|

市场调查报告书

商品编码

1686198

北美休閒车:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)North America Recreational Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

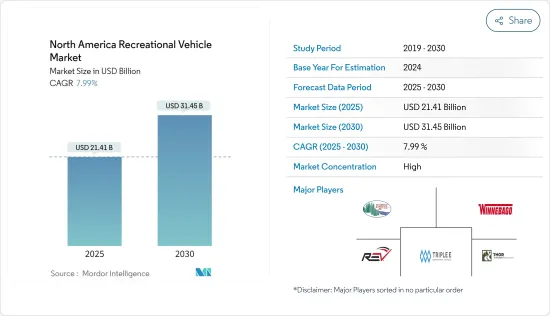

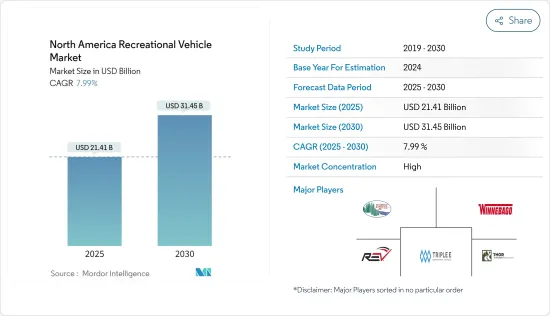

北美休閒车 (RV) 市场规模预计在 2025 年达到 214.1 亿美元,预计到 2030 年将达到 314.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.99%。

北美休閒车(RV)市场是一个充满活力和蓬勃发展的行业,其驱动力有多种因素,包括消费者可支配收入的增加以及投资旅行和户外探险等休閒活动的能力。随着人们对户外休閒和露营的偏好日益浓厚,尤其是千禧世代和家庭,人们对房车的需求也在增长,因为房车是探索大自然和享受开放车道自由的一种方式。

然而,市场上也存在一些限制因素,包括购买房车的前期成本较高,这可能会让对价格敏感的消费者望而却步。燃料价格的波动也会影响房车旅行的可负担性,进而影响消费者对休閒活动的决定。此外,授权要求和分区限制等监管挑战可能会成为某些地区进入和运营的障碍,从而限制市场成长。

儘管有这些挑战,北美房车市场仍有许多成长和创新的机会。共享经济的兴起带来了P2P房车租赁平台和共用所有权模式的出现,为消费者提供了灵活、实惠的房车旅行体验选择。此外,拓展年轻人口、居住者和国际市场等新市场将使基本客群多样化并刺激市场扩张。

北美房车市场主要由 Thor Industries、Forest River、Winnebago Industries 和 REV Group 等大公司主导。这些公司在产品创新、品牌声誉、定价和分销网络等多种因素上竞争,以保持市场占有率并获得竞争优势。规模较小的公司和利基製造商透过提供针对特定客户偏好和需求的专用房车,为市场带来多样性,进一步丰富了整体市场格局。

北美房车市场趋势

电动房车是最大的细分市场

随着旅行和旅游业在世界各地越来越受欢迎,人们正在寻求独特而冒险的体验。对体验式、沉浸式旅行体验的渴望导致了对电动房车的需求增加。许多国家缺乏可用的露营地也推动了对电动房车的需求。

此外,美国、加拿大等北美国家对旅居车的需求正大幅成长。日益富裕和休閒车停车位的广泛普及正在推动北美休閒车的普及。

自新冠疫情爆发以来,许多人出于安全考虑计划度假时避免乘坐公共交通工具,导致休閒车的需求激增。在新冠疫情期间,几家北美休閒车公司的预订量均大幅成长。

近年来,B级和C级旅居车因其优势,其需求量也随之增加。近年来,参加美国夏令营的人数一直呈上升趋势。

- 预计 2023 年将有超过 5,700 万人在美国享受露营,而 2022 年这一数字约为 5,500 万人。

- 2023年美国从製造商到经销商的旅居车批发出货量约为45,900辆。

预计这些综合因素将在预测期内推动该地区对电动房车的需求。

预计美国将主导市场

该国露营地数量的增加证明人们对使用旅居车进行休閒旅行的偏好日益增长。美国有超过 230 家连锁店,当地旅居车经销商买卖旅居车,旅居车。这些经销商提供最先进的旅居车以及最新型的旅居车车,受到许多车队营运商的青睐。为了与日益发展的电动车时代竞争,大多数房车製造公司都在生产电动休閒车以在市场上占据优势。

- 例如,2023 年 3 月,总部位于南加州的汽车製造商 Harbinger 向 THOR Industries交付了专用的中型电动车底盘。 THOR 计划在印第安纳州埃尔克哈特的 THOR美国创新实验室将底盘升级为电动 A 级房车。

美国从新冠疫情中迅速而稳定地復苏,创造了更健康的资金筹措环境,推动了美国旅居车市场的发展。目前,中国是全球最大的房车市场。

旅居车广泛用于度假旅行、车尾聚会、携带宠物旅行和商务。它也是户外运动和其他休閒活动的热门交通方式。

这些车辆为露营者提供舒适的睡眠区和所有必需品,以及冰箱、热水、空调和暖气等豪华设施。然而,由于体积小,它们缺少一些功能,例如全尺寸娱乐系统和洗衣设施。

预计上述因素将在预测期内促进整个市场的发展。

北美房车行业概况

北美房车市场的主要企业有 Thor Industries Inc.、Forest River Inc.、Winnebago Industries 和 REV Group。休閒车市场在主导企业之间竞争非常激烈。公司之间不断竞争,选择收购、大力投资研发计划等策略,同时在其车辆上提供更多豪华服务。

- 2023 年 4 月,First Hydrogen 与 EDAG 集团合作推出了一款采用燃料电池技术的新型零排放休閒车 (RV)。此次合作旨在将燃料电池电动技术应用于大型车辆,与电池电动车 (BEV) 相比,休閒车具有有效负载容量更大、续航里程更长的优势。第一代厢型车的设计行驶里程为 249 至 373 英里(加满油五分钟),第二代车辆的预期行驶里程尚未公布。

- 2023 年 1 月,Winnebago Industries 在坦帕举行的佛罗里达房车超级展上推出了首款全电动房车 eRV2。这种排放气体排放车型以电力运行所有系统,包括房屋和动力传动系统,并且仅使用电池即可支援长达七天的野外露营。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 旅游业的成长推动了市场需求

- 市场限制

- 休閒车租赁将对市场产生长期影响

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 按类型

- 拖曳式房车

- 旅行拖车

- 第五轮拖车

- 折迭式露营拖车

- 卡车露营

- 旅居车

- A型

- B型

- C型

- 拖曳式房车

- 按应用

- 个人

- 商业的

- 按国家

- 美国

- 加拿大

- 北美其他地区

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Thor Industries Inc.

- Winnebago Industries Inc.

- Forest River Inc.

- REV Group

- NeXus RV

- Triple E Recreational Vehicles

- Tiffin Motorhomes Inc.

- Entegra Coach Inc.

- Cruiser RV

第七章 市场机会

- 自动驾驶房车重塑旅行体验

The North America Recreational Vehicle Market size is estimated at USD 21.41 billion in 2025, and is expected to reach USD 31.45 billion by 2030, at a CAGR of 7.99% during the forecast period (2025-2030).

The North American RV (recreational vehicle) market is a dynamic and flourishing industry, driven by various factors, such as the rising disposable income among consumers, enabling them to invest in leisure activities such as travel and outdoor adventures. There is a growing preference for outdoor recreation and camping, especially among millennials and families, fostering increased demand for RVs as a means to explore nature and enjoy the freedom of the open road.

However, the market also faces certain restraints, including the high initial cost of purchasing an RV, which may deter price-sensitive consumers. Fluctuating fuel prices also impact the affordability of RV travel, influencing consumer decisions regarding leisure activities. Moreover, regulatory challenges such as licensing requirements and zoning restrictions can pose barriers to entry and operation in certain regions, potentially limiting the market's growth.

Despite these challenges, the North American RV market presents numerous opportunities for growth and innovation. The rise of the sharing economy has led to the emergence of peer-to-peer RV rental platforms and shared ownership models, providing consumers with more flexible and affordable options for experiencing RV travel. Furthermore, expanding into new markets, such as younger demographics, urban dwellers, and international markets, can diversify the customer base and stimulate market expansion.

Major players such as Thor Industries, Forest River Inc., Winnebago Industries, and REV Group dominate the North American RV market. These companies compete on various factors such as product innovation, brand reputation, pricing, and distribution networks to maintain market share and gain a competitive edge. Smaller players and niche manufacturers contribute to market diversity by offering specialized RVs tailored to specific customer preferences and needs, further enriching the overall market landscape.

North America RV Market Trends

Motorized RVs are the Largest Segment by Type

With travel and tourism gaining popularity worldwide, people are seeking unique and adventurous experiences. The desire for experiential and immersive travel experiences has contributed to the increased demand for motorized RVs. The shortage of available campgrounds in many countries has also contributed to the demand for motorized RVs.

Furthermore, motorhomes are witnessing a significant growth in demand across North American countries like the United States and Canada. The increasing number of HNWIs and the availability of widespread parking areas for RVs are driving their adoption in North America.

The demand for recreational vehicles has boomed after the COVID-19 pandemic, as most people started planning their holidays while avoiding public transportation due to safety precautions. Several recreational vehicle companies across North America witnessed significant booking growth during the COVID-19 pandemic.

Over the past few years, the demand for Class B and Class C motorhomes has also increased due to their advantages. The population of the United States participating in camping has seen an upward trajectory over the last few years.

- In 2023, the number of users opting for camping in the United States stood at over 57 million compared to the figure of around 55 million in 2022.

- In 2023, The US wholesale shipments of motorhomes from manufacturers to dealers amounted to approximately 45.9 thousand.

All these factors combined are expected to boost the demand for motorized RVs during the forecast period in the region.

United States Expected to Dominate the Market

The increase in campgrounds in the country illustrates the increasing preference for recreational travel with motorhomes. The United States has more than 230 chain outlets and local motorhome dealers are trading motorhomes to meet the increasing demand for them. These dealers provide a range of state-of-the-art motorhomes and the latest-model-year second-hand motorhome units preferred by most fleet operators. To compete in the growing electrical vehicle era, most of the RV manufacturing companies are manufacturing electric recreational vehicles to stay ahead in the market.

- For instance, in March 2023, Harbinger, a Southern California-based automotive manufacturer, delivered a purpose-built medium-duty EV chassis to THOR Industries. THOR plans to upgrade the chassis into an electrified class A RV at its THOR US Innovation Lab in Elkhart, Indiana.

The quick and steady recovery of the United States from the COVID-19 pandemic and the availability of a healthier financing environment drove the motorhome market in the United States. Currently, the country forms the largest market for RVs globally.

Motorhomes are widely used in the country for travels during vacations and for tailgating, traveling with pets, and business. They are also a preferred mode of transportation in outdoor sports and other leisure activities.

These vehicles provide campers with comfortable sleeping quarters and all the necessities, along with some luxurious features, such as a refrigerator, hot water, air conditioning, and heating. However, they miss out on some features, such as a full-sized entertainment system and laundry facilities, owing to their small size.

The factors mentioned above are expected to contribute to the market's overall development during the forecast period.

North America RV Industry Overview

The major players in the North American RV market are Thor Industries Inc., Forest River Inc., Winnebago Industries, and REV Group. The recreational vehicle market is highly competitive amongst the dominant players. The companies are continually competing with each other and are opting for strategies, like acquisitions and heavy investment in R&D projects, while offering more luxurious services in the vehicle.

- April 2023: First Hydrogen introduced a novel zero-emission recreational vehicle (RV), utilizing fuel cell technology in collaboration with the EDAG Group. This partnership seeks to apply fuel cell electric technology to larger vehicles, showcasing the advantage of handling higher payloads and achieving longer ranges compared to battery electric vehicles (BEVs) for RVs. Their inaugural van is designed to cover distances ranging from 249 to 373 miles (400 to 600 kilometers) on a single five-minute refueling, with the expected range for the Gen 2 vehicle yet to be disclosed.

- January 2023: Winnebago Industries debuted its inaugural fully electric RV, the "eRV2," at the Florida RV SuperShow in Tampa. This emission-free model operates all systems, both house and powertrain, on electricity, supporting up to seven days of "boondocking" solely on batteries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Travel and Tourism to Fuel Market Demand

- 4.2 Market Restraints

- 4.2.1 Recreational Vehicle Rental to Affect the Market Over the Long Term

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Value in USD)

- 5.1 By Type

- 5.1.1 Towable RVs

- 5.1.1.1 Travel Trailers

- 5.1.1.2 Fifth Wheel Trailers

- 5.1.1.3 Folding Camp Trailers

- 5.1.1.4 Truck Campers

- 5.1.2 Motorhomes

- 5.1.2.1 Type A

- 5.1.2.2 Type B

- 5.1.2.3 Type C

- 5.1.1 Towable RVs

- 5.2 By Application

- 5.2.1 Private

- 5.2.2 Commercial

- 5.3 By Country

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Thor Industries Inc.

- 6.2.2 Winnebago Industries Inc.

- 6.2.3 Forest River Inc.

- 6.2.4 REV Group

- 6.2.5 NeXus RV

- 6.2.6 Triple E Recreational Vehicles

- 6.2.7 Tiffin Motorhomes Inc.

- 6.2.8 Entegra Coach Inc.

- 6.2.9 Cruiser RV

7 MARKET OPPORTUNITIES

- 7.1 Autonomous RV to Rebuild the Caravanning Experience