|

市场调查报告书

商品编码

1686261

超材料:市场占有率分析、产业趋势和成长预测(2025-2030)Metamaterials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

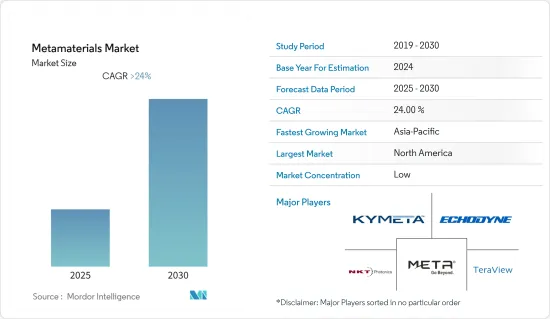

预计预测期内超材料市场将以超过 24% 的复合年增长率成长。

COVID-19 对市场产生了负面影响。由于多个正在进行的计划停止以及汽车、国防、航太和电子行业的投资低迷,超材料市场受到负面影响。不过,预计 2021 年市场将获得动力并实现健康成长。

主要亮点

- 推动超材料应用的主要驱动因素之一是航太和国防、通讯和消费性电子终端用户产业中各种应用的研究和开发活动活性化。

- 相反,超材料大规模生产基础设施不足以及对超材料益处的认识不足可能会阻碍市场成长。

- 超材料在太阳系中的应用以及基于超材料的无人机雷达可能会成为市场研究的机会。

- 北美占据全球市场主导地位。然而,预计亚太地区在预测期内的复合年增长率最高。

超材料市场趋势

航太和国防工业占市场主导地位

超材料被广泛应用于电子、医疗保健和通讯等多个行业。然而,由于天线、屏蔽、挡风玻璃、EMC屏蔽和隐形装置等超材料设备的广泛使用,航太和国防工业是超材料的主要用户和主导产业。

天线可以设定为特定频率,以便用于安全防御通讯。对频宽的需求和对安全通讯的需求不断增长,推动了航太和垂直防御超材料市场的扩张。

斯德哥尔摩国际和平研究所(SIPRI)在年度出版刊物中表示,2021年全球军费开支将首次突破2兆美元大关,达到约2.113兆美元。

此外,美国预算办公室预计,国防支出将从2014年的5,960亿美元增至2031年的9,150亿美元。此外,美国国防部在声明中表示,拜登-哈里斯政府已向国会提交了2023财年预算提案,国防支出8,133亿美元,其中国防部将承担7,730亿美元。该预算请求比 2022 财年预算增加 4%,约 3,000 万美元。

此外,加拿大政府在2022年预算中将拨款总合80亿美元,用于加强加拿大武装部队的能力,并引进新技术和设备以取代老化的设备。

根据波音公司《2022-2041年商业展望》,到2041年,全球商业航空服务(包括飞行业务、维护和工程、地面、站、货运业务等)预计价值将达到3.615万亿美元,这表明所研究市场的需求在未来几年可能会增加。

此外,波音公司《2022-2041年商业展望》估计,到2041年,全球新飞机交付总量将达到41,170架。 2019年全球飞机持有约25,900架,到2041年可能达到47,080架。

随着全球对提高军事安全的需求不断增加,超材料市场在满足每个国家的需求和标准方面发挥着重要作用。因此,预计预测期内市场需求将会增加。

亚太地区是一个快速成长的市场

由于多个计划的投资不断增加以及世界各国政府的支持,亚太地区预计将成为超材料市场成长最快的地区。

中国、印度、韩国和日本等国家的政府都在定期增加国防预算。中国近期国防支出的成长发出了一个明确的信号,即中国仍然致力于在2035年之前完成中国人民解放军的现代化建设,并在2049年之前将中国人民解放军打造成为一支「世界一流」的军队,这将为军事技术领域带来巨大的商机。

此外,根据印度品牌股权基金会的数据,2022-23 财年(截至 2022 年 8 月 1 日)的国防产值为 17,885 千万印度卢比(约 22 亿美元)。该国还计划在未来五年内投入1,300亿美元用于军事现代化,并考虑实现国防生产的自力更生。

韩国国防采购、技术与后勤局(DAPA)也计划投资 18 亿欧元(约 20 亿美元)用于轻型飞机,目标是在 2033 年开始营运。现代重工参与了这项製造过程,每年的维护成本为 1.8 亿欧元(约 2.1 亿美元)。

此外,在亚太地区,中国、东南亚和南亚的航太市场预计将大幅成长,进一步支持研究市场的需求。在中国,根据波音公司《2022-2041年商用飞机展望》,到2041年将交付约8,485架新飞机,市场价值达5,450亿美元。

随着电子产业不断取得显着进步与发展,所研究市场的需求也迅速成长。预计行动电话、可携式电脑、游戏系统和其他个人电子设备的生产将继续推动对电子元件的需求。根据印度品牌股权基金会(IBEF)预测,到2025年,印度电子製造业规模预计将达到5,200亿美元。

日本电子情报技术产业协会(JEITA)预测,截至2022年11月,日本电子产业的总产值将达到约10.1兆日圆(约850亿美元),与前一年同期比较成长约100.7%。

因此,航太和国防工业的成长、通讯产业的成长以及电子产业的崛起正在促进超材料和其他应用的成长,这可能会在预测期内推动市场发展。

超材料产业概况

超材料市场部分分散,没有一家公司拥有足够的份额来影响市场。 Kymeta Corporation、Meta Materials Inc.、NKT Photonics A/S、Echodyne Corp.、TeraView Limited 等是该市场上的一些知名公司(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 加大各类应用的研发投入

- 其他驱动因素

- 限制因素

- 缺乏对超材料益处的认识

- 合成超材料的成本

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 专利分析

第五章市场区隔

- 类型

- 电磁波

- 兆赫

- 可调

- 光子

- FSS

- 其他类型(掌性、非线性等)

- 应用领域

- 天线和雷达

- 感应器

- 屏蔽装置

- 超级镜头

- 光和声音过滤器

- 其他用途(太阳能、吸收器等)

- 最终用户产业

- 卫生保健

- 通讯

- 航太与国防

- 电子产品

- 其他终端用途产业(包括光学)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Echodyne Corp.

- Evolv Technologies Inc.

- Fractal Antenna Systems Inc.

- JEM Engineering

- Kymeta Corporation

- Metamaterials Inc.

- Multiwave Technologies AG

- Nanohmics Inc.

- NKT Photonics A/S

- TeraView Limited

- Metawave Corporation

- Aegis Technologies

- Metamagnetics

- NanoSonic Inc.

- Nanoscribe GmbH & Co. KG

第七章 市场机会与未来趋势

- 超材料在太阳系的应用

- 基于超材料的无人机雷达

The Metamaterials Market is expected to register a CAGR of greater than 24% during the forecast period.

COVID-19 had a negative impact on the market. The Metamaterials Market was negatively affected due to the suspension of several ongoing projects and low investments in the automotive, defense, aerospace, and electronics industries. However, the market gained momentum in 2021 and was expected to grow at a healthy rate.

Key Highlights

- One of the major factors driving the use of metamaterials is increasing R&D activities for various applications in the aerospace and defense, telecommunication, and consumer electronics end-user industries, among others.

- On the contrary, the inadequate infrastructure for large quantities of metamaterials and a lack of awareness of the benefits of metamaterials are likely to hamper the market growth.

- The use of metamaterials in solar systems and metamaterial-based radars for drones will likely act as opportunities for the market studied.

- North America dominated the market globally. However, the Asia-Pacific region is expected to register the highest CAGR during the forecast period.

Metamaterials Market Trends

Aerospace and Defense Industry to Dominate the Market

Metamaterials are employed in various industries, including electronics, healthcare, and telecommunications. Nonetheless, the aerospace and defense industries are the primary users and dominant industries for metamaterials, owing to the widespread use of metamaterial devices such as antennas, shields, windscreens, EMC shields, and cloaking devices.

Because antennas may be set to certain frequencies, they can be used for secure defense communications. The increased need for bandwidth and the requirement for secure communications are driving the expansion of the aerospace and vertical defense metamaterials market.

In its annual publication, the Stockholm International Peace Research Institute (SIPRI) stated that the global military expenditure crossed the mark of USD 2 trillion for the first time in the year 2021, reaching about USD 2,113 billion.

Furthermore, the US Congressional Budget Office predicts that defense spending will have climbed from 596 billion dollars in 2014 to 915 billion dollars by 2031. Aside from that, the US Department of Defense noted in a statement that the Biden-Harris Administration presented to Congress a planned Fiscal Year (FY) 2023 Budget proposal of USD 813.3 billion for national defense, of which USD 773.0 billion is for the Department of Defense (DoD). This budget request grew by 4%, or roughly USD 30 million, compared to the FY 2022 budget.

In its annual budget for 2022, the Government of Canada also stated that a total of USD 8 billion would be used to bolster the capacity of the Canadian Armed Forces with new aged technology and equipment.

According to the Boeing Commercial Outlook 2022-2041, the global forecast for commercial aviation services (including flight operations, maintenance and engineering, ground, station, and cargo operations, and others) by 2041 is expected to be USD 3,615 billion, indicating that demand for the studied market will likely increase in the coming years.

The Boeing Commercial Outlook 2022-2041 also stated that the total global deliveries of new airplanes are estimated to be 41,170 by 2041. The global airplane fleet amounted to around 25,900 units as of 2019, and the fleet number is likely to reach 47,080 units by 2041.

With the increasing need for increased safety in military equipment worldwide, the metamaterials market plays an important role in meeting the needs and standards of every country. As a result, the market demand is expected to rise during the forecast period.

Asia-Pacific to be the Fastest-growing Market

Owing to the rising investments in several projects and the support of the national governments in the countries, Asia-Pacific is expected to be the fastest-growing region in the metamaterials market.

Governments have regularly increased the national defense budget in countries like China, India, South Korea, Japan, etc. China's recent increase in defense spending sends a clear signal that the country remains committed to completing the modernization of the People's Liberation Army (PLA) by 2035 and transforming the PLA into a 'world-class' military by 2049, thus creating opportunities in the military technology sector.

Moreover, according to the India Brand Equity Foundation, the defense production in FY 2022-23 (until August 1, 2022) stood at INR 17,885 crore (~USD 2.2 billion). The country also plans to spend USD 130 billion on military modernization in the next five years and is also considering achieving self-reliance in defense production.

The South Korean Defense Acquisition Program Administration (DAPA) also plans to work on light aircraft with an investment of EUR 1.8 billion (~USD 2 billion), which is expected to be operable in 2033. Hyundai Heavy Industries is involved in this manufacturing process with annual maintenance of EUR 180 million (~USD 210 million).

Furthermore, in the Asia-Pacific region, China, Southeast Asia, and South Asia aerospace market are expected to rise significantly, further supporting the demand for the studied market. In China, according to the Boeing Commercial Outlook 2022-2041, around 8,485 new fleet deliveries will be made by 2041 with a market service value of USD 545 billion.

As the electronics industry is continuously making remarkable progress and development, the demand for the market studied is growing rapidly. The production of cellular phones, portable computing devices, gaming systems, and other personal electronic devices will continue to spark the demand for electronic components. As per the India Brand Equity Foundation (IBEF), the Indian electronics manufacturing industry is expected to reach USD 520 billion by 2025.

The overall production value of the electronics sector in Japan was estimated by the Japan Electronics and Information Technology Industries Association (JEITA) to be around JPY 10.1 trillion (~USD 85 billion) as of November 2022, which is roughly 100.7% of the value from the previous year.

Thus, the growing aerospace and defense industry, the increasing telecommunication sector, and the rising electronics sector are instrumental in the growth of metamaterials and other applications, which would boost the market during the forecast period.

Metamaterials Industry Overview

The Metamaterials Market is partially fragmented, with no player having a significant enough share to influence the market. Kymeta Corporation, Meta Materials Inc., NKT Photonics A/S, Echodyne Corp., and TeraView Limited, among others, are some of the prominent players in the market (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing R&D Investments for Various Applications

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Lack of Awareness of Benefits of Metamaterials

- 4.2.2 Cost of Synthesization of Metamaterials

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Electromagnetic

- 5.1.2 Terahertz

- 5.1.3 Tunable

- 5.1.4 Photonic

- 5.1.5 FSS

- 5.1.6 Other Types (Chiral, Nonlinear, etc.)

- 5.2 Application

- 5.2.1 Antenna and Radar

- 5.2.2 Sensors

- 5.2.3 Cloaking Devices

- 5.2.4 Superlens

- 5.2.5 Light and Sound Filtering

- 5.2.6 Other Applications (Solar, Absorbers, etc.)

- 5.3 End-user Industry

- 5.3.1 Healthcare

- 5.3.2 Telecommunication

- 5.3.3 Aerospace and Defense

- 5.3.4 Electronics

- 5.3.5 Other End-use Industries (including Optics)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.2.4 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Echodyne Corp.

- 6.4.2 Evolv Technologies Inc.

- 6.4.3 Fractal Antenna Systems Inc.

- 6.4.4 JEM Engineering

- 6.4.5 Kymeta Corporation

- 6.4.6 Metamaterials Inc.

- 6.4.7 Multiwave Technologies AG

- 6.4.8 Nanohmics Inc.

- 6.4.9 NKT Photonics A/S

- 6.4.10 TeraView Limited

- 6.4.11 Metawave Corporation

- 6.4.12 Aegis Technologies

- 6.4.13 Metamagnetics

- 6.4.14 NanoSonic Inc.

- 6.4.15 Nanoscribe GmbH & Co. KG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of Metamaterials in Solar Systems

- 7.2 Metamaterial-based Radars for Drones