|

市场调查报告书

商品编码

1685939

北美饲料酸味剂:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Feed Acidifiers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

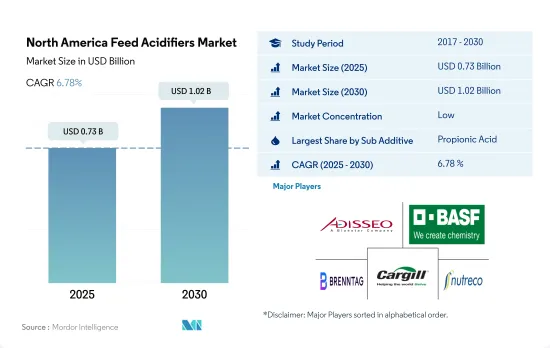

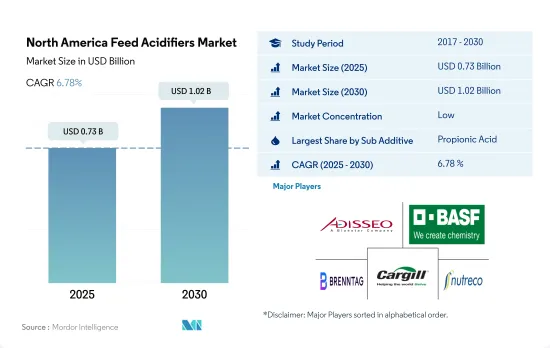

北美饲料酸味剂市场规模预计在 2025 年为 7.3 亿美元,预计到 2030 年将达到 10.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.78%。

- 饲料酸味剂对于促进动物生长、增强新陈代谢、抵抗有害病原体并减少对抗生素的依赖具有重要意义。预计到 2022 年,北美饲料酸味剂市场将占饲料添加剂总市场的 7.1%,2019 年将较 2018 年成长 18.8%。这一高份额归因于饲料产量增加导致益生菌类型的市场价值增加。

- 美国将主导北美饲料酸味剂市场,到 2022 年将占 70%,这主要归因于该国饲料产量的增加以及肉类和乳製品市场不断增长的需求。在所有饲料酸味剂中,丙酸是使用最多的,2022 年的价值接近 2 亿美元,其次是富马酸和乳酸,分别占市场的 25% 和 22.8%。

- 由于对反刍动物产品的需求量很大,反刍动物将在饲料丙酸领域占据最大份额,到 2022 年将达到 38.8%。美国是饲料酸味剂市场成长最快的国家,预计在预测期内的复合年增长率为 7%。预计未来几年,肉类(尤其是鸡肉和猪肉)需求的增加、乳製品需求的增加以及水产养殖业的扩张将推动该国饲料酸味剂市场的发展。

- 对肉类和水产品的需求不断增长以及对饲料添加剂对动物生产力益处的认识不断提高是北美饲料酸味剂市场(尤其是在美国)发展的主要驱动力。

- 北美饲料酸味剂市场近年来稳定成长,预计2022年将占全球市场的7.1%,市场规模达6.5亿美元。由于对肉类和肉类的需求不断增加,酸味剂在动物饲料中的使用范围不断扩大,导致2019年的市场规模较2018年增长了18.7%。

- 在所有动物种类中,反刍动物是饲料酸味剂的最大使用者,2022 年该部分的市值为 2.3 亿美元。这一趋势主要是由于乳製品产业的高需求。家禽业紧随其后,2022 年的市场占有率为 35.4%。然而,由于益生菌对动物健康的正面影响,猪业正在成为成长最快的行业,预计在预测期内的复合年增长率将达到 6.7%。

- 美国是北美最大的饲料酸味剂市场,占2022年总市场占有率的70%。它也是北美饲料酸味剂市场成长最快的国家,预计在预测期内复合年增长率为7%。

- 在酸化剂类型中,丙酸、富马酸和乳酸是北美最常用的,分别占该地区市场以金额为准的 37.1%、25.1% 和 22.7%。这些酸味剂的流行与它们在多种动物中的益处和应用密切相关,即提高饲料的偏好和增加饲料摄入量。

- 据估计,肉类和肉类产品需求的不断增加、人均肉品消费量和牲畜数量的增加将推动北美饲料酸味剂市场在预测期内以 6.7% 的复合年增长率增长。

北美饲料酸味剂市场趋势

禽肉消费量高于红肉,而且美国是世界上最大的鸡蛋和禽肉生产国,这推动了禽肉生产的需求。

- 北美家禽业在过去几年经历了强劲增长,2017 年至 2022 年家禽数量将增加 5.0%。这种增长很大程度上是由于对鸡肉和其他鸡肉产品的需求不断增加。美国是世界上最大的鸡肉生产国和第二大出口国,并且作为最大的鸡蛋生产国,主导北美鸡肉产业。到2022年,美国将占该地区鸡肉总产量的62.0%。该行业的高利润率正在吸引新的鸡肉生产商,从而导致该地区生产商数量的增加。例如,加拿大的鸡蛋生产商数量将从2016年的1,062家增加到2021年的1,205家。

- 家禽,尤其是肉鸡,产量很大,因为它比其他牲畜更快成熟并达到市场重量。家禽(包括肉鸡)可以在狭小的空间内饲养,这使得生产者可以在包括小块土地在内的各种环境中饲养家禽。这些优点使得家禽养殖更加可行。 2022年墨西哥鸡肉产量与前一年同期比较去年同期成长12%。

- 家禽消费量远消费量牛肉和猪肉。由于食用红肉的健康风险越来越大,越来越多的人选择鸡肉作为更精简、更健康的蛋白质来源。预计这一趋势将持续下去并推动该地区家禽业的成长。预计预测期内国内外市场对鸡肉产品的需求不断增加以及鸡肉产量不断上升将进一步推动市场成长。

零售贸易的扩大和对高品质水产品的需求正在增加对富含大量和微量营养素的水产养殖饲料的需求。

- 北美水产养殖饲料产量占全球产量的比例很小,到2022年仅3.8%。然而,对多样化水产品的需求正在推动当地水产养殖生产。 2017年至2022年饲料产量将成长9.2%。为满足日益增长的营养均衡饲料需求,该地区的饲料製造商计划将产量从2022年的220万吨增加到2029年的260万吨。为水产养殖物种提供的配方饲料含有集约化养殖条件下健康生长所需的大量和微量营养素,从而促进了该地区对水产饲料的需求增长。

- 鱼类是饲料产量最突出的物种,占2022年饲料产量的73.2%。人们对鱼类在人类饮食中的健康益处的认识不断提高、食品消费模式的改变、零售业的扩张以及国际市场的高需求,都促进了该地区鱼类产量的增长。由于生产商专注于营养管理以确保动物健康和性能,鱼饲料产量预计将从 2022 年的 160 万吨增加到 2029 年的 190 万吨。

- 2020 年,加拿大水产养殖生产商在饲料上的支出为 3.938 亿美元,比 2016 年增加 6.6%,显示对高品质海鲜的需求增加。总体而言,对多样化水产品日益增长的需求以及对养殖物种营养均衡饲料的需求预计将在未来几年推动北美水产养殖饲料产量的成长。

北美饲料酸味剂产业概况

北美饲料酸味剂市场分散,前五大公司占25.96%的市占率。该市场的主要企业有:安迪苏、BASFSE、Brenntag SE、嘉吉公司和 SHV(Nutreco NV)(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 动物数量

- 家禽

- 反刍动物

- 猪

- 饲料生产

- 水产养殖

- 家禽

- 反刍动物

- 养猪业

- 法律规范

- 加拿大

- 墨西哥

- 美国

- 价值炼和通路分析

第五章市场区隔

- 副添加剂

- 富马酸

- 乳酸

- 丙酸

- 其他酸味剂

- 动物

- 水产养殖

- 按亚动物

- 鱼

- 虾

- 鱼

- 其他养殖物种

- 家禽

- 按亚动物

- 肉鸡

- 图层

- 其他鸟类

- 反刍动物

- 小动物

- 肉牛

- 乳牛

- 其他反刍动物

- 猪

- 其他动物

- 水产养殖

- 国家

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介.

- Adisseo

- Alltech, Inc.

- BASF SE

- Bio Agri Mix

- Brenntag SE

- Cargill Inc.

- EW Nutrition

- Kemin Industries

- SHV(Nutreco NV)

- Yara International ASA

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 全球市场规模和DRO

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 49634

The North America Feed Acidifiers Market size is estimated at 0.73 billion USD in 2025, and is expected to reach 1.02 billion USD by 2030, growing at a CAGR of 6.78% during the forecast period (2025-2030).

- Feed acidifiers are important in promoting animal growth, increasing metabolism, and providing resistance to harmful pathogens while reducing dependence on antibiotics. The North American feed acidifiers market accounted for 7.1% of the total feed additives market in 2022, an 18.8% increase in 2019 compared to 2018. This high share was attributed to the increased market value of probiotic types due to increased feed production.

- The United States dominated the North American feed acidifiers market, accounting for 70% in 2022, mainly due to higher feed production and demand from the country's growing meat and dairy product markets. Among all feed acidifiers, propionic acid was most significantly used, valued at almost USD 0.2 billion in 2022, followed by fumaric acid and lactic acid, accounting for 25% and 22.8% of the market, respectively.

- Ruminants held the largest share of the feed propionic acid segment, accounting for 38.8% in 2022 due to the high demand for ruminant products. The United States is the fastest-growing country in the feed acidifiers market, with a projected CAGR of 7% during the forecast period. The increasing demand for meat, especially poultry and pork, the rising demand for dairy products, and the growing aquaculture cultivation are expected to drive the country's feed acidifiers market in the coming years.

- The rising demand for meat and seafood and increasing awareness about the benefits of feed additives in animal productivity are the major drivers of the North American feed acidifiers market, especially in the United States.

- The North American feed acidifiers market has grown steadily in recent years, and in 2022, it accounted for 7.1% of the global market, with a value of USD 0.65 billion. The use of acidifiers in animal feed has expanded due to the rising demand for meat and meat products, which resulted in an 18.7% increase in the market's value in 2019 compared to 2018.

- Among all animal types, ruminants are the biggest users of feed acidifiers, and the segment accounted for a market value of USD 0.23 billion in 2022. This trend was mainly due to the high demand from dairy industries. The poultry segment followed closely behind, with a market share of 35.4% in 2022. However, swine is emerging as the fastest-growing segment, expected to record a CAGR of 6.7% during the forecast period due to the positive impact of probiotics on animal health.

- The United States is the largest feed acidifiers market in North America, accounting for 70% of the total market share in 2022. It is also the fastest-growing country in the North American feed acidifiers market, expected to witness a CAGR of 7% during the forecast period.

- Among acidifier types, propionic acid, fumaric acid, and lactic acid are the most commonly used in North America, accounting for 37.1%, 25.1%, and 22.7%, respectively, of the total regional market by value. The popularity of these acidifiers is closely linked to their benefits and application in different animals for enhancing feed intake by increasing the palatability of feed.

- The increase in demand for meat and meat products and the rising per capita meat consumption and livestock population are estimated to drive the North American feed acidifiers market with a CAGR of 6.7% during the forecast period.

North America Feed Acidifiers Market Trends

Higher consumption of poultry meat than red meat and the United States is globally largest producer of eggs and poultry meat is driving the demand for poultry production

- The North American poultry industry has experienced significant growth over the past few years, with the poultry headcount increasing by 5.0% from 2017 to 2022. This growth is largely due to the increasing demand for poultry meat and other poultry products. The United States dominates the North American poultry industry as the world's largest producer and second-largest exporter of poultry meat and a major egg producer. The United States accounted for 62.0% of the region's total poultry production in 2022. The high-profit margin in the industry is attracting new poultry producers, leading to an increase in the number of producers in the region. For example, Canada's number of egg producers increased from 1,062 in 2016 to 1,205 in 2021.

- Poultry birds, especially broiler meat, are produced in large quantities due to their quick maturity and market weight, which is faster than other livestock. Poultry birds, including broilers, can be raised in small spaces, making it possible for producers to raise poultry in a variety of environments, including small plots of land. These advantages make poultry production more feasible. Mexican poultry production increased by 12% in 2022 from the previous year.

- Poultry meat consumption is significantly higher than that of beef or pork. More people are choosing poultry as a leaner, healthier source of protein due to the rising health risks linked to eating red meat. This trend is expected to continue, driving the growth of the region's poultry industry. The increasing demand for poultry products from both domestic and international markets and rising poultry production are expected to further drive the growth of the market during the forecast period.

Expansion of retail industry, and demand for high-quality seafood is increasing the demand for macro-nutrients and micro-nutrients rich aquaculture feed

- Aquaculture feed production in North America accounted for a small fraction of global production, representing only 3.8% in 2022. However, the demand for diverse seafood products is driving local aquaculture production. Feed production grew by 9.2% between 2017 and 2022. In response to the increasing demand for nutritionally balanced feed, feed millers in the region plan to increase production from 2.2 million metric tons in 2022 to 2.6 million metric tons in 2029. The compound feed offered to aquaculture species contains the macro and micronutrients needed for healthy growth under intensive rearing conditions, thus contributing to the increased demand for aquaculture feed in the region.

- Fish, which accounted for 73.2% of feed production in 2022, is the most prominent species in terms of feed production. The rising awareness of the health benefits of fish in the human diet, changing food consumption patterns, the expanding retail sector, and high demand in the international market are contributing to the growth of fish production in the region. Fish feed production is expected to increase from 1.6 million metric tons in 2022 to 1.9 million metric tons in 2029 as producers focus on nutritional management to ensure the health and performance of their animals.

- Canada's aquaculture producers spent USD 393.8 million on feed in 2020, a 6.6% increase from 2016, demonstrating the increasing demand for high-quality aquatic food. Overall, the increasing demand for diverse seafood products and the need for nutritionally balanced feed for aquaculture species are expected to drive the growth of aquaculture feed production in North America in the coming years.

North America Feed Acidifiers Industry Overview

The North America Feed Acidifiers Market is fragmented, with the top five companies occupying 25.96%. The major players in this market are Adisseo, BASF SE, Brenntag SE, Cargill Inc. and SHV (Nutreco NV) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Fumaric Acid

- 5.1.2 Lactic Acid

- 5.1.3 Propionic Acid

- 5.1.4 Other Acidifiers

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 fish

- 5.2.1.1.4 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Alltech, Inc.

- 6.4.3 BASF SE

- 6.4.4 Bio Agri Mix

- 6.4.5 Brenntag SE

- 6.4.6 Cargill Inc.

- 6.4.7 EW Nutrition

- 6.4.8 Kemin Industries

- 6.4.9 SHV (Nutreco NV)

- 6.4.10 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219