|

市场调查报告书

商品编码

1685856

北美保护性包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Protective Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

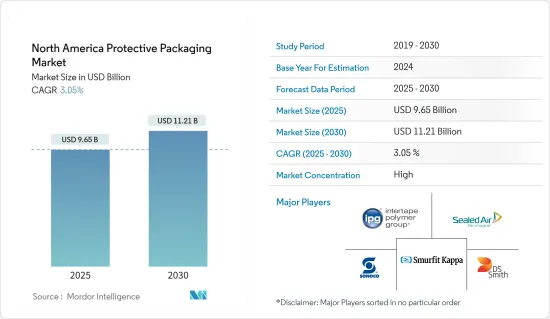

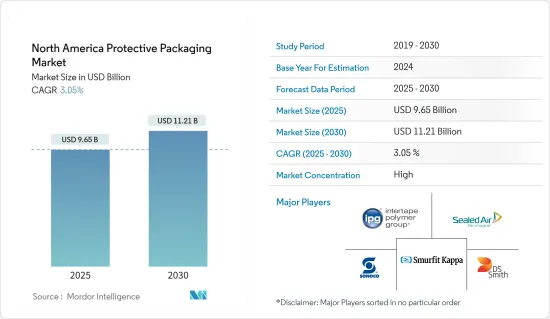

北美保护性包装市场规模预计在 2025 年为 96.5 亿美元,预计到 2030 年将达到 112.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.05%。

由于生物分解性塑胶的引入,北美对保护性包装的需求预计将会增加。生物分解性塑胶有助于减少全国的碳排放和塑胶污染。

主要亮点

- 保护性包装已成为最有效的包装技术之一,用于包装消费性电子产品、製药、汽车等各种最终用户产业,以保护和防止主力产品在运输和储存过程中受到损坏。

- 此外,随着北美地区电子商务的兴起,购买力预计将成为推动保护性包装需求的主要因素。消费者网上购物的趋势日益增长以及製造商直接销售的意愿正在加强产品供应的创新。此外,它还促使供应商对产品设计、包装、挑选、履约和运输做出改变。因此,产品保护被视为最终用户最关心的问题之一。

- 电子商务的快速成长、技术进步导致包装解决方案需求的客製化、各种包装选择的出现(例如使产品可见的透明材料、自黏膜、电视等消费性电子产品的边缘保护等)正在改变许多企业选择这些产品的方式。根据世界银行的资料,美国2021年的人均国内生产总值毛额(GDP)最新估计为69,288美元,比世界平均高出485%。人均收入的提高将提高人们的购买力,从而带来更多的网路销售和对保护性包装的更大需求。

- 此外,自动化包装解决方案也越来越受到人们的欢迎,因为它们可以减少劳动力和浪费,同时提高大批量包装过程的速度。市场发展也正在不断努力和增加投资,以开发可回收或再利用的环保、永续的保护包装材料。

- 塑胶产品生物分解性、环保的承诺让消费者感到困惑。塑胶製品最终所处的环境将极大地影响其分解的速度和程度。因此,加州和联邦政府加强了对环境标语的限制。加州法律对可分解塑胶产品的销售进行监管,包括那些声称可堆肥或生物分解性的产品。环境行销宣传必须有充分、可靠的科学事实支持,并符合指定的标准,以确保其不会在袋子、餐饮用具和包装等可分解塑胶产品对环境的影响方面误导消费者。

- 由于 COVID-19 疫情爆发,电子商务、製药和其他终端用户行业的需求增加,保护性包装市场正在经历显着增长。

北美保护性包装市场的趋势

电子商务趋势的兴起推动市场成长

- 由于电子零售中家电销售的快速成长,电子商务产业对保护性包装的需求将出现前所未有的成长。十年前,这个细分市场并不存在。然而,电子商务变化的步伐不断加快,催生了电子商务保护包装市场这一新兴领域。

- 过去十年来,电子商务已成为消费者流行的购买选择。网路普及率的提高、新兴经济体大多数人口网路存取的扩大、智慧型手机普及率的提高、技术的进步和快速的都市化正在为电子商务市场创造巨大的机会。

- 市场的快速成长主要受到时尚服装、家用电器和个人护理行业的推动。对消费电子产品、个人护理、时尚服饰等终端用户行业的大量投资为扩大包装机会(包括保护性包装)创造了空间。

- 电子商务在美国持续呈指数级增长,对传统零售业带来压力。此外,长期以来仅限于传统零售通路的消费包装商品销售,如今在网路上呈现爆炸性成长,在许多情况下,年成长率超过 50%。此外,根据美国人口普查局的数据,2021 年第四季零售电子商务销售额为 2,441.44 亿美元。

- 此外,对于网路购物的包装而言,愉快的拆包体验(消费者可以接收、打开并接触一次包装和二次包装)也是帮助推动消费者参与度并最终提高品牌忠诚度的关键因素。保护性包装允许电子商务参与者以一种方式包装他们的产品,使消费者可以享受开箱体验而不会损坏产品。

美国占有很大的市场占有率

- 该地区的消费性电子产品领域需求庞大。据消费科技协会称,美国消费电子产业预计将年增与前一年同期比较%。随着家用电器需求的不断增加,预测期内对保护性包装的需求可能会增加。

- 耐久财是消费者长期(通常是多年)使用的物品。因此,包装对于确保这些产品以原始形式到达消费者手中极为重要。此类产品在运送过程中经常面临处理不当的风险。它们也容易受到压力和振动的影响。因此,包装可能很困难,并且经常使用保护性包装。

- 根据美国人口普查局的数据,2021年耐用消费品出口总额为2,9229.8亿美元,较前一年的2,6271.6亿美元成长11.26%。耐用消费品出口的激增可能会促进该国保护性包装的消费。该地区的供应商正在创新,提供一系列保护性包装产品。此外,该地区正在出现新的伙伴关係和併购活动,以应对市场出现的新挑战并推动成长。

- 例如,2021 年 10 月,Altor Solutions 以 5,600 万美元收购了保护性包装公司 Plymouth Foam。 Plymouth Foam 提供客自订保护包装、低温运输包装和由发泡聚苯乙烯和聚丙烯製成的内部组件。此次合作使 Altor 能够接触到美国各个终端市场的广泛客户,包括食品和饮料、製药、休閒车和建筑。

- 但随着供应担忧加剧,亚马逊等供应商开始囤积纸板以满足需求,导緻小型企业供不应求。根据生产者物价指数和美国劳工统计局的数据,2021 年 2 月瓦楞纸箱价格创下新高。 2021 年 7 月,美国最大的箱板纸和瓦楞包装供应商之一国际纸业公司警告投资者,瓦楞纸箱的供应量“非常低”,供应链瓶颈将持续到今年年底。

- 2022年1月,总部位于俄亥俄州的工业包装产品和服务供应商Greif Inc.宣布所有等级的未涂布再生纸板(URB)价格每吨上涨50美元,所有晶片和保护性包装产品价格至少上涨6.0%。该公司表示,保护性包装产品的价格上涨将适用于2022年3月后的出货。

北美保护性包装产业概况

北美保护性包装市场较为集中,由少数几家占据市场很大收益占有率并提供产品和解决方案的公司组成。市场上的供应商正专注于产品创新和併购、伙伴关係等策略措施来获得市场占有率。市场的最新趋势包括:

- 2022年3月8日,Clearlake Capital Group, LP宣布收购Intertape Polymer Group Inc.。 2022年5月11日,IPG股东核准了此次收购。根据协议条款,Clearlake 将以每股 40.50 加币的价格收购 IPG 全部已发行普通股。交易完成后,IPG 已成为一家私人公司,其普通股不再在证券交易所上市。

- 2021 年 10 月 - Smurfit Kappa 为快速成长的电子健康和美容市场推出一系列圆形保护包装解决方案。我们可客製化的电子健康和美容产品组合包括永续的纸质包装解决方案,非常适合运输香水、化妆品、护肤和护髮产品等易碎产品,以及专为维生素、补充剂和运动营养设计的防篡改包装解决方案。

- 2021 年 8 月-Huhtamaki 签署协议,以 4.21 亿欧元收购领先的软包装供应商 Elif。透过此次收购,Huhtamaki 旨在巩固其在新兴市场的主要企业,加强其在消费品类别中现有的柔性保护包装业务,并推动其永续发展目标。 Elif 也提供工业保护包装膜。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对电子商务产品的需求不断增加

- 柔性保护包装产品的需求

- 市场挑战

- 关于可降解性的严格规定

第六章市场区隔

- 产品类型

- 难的

- 纸板保护器

- 纸浆模塑

- 隔热运输货柜

- 灵活的

- 保护性邮件

- 气泡膜

- 空气枕/气囊

- 纸张填充

- 其他柔性产品

- 形式

- 发泡成型

- 现场成型(FIP)

- 鬆散填充

- 发泡捲/片

- 其他发泡製品

- 难的

- 按行业

- 食品和饮料

- 工业的

- 製药

- 家电

- 美容及居家护理

- 其他最终用户产业

- 地区

- 美国

- 加拿大

第七章竞争格局

- 公司简介

- Intertape Polymer Group Inc.

- Pregis LLC

- Riverside Paper Co.

- Sealed Air Corporation

- Sonoco Products Company

- Smurfit Kappa Group

- DS Smith PLC

- International Paper Company

- Pro-pac Packaging Limited

第八章投资分析

第九章:市场的未来

The North America Protective Packaging Market size is estimated at USD 9.65 billion in 2025, and is expected to reach USD 11.21 billion by 2030, at a CAGR of 3.05% during the forecast period (2025-2030).

The demand for protective packaging in North America is predicted to rise due to the introduction of biodegradable plastics. It aids in lowering carbon emissions and plastic pollution nationwide.

Key Highlights

- Protective packaging emerged as one of the most effective packaging techniques used for packaging in various end-user industries, such as consumer electronics, pharmaceutical, and automotive, that safeguard and shield core products from damage during transportation or storage.

- Further, with the rise in e-commerce in the North American region, purchases are the key factor expected to boost the demand for protective packaging. The increasing trend of online purchasing by consumers and the readiness of manufacturers for direct sales augment the innovation in product offerings. Moreover, it drives the vendors for changes in product design, packaging, picking, fulfillment, and shipping. As a result, product protection is considered one of the most important issues among end users.

- The exponential growth of e-commerce, technological advancements resulting in customized packaging solution needs, and the availability of different packaging options, such as transparency of materials to allow product visibility, adhesive films, and edge protection of consumer electronics items like TVs, are primarily changing the way most companies choose these products. The US Gross Domestic Product (GDP) per capita was last estimated at USD 69288 in 2021, according to data from the World Bank. American GDP per capita is 485 percent more than the global average. The significant per capita income in the nation increases the purchasing power of the citizens and may cause an increase in online sales, which will raise the need for protective packaging.

- Moreover, automated packaging solutions are also witnessing increasing adoption, as they reduce labor and waste while increasing processing speeds for high-volume packaging. Also, the market is witnessing constant efforts and increased investments to develop eco-friendly and sustainable protective packaging materials, which can be recycled and reused.

- Consumer confusion has arisen due to promises that plastic products are biodegradable and environment-friendly. The end-of-life conditions to which plastic items are exposed significantly impact the rate and extent of degradation. As a result, California and the federal government have tightened environmental marketing claims rules. California's laws regulate selling degradable plastic products, including those claimed to be compostable or biodegradable. Environmental marketing claims must be supported by competent and credible scientific facts and adhere to predetermined standards to avoid misleading consumers about the environmental impact of degradable plastic products, such as bags, food service ware, and packaging.

- With the outbreak of COVID-19, the market for protective packaging is witnessing significant growth owing to a rise in demand from e-commerce, pharmaceutical, and other end-user industries.

North America Protective Packaging Market Trends

Increasing Trend of E-commerce to Augment the Market Growth

- The demand for protective packaging in the e-commerce industry is set to witness unprecedented growth due to rapid strides in the sales of consumer electronics in e-retailing. This market segment was non-existent a decade ago. However, the pace of change in e-commerce has picked up and given rise to this fledgling segment in the e-commerce protective packaging market.

- E-commerce has become a superior choice for consumers to purchase goods during the last decade. The rising internet penetration, growing access to the internet across most of the population in developing economies, increasing smartphone penetration, increasing technology, and rapid urbanization have created a massive opportunity for the e-commerce market.

- The market's rapid growth is primarily driven by fashion and apparel, consumer electronics, and personal care industries. Considerable investments in the consumer electronics, personal care, and fashion and clothing end-user industries are creating scope for expansion of packaging opportunities such as protective packaging.

- In the United States, e-commerce continues to grow dramatically, putting pressure on traditional retail. Also, sales of consumer-packaged goods, long confined to conventional retail channels, are exploding online, with growth rates, in many cases, more than 50% Y-o-Y. Also, the Q4 2021 retail e-commerce sales accounted for USD 244.144 billion, according to the US Census Bureau.

- Moreover, when it comes to packaging for online shopping, an enjoyable unboxing experience, where the consumers experience receiving, opening, and engaging with primary and secondary packaging, is also a major factor that can help drive consumer engagement, ultimately driving brand loyalty. Protective packaging allows e-commerce players to package their products where the unboxing experience for consumers remains good without any product damage.

The United States Holds a Significant Market Share

- The region is witnessing significant demand from the consumer electronics segment. According to the Consumer Technology Association, the consumer electronics industry in the United States is expected to grow by 4.3% Y-o-Y. With the increasing demand for consumer electronics, the need for protective packaging will likely increase during the forecast period.

- Consumer durables are items that consumers use for an extended period, usually for years. Hence packing is crucial to ensuring that these products get to the consumer in pristine condition. Such products frequently carry the risk of being handled improperly while being transported. These are also susceptible to stress and vibration. As a result, packaging becomes difficult, and protective packaging is often used.

- According to the United States Census Bureau, exports of durable goods totaled USD 2922.98 billion in 2021, up 11.26% over the previous year's value of shipments of USD 2627.16 billion. The country's consumption of protective packaging may increase due to the sharp growth in exports of durable goods. Regional vendors are innovating and offering various protective packaging products in the region. Moreover, the area has been witnessing new partnerships and merger and acquisition activities to address new challenges emerging in the market and drive growth.

- For instance, in October 2021, Altor Solutions acquired the protective packaging firm Plymouth Foam for USD 56 million. Plymouth Foam offers custom protective packaging, cold chain packaging, and internal components made from expanded polystyrene and polypropylene. The partnership enables Altor to access a range of clients across different end markets in the United States, including food and beverage, pharmaceuticals, recreational vehicles, and construction.

- However, as supply concerns mounted, merchants like Amazon began storing cardboard to fulfill demand, leaving smaller firms without supplies. According to the Producer Price Index and the US Bureau of Labor Statistics, the price of cardboard hit a new high in February 2021. In July 2021, International Paper, one of the country's top suppliers of containerboard and corrugated cardboard, warned investors that the supply of cardboard boxes was "very low," with supply chain bottlenecks continuing into the rest of the year.

- In January 2022, Ohio-based Greif Inc., industrial packaging products and service provider, announced that it is implementing a USD 50 per ton price increase for all grades of uncoated recycled paperboard (URB) and a minimum 6.0% increase on all tube and core and protective packaging products. The company stated that an increase in protective packaging products would be effective with shipments on and after March 2022.

North America Protective Packaging Industry Overview

The North American protective packaging market is consolidated and consists of a few players generating significant revenue share in the market and providing the products and solutions. Vendors in the market focus on product innovations and strategic initiatives such as mergers and acquisitions and partnerships to capture the market share. Some of the recent developments in the market are:

- June 2022 - The acquisition of Intertape Polymer Group Inc. was announced by Clearlake Capital Group, L.P. The purchase was disclosed on March 8, 2022. On May 11, 2022, IPG shareholders approved the deal. Following the contract terms, Clearlake acquired the outstanding shares of IPG common stock for CDN 40.50 each. IPG is now a privately held business due to the deal, and its common stock is no longer listed on the stock exchange.

- October 2021 - Smurfit Kappa launched various circular protection packaging solutions for the fast-growing e-health and beauty market. The customizable eHealth and Beauty portfolio includes sustainable paper-based packaging solutions ideal for shipping fragile products such as fragrances, cosmetics, skincare, and hair care products and tamper-proof packaging solutions designed for vitamins, supplements, and sports nutrition.

- August 2021 - Huhtamaki signed an agreement to acquire Elif, a leading supplier of flexible packaging, for EUR 421 million. With this acquisition, Hutamaki hopes to strengthen its position as a leading flexible packaging company in emerging markets and strengthen its existing flexible protective packaging business in the consumer goods category while advancing its sustainability goals. Elif also offers industrial protective packaging films.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for E-commerce-based Products

- 5.1.2 Demand for Flexible Protective Packaging Products

- 5.2 Market Challenges

- 5.2.1 Stringent Regulations Related to Degradability

6 MARKET SEGMENTATION

- 6.1 Product Type

- 6.1.1 Rigid

- 6.1.1.1 Corrugated Paperboard Protectors

- 6.1.1.2 Molded Pulp

- 6.1.1.3 Insulated Shipping Containers

- 6.1.2 Flexible

- 6.1.2.1 Protective Mailers

- 6.1.2.2 Bubble Wraps

- 6.1.2.3 Air Pillows/Air Bags

- 6.1.2.4 Paper Fill

- 6.1.2.5 Other Flexible Products

- 6.1.3 Foam

- 6.1.3.1 Molded Foam

- 6.1.3.2 Foam in Place (FIP)

- 6.1.3.3 Loose Fill

- 6.1.3.4 Foam Rolls/Sheets

- 6.1.3.5 Other Foam Products

- 6.1.1 Rigid

- 6.2 End-user Vertical

- 6.2.1 Food and Beverage

- 6.2.2 Industrial

- 6.2.3 Pharmaceuticals

- 6.2.4 Consumer Electronics

- 6.2.5 Beauty and Home Care

- 6.2.6 Other End-user Verticals

- 6.3 Geography

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intertape Polymer Group Inc.

- 7.1.2 Pregis LLC

- 7.1.3 Riverside Paper Co.

- 7.1.4 Sealed Air Corporation

- 7.1.5 Sonoco Products Company

- 7.1.6 Smurfit Kappa Group

- 7.1.7 DS Smith PLC

- 7.1.8 International Paper Company

- 7.1.9 Pro-pac Packaging Limited