|

市场调查报告书

商品编码

1686193

拉丁美洲数位电子看板:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Latin America Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

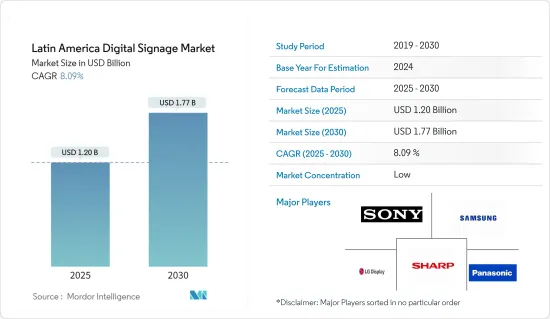

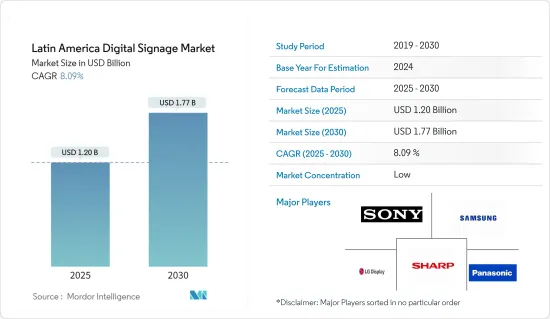

拉丁美洲的数位电子看板市场规模预计在 2025 年为 12 亿美元,预计到 2030 年将达到 17.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.09%。

主要亮点

- 数位数位电子看板使该地区的供应商能够更快地更改显示和讯息,以经济高效的方式向潜在客户提供内容。比传统广告更易于管理。数位电子看板提供即时产品和库存资讯、互动式资料以及视觉上吸引人的照片和影片。

- 拉丁美洲在数位广告方面的支出增加预计将为数位电子看板位看板市场的成长创造巨大机会。数位户外指示牌是视听市场的一部分,该市场在过去十年中稳步增长,并且这种增长速度仍在加速。数位户外指示牌几乎应用于所有行业,包括餐厅、饭店、零售店、交通和娱乐活动。

- 该地区为解决方案提供者提供了有利可图的发展和成长机会,从而吸引了越来越多的全球公司。例如,2023 年 11 月,Navori Labs 为沃尔玛墨西哥和中美洲的全通路零售媒体业务 Walmart Connect 部署了整合数位电子看板软体和基于人工智慧的摄影机分析解决方案。目前,墨西哥全部 173 家沃尔玛购物购物中心和 200 家山姆会员商店中的 180 家已采用该解决方案,剩余 20 家也将陆续采用。

- 希望解决方案提供者加强合作,为客户提供创新解决方案。例如,支持数位看板产业的独立非营利贸易协会数位看板数位电子看板(DSF)数位电子看板,DSMX 已成为 DSF 的附属机构,称为拉丁美洲数位指示牌协会(DS Latin America)。这位新同事将帮助DSF在全球开发领先业界的教育、标准和最佳实践。

- 拉丁美洲正在进行的数位转型是主要驱动因素。互联网连接的不断增强以及物联网、人工智慧和巨量资料等技术的采用正在推动对数位电子看板解决方案的需求。这种数位化转变使企业能够利用先进的显示技术和互动功能有效地吸引客户。

- 此外,OLED、microLED 和互动式触控萤幕等显示技术的创新使数位电子看板更具吸引力和功能性。这些技术提供了更高品质的显示和新的互动功能,将吸引那些希望更有效地吸引消费者註意力的企业。例如,2024 年 5 月,全球显示器技术创新者 LG Display 在该地区推出了其下一代 OLED 和许多尖端显示技术。

- 当最终用户尝试开发和部署自己的基础设施时,数位指示牌可能会令人困惑。这是一项复杂的任务,需要许多不同领域的专业知识,包括 IT、视听、软体、机械和显示技术。要利用增值零售商提供的完整解决方案,需要技术简便性和通讯协定标准化。这不仅简化了安装,而且简化了升级并减少了维护。互通性是市场关注的另一个重大议题。

- 疫情过后,随着新技术的出现和数位内容的日益流行,企业正在寻找新方法来吸引客户。过去两年来,曾经透过印刷标牌和麵对面会议进行沟通的企业变得更加依赖数位通信,预计这一趋势将会持续下去。随着企业削减列印量并减少产能限制,数位电子看板预计将在后疫情时代的拉丁美洲发挥重要作用。

拉丁美洲数位电子看板市场趋势

LCD/LED显示器可望推动市场成长

- LED 和 LCD 是该地区数位电子看板需求的主要驱动力。这些显示器提供出色的影像质量,包括高解析度、明亮的色彩和Sharp Corporation的对比度。数位数位电子看板凭藉其增强的视觉吸引力,能够有效地吸引零售环境、企业环境和公共场所的注意力并吸引观众。其显示高解析度内容的能力将吸引寻求强烈视觉衝击力的企业。

- LCD 和 LED 技术的不断进步,包括更高的解析度(4K 和 8K)、触控萤幕功能以及与互动性的集成,使得数指示牌更具吸引力和功能性。这些技术改进使得内容更具创新和互动性,提高了用户参与度并提供更好的客户体验。

- 例如,2023年5月,LG电子向秘鲁交付了一座超大型LED户外广告塔。此广告看板拥有 140 个面板,可呈现逼真的3D变形内容。

- 拉丁美洲的快速都市化和经济发展为数数位电子看板创造了新的机会。随着城市的发展和新的商业空间的开发,对现代有效的通讯工具的需求也随之增加。数数位电子看板采用先进的 LED 和 LCD 显示器,透过提供动态、视觉吸引力强的解决方案来满足这一需求。 2023年,全球都市化将达57%。拉丁美洲、加勒比海地区和北美洲是都市化最高的地区,超过五分之四的人口居住在都市区。

- 越来越多的企业正在整合线上和线下行销策略。透过 LED 和 LCD,数指示牌使企业能够将其网路广告宣传延伸到现实世界,创造无缝的品牌体验。这种融合推动了对具有与线上广告相同视觉衝击力的高品质显示器的需求。根据Zenith预测,2023年拉丁美洲网路广告支出将达132.9亿美元,与前一年同期比较增加12.03%。预计到 2024 年,这一数字将达到 145 亿美元以上。这将使其成为拉丁美洲第二大广告媒体,占该地区广告总支出的三分之一。

巴西占有最大市场占有率

- 巴西生活的许多方面,包括公共和私营部门,都日益拥抱数位化。智慧城市的发展是主要的成长动力,数位电子看板将在提供即时资讯和互动式服务方面发挥关键作用。这包括公共交通系统、交通管理和公共资讯显示的应用。

- 2023年8月,韩国首尔市政府和世界永续智慧城市组织(WeGO)基金会选出三个巴西计划作为首届首尔智慧城市奖的准决赛入围者。该奖项鼓励利用资讯通信技术关怀弱势群体的包容性创新城市模式的创新。该奖项强化了我们的信念:智慧城市不仅应以技术为基础,也应以人为基础。该奖项设有两个类别:科技创新城市和以人为本城市。此类创新城市措施的兴起预计将推动国内数位电子看板市场的发展。

- 此外,三星、LG等大公司以及本土公司也积极投资巴西市场,提供先进的数位指示牌解决方案。此外,互动式显示器和行动技术整合等创新也在推动市场成长。这些公司不断致力于使数指示牌更具成本效益且更易于部署,从而促进其在各行各业的广泛应用。

- 2024年1月,三星电子宣布正式推出视觉体验转型(VXT)平台。 VXT 是一种云端原生 CMS(内容管理解决方案),它将内容和远端指示牌管理整合到一个安全平台中。我们的一体化解决方案易于使用,使企业能够轻鬆创建和管理数位显示器。

- 由于技术进步、数位化不断提高、经济因素、积极的市场参与企业以及政府的支持性政策,巴西数位电子看板市场预计将实现成长。总的来说,这些因素创造了一种动态环境,使数指示牌能够蓬勃发展,增强各个领域的沟通和广告效果。根据美洲开发银行预测,2023年拉丁美洲物联网(IoT)设备价值将增加约9.956亿美元,预计2025年将达到472亿美元。

拉丁美洲数位电子看板产业概况

各类终端用户的需求不断增长以及数位电子看板产品的商业机会不断增加,加剧了市场参与者之间的竞争。拉丁美洲数位电子看板市场由Panasonic Corporation、LG Display、三星电子公司、Sony Corporation和Sharp Corporation等主要参与者组成。公司不断投资于策略联盟和产品开发以获得市场占有率。

- 2024 年 5 月数位电子看板技术公司 CastHub 宣布进行重大软体更新。最新版本引入了强大的功能,可简化医疗保健和健康、专业服务、教育、非营利组织、零售、教会和商业企业等各行各业的数位内容管理和展示。 CastHub 未来的软体更新将包括影片播放方面的改进,允许用户无缝整合 Vimeo 和 YouTube 的高品质影片。

- 2024 年 2 月,Embed 指示牌宣布与 Perion 的 Hivestack 建立策略伙伴关係。此次合作将改变数位电子看板的收益机会,为世界各地的媒体所有者提供强大的解决方案,以前所未有的效率和创新利用他们的萤幕库存。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- 主要宏观经济趋势的市场影响

第五章 市场动态

- 市场驱动因素

- 数位化的逐步推进

- 市场挑战

- 创新初期成本高、技术复杂

第六章 技术简介

- 亭

- 广告看板

- 选单板

- 招牌

第七章 市场区隔

- 按类型

- 硬体

- LCD/LED 显示器

- 有机发光二极体显示屏

- 媒体播放机

- 投影机/投影萤幕

- 其他硬体

- 软体

- 按服务

- 硬体

- 按最终用户产业

- 零售

- 运输

- 饭店业

- 企业

- 政府

- 其他最终用户产业

- 按国家

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲国家

第八章 竞争格局

- 公司简介

- Panasonic Corporation

- LG Display Co. Ltd

- Samsung Electronics Co. Ltd

- Sony Corporation

- Sharp Corporation

- 3M Corporation

- Scala Inc.

- Cisco Systems Inc.

- Broadsign International LLC

- Omnivex Corporation

- Stratacache Inc.

第九章投资分析

第 10 章:市场的未来

The Latin America Digital Signage Market size is estimated at USD 1.20 billion in 2025, and is expected to reach USD 1.77 billion by 2030, at a CAGR of 8.09% during the forecast period (2025-2030).

Key Highlights

- Digital signage enables vendors in the region to change the displays and messages more quickly and let the content reach potential customers cost-effectively and efficiently. It is easy to manage compared to traditional advertisements. Digital signs offer real-time information on products and availability, interactive data, and visually enticing photos and videos.

- The increased spending on digital advertising in Latin America is expected to create significant opportunities for the growth of the digital signage market. Digital outdoor signage is a part of the audio and visual market that has grown steadily over the last decade, and that growth is only accelerating. Digital outdoor signage is used in almost every industry, with applications in restaurants and hotels, retail places, transit facilities, and entertainment events.

- The region has been witnessing expansions from global companies, as the area offers lucrative opportunities to solution providers for development and growth. For instance, in November 2023, Navori Labs deployed a unified digital signage software and AI-based camera analytics solution for Walmart Connect, the omnichannel retail media business of Walmart de Mexico y Centroamerica. The solution is employed across all 173 Walmart Supercenters in Mexico and 180 of 200 in-country Sam's Club locations, with the remaining 20 stores expected to follow.

- Increasing collaborations are expected to aid the solution providers in providing innovative solutions to customers. For instance, the Digital Signage Federation (DSF), the independent not-for-profit trade organization serving the digital signage industry, announced that DSMX is an affiliate of the DSF called Asociacion Digital Signage Latinoamerica or DS Latin America. The new companion will help DSF to develop industry-leading education, standards, and best practices globally.

- The ongoing digital transformation across Latin America is a significant driver. Enhanced internet connectivity and adopting technologies like IoT, AI, and Big Data are boosting the demand for digital signage solutions. This digital shift allows businesses to leverage advanced display technologies and interactive features to effectively engage customers.

- In addition, innovations in display technologies, such as OLED, micro-LED, and interactive touchscreens, make digital signage more attractive and functional. These technologies provide higher-quality displays and new interactive capabilities, which appeal to businesses looking to capture consumer attention effectively. For instance, in May 2024, LG Display, the world's significant innovator of display technologies, announced the unveiling of many of its next-generation OLED and cutting-edge display technologies in the region.

- Digital signage for end users trying to develop and deploy the infrastructure independently can be confusing. Being a complex undertaking, it requires expertise in various areas, such as IT, audiovisual, software, mechanical, and display technologies. Technical ease and standardization of protocols are required to take advantage of complete solutions offered by value-added retailers who incorporate products from partner hardware and software vendors. This not only eases installation but also simplifies upgrades and reduces maintenance. Interoperability is another major concern in the market.

- Post-pandemic, businesses have been looking toward new approaches to engage customers with the emergence of new technologies and the ever-increasing popularity of digital content. Organizations that once used printed signage and in-person communication depended more heavily on digital communications over the past two years, and the trend is expected to continue. With companies printing less physical material and reducing capacity limits, digital signage is expected to play an essential role in the post-COVID-19 period in Latin America.

Latin America Digital Signage Market Trends

LCD/LED Displays Are Expected to Drive Market Growth

- LEDs and LCDs are significantly driving the demand for digital signage in the region. These displays offer superior image quality with high resolution, bright colors, and sharp contrast. The enhanced visual appeal makes digital signage more effective at capturing attention and engaging viewers in retail environments, corporate settings, or public spaces. The ability to display high-definition content attracts businesses looking to make a strong visual impact.

- Continuous advancements in LCD and LED technology, such as higher resolutions (4K and 8K), touchscreen capabilities, and integration with interactive features, make digital signage more engaging and functional. These technological improvements enable more creative and interactive content, enhancing user engagement and providing better customer experiences.

- For instance, in May 2023, LG Electronics delivered a super-large LED outdoor billboard to Peru. The billboard, equipped with 140 panels, offers realistic three-dimensional anamorphic content.

- The rapid urbanization and economic development in Latin America are creating new opportunities for digital signage. As cities grow and new commercial spaces are developed, the demand for modern, effective communication tools is increasing. Digital signage, powered by advanced LED and LCD displays, meets this demand by providing dynamic and visually appealing solutions. In 2023, the degree of urbanization worldwide was at 57%. Latin America, the Caribbean, and North America were the regions with the highest level of urbanization, with over four-fifths of the population residing in urban areas.

- Companies are increasingly integrating their online and offline marketing strategies. Digital signage, powered by LED and LCDs, allows businesses to extend their internet advertising campaigns into the physical world, creating a seamless brand experience. This integration drives the need for high-quality displays with the same visual impact as online ads. According to Zenith, in 2023, internet advertising spending in Latin America amounted to USD 13.29 billion, an increase of 12.03% from the previous year. It is projected to rise to over 14.5 billion by 2024. This would make it the second-largest ad medium in Latin America, accounting for a third of the total ad spend in the region.

Brazil Holds the Largest Market Share

- Brazil is increasingly embracing digitization across different aspects of life, including public and private sectors. The push toward smart cities, where digital signage is crucial in providing real-time information and interactive services, is a significant growth driver. This includes applications in public transport systems, traffic management, and public information displays.

- In August 2023, the Seoul Metropolitan Government in South Korea and the World Organization of Smart Sustainable Cities (WeGO) Foundation selected three Brazilian projects as semifinalists in the first edition of the Seoul Smart City Prize. This award encourages innovation in inclusive, innovative city models driven by ICT to care for vulnerable groups. The award reinforces the belief that smart cities should be based on technology as well as people. It includes two categories: Tech-InnovaCity and Human-CentriCity. Such a rise in innovative city initiatives is anticipated to drive the development of the digital signage market in the country.

- In addition, major companies like Samsung, LG, and local players are actively investing in the Brazilian market and offering advanced digital signage solutions. Innovations such as interactive displays and integration with mobile technologies are also propelling market growth. These companies continuously work on making digital signage more cost-effective and accessible to deploy, encouraging wider adoption across various industries.

- In January 2024, Samsung Electronics announced the official launch of its Visual eXperience Transformation (VXT) platform, a cloud-native CMS (content management solution) that combines content and remote signage management on one secure platform. Designed with ease of use, the all-in-one solution allows businesses to easily create and manage their digital displays.

- The digital signage market in Brazil is set to grow due to technological advancements, increasing digitization, economic factors, proactive market players, and supportive government policies. These elements collectively foster a dynamic environment where digital signage can flourish, enhancing communication and advertising effectiveness across multiple sectors. According to the Inter-American Development Bank, the value of Latin America's Internet of Things (IoT) devices increased to around USD 995.6 million in 2023; the figure is expected to reach USD 47.2 billion by 2025.

Latin America Digital Signage Industry Overview

The rising demand across various end users and increasing opportunities for digital signage products contribute to competition among the market players. The Latin American digital signage market is fragmented, with the presence of significant companies such as Panasonic Corporation, LG Display Co. Ltd, Samsung Electronics Co. Ltd, Sony Corporation, and Sharp Corporation. The companies continuously invest in strategic collaborations and product developments to gain market share.

- May 2024: CastHub, a player in digital signage technology, announced a significant software update. This latest version introduced robust functionalities to streamline the management and display of digital content across various industries, including healthcare, wellness, professional services, education, non-profit, retail, religious institutions, and business corporations. CastHub's upcoming software update includes improved video playback, allowing users to seamlessly integrate high-quality videos from Vimeo or YouTube.

- February 2024: Embed Signage announced its strategic partnership with Hivestack by Perion. This collaboration is set to transform monetization opportunities for digital signage, providing a robust solution for media owners globally to capitalize on their screen inventory with unprecedented efficiency and innovation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Gradual Increasing Pace of Digitization

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Innovation and Technical Complexity

6 TECHNOLOGY SNAPSHOT

- 6.1 Kiosk

- 6.2 Billboards

- 6.3 Menu Boards

- 6.4 Signboards

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Hardware

- 7.1.1.1 LCD/LED Display

- 7.1.1.2 OLED Display

- 7.1.1.3 Media Players

- 7.1.1.4 Projector/Projection Screens

- 7.1.1.5 Other Hardware

- 7.1.2 Software

- 7.1.3 Services

- 7.1.1 Hardware

- 7.2 By End-user Industry

- 7.2.1 Retail

- 7.2.2 Transportation

- 7.2.3 Hospitality

- 7.2.4 Corporate

- 7.2.5 Government

- 7.2.6 Other End-user Industries

- 7.3 By Country

- 7.3.1 Brazil

- 7.3.2 Mexico

- 7.3.3 Argentina

- 7.3.4 Rest of Latin America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Panasonic Corporation

- 8.1.2 LG Display Co. Ltd

- 8.1.3 Samsung Electronics Co. Ltd

- 8.1.4 Sony Corporation

- 8.1.5 Sharp Corporation

- 8.1.6 3M Corporation

- 8.1.7 Scala Inc.

- 8.1.8 Cisco Systems Inc.

- 8.1.9 Broadsign International LLC

- 8.1.10 Omnivex Corporation

- 8.1.11 Stratacache Inc.