|

市场调查报告书

商品编码

1685849

智慧包装:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Smart Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

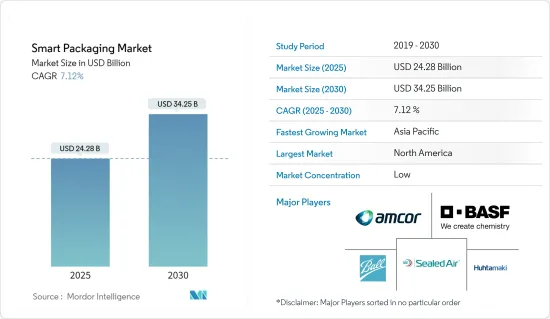

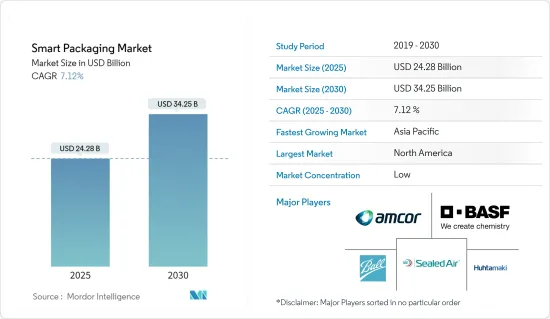

智慧包装市场规模预计在 2025 年为 242.8 亿美元,预计到 2030 年将达到 342.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.12%。

智慧包装是指配备感测器的特定类型的包装系统,用于各种物品,包括食品和药品。智慧包装所使用的技术有助于提高产品品质、保质期、新鲜度监控以及客户和产品安全。一旦使用智慧技术包装产品,这些系统就会提供有关产品品质和新鲜度的详细资讯。

主要亮点

- 智慧包装市场的成长受到快速都市化带来的消费者生活方式的改变以及个性化个人物品使用日益增多和先进综合技术创新的推动。该市场依赖尚未开发的地理区域,这些区域为竞争对手提供了巨大的商机。人们对健康和卫生的担忧日益加剧,尤其是在疫情之后,导致全球对永续包装的有机食品的需求增加。

- 根据杜拜工商会欧睿国际预测,2020年至2025年间,阿联酋包装主食的成长率最高,为4%。在印度、中国、泰国和印尼等新兴国家,有机包装食品市场近年来均录得正成长。因此,预计未来这些国家对智慧包装的需求将会增加。

- 根据 YouGov 于 2023 年 9 月针对印度消费者在永续食品上的支出进行的调查,38% 的受访者愿意为永续包装的食品和饮料支付比传统包装食品高出 10% 的费用。同时,只有4%的受访者表示愿意为采用永续包装的食品和饮料支付100%或更多的价格。

- 生态智慧包装的一个特点是在盒子外面印有二维码,该二维码连结到包含所有可用产品的快速入门指南 (QSG) 的网页。客户可以使用智慧型手机扫描包装盒上的二维码并查看相关主页上的 QSG,快速下载与新 LMI 产品对应的 PDF 版本。

- 智慧包装还提供了基于数位化的经济可能性并适应工业4.0。希悦尔推出包装品牌,提供一系列设计服务、数位印刷和智慧包装解决方案。 2023 年 10 月,数位科技工作室 Appetite 创新与包装公司 Tetra Pak 合作,为欧洲果汁製造商 Rauch 推出了互动式创新新包装。

- 然而,实施的高资本成本、安全问题、製造符合包装标准的感测器和指示器的新技术以及消费者意识是市场成长的一些主要限制和挑战。对于没有实现这些软体包功能所需基础设施的最终用户来说,建立支援基础设施意味着一笔额外的开支。为了最大限度地提高投资的效率和效果,现有的市场结构确保供应链中的每个环节都具有相同的技术水准。

智慧包装市场趋势

活性包装可望占据显着的市场占有率

- 主动包装技术建立在传统包装概念的基础上,为包装产品添加功能,并根据产品的保护功能和需求调整其作用方式,超越简单的容纳、保护和传输,以限制破坏性过程。在供应链需求增加时,主动包装为减少食物废弃物和损失提供了一种新方法。

- 公司正在利用智慧主动包装来在市场上区分他们的产品,提供增强用户体验和品牌认知的创新功能。例如,2024年1月,NPP完成对Active Packaging的收购。 Active Packaging 总部位于奥马,是一家拥有 21 年历史的公司,为爱尔兰各地的食品、园艺和工业部门提供各种软包装。透过此次收购,NPP 旨在利用两家公司的优势,为客户提供增强的、多样化的包装解决方案。

- 2024 年 1 月,软包装和材料科学公司 ProAnpack 宣布推出 ProActive Intelligence Moisture Protect (MP-1000),这是一项突破性的正在申请专利的吸湿技术,无需使用干燥剂包。 MP-1000 平台采用 Aptar 旗下 CSP Technologies 的 3-Phase Activ-Polymer 平台技术来降低包装顶部空间的水分含量,使其成为需要最佳水分控制的应用的理想选择,例如照护现场诊断试剂套件、活培养益生菌和吸湿性粉状食品产品。此次合作旨在透过 CSP 成熟的活性聚合物技术提供灵活、完全整合的多层薄膜解决方案,改变活性包装的交付方式并满足尚未满足的需求。此类技术创新将推动活性包装领域的成长。

- 对安全和追踪解决方案不断增长的需求正在推动这一领域的成长。例如,RFID标籤提供识别、控制和管理食品供应链的能力。它们比传统的条码标籤更先进、更可靠,并且能够有效地追溯食品。市面上有 RFID 标籤可用于监测产品温度、相对湿度、压力、pH 值和光照,有助于提高食品品质和安全。 2023 年 10 月,费森尤斯卡比 (Fresenius Kabi) 宣布推出用于在美国销售的单剂量 Diprivan(Propofol)注射乳剂(USP,每 20 毫升 200 毫克)管瓶的 +RFID 智慧标籤。 RFID 标籤与所有主要的美国RFID套件和托盘系统完全相容。

- 此外,美国製造公司 Zebra Technologies Corporation 报告称,到 2024 年,市场领先的包装製造商和最终用户将倾向于在其仓库营运中实现更全面的技术整合。根据斑马技术公司(Zebra Technologies)的《仓储愿景研究》报告,预计到2024年,对RFID、感测器和扩增实境等仓库管理技术的投资将分别从上一年的29%、29%和22%增至35%、35%和29%,这显示智慧包装的成长机会越来越大。

- 主动包装在工业领域越来越受欢迎,因为它可以延长产品寿命并维持品质标准。主动包装广泛应用于食品工业,以保存生鲜产品并防止变质。然而,将吸附剂等活性包装成分加入食品中所带来的成本增加可能会阻碍未来的市场成长。例如,2023年6月,透过利用FreshCase主动真空包装的优势,优化了成本效率。 FreshCase主动包装降低了成本并有效提高了盈利。为了解决加工商面临的成本上升问题,Amcor Limited 的创新解决方案增强了消费者吸引力并最大限度地提高了单位利润率。

预计北美市场将大幅成长

- 预计该地区将实现显着增长。美国消费者越来越寻求智慧包装所提供的技术型、增值功能,例如新鲜度指示器、互动式包装和产品认证。

- 食品安全是重中之重,尤其是在最近发生的食物中毒事件之后,推动了对智慧包装和可在整个供应链中提供即时监控和可追溯性的解决方案的需求。美国美国有4,800万人(六分之一)食物中毒,12.8万人因食物中毒住院,3,000人死于食物中毒。

- 受有利的监管条件、对永续性的日益关注以及各个终端用户行业(尤其是食品和医疗保健)对主动和智慧包装的需求不断增长的推动,美国智慧包装市场在过去几年中经历了显着增长。

- 根据美国粮食及农业组织统计,每年约有 1,330 亿磅(价值 1,610 亿美元)的食物被浪费。减少食物浪费的努力是多方面的,包括增加向食物银行的食物转移、教育和推广工作,以及标准化食品标籤上日期标记的努力。此外,透过智慧包装减少食物废弃物在美国正获得大力支持。

- 此外,食品业智慧包装的成长很大程度上得益于政府的倡议。智慧包装除了有助于减少食物废弃物和确保食品安全之外,还可以追踪食品的位置和状况。例如,美国国防部(DOD)和食品药物管理局(FDA)正在鼓励使用RFID技术进行供应链管理以及需要创新包装的产品的追踪和追溯。

- 感测器、RFID 标籤和 NFC(近距离场通讯)等技术进步使得创新包装更加普及且更具成本效益,加速了其在美国各行各业的应用。例如,2023年2月,UPS投资1.4亿美元在其位于美国剩余的940栋建筑中安装该技术。该计划包括在行李上贴上 RFID 标籤,并为员工配备可穿戴设备。此举旨在实现扫描自动化,最大限度地减少错误装载,并加快快递公司仓库内小包裹的处理速度。

- 为了在竞争激烈的市场中脱颖而出,各公司越来越多地采用智慧包装来提供创新功能,从而增强消费者体验和品牌认知。例如,2023年5月,专注于永续包装和解决方案的全球知名公司Amcor PLC宣布收购ModaSystems。 ModaSystems 以其先进的自动化蛋白质包装机而闻名,专注于为肉类、家禽和酪农行业开发和提供可客製化的关键真空包装系统。

智慧包装市场概览

智慧包装市场参与者之间的竞争态势适中,预计在预测期内将保持不变。市场的主要企业包括 Sealed Air Corporation、Amcor PLC、Ball Corporation、 BASF SE 和 Huhtamaki OYJ。市场上的公司正在采用伙伴关係、创新和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2024 年 1 月,NPP 收购了 Active Packaging Limited,后者是一家为爱尔兰食品、园艺和工业领域提供软包装的供应商。该策略联盟旨在结合两家公司的优势,为客户提供更广泛的包装解决方案。我们的重点是坚持品质、永续性和以客户为中心的通用价值观。透过此次收购,NPP 强调了其致力于保持包装行业领先地位并适应客户不断变化的需求的决心。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 主要宏观经济趋势的市场影响

第五章市场动态

- 市场驱动因素

- 用于品质检验的先进食品包装技术

- 提高食品安全意识

- 透过智慧包装的各种应用促进印刷产业的发展

- 市场限制

- 由于初始要求较高,成本较高

第六章市场区隔

- 依技术

- 活性包装

- 智慧包装

- 按行业

- 食物

- 饮料

- 卫生保健

- 个人护理

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- Sealed Air Corporation

- Amcor PLC

- Ball corporation

- BASF SE

- Huhtamaki OYJ

- Stora Enso

- Avery Dennison Corporation

- Zebra Technologies Corporation

- 3M Company

- International Paper Company

第八章投资分析

第九章:市场的未来

The Smart Packaging Market size is estimated at USD 24.28 billion in 2025, and is expected to reach USD 34.25 billion by 2030, at a CAGR of 7.12% during the forecast period (2025-2030).

Smart packaging refers to a specific type of sensor-equipped packaging system used for various items, including food and medication. The technology used in smart packaging helps increase product quality, shelf life, freshness monitoring, and customer and product safety. When products are packaged using intelligent technology, these systems provide details about the product's quality and freshness.

Key Highlights

- The smart packaging market's growth is driven by consumer lifestyle changes brought on by rapid urbanization and increased use of individualized personal items with advanced integrated innovation. The market depends on untapped geographic areas that offer enormous opportunities for competitors. Owing to increasing concern about health and hygiene, especially after the pandemic, the demand for sustainably packaged organic food has increased worldwide.

- According to the Dubai Chamber of Commerce and Industry Euromonitor, between 2020 and 2025, the growth rate of packaged staple food in the United Arab Emirates was the highest at 4%. In developing countries like India, China, Thailand, and Indonesia, the market for organic packaged food has recorded positive growth in the past few years. This is expected to lead to an increase in the demand for smart packaging in these countries in the future.

- According to a survey by YouGov in September 2023 about consumer spending on sustainable food products in India, 38% of the respondents were willing to pay 10% more for sustainably packaged food and drinks than conventionally packaged food products. On the other hand, 4% of respondents were willing to pay more than 100% for sustainably packaged food and beverages.

- Eco-smart packaging features a printed QR code on the outside of the box that connects to a webpage with all available product quick start guides (QSG). Customers can quickly download the PDF version corresponding to their new LMI product by scanning the QR code on the box with their smartphone and then perusing the QSGs on the associated homepage.

- Smart packaging also presents economic potential based on digitization, making it compatible with Industry 4.0. Sealed Air launched its digital packaging brand with a portfolio of design services, digital printing, and intelligent packaging solutions. Additionally, in October 2023, the digital technology studio Appetite Creative, in collaboration with packaging company Tetra Pak, launched a new interactive, innovative packaging for European fruit juice producer Rauch.

- However, the high cost of capital for installment, security issues, new techniques for fabricating such sensors and indicators compatible with packaging standards, and consumer awareness are vital restraints and challenges to the market's growth. Building a supporting infrastructure is an additional expense for end users who lack the infrastructure required to enable these package functionalities. To maximize the efficiency and efficacy of investments, every link in the supply chain has developed equivalent technological proficiency due to the existing market structure.

Smart Packaging Market Trends

Active Packaging is Expected to Hold a Significant Market Share

- Active packaging technology builds on the traditional concept of packaging by adding functionality to the packaged product, adapting its mode of action to the protective function and needs of the product, and going beyond mere containment, protection, and transmission to limit destructive processes. Active packaging offers a new approach to reducing food waste and loss during increased demand in the supply chain.

- Companies are leveraging smart active packaging to differentiate their products in the market, offering innovative features that enhance user experience and perception of their brand. For instance, in January 2024, NPP completed the acquisition of Active Packaging Limited. Active Packaging, based in Omagh, is a business with a 21-year history supplying various flexible packaging materials to the food, horticultural, and industrial sectors throughout Ireland. With this acquisition, NPP aimed to leverage the strengths of both entities to deliver enhanced and diversified packaging solutions to its customers.

- In January 2024, ProAmpac, a player in flexible packaging and material science, announced the launch of ProActive Intelligence Moisture Protect (MP-1000), a patent-pending breakthrough moisture-adsorbing technology that eliminates the need for desiccant packets. MP-1000 platforms use Aptar's CSP Technologies' 3-Phase Activ-Polymer platform technology to lower the moisture level in the packaging headspace, making it ideal for applications that require optimal moisture control, such as point-of-care diagnostic kits, live culture probiotics, and hygroscopic powdery food products. This collaboration aims to transform how active packaging is delivered and fulfill unmet needs by providing a fully integrated, multi-layer film solution that is flexible and powered by CSP's proven Activ-Polymer technology. Such innovations drive the growth of the active packaging segment.

- Increasing demand for security and tracking solutions drives the growth of the segment. For instance, RFID tags provide the ability to identify, control, and manage the food supply chain. These are more advanced, reliable, and efficient for food traceability than conventional barcode tags. RFID tags for monitoring the products' temperature, relative humidity, pressure, pH, and light exposure are available in the market, aiding in enhancing food quality and safety. In October 2023, Fresenius Kabi announced the introduction of +RFID smart labels for Diprivan (Propofol) Injectable Emulsion, USP, 200 mg per 20 ml in single-dose vials, sold in the United States. The +RFID labels are fully compatible with all significant US RFID kit and tray systems.

- Additionally, Zebra Technologies Corporation, a US manufacturing company, reported that, by 2024, the market-leading packaging manufacturers and end users will likely gravitate toward incorporating more comprehensive technology integrations in warehousing management. According to the Warehousing Vision Study report by Zebra Technologies, the investment in technologies in warehousing, including RFID, sensors, and augmented reality, is expected to increase from 29%, 29%, and 22%, respectively, in previous years to 35%, 35%, and 29% in 2024, showing the increasing growth opportunity of smart packaging.

- Active packaging is increasingly gaining popularity in the industrial sector because it enhances product longevity and maintains quality standards. The food industry extensively utilizes active packaging to preserve perishable items and prevent spoilage. However, the growing costs associated with incorporating active packaging components, such as sorbents, into food products may hinder market growth in the future. For instance, in June 2023, cost efficiency was optimized by leveraging the benefits of FreshCase active vacuum packaging. FreshCase active packaging reduces costs and boosts profitability effectively. In response to the escalating expenses faced by processors, Amcor Limited's innovative solution enhances consumer appeal and maximizes profit margins per unit.

North America is Expected to Witness a Significant Market Growth

- The region is expected to record significant growth. Consumers in the United States are increasingly demanding tech-savvy and value-added features such as freshness indicators, interactive packaging, and product authentication, which smart packaging provides.

- With food safety being a top priority, especially in light of recent foodborne illness outbreaks, there is a growing demand for smart packaging solutions that offer real-time monitoring and traceability throughout the supply chain. The US Centers for Disease Control and Prevention (CDC) estimated that every year in the United States, 48 million (or 1 in 6) people get sick from a foodborne illness, 128 thousand are hospitalized because of a foodborne illness, and 3,000 people die from a foodborne illness.

- Due to favorable regulatory conditions, a growing focus on sustainability, and the rising demand for active and intelligent packaging across various end-user industries, particularly food and healthcare, the smart packaging market in the United States has experienced substantial growth over the past few years.

- According to the Food and Agriculture Organization of the United States, an estimated 133 billion pounds of food, worth USD 161 billion, is wasted yearly. Efforts to reduce food waste are multifaceted, including increased diversion of food to food banks, education and outreach, and efforts to standardize date markings on food labels. Further, reducing food waste using smart packaging is gaining significant traction in the United States.

- Moreover, the growth of intelligent packaging in the food industry is significantly attributed to government efforts, as smart packaging can track the location and condition of food beyond reducing food waste or helping to ensure food safety. For instance, the US Department of Defense (DOD) and the Food and Drugs Association (FDA) have encouraged the use of RFID technology for supply chain management and the tracking and tracing of products requiring innovative packaging.

- Technological advancements, such as sensors, RFID tags, and NFC (Near Field Communication), have made innovative packaging more accessible and cost-effective, driving its adoption across various industries in the United States. For instance, in February 2023, UPS invested USD 140 million in an initiative as it implemented the technology at its 940 remaining US buildings. The initiative entails affixing RFID tags to packages and equipping employees with wearable devices. This move aims to automate scans, minimize misloads, and expedite parcel processing within the delivery company's warehouses.

- Companies are increasingly using smart packaging to differentiate their products in a competitive market, offering innovative features that enhance consumer experience and brand perception. For instance, in May 2023, Amcor PLC, a prominent global company specializing in sustainable packaging solutions, confirmed its acquisition of ModaSystems. ModaSystems, known for its advanced automated protein packaging machines, focuses on creating and servicing significant, customizable vacuum packaging systems tailored for the meat, poultry, and dairy sectors.

Smart Packaging Market Overview

The intensity of competitive rivalry in the smart packaging market is moderately high and is expected to remain the same during the forecast period. Some of the major players in the market are Sealed Air Corporation, Amcor PLC, Ball Corporation, BASF SE, and Huhtamaki OYJ. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2024: NPP acquired Active Packaging Limited, a supplier of flexible packaging materials to the food, horticultural, and industrial sectors throughout Ireland. This strategic move was designed to fuse the best of both companies, promising customers a broader spectrum of packaging solutions. The focus is on upholding shared values of quality, sustainability, and customer-centricity. Through this acquisition, NPP underscored its dedication to spearheading the packaging sector and adapting to its clientele's changing demands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advancement in Technology in Food Packaging for Quality Inspection

- 5.1.2 Rising Awareness Regarding Food Safety

- 5.1.3 Development in the Printing Industry Due to Various Applications of Smart Packaging

- 5.2 Market Restraints

- 5.2.1 High Costs Due to Initial Requirement

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Active Packaging

- 6.1.2 Intelligent Packaging

- 6.2 By End-user Vertical

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care

- 6.2.5 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sealed Air Corporation

- 7.1.2 Amcor PLC

- 7.1.3 Ball corporation

- 7.1.4 BASF SE

- 7.1.5 Huhtamaki OYJ

- 7.1.6 Stora Enso

- 7.1.7 Avery Dennison Corporation

- 7.1.8 Zebra Technologies Corporation

- 7.1.9 3M Company

- 7.1.10 International Paper Company