|

市场调查报告书

商品编码

1851280

先进封装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Advanced Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

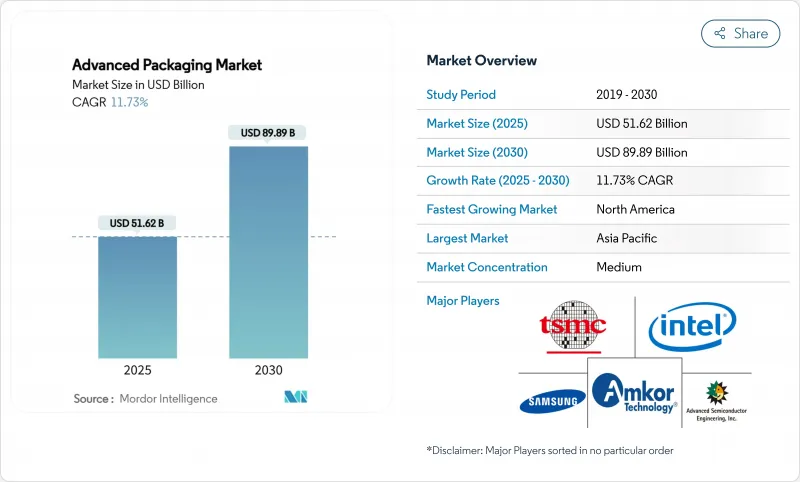

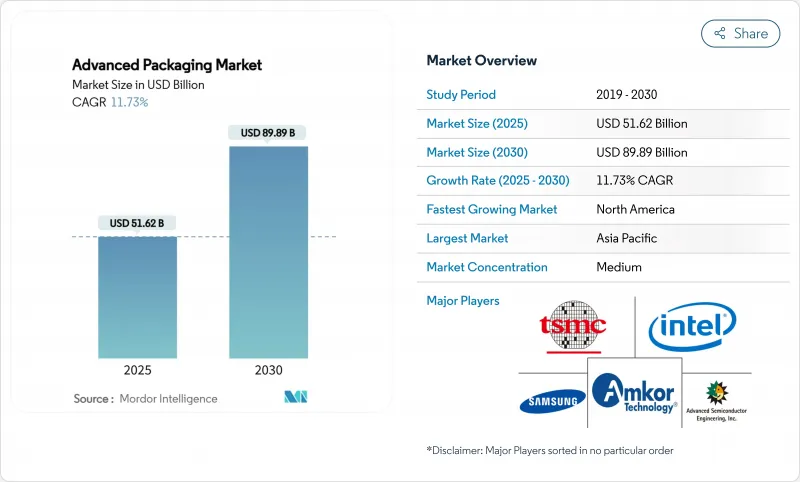

预计到 2025 年,先进封装市场规模将达到 516.2 亿美元,到 2030 年将达到 898.9 亿美元,年复合成长率为 11.73%。

由于异质整合对于人工智慧 (AI) 处理器至关重要,而传统封装的散热和互连能力又受到限制,因此市场需求超出了先前的预期。这促使集成设备製造商 (IDM) 和半导体组装测试外包 (OSAT) 服务商加快资本支出,同时各国政府也累计了多项激励措施,鼓励本地化组装能力。先进封装市场也受惠于玻璃芯基板的研发、面板级加工试验以及超大规模资料中心对共封装光学元件的快速应用。然而,供应仍然紧张,BT 树脂基板短缺和工程人才匮乏阻碍了产能的及时提升。随着代工厂将封装业务纳入内部,以管理端到端的 AI 供应链,竞争日益激烈,传统 OSAT 服务商的利润空间被压缩,策略专业化趋势也随之兴起。

全球先进封装市场趋势与洞察

人工智慧和高效能运算对异质整合的需求日益增长

人工智慧工作负载需要传统封装无法实现的运算密度和记忆体频宽。台积电的CoWoS平台将晶片组和高频宽记忆体整合到单一结构中,并正迅速被主流人工智慧加速器厂商所采用。三星的SAINT技术采用混合键结技术实现了类似的目标,并支援即将推出的HBM4堆迭,凸显了自主研发先进封装的战略价值。导热介面材料、专用基板和主动中介层等技术的出现,使得封装成本占半导体总成本的比例从主流CPU的5%-8%上升至15%-20%。因此,先进封装产能对于人工智慧系统的上市时间而言,其重要性堪比尖端晶圆厂。正因如此,先进封装市场的发展与前端製程的转型同步进行,而非落后于其后。

消费性电子设备的微型化推动了WLP技术的普及。

智慧型手机、穿戴式装置和音讯装置对更薄的设计和更高的功能密度有着持续的需求。扇出型晶圆级封装 (FOWLP) 能够在厚度小于 0.5 毫米的超薄封装中整合多个晶粒,从而支援旗舰级移动处理器,同时又不影响散热性能。从扇入型晶圆级封装 (WLP) 过渡到 FOWLP,透过省去底部填充、引线接合法和层压基板,使系统总成本降低了高达 25%。小型化也推动了植入式医疗用电子设备的发展,因为尺寸对这类产品至关重要;无导线起搏器受益于 WLP 技术,在满足严格的可靠性目标的同时,装置尺寸缩小了 93%。因此,消费和医疗领域的需求形成了一个稳定的基准,使先进封装市场免受个人电脑终端市场週期性变化。

高资本密集度限制了市场进入。

用于 2.5D 和 3D 製程的模具成本每个腔室在 1000 万美元到 1500 万美元之间,远高于传统生产线通常的 300 万美元。台积电已为 2025 年的资本支出累计了420 亿美元,其中很大一部分用于先进封装的扩张。因此,规模较小的 OSAT(外包半导体组装和测试)厂商难以在快速缩短的产品生命週期内摊提投资,促使它们转向细分市场并进行防御性併购。高门槛扩大了顶级供应商与区域追随者之间的技术差距,抑制了 2024 年至 2026 年间先进封装市场的新增产能成长。

细分市场分析

到2024年,覆晶封装仍将维持领先地位,占据49.0%的市场份额,这主要得益于大批量消费和工业应用的需求。然而,2.5D/3D封装将实现最快成长,预计复合年增长率将达到13.2%,因为人工智慧加速器需要比覆晶更紧密的逻辑记忆体接近性。预计到2030年,2.5D/3D解决方案的先进封装市场规模将达341亿美元,占平台总收入的38%。

三星的SAINT平台实现了小于10µm的混合键合,与传统的引线键合堆迭相比,讯号延迟降低了30%,热感余量提高了40%。台积电的CoWoS计画在2025年新增三条生产线,解决了12个月的订单积压。嵌入式封装非常适合空间受限的汽车领域,而扇出型晶圆级封装(WLP)则非常适合5G基地台和毫米波雷达设计。综上所述,这些发展趋势使得2.5D/3D封装成为下一代装置发展蓝图的核心,确保其在先进封装市场中发挥关键的价值驱动作用。

2024年,消费性电子产品占总出货量的40.0%,但其成长率仍维持在个位数。相较之下,汽车和电动车的需求预计将以12.4%的复合年增长率成长,到2030年,其在先进封装市场的份额将增至18%。预计到预测期结束时,汽车电子先进封装的市场规模将超过160亿美元。

电动车牵引逆变器、车载充电器和网域控制器现在都采用车规级扇出型双面冷却功率模组和射出成型的系统级封装 (SiP) 组件。资料中心基础设施已成为另一个高成长细分市场:人工智慧伺服器采用功率密度高达 1000 W/cm² 的先进封装,需要创新的热感盖和底部填充材料。同时,医疗保健产业需要生物相容性涂层和密封外壳,这些特性推高了平均售价,并带来了稳定的更换需求。这些细分市场趋势使收入来源多元化,并降低了先进封装市场对智慧型手机週期性更新的依赖。

先进封装市场按封装平台(覆晶、嵌入式晶粒、扇入式晶圆级封装等)、终端用户产业(消费性电子、汽车及电动车、资料中心及高效能运算等)、装置架构(2D IC、2.5D 中介层、3D IC)、南美洲互通技术(焊料凸块、铜柱、混合键结)及欧洲地区(北美、非洲、欧洲地区)和欧洲地区(北美地区和欧洲地区)。

区域分析

亚太地区贡献了2024年75.0%的营收,其中台湾、韩国和中国当地占据了前端晶圆厂和基板供应商的大部分份额。台积电宣布在美国投资1,650亿美元,这反映了其多元化战略,而非将台湾总部迁至美国,从而确保亚洲在中期内保持领先地位。中国本土的OSAT厂商实现了两位数的营收成长,并拓展至汽车封装领域,但对极紫外线(EUV)光刻设备的严格监管限制了它们向先进晶圆製造製程领域的扩张。

受《晶片封装法案》(CHIPS Act)激励措施的推动,北美已成为快速成长的地区,复合年增长率高达12.5%。安靠(Amkor)位于亚利桑那州、投资20亿美元的工厂将于2027年全面运作,届时将整合凸点级、晶圆级和麵板级生产线,为美国系统整合商提供首个靠近美国的大规模外包选择。英特尔、苹果和英伟达已预先预订了部分产能,以规避地缘政治供应链中断的风险,并将此前流向东亚外包半导体组装和测试(OSAT)企业的大量生产转移至北美。因此,先进封装市场如今拥有一个可靠的北美供应链节点,能够支援大量人工智慧产品的生产。

安森美半导体位于捷克的工厂专注于汽车电源用碳化硅元件,这与当地原始设备製造商的电气化目标相契合。德国弗劳恩霍夫研究所主导了小组层面的研究,但製造商对待开发区大型工厂的承诺仍持谨慎态度。同时,新加坡进一步巩固了其中心地位。美光半导体的HBM晶圆厂和科磊的製程控制扩建专案建构了一个垂直整合的生态系统,将人工智慧记忆体和计量技术整合于同一平台之下。印度推出了50%的资本成本分摊计划,吸引了许多具有中期成长潜力且取决于人才供应的先进封装试点提案。

这些发展分散了系统OEM厂商的地理风险,并重新平衡了先进封装市场。儘管如此,预计到2030年,亚太地区仍将保持60%以上的市场份额,因为现有的基础设施、供应链丛集和规模经济仍然使其相对于新参与企业俱有优势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 宏观经济因素的影响

- 市场驱动因素

- 人工智慧和高效能运算对异质整合的需求日益增长

- 消费性电子设备的微型化推动了WLP技术的普及。

- 政府半导体补贴(例如 CHIPS、欧盟晶片法案)

- 电动汽车电力电子设备(先进功率组件)的可靠性需求

- 新型玻璃芯基板可实现面板级封装

- 超大规模资料中心对共封装光元件的需求

- 市场限制

- 先进包装生产线的高资本密集度

- 产业整合为外包利润率带来压力

- BT树脂基板产能瓶颈

- 熟练组装人员短缺

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争的激烈程度

- 投资分析

第五章 市场规模与成长预测

- 透过包装平台

- 覆晶

- 嵌入式

- 扇入式 WLP

- 扇出WLP

- 2.5D/3D

- 按最终用户行业划分

- 消费性电子产品

- 汽车和电动车

- 资料中心和高效能运算

- 工业和物联网

- 医疗保健/医疗技术

- 依设备架构

- 2DIC

- 2.5D 中介层

- 3D IC(TSV/混合键结)

- 透过互连技术

- 焊料凸块

- 铜柱

- 混合键

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 荷兰

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 台湾

- 韩国

- 日本

- 新加坡

- 马来西亚

- 印度

- 亚太其他地区

- 中东和非洲

- 中东

- 以色列

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amkor Technology, Inc.

- Taiwan Semiconductor Manufacturing Company Limited

- Advanced Semiconductor Engineering, Inc.

- JCET Group Co., Ltd.

- Samsung Electronics Co., Ltd.

- Intel Corporation

- Chipbond Technology Corporation

- ChipMOS Technologies Inc.

- Powertech Technology Inc.

- TongFu Microelectronics Co., Ltd.

- Nepes Corporation

- STATS ChipPAC Pte. Ltd.

- Siliconware Precision Industries Co., Ltd.

- UTAC Holdings Ltd.

- Walton Advanced Engineering, Inc.

- Xintec Inc.

- Tianshui Huatian Technology Co., Ltd.

- King Yuan Electronics Co., Ltd.

- Signetics Corporation

- GlobalFoundries Inc.

- Semiconductor Manufacturing International Corporation

- SFA Semicon Co., Ltd.

- Nantong Fujitsu Microelectronics Co., Ltd.

- Hana Micron Inc.

- Unisem(M)Berhad

第七章 市场机会与未来展望

The advanced packaging market size was valued at USD 51.62 billion in 2025 and is forecast to expand at an 11.73% CAGR to reach USD 89.89 billion by 2030.

Demand outpaced earlier projections because heterogeneous integration became indispensable for artificial-intelligence (AI) processors that exceed the thermal and interconnect limits of conventional packages. In response, integrated-device manufacturers (IDMs) and outsourced semiconductor assembly and test (OSAT) providers accelerated capital spending, while governments earmarked large incentives to localize assembly capacity. The advanced packaging market also benefited from glass-core substrate R&D, panel-level processing pilots, and the rapid adoption of co-packaged optics in hyperscale data centers. Supply remained tight, however, as BT-resin substrate shortages and scarce engineering talent hindered timely capacity additions. Competitive intensity rose as foundries internalized packaging to secure end-to-end control of AI supply chains, squeezing traditional OSAT margins and prompting strategic specialization.

Global Advanced Packaging Market Trends and Insights

Rising demand for heterogeneous integration for AI and HPC

AI workloads require compute density and memory bandwidth unattainable with legacy packaging. TSMC's CoWoS platform integrates chiplets and high-bandwidth memory in a single structure, gaining rapid adoption among leading AI accelerator vendors. Samsung's SAINT technology achieved similar objectives using hybrid bonding that supports forthcoming HBM4 stacks, underscoring the strategic value of in-house advanced packaging. Thermal interface materials, specialized substrates, and active interposers raised package cost to 15-20% of the total semiconductor build-to-materials, up from 5-8% for mainstream CPUs. As a result, advanced packaging capacity became as critical as leading-edge fabs in determining time-to-market for AI systems. The advanced packaging market, therefore, grew in tandem with, rather than lagging, front-end process migrations.

Miniaturization of consumer devices boosting WLP adoption

Smartphones, wearables, and hearables consistently demand thinner profiles and higher functional density. Fan-out wafer-level packaging (FOWLP) enables multiple dies to be embedded in ultra-thin packages below 0.5 mm, supporting flagship mobile processors without compromising thermal performance. The shift from fan-in WLP to FOWLP reduced overall system cost by up to 25% because under-fill, wire-bonding, and laminate substrates were eliminated. Miniaturization also moved into implantable medical electronics, where dimensions are life-critical; leadless pacemakers benefited from WLP to cut device size by 93% while meeting stringent reliability targets. Consequently, consumer and medical demand created a recurring baseline that insulated the advanced packaging market from cyclical swings in PC end-markets.

High capital intensity constraining market entry

Tooling for 2.5D and 3D processes can cost USD 10-15 million per chamber, vastly exceeding the USD 3 million typical for legacy lines. TSMC budgeted USD 42 billion in 2025 capital outlays, of which a material share targeted advanced packaging expansions. Smaller OSATs, therefore, struggled to amortize investments across rapidly shrinking product life cycles, prompting niche specialization or defensive mergers. The elevated hurdle rate widened the technological gap between tier-one providers and regional followers, dampening fresh capacity in the advanced packaging market during 2024-2026.

Other drivers and restraints analyzed in the detailed report include:

- Government semiconductor subsidies accelerating infrastructure development

- EV power-electronics reliability transforming packaging requirements

- BT-resin substrate bottlenecks limiting production capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flip-chip packages retained leadership with 49.0% revenue in 2024, anchored by high-volume consumer and industrial applications. Yet 2.5D/3D configurations delivered the fastest gains, achieving a 13.2% CAGR outlook as AI accelerators demanded logic-to-memory proximity beyond flip-chip limits. The advanced packaging market size for 2.5D/3D solutions is forecast to reach USD 34.1 billion by 2030, equal to 38% of total platform revenue.

Samsung's SAINT platform attained sub-10 µm hybrid bonds, reducing signal latency by 30% and extending thermal headroom by 40% relative to wire-bonded stacks. TSMC's CoWoS ramped three additional lines in 2025 to clear a 12-month backlog. Embedded-die and fan-out WLP progressed as complementary options: embedded packages suited space-constrained automotive domains, while fan-out WLP captured 5G base-station and mmWave radar designs. Collectively, these dynamics embedded 2.5D/3D packaging at the center of next-generation device roadmaps, guaranteeing its role as the prime value driver inside the advanced packaging market.

Consumer electronics absorbed 40.0% of 2024 shipments, but its growth plateaued at single digits. In contrast, automotive and EV demand is projected to expand at a 12.4% CAGR, lifting its share of the advanced packaging market to 18% by 2030. The advanced packaging market size for automotive electronics is estimated to surpass USD 16 billion by the end of the forecast period.

EV traction inverters, on-board chargers, and domain controllers now specify automotive-grade fan-out, double-side cooled power modules, and over-molded system-in-package (SiP) assemblies. Data-center infrastructure provided another high-growth niche: AI servers utilize advanced packages with power densities reaching 1,000 W/cm2, dictating innovative thermal lid and under-fill chemistries. Healthcare, meanwhile, requires biocompatible coatings and hermetic enclosures, attributes that carry premium average selling prices and stable replacement demand. Cumulatively, these segment trends diversified revenue streams and reduced dependence on cyclical smartphone refresh cycles within the advanced packaging market.

Advanced Packaging Market is Segmented by Packaging Platform (Flip-Chip, Embedded Die, Fan-In WLP, and More), End-User Industry (Consumer Electronics, Automotive and EV, Data Center and HPC, and More), Device Architecture (2D IC, 2. 5D Interposer, and 3D IC), Interconnect Technology (Solder Bump, Copper Pillar, and Hybrid Bond), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa).

Geography Analysis

Asia-Pacific generated 75.0% of 2024 revenue because Taiwan, South Korea, and mainland China house the bulk of front-end fabs and substrate suppliers. TSMC announced a USD 165 billion U.S. investment, reflecting a diversification strategy rather than the displacement of its Taiwan base, ensuring Asia retains leadership in the medium term. China's domestic OSATs delivered double-digit sales gains and expanded into automotive packaging, but tight controls on extreme-ultraviolet (EUV) tools limited their move into leading-edge wafer-fab processes.

North America emerged as the fastest-growing region at a 12.5% CAGR thanks to the CHIPS Act incentives. Amkor's USD 2 billion Arizona site will combine bump, wafer-level, and panel-level lines once fully ramped in 2027, providing the first large-scale outsourced option near U.S. system integrators. Intel, Apple, and NVIDIA pre-booked a portion of this capacity to de-risk geopolitical supply interruptions, redirecting meaningful volumes that historically flowed to East Asian OSATs. Consequently, the advanced packaging market now includes a credible North American supply node capable of high-volume AI product support.

Europe pursued specialization rather than volume leadership. onsemi's Czech facility addressed silicon-carbide devices for automotive power, aligning with local OEM electrification targets. Germany's Fraunhofer institutes led panel-level research, but manufacturers stayed cautious on green-field megasite commitments. Meanwhile, Singapore strengthened its hub role; Micron's HBM plant and KLA's process-control expansion created a vertically coherent ecosystem that supports AI memory and metrology under one jurisdiction. India introduced a 50% capital cost-sharing scheme, attracting proposals for advanced packaging pilots that promise medium-term upside yet remain contingent on talent availability.

Collectively, these developments diversified geographic risk for system OEMs and rebalanced the advanced packaging market. Even so, Asia-Pacific is forecast to maintain more than 60% share in 2030 because existing infrastructure, supply clusters, and economies of scale still surpass new regional entrants.

- Amkor Technology, Inc.

- Taiwan Semiconductor Manufacturing Company Limited

- Advanced Semiconductor Engineering, Inc.

- JCET Group Co., Ltd.

- Samsung Electronics Co., Ltd.

- Intel Corporation

- Chipbond Technology Corporation

- ChipMOS Technologies Inc.

- Powertech Technology Inc.

- TongFu Microelectronics Co., Ltd.

- Nepes Corporation

- STATS ChipPAC Pte. Ltd.

- Siliconware Precision Industries Co., Ltd.

- UTAC Holdings Ltd.

- Walton Advanced Engineering, Inc.

- Xintec Inc.

- Tianshui Huatian Technology Co., Ltd.

- King Yuan Electronics Co., Ltd.

- Signetics Corporation

- GlobalFoundries Inc.

- Semiconductor Manufacturing International Corporation

- SFA Semicon Co., Ltd.

- Nantong Fujitsu Microelectronics Co., Ltd.

- Hana Micron Inc.

- Unisem (M) Berhad

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Impact of Macroeconomic Factors

- 4.3 Market Drivers

- 4.3.1 Rising demand for heterogeneous integration for AI and HPC

- 4.3.2 Miniaturization of consumer devices boosting WLP adoption

- 4.3.3 Government semiconductor subsidies (e.g., CHIPS, EU Chips Act)

- 4.3.4 EV power-electronics reliability needs (advanced power packages)

- 4.3.5 Emerging glass-core substrates enabling panel-level packaging

- 4.3.6 Co-packaged optics demand in hyperscale datacenters

- 4.4 Market Restraints

- 4.4.1 High capital intensity of advanced packaging lines

- 4.4.2 Industry consolidation squeezing outsourced margins

- 4.4.3 BT-resin substrate capacity bottlenecks

- 4.4.4 Shortage of advanced assembly talent

- 4.5 Value Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Rivalry

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Packaging Platform

- 5.1.1 Flip-Chip

- 5.1.2 Embedded Die

- 5.1.3 Fan-in WLP

- 5.1.4 Fan-out WLP

- 5.1.5 2.5D / 3D

- 5.2 By End-User Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Automotive and EV

- 5.2.3 Data Center and HPC

- 5.2.4 Industrial and IoT

- 5.2.5 Healthcare / Med-tech

- 5.3 By Device Architecture

- 5.3.1 2D IC

- 5.3.2 2.5D Interposer

- 5.3.3 3D IC (TSV / Hybrid-Bond)

- 5.4 By Interconnect Technology

- 5.4.1 Solder Bump

- 5.4.2 Copper Pillar

- 5.4.3 Hybrid Bond

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Netherlands

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Taiwan

- 5.5.4.3 South Korea

- 5.5.4.4 Japan

- 5.5.4.5 Singapore

- 5.5.4.6 Malaysia

- 5.5.4.7 India

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Israel

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Saudi Arabia

- 5.5.5.1.4 Turkey

- 5.5.5.1.5 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amkor Technology, Inc.

- 6.4.2 Taiwan Semiconductor Manufacturing Company Limited

- 6.4.3 Advanced Semiconductor Engineering, Inc.

- 6.4.4 JCET Group Co., Ltd.

- 6.4.5 Samsung Electronics Co., Ltd.

- 6.4.6 Intel Corporation

- 6.4.7 Chipbond Technology Corporation

- 6.4.8 ChipMOS Technologies Inc.

- 6.4.9 Powertech Technology Inc.

- 6.4.10 TongFu Microelectronics Co., Ltd.

- 6.4.11 Nepes Corporation

- 6.4.12 STATS ChipPAC Pte. Ltd.

- 6.4.13 Siliconware Precision Industries Co., Ltd.

- 6.4.14 UTAC Holdings Ltd.

- 6.4.15 Walton Advanced Engineering, Inc.

- 6.4.16 Xintec Inc.

- 6.4.17 Tianshui Huatian Technology Co., Ltd.

- 6.4.18 King Yuan Electronics Co., Ltd.

- 6.4.19 Signetics Corporation

- 6.4.20 GlobalFoundries Inc.

- 6.4.21 Semiconductor Manufacturing International Corporation

- 6.4.22 SFA Semicon Co., Ltd.

- 6.4.23 Nantong Fujitsu Microelectronics Co., Ltd.

- 6.4.24 Hana Micron Inc.

- 6.4.25 Unisem (M) Berhad

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment