|

市场调查报告书

商品编码

1686611

核子反应炉退役:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Nuclear Power Reactor Decommissioning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

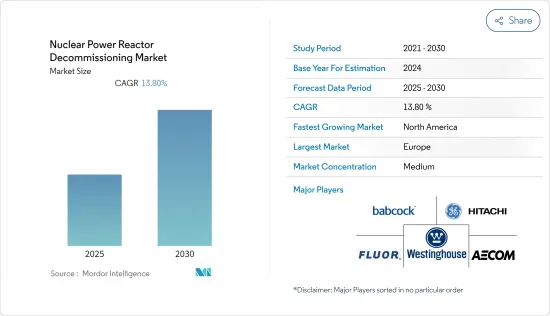

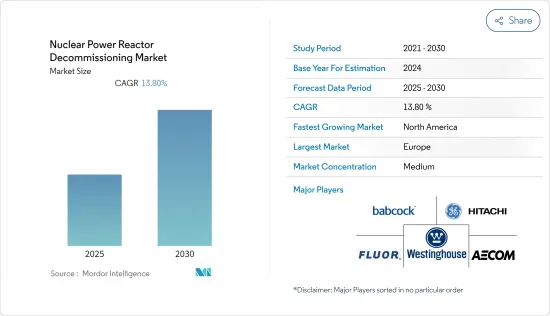

预计预测期核子反应炉退役市场将以 13.8% 的复合年增长率成长。

该市场在 2020 年受到 COVID-19 疫情的一定程度影响,但正在復苏并达到疫情前的水平。

推动市场成长的关键因素是越来越多的核子反应炉达到退役年龄、可再生能源(即风能和太阳能)价格下降以及对环境问题的日益敏感。

然而,由于政府的优惠政策而延长核能发电厂的使用寿命预计会阻碍市场的成长。

预计德国、英国和韩国等多个国家的核能淘汰政策将为国内外公司创造机会,提供开发符合国家需求的除役市场所需的专业知识。

北美预计将成为核能发电反应器退役成长最快的市场,其中美国是该地区的主要退役热点之一。

核子反应炉退役市场趋势

预计商用炉领域将占据市场主导地位。

截至2022年10月,全球共有32个国家运作437座商业核能发电厂。美国拥有最大的核能发电能力,核能发电其他国家都多。法国拥有世界第二大核能发电能力,核能发电量也高居世界第二。

商业核能发电厂的关闭和除役受到多种因素的影响,包括经济、监管和社会因素。太阳能和风能等替代能源的使用寿命结束和成本下降等主要资讯使得核能的成本竞争力下降。 2011年福岛核电事故发生后,世界各地的核能安通讯协定都进行了升级,导致基础设施升级相关的额外成本以及与营运和维护成本的增加。因此,许多老式商用核子反应炉的营运商选择除役运行寿命为 40 年的老旧核子反应炉,并透过基础设施升级将其生命再延长 20 年。

世界各国政府的政策措施也导致核能发电厂的关闭。许多政府已计划减少国家能源结构中的核能。此类监管政策在拥有充足可再生能源且对商业核能发电厂营运的环境影响和潜在风险深感担忧的西方国家十分普遍。

作为一项国家政策,德国计划在2022年底前关闭所有核子反应炉。 2017年,瑞士决定逐步淘汰该国的核能发电厂。 2020年9月,比利时政府签署协议,重申2025年逐步淘汰核电的承诺。西班牙承诺在2030年关闭其七座运作中的商业核子反应炉中的四座,在未来五年内关闭剩余三座,到2035年彻底淘汰核能发电。

随着可再生能源技术的发展和经济性的提高,核能发电得到了大规模成长。世界各国正在建造庞大的可再生能源基础设施,以抵销对核子反应炉的需求。核能发电正在被可再生能源发电所取代,这导致核子反应炉的关闭。因此,再生能源来源发展的激增对全球核子反应炉退役市场起到了重大推动作用。

因此,由于上述因素,预计商用核子反应炉将在预测期内占据研究市场的主导地位。

北美可望实现强劲成长

北美是世界上运作核子反应炉数量最多的地区之一。由于美国、加拿大和墨西哥的需求,核子反应炉退役市场预计将显着成长。

美国是最大的核能发电国之一,占2021年全球核能发电的30%。该国核子反应炉在2021年生产了778.15 TWh的电力,比2020年略有下降1.48%。

截至 2022 年 8 月,美国共有 92 座核子反应炉在运作,总合容量为 94.7 GWe,分布在 30 个州,由 30 家电力公司使用。两座核子反应炉正在兴建中,总合容量为223万千瓦。

美国的核能时代即将结束,核能发电厂除役已成为重要的产业。私人公司收购了这些工厂,并接管了许可证、责任、除役基金和废弃物处理合约。约有 41 座核子反应炉、总合容量为 1,997 万千瓦的反应器被关闭,最近关闭的是密西根州的帕利塞兹核电厂,该核电厂于 2022 年 5 月关闭。 2021 年 12 月,Holtec International 获得美国核能管理委员会的批准,收购、除役和拆除位于密西根州科弗特的帕利塞兹核电厂。预计到2030年将有约198座核子反应炉关闭。

美国的核子反应炉正在老化。美国美国核能管理委员会(NRC) 透过后续许可证续约 (SLR) 计画考虑将营运许可证延长 60 至 80 年的申请。然而,最近一些核电厂业主选择在45至50年后提前退休。

低成本页岩气发电的激烈竞争,损害了国内核能产业的竞争力。创纪录的低批发电价,加上高成本延长(PLEX)升级,导致核能发电厂提前退役。

多年来,加拿大一直在核能研究和技术领域处于领先地位,出口加拿大开发的核子反应炉系统。 2021年,加拿大核能发电厂发电量为92.6TWh,约占总发电量的15%。安大略省 19 座运转核子反应炉(总合容量 13,624 兆瓦)和 6 座核子反应炉(总合容量 214 万千瓦)于 2022 年 8 月关闭。

截至2022年8月,加拿大有多种研究和原型核子反应炉已不再使用并已关闭。这些核子反应炉目前处于安全储存状态,等待最终除役。这些核子反应炉包括 WR-1、Chalk River 实验室 (CRL) 的 NRX核子反应炉、CRL 的 MAPLE-1 和 MAPLE-2(多用途应用物理晶格实验)核子反应炉、魁北克省贝坎库尔的 Gentilly 1核能发电厂、安大略省罗尔夫顿的核能发电示范 (NPD)核子反应炉以及安大略省金站的道格拉斯角核能发电厂。预计这些将在预测期内推动加拿大核子反应炉退役市场的需求。

因此,预计预测期内北美核子反应炉退役市场将显着成长。

核子反应炉退役业概况

核子反应炉退役市场相当分散。市场的主要企业(不分先后顺序)包括巴布科克国际集团、福陆公司、通用电气日立核服务公司、AECOM 和西屋电气公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 调查前提条件

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2027 年市场规模与需求预测

- 核能发电量预测

- 近期趋势和发展

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 核子反应炉类型

- 压水式反应炉

- 加压重水反应器

- 沸水式反应炉

- 高温反应炉

- 液态金属快滋生反应器

- 其他核子反应炉

- 按应用

- 商业动力反应炉

- 原型炉

- 研究反应器

- 按容量

- 100MW以下

- 100-1000 MW

- 超过1000MW

- 按地区

- 北美洲

- 亚太地区

- 欧洲

- 南美洲

- 中东和非洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Babcock International Group PLC

- James Fisher & Sons PLC

- NorthStar Group Services Inc.

- Fluor Corporation

- GE Hitachi Nuclear Services

- Studsvik AB

- Enercon Services Inc.

- Orano Group

- Aecom

- Bechtel Group Inc.

- Westinghouse Electric Company

第七章 市场机会与未来趋势

The Nuclear Power Reactor Decommissioning Market is expected to register a CAGR of 13.8% during the forecast period.

Although the market studied was moderately impacted by the COVID-19 pandemic in 2020, it has been recovering and reached pre-pandemic levels.

The major factors driving the market's growth are the increasing number of nuclear reactors reaching operational retirement, declining prices of renewable power generation sources (i.e., wind and solar), and growing sensitivity toward environmental issues.

However, the lifetime extension of nuclear power plants with favorable government policies is expected to hinder the market's growth.

Nuclear phase-out policies in several countries, such as Germany, the United Kingdom, and South Korea, are expected to create opportunities for foreign and domestic players to provide the necessary expertise for the country's needs to develop their decommissioning market.

North America is expected to be the fastest-growing market for nuclear power reactor decommissioning, with the United States being one of the significant decommissioning hotspots in the region.

Nuclear Power Reactor Decommissioning Market Trends

Commercial Reactors Segment is Expected to Dominate the Market

As of October 2022, 437 commercial nuclear power plants were in operation across 32 countries. The United States had the largest nuclear electricity generation capacity and generated more nuclear electricity than any other country. France has the second-largest nuclear electricity generation capacity and second-highest nuclear electricity generation.

Several factors are responsible for the shutdown and decommissioning of commercial nuclear power plants, including economic, regulatory, and social factors. Some primary factors, such as the end of operational life and the fall in the cost of alternative energy generation sources, like solar and wind, made nuclear energy less cost-competitive. Following the Fukushima disaster of 2011, nuclear safety protocols have been upgraded across the world, which levied additional costs for the upgradation of infrastructure and increased operations and maintenance costs. Due to this, operators of many older commercial reactors, which have an operating life of 40 years and can be extended by 20 more years with infrastructural upgrades, are opting to decommission older units.

The policy-level initiatives from governments across the world have also led to the shutdown of nuclear power plants. The governments in many countries planned to reduce nuclear power in the energy mix of their countries. Such regulatory policies are prevalent among Western European states with a strong renewable portfolio and serious concerns about the environmental footprint and potential risk of operating commercial nuclear power plants.

As per its national policy, Germany plans to shut down all its reactors by the end of 2022. In 2017, Switzerland voted to phase-out nuclear power plants from the country. In September 2020, the Belgian government signed an agreement reaffirming its commitment to phasing-out nuclear power by 2025. Spain declared that it will close four of its seven operating commercial reactors by 2030 and close the rest three reactors within the next five years, completely phasing out nuclear generation by 2035.

The development of renewable energy technologies and increasing economic viability have led to its massive development. Countries across the world are creating huge infrastructures pertaining to renewable power, which has offset the requirement for nuclear reactors. Nuclear power generation is being replaced by renewable energy sources, which led to the closure of nuclear reactors. Therefore, the surge in the development of renewable energy sources is a big boost for the global nuclear reactor decommissioning market.

Therefore, due to the aforementioned factors, commercial rectors are expected to dominate the market studied during the forecast period.

North America is Expected to Witness Significant Growth

North America is one of the largest regions in terms of operable reactors worldwide. The nuclear power reactor decommissioning market is expected to witness significant growth due to the demand from the United States, Canada, and Mexico.

The United States is one of the largest nuclear power producers, accounting for 30% of the global nuclear power generated in 2021. The country's nuclear reactors produced 778.15 TWh of electricity in 2021, representing a slight decline of 1.48% from 2020.

As of August 2022, the United States has 92 operating nuclear power reactors with a combined capacity of 94.7 GWe in 30 states, used by 30 different power companies. Two reactors are under construction with a total of 2.23 GWe.

As the era of nuclear power winds down in the United States, the decommissioning of nuclear power plants is becoming a significant industry. Private companies are acquiring these plants, taking over their licenses, liability, decommissioning funds, and waste contracts. Around 41 reactors with a combined capacity of 19.97 GW were shut down, the latest being the Palisades nuclear plant in Michigan shut down in May 2022. In December 2021, HoltecInternational received approval from the Nuclear Regulatory Commission to acquire the Palisades plant in Covert, Michigan, to decommission and dismantle the plant. Around 198 reactors are expected to shut down by 2030.

The nuclear reactor fleet of the United States is aging. The United States Nuclear Regulatory Commission (NRC) is considering applications for extending operating licenses beyond 60 to 80 years with its subsequent license renewal (SLR) program. However, some plant owners recently opted for early retirement of their nuclear units at 45 to 50 years old.

Intense competition from electricity generation using low-cost shale gas hurt the competitiveness of the nuclear power industry in the country. Record low wholesale electricity prices and the high cost of life extension (PLEX) upgrades have together driven early nuclear plant retirements.

For many years, Canada has been a leader in nuclear research and technology, exporting reactor systems developed in Canada. In 2021, Canada generated 92.6 TWh of electricity from nuclear power plants, accounting for about 15% of the total electricity generation mix. In Ontario, 19 operable reactors with a combined capacity of 13,624 MW and around six reactors with a combined capacity of 2.14 GW were shut down in August 2022.

As of August 2022, Canada has a variety of research and prototype power reactors that are no longer in use and have been shut down. These reactors are in a safe storage state and awaiting final decommissioning. Some of these reactors include the WR-1, the NRX reactor at Chalk River Laboratories (CRL), the MAPLE-1 and MAPLE-2 (Multipurpose Applied Physics Lattice Experiment) reactors at CRL, the Gentilly-1 nuclear generating station in Becancour, QC, the Nuclear Power Demonstration (NPD) reactor in Rolphton, ON, and the Douglas Point nuclear-generating station in Kincardine, ON. These are expected to drive the demand for the Canadian nuclear power reactor decommissioning market during the forecast period.

Therefore, North America is expected to witness significant growth in the nuclear power reactor decommissioning market during the forecast period.

Nuclear Power Reactor Decommissioning Industry Overview

The nuclear power reactor decommissioning market is moderately fragmented. Some of the major players in the market (in no particular order) are Babcock International Group PLC, Fluor Corporation, GE Hitachi Nuclear Services, AECOM, and Westinghouse Electric Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Nuclear Power Generation Forecast in TWh, till 2027

- 4.4 Recent Trends and Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Reactor Type

- 5.1.1 Pressurized Water Reactor

- 5.1.2 Pressurized Heavy Water Reactor

- 5.1.3 Boiling Water Reactor

- 5.1.4 High-temperature Gas-cooled Reactor

- 5.1.5 Liquid Metal Fast Breeder Reactor

- 5.1.6 Other Reactor Types

- 5.2 By Application

- 5.2.1 Commercial Power Reactor

- 5.2.2 Prototype Power Reactor

- 5.2.3 Research Reactor

- 5.3 By Capacity

- 5.3.1 Below 100 MW

- 5.3.2 100-1000 MW

- 5.3.3 Above 1000 MW

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Asia-Pacific

- 5.4.3 Europe

- 5.4.4 South America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Babcock International Group PLC

- 6.3.2 James Fisher & Sons PLC

- 6.3.3 NorthStar Group Services Inc.

- 6.3.4 Fluor Corporation

- 6.3.5 GE Hitachi Nuclear Services

- 6.3.6 Studsvik AB

- 6.3.7 Enercon Services Inc.

- 6.3.8 Orano Group

- 6.3.9 Aecom

- 6.3.10 Bechtel Group Inc.

- 6.3.11 Westinghouse Electric Company