challenges (Key factors such as the dynamic nature of regulations, evolving customer needs are mapped based on their relative impact over the next 5-7 years)

- 5.3 Market Opportunities

- 5.4 Comparison of raised floor with containment & raised floor without commitment

- 5.5 Industry Ecosystem Analysis

6 ANALYSIS OF THE CURRENT REGIONAL DATA CENTER FOOTPRINT

- 6.1 Regional Analysis of IT Load Capacity & Area Footprint of Data Centers (for the period of 2017-2030)

- 6.2 Regional Analysis of the Established DC Markets and Emerging DC Hotspots in North America region (we will include coverage by highlighting major established and emerging DC markets)

- 6.3 Regional Analysis of Regulatory Framework On DC Cooling

7 DATA CENTER COOLING MARKET SEGMENTATION

- 7.1 By Cooling Technology (Key trends, market size estimates & projections for the period of 2022-2029 and future outlook)

- 7.1.1 Air-based Cooling

- 7.1.1.1 CRAH

- 7.1.1.2 Chiller and Economizer

- 7.1.1.3 Cooling Tower (covers direct, indirect & two-stage cooling)

- 7.1.1.4 Others

- 7.1.2 Liquid-based Cooling

- 7.1.2.1 Immersion Cooling

- 7.1.2.2 Direct-to-Chip Cooling

- 7.1.2.3 Rear-Door Heat Exchanger

- 7.1.1 Air-based Cooling

- 7.2 By End-user Vertical

- 7.2.1 IT & Telecom

- 7.2.2 Retail & Consumer Goods

- 7.2.3 Healthcare

- 7.2.4 Media & Entertainment

- 7.2.5 Federal & Institutional agencies

- 7.2.6 Other end-users

- 7.3 By Country

- 7.3.1 United States

- 7.3.2 Canada

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Vertiv Group Corp.

- 8.1.2 Stulz GmbH

- 8.1.3 Schneider Electric SE

- 8.1.4 Rittal GmbH & Co. KG

- 8.1.5 Asetek A/S

- 8.1.6 Alfa Laval AB

- 8.1.7 Iceotope Technologies Limited

- 8.1.8 Green Revolution Cooling Inc.

- 8.1.9 Chilldyne Inc.

- 8.1.10 Airedale International Air Conditioning Ltd.