|

市场调查报告书

商品编码

1686658

水电-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Hydropower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

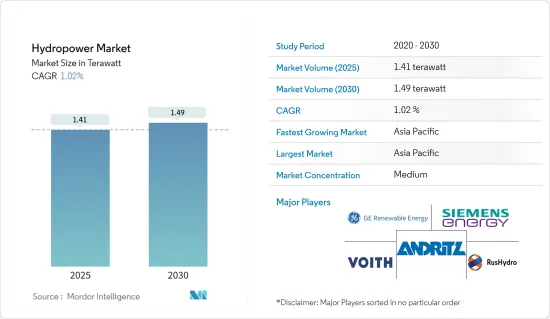

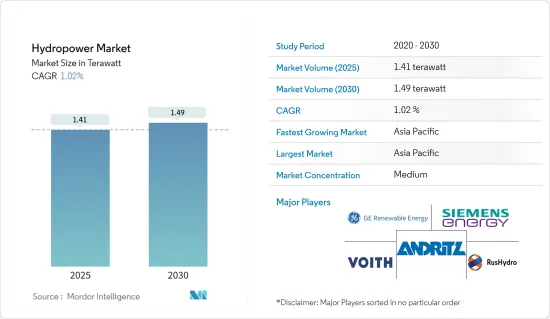

预计 2025 年水电市场规模为 1.41兆瓦,预计到 2030 年将达到 1.49兆瓦,预测期内(2025-2030 年)的复合年增长率为 1.02%。

主要亮点

- 从中期来看,预计预测期内,政府支持下的新水力发电发电工程增加以及对可靠电力的需求不断增长等因素将推动市场发展。

- 另一方面,发电工程对环境的不利影响可能会在预测期内阻碍市场成长。

- 然而,旨在增加水力发电的新技术趋势预计将在未来几年为水力发电市场创造重大机会。

- 由于亚太地区各国对发电工程的投资不断增加,预计该地区将占据市场主导地位。

水力发电市场趋势

大型水力发电(100MW以上)领域占据市场主导地位

- 大型水力发电是一种利用流水获取的可再生能源发电形式,用于驱动大型水轮机。为城市生产大量水力发电需要湖泊、水库和水坝来储存和调节水量,以便日后用于发电、灌溉、家庭或工业用途。由于大型水力发电设施可以轻鬆开启和关闭,因此水力发电比大多数其他能源来源更可靠,可以满足全天的尖峰时段电力需求。

- 传统水力发电厂、抽水蓄能电站和径流式水力发电厂是世界各地大型水力发电厂的不同类型。

- 根据国际可再生能源机构的数据,2022年全球水力发电投资约为75.5亿美元,而2021年约为78.3亿美元。对新水力发电装置容量的持续投资正在推动全球大型水力发电领域的成长。此外,大型水力发电的平均安装成本相对较低。

- 中国、巴西、美国、加拿大、印度、日本是世界上开发大型水力发电发电工程的主要国家。预计在预测期内,向更清洁能源来源的转变以及增加世界主要已开发经济体和新兴经济体可再生能源在总发电量中的比重的计划等因素将推动大型水力发电行业的发展。

- 除了主要水力发电生产国外,东南亚地区较小的国家也迅速进行大规模水力发电开发。湄公河经济对能源的需求不断增长,引起了流域国家对水力发电开发的浓厚兴趣。近几十年来,全部区域发电工程的投资巨大。

- 例如,寮国政府宣布计画完成12个水力发电厂计划,总装置容量为195万千瓦。寮国政府计划在2030年向邻国出口约20,000兆瓦电力,水电开发是该计画的核心重点。

- 2022 年 5 月,Drax Group PLC 向克鲁坎发电厂投资 6.16 亿美元。该公司计划为其克鲁坎发电厂增加 600MW 地下抽水蓄能容量。该公司计划在 2030 年将克鲁坎发电站的容量翻一番,现场工程将于 2024 年开始。该公司计划挖空本克鲁坎洞穴并挖掘约 200 万吨岩石,以容纳发电站和相关基础设施。

- 因此,由于上述因素,预计大型水力发电(100兆瓦以上)部分将在预测期内主导全球水力发电市场。

亚太地区占市场主导地位

- 近年来,亚太地区一直占据水力发电市场的主导地位,预计在预测期内将继续占据主导地位。根据国际可再生能源机构的数据,截至 2022 年,中国是全球水力发电市场的领导者,装置容量为 413.5 吉瓦。

- 中国已宣布计画在2060年实现碳中和,到2025年煤炭消费达到高峰。这将带动可再生能源领域的投资增加,到2022年将新增水力发电装置容量约2,250万千瓦。

- 2023年5月,中国国家发展与改革委员会宣布,将核准在西藏自治区建造一座新的水力发电厂,资金支持约84.3亿美元。年平均发电量超过112.8亿度。

- 此外,2023年2月,印度核准投资39亿美元,用于国家水电公司(NHPC)在阿鲁纳恰尔邦的迪邦水力发电发电工程(2,880兆瓦(MW)),预计计划工期为9年。

- 因此,由于上述因素,预计亚太地区将在预测期内主导全球水力发电市场。

水力发电产业概况

水电市场正在变得半固体。主要公司包括通用电气再生能源公司、西门子能源股份公司、安德里茨股份公司、福伊特有限公司和 PJSC RusHydro。

2022年3月,安德里茨与泰国电力局(EGAT)签署谅解备忘录,共同探索并拓展泰国及邻近东南亚国家发电工程的商机。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 装置容量及2029年预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 可靠电力的需求不断增加

- 政府加强对水力发电的支持

- 限制因素

- 发电工程对环境的不利影响

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 规模

- 大型水力发电(100MW以上)

- 小型水力(小于10MW)

- 其他规模(10-100MW)

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- GE Renewable Energy

- Siemens Energy AG

- Andritz AG

- Voith GmbH & Co. KGaA

- China Yangtze Power Co. Ltd

- PJSC RusHydro

- Electricite de France SA(EDF)

- Iberdrola SA

- Market Ranking/Share Analysis

第七章 市场机会与未来趋势

- 旨在提高水力发电量的新技术趋势

The Hydropower Market size is estimated at 1.41 terawatt in 2025, and is expected to reach 1.49 terawatt by 2030, at a CAGR of 1.02% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, gactors such as the increasing number of new hydropower projects backed by government support and the rising demand for reliable electricity are expected to drive the market during the forecast period.

- On the other hand, negative environmental consequences of hydropower projects are likely to hinder the market growth during the forecast period.

- Nevertheless, emerging technological trends aimed at increasing hydropower generation are expected to provide significant opportunities for the hydropower market in the coming years.

- Asia-Pacifc is estimated to dominate the market due to increasing investment in hydropower projects across the various countries in the region.

Hydropower Market Trends

The Large Hydropower (Greater Than 100 MW) Segment to Dominate the Market

- Large-scale hydropower is a form of renewable energy generation derived from flowing water, which is used to drive large water turbines. In order to generate large amounts of hydroelectricity for cities, lakes, reservoirs, and dams are needed to store and regulate water for later release for power generation, irrigation, and domestic or industrial use. Since large-scale hydropower facilities can easily be turned on and off, hydropower has become more reliable than most other energy sources for meeting peak electricity demands throughout the day.

- Conventional hydroelectric dams, pumped storage, and run-of-the-river are the different types of large-scale hydropower plants worldwide.

- As per International Renewable Energy Agency, around USD 7.55 billion was invested in hydropower globally in 2022, whereas around USD 7.83 billion was invested in 2021. The constant investment in new hydropower capacity globally drives growth in large hydropower segments. Also, the average cost of large hydropower installation is comparatively low.

- China, Brazil, the United States, Canada, India, and Japan are the major countries in the deployment of large-scale hydropower projects across the world. Factors such as a shift towards cleaner energy sources and plans to increase the share of renewable energy in the total power generation mix across all the major developed and emerging economies across the world are expected to drive the large hydropower segment during the forecast period.

- In addition to the major hydropower countries, smaller countries from the Southeast Asia region are also moving forward rapidly in the large hydropower development. Increasing demand for energy to boost the Mekong economy has attracted riparian countries' keen interest in hydropower development. Over the last few decades, this has been evidenced by extensive investment in hydropower projects across the region.

- For instance, the Lao government announced that it plans to complete 12 hydropower dam projects with a total capacity of 1,950 MW. Hydropower development is a central priority of the Lao government's plan to export around 20,000 MW of electricity to its neighboring countries by 2030.

- In May 2022, Drax Group PLC invested USD 616 million in the Cruachan power station. The company planned to add 600 MW of underground pumped storage hydropower capacity to the Cruachan power station. The company plans to double the Cruachan facility's capacity by 2030, and work on-site begins in 2024. The company plans to hollow out a cavern in Ben Cruachan and excavate around two million tons of rock to house the power station and related infrastructure.

- Therefore, based on the factors mentioned above, the large hydropower (greater than 100 MW) segment is expected to dominate the global hydropower market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asian-Pacific region has dominated the hydropower market in recent years, and it is likely to maintain its dominance during the forecast period. According to International Renewable Energy Agency, as of 2022, China is the global leader in the hydropower market, with an installed capacity of 413.5 GW.

- China announced its plan to become carbon neutral by 2060 and peak coal consumption by 2025. This led to increased investment in the renewable sector, and in 2022, around 22.5 GW of new hydropower was installed.

- In May 2023, the National Development and Reform Commission (NDRC) of China announced to approval construction of a new hydropower plant in the Xizang Autonomous region which will have capital backing of around USD 8.43 billion. The annual average electricity volume produced by the plant will surpass 11.28 billion kilowatt-hours.

- Further, in February 2023, India approved a USD 3.9 billion investment for the 2,880 megawatts (MW) Dibang hydropower project in Arunachal Pradesh, National Hydroelectric Power Corporation (NHPC), and it is estimated that this project will take nine years to build.

- Therefore, based on the factors mentioned above, Asia-Pacific is expected to dominate the global hydropower market during the forecast period.

Hydropower Industry Overview

The hydropower market is semi-consolidated. Some of the major players include (not in particular order) GE Renewable Energy, Siemens Energy AG, Andritz AG, Voith GmbH & Co. KGaA, and PJSC RusHydro, among others.

In March 2022, ANDRITZ and the Electricity Generating Authority of Thailand (EGAT) signed a Memorandum of Understanding (MoU) to jointly explore and expand business opportunities for hydropower projects in Thailand and surrounding Southeast Asian countries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in GW, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Demand for Reliable Electricity

- 4.5.1.2 Increasing Government Support for Hydropower Gneeration

- 4.5.2 Restraints

- 4.5.2.1 Negative Environmental Consequences of Hydropower Projects

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Size

- 5.1.1 Large Hydropower (Greater Than 100 MW)

- 5.1.2 Small Hydropower (Smaller Than 10 MW)

- 5.1.3 Other Sizes (10-100 MW)

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 GE Renewable Energy

- 6.3.2 Siemens Energy AG

- 6.3.3 Andritz AG

- 6.3.4 Voith GmbH & Co. KGaA

- 6.3.5 China Yangtze Power Co. Ltd

- 6.3.6 PJSC RusHydro

- 6.3.7 Electricite de France SA (EDF)

- 6.3.8 Iberdrola SA

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Technological Trends Aimed at Increasing Hydropower Generation