|

市场调查报告书

商品编码

1686223

农业酵素-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Agricultural Enzymes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

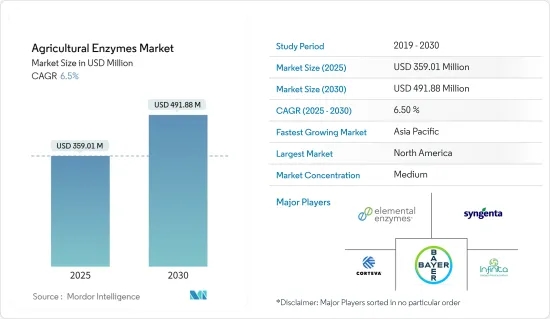

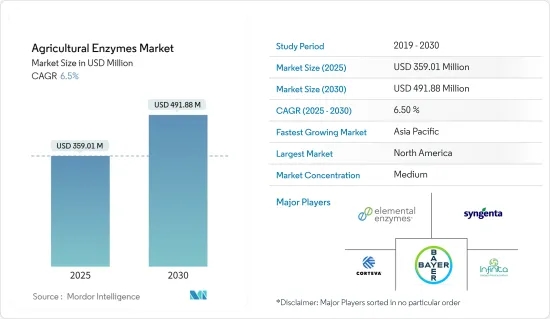

预计 2025 年农业酵素市场规模为 3.5901 亿美元,到 2030 年将达到 4.9188 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.5%。

主要亮点

- 农业酵素市场是更广泛的农业产业的一个重要部分,其重点是提高作物生产力、土壤健康和永续的农业实践。在消费者需求和永续农业实践监管压力的推动下,酵素在农业中的应用正在蓬勃发展。这些酶减少了对化学物质的依赖并支持环保农业。根据有机农业研究所的数据,从 2021 年到 2023 年,有机食品销售额从 1,320 亿美元成长到 1,340 亿美元。有机食品消费的成长趋势正在推动有机农业的发展,并刺激对农业酵素的需求。有机农民使用这些酵素来增强土壤健康并提高作物产量,而无需依赖合成化学物质。此外,酵素和精选微生物在农业中被用作化学品更健康、更有机的替代品,进一步推动了市场的成长。

- 此外,人们越来越认识到保持土壤健康对于维持农业生产力的必要性。农业酵素有助于分解有机物、增加养分利用率和改善土壤结构,这些结构对于维持土壤健康至关重要。儘管可耕地有限,但提高作物产量的需求进一步增加了对农业酵素的需求。例如,根据匈牙利中央统计局的数据,匈牙利的耕地面积总体上正在减少。预计2024年耕地面积为413.2万公顷,比上年的415.4万公顷减少。因此,对永续农业和有机农产品的需求不断增长,使农业酵素市场走上成长轨道。儘管农业酶市场呈现成长趋势,但仍面临酵素生产成本高、区域认知差距和监管环境多样化等挑战。结合技术进步和对酵素益处的认识不断提高,市场预计将继续扩大,凸显其对全球农业未来的重要性。

农业酵素市场趋势

依作物类型划分,谷物和谷类比最大

农业酵素的应用正在增加,特别是在谷类和谷类种植。人们对农业中过量使用化学物质的环境问题的担忧,凸显了作物中化学残留的问题。例如,粮农组织2022年的资料显示,安提瓜和巴布达在农药使用量方面位居榜首,每公顷使用36.59公斤。这导致人们转向使用酵素等更安全的替代品。此外,酵素在谷物生产中的使用已显示出诸如提高保湿性、增加根生物量和加快有机物分解等好处,进一步支持了酵素在谷物和谷类种植中的全球普及。

此外,随着消费者健康意识的增强,他们明显转向有机食品,以避免化学防腐剂对健康的不利影响。这一趋势正在扩大有机农业的范围。例如,根据FibL的资料,有机谷物种植面积从2021年的550万公顷扩大到2022年的560万公顷。这些发展支持酵素在有机农业中的使用日益增加。随着有机食品产业的成长和对食品安全的日益重视,农业酵素在谷物和谷类作物中的应用正在增加,未来几年该产业将迎来良好的发展前景。

北美占据市场主导地位

北美在农业酶消费方面居世界领先地位,其中美国居首。美国农业部门迅速采用了现代技术。化学投入成本上升、对土壤和环境的有害影响以及对平衡植物营养的认识不断提高等因素正在推动美国对农业酶的需求。例如,2022年8月,美国农业部(USDA)推出了一项耗资3亿美元的有机转型计划,旨在培训下一代有机生产者并加强有机供应链。预计这些措施将促进包括农业酵素在内的生物基投入的采用,并扩大北美市场。

加拿大已明确转向生物基农业,从早期发展阶段就专注于提高作物的生产力和品质。在政府的推动下,人们对有机产品的偏好日益增长,这鼓励了产业参与者加大在该地区的产品供应。例如,Novonesis 于 2024 年 3 月扩大了与 FMC 的合作伙伴关係,任命 FMC 从 2025 年生长季节开始为 Novonesis 农业生物解决方案在加拿大的独家经销商。在墨西哥,人们对有机和天然食品的需求日益增长,加上永续农业的趋势,推动了对天然来源农业投入品的需求。根据2023年农业生产统计年鑑,墨西哥有超过54,000公顷土地用于种植有机作物,其中约52,000公顷土地成功收穫。预计这些趋势将在未来几年进一步推动市场成长。因此,由于政府的支持政策和对有机农业的日益重视,农业酶市场预计将在预测期内蓬勃发展。

农业酵素产业概况

农业酵素市场适度整合,主要企业包括:主要企业包括拜耳作物科学、Elemental Enzymes、Corteva Agriscience、Infinita Biotech Private Limited. 和先正达股份公司。公司正在进行各种策略活动,包括产品创新、业务扩展、合作伙伴关係、併购。我们也与其他公司合作进行联合研究,以在市场上占据强大的地位。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 有机食品需求不断成长

- 生物农产品的采用率不断提高

- 主要企业加大研发和市场策略

- 市场限制

- 政府监管障碍

- 化工产品需求旺盛

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 依酶类型

- 氧化酵素

- 去氢酶

- 尿素酶

- 蛋白酶

- 其他酵素类型

- 按应用

- 作物保护

- 生育能力

- 植物生长调节

- 按作物类型

- 粮食

- 油籽和豆类

- 水果和蔬菜

- 其他作物

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Bayer Cropscience AG

- Syngenta AG

- American Vanguard Corporation

- Bioworks Inc.

- Corteva Agrisciences

- Infinita Biotech Private Limited

- Creative Enzymes

- Kemin Industries Inc

- Novozymes Inc

- Elemental Enzymes

第七章 市场机会与未来趋势

The Agricultural Enzymes Market size is estimated at USD 359.01 million in 2025, and is expected to reach USD 491.88 million by 2030, at a CAGR of 6.5% during the forecast period (2025-2030).

Key Highlights

- The agricultural enzymes market has become a pivotal segment in the broader agricultural industry, emphasizing enhancements in crop productivity, soil health, and sustainable farming practices. Driven by consumer demand and regulatory pressures for sustainable practices, the adoption of agricultural enzymes has surged. These enzymes diminish the dependence on chemical inputs, championing eco-friendly farming. According to the Research Institute of Organic Agriculture, organic food sales grew from USD 132 billion to USD 134 billion from 2021 to 2023. This rising trend of organic food consumption has raised organic farming which has fueled the demand for agricultural enzymes. Organic farmers utilize these enzymes to bolster soil health and boost crop yields, all without resorting to synthetic chemicals. Moreover, enzymes along with select microbes are being used in agriculture as a healthier and organic replacement for chemicals, thus driving the market's growth.

- Moreover, there's an increasing recognition of the need to uphold soil health for sustained agricultural productivity. Agricultural enzymes are instrumental in decomposing organic matter, boosting nutrient availability, and refining soil structure, all vital for robust soil health. The need for increased crop yields, despite limited arable land, has further fueled the demand for agricultural enzymes. For instance, according to the Hungarian Central Statistical Office, the arable land area decreased overall in Hungary. In 2024, the arable land area totaled around 4,132 thousand hectares in the country which decreased from 4,154 thousand hectares compared to the previous year. Therefore, with the rising demand for sustainable farming and organic produce, the agricultural enzymes market is on a growth path. Despite its growth trajectory, the agricultural enzymes market grapples with challenges such as high enzyme production costs, regional awareness gaps, and diverse regulatory landscapes. Coupled with technological strides and heightened awareness of enzyme benefits, the market is set for continued expansion, underscoring its significance in the future of global agriculture.

Agricultural Enzymes Market Trends

Cereals and Grains Holds Significant Shares by Crop Type

The adoption of agricultural enzymes is on the rise, particularly in the cultivation of cereals and grains. Environmental concerns about the overuse of chemicals in agriculture have highlighted the issue of chemical residues in crops. For example, FAO data from 2022 revealed that Antigua and Barbuda led in agricultural pesticide consumption, using over 36.59 kilograms per hectare of cropland, with Qatar closely following at 35.11 kilograms per hectare. This has driven a shift towards safer alternatives like enzymes. Additionally, the use of enzymes in cereal production has shown benefits such as improved moisture retention, increased root biomass, and faster organic matter decomposition, further encouraging their global adoption in cereal and grain cultivation.

Moreover, as consumers become more health-conscious, there is a noticeable shift towards organic foods to avoid the negative health effects associated with chemical preservatives. This trend has expanded the scope of organic farming. For instance, FibL data indicates that the organic area for cereals grew from 5.5 million hectares in 2021 to 5.6 million hectares in 2022. These developments underscore the increasing use of enzymes in organic farming. With the organic food industry growing and a strong emphasis on food safety, the adoption of agricultural enzymes in cereal and grain crops is set to increase, signaling a positive trend for the segment in the coming years.

North America Dominates the Market

North America leads the globe in the consumption of agricultural enzymes, with the United States taking the forefront. The U.S. agriculture sector swiftly adopts modern technologies. Factors such as rising costs of chemical inputs, their harmful impacts on soil and the environment, and an increased awareness of balanced plant nutrition are driving the demand for agricultural enzymes in the U.S. Additionally, strong government initiatives in the region further fuel this market's expansion. For instance, in August 2022, the U.S. Department of Agriculture (USDA) launched the USD 300 million Organic Transition Initiative, aiming to nurture the next generation of organic producers and strengthen organic supply chains. Such measures are likely to boost the adoption of bio-based inputs, including agricultural enzymes, thus broadening the market in North America.

Canada is witnessing a clear pivot towards bio-based agriculture, focusing on improved crop productivity and quality from the early growth stages. This rising inclination towards organic products, supported by government backing, is encouraging industry players to enhance their services in the region. For example, in March 2024, Novonesis expanded its partnership with FMC, appointing FMC as the exclusive distributor for select Novonesis agricultural bio-solutions in Canada, effective from the 2025 growing season. In Mexico, a growing appetite for organic and natural foods, coupled with a trend towards sustainable farming, has increased the demand for naturally sourced agricultural inputs. According to the 2023 Statistical Yearbook of Agricultural Production, over 54 thousand hectares in Mexico were dedicated to organic crops, with approximately 52 thousand hectares successfully harvested. These trends are poised to further drive the market's growth in the coming years. Thus, with supportive government measures and a rising emphasis on organic farming, the agricultural enzymes market is set to flourish during the forecast period.

Agricultural Enzymes Industry Overview

The Agricultural Enzymes market is moderately consolidated, with major players such as Bayer CropScience, Elemental Enzymes, Corteva Agriscience, Infinita Biotech Private Limited., and Syngenta AG occupying a significant market shares. The companies are adopting various strategic activities, such as product innovation, expansion, partnership, and mergers & acquisitions. The players are partnering with other companies to build a strong presence in the market while researching collaboratively.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Organic Food

- 4.2.2 Increasing Adoption of Biological Agricultural Products

- 4.2.3 Rising R&D and Market Strategies by Key Players

- 4.3 Market Restraints

- 4.3.1 Government Regulatory Barriers

- 4.3.2 High Demand for Chemical Products

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Enzyme Type

- 5.1.1 Phosphatases

- 5.1.2 Dehydrogenases

- 5.1.3 Ureases

- 5.1.4 Proteases

- 5.1.5 Other Enzyme Types

- 5.2 By Application

- 5.2.1 Crop Protection

- 5.2.2 Fertility

- 5.2.3 Plant Growth Regulation

- 5.3 By Crop Type

- 5.3.1 Grains and Cereals

- 5.3.2 Oil Seeds and Pulses

- 5.3.3 Fruits and Vegetables

- 5.3.4 Other Crop Types

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Bayer Cropscience AG

- 6.3.2 Syngenta AG

- 6.3.3 American Vanguard Corporation

- 6.3.4 Bioworks Inc.

- 6.3.5 Corteva Agrisciences

- 6.3.6 Infinita Biotech Private Limited

- 6.3.7 Creative Enzymes

- 6.3.8 Kemin Industries Inc

- 6.3.9 Novozymes Inc

- 6.3.10 Elemental Enzymes