|

市场调查报告书

商品编码

1687172

小型液化天然气 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Small-scale LNG - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

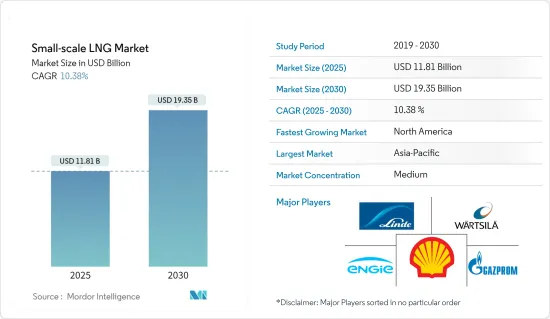

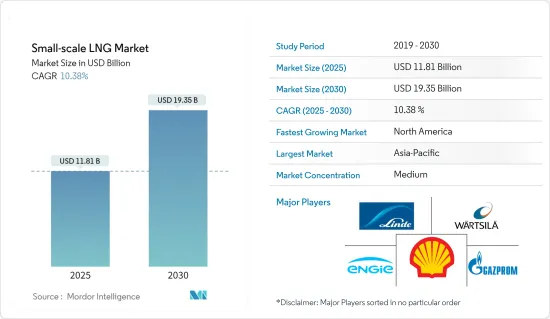

小型液化天然气市场规模预计在 2025 年为 118.1 亿美元,预计到 2030 年将达到 193.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.38%。

关键亮点

- 从长远来看,燃料库、道路运输和离网电力对液化天然气的需求不断增长等因素将在未来几年推动小规模液化天然气市场的发展。

- 另一方面,小型液化天然气营业成本高、中东和非洲等地区缺乏配套基础设施、资本支出要求高以及超过12年的长期回收期等因素预计将阻碍市场成长。

- 然而,由于小型液化天然气基础设施所需的资本支出较高,开发具有成本效益的小型液化天然气基础设施预计将为小型液化天然气技术供应商和运输商提供重大机会。

- 亚太地区占据市场主导地位,预测期内可能以显着的复合年增长率成长。

小型液化天然气市场趋势

预计运输领域将主导市场

- LNG主要用作卡车和船舶的燃料,主要是因为它在经济和环境方面优于柴油和燃料油。 LNG无腐蚀性、无毒,可使车辆的使用寿命延长三倍。此外,由于液化天然气的沸点极低,因此在高压下仅需少量的热量和可忽略不计的机械能即可将其转化为气态。这使得液化天然气成为一种高效率的运输燃料。

- 处理液化天然气是一项艰鉅的任务,因为即使是微小的温差也可能导致燃料沸腾和汽化。这使得乘用车的实用性远不及商用卡车等大型车辆。这限制了液化天然气在运输领域的使用。

- 使用液化天然气作为运输燃料在世界各地日益普及。中国、美国和欧洲已经开始部署以液化天然气为燃料的卡车,主要用于远距货运。这主要归功于政府在脱碳和控制排放气体方面的政策和倡议,例如中国六号排放标准和欧洲绿色交易。

- 欧盟委员会于2019年制定的《欧洲绿色交易》是一系列倡议倡议,旨在2050年使欧洲实现碳中和。该措施简洁地强调了液化天然气在实现目标中的重要性,并强调使用液化天然气作为卡车和船舶的燃料。

- 根据壳牌《2024年液化天然气展望》,截至2023年,共有469艘液化天然气燃料船舶投入运营,另有537艘液化天然气燃料船舶订单。随着越来越多的船东和营运商意识到液化天然气对环境和气候的益处,液化天然气燃料船舶的订单成长速度比以往任何时候都要快。

- 新兴经济体也计划为未来运输使用液化天然气奠定基础。例如,Venture World LNG 于 2024 年 3 月开始建造其液化天然气船队。该船队包括目前在韩国建造的 9 艘船舶——其中 6 艘载货能力为 174,000 立方米,3 艘载货能力为 200,000 立方米。

- 因此,由于上述因素,预测期内运输领域对小型液化天然气基础设施的需求可能会成长,并在很大程度上主导市场。

亚太地区占市场主导地位

- 近年来,亚太地区已成为全球实施小型液化天然气计划的先驱。随着中国、印度、新加坡和日本等国家对天然气的需求不断增长,近年来人们对使用小型液化天然气(SSLNG)的兴趣也日益浓厚。

- 中国是世界主要国家之一,带动液化天然气需求增加。 2022年液化天然气进口量约6,440万吨。需求激增使中国成为世界上最大的液化天然气进口国之一。随着中国液化天然气买家签署每年超过 2,000 万吨的长期合同,需求也随之增加。

- 中国的天然气市场由国内生产和透过管道和液化天然气终端进口组成。在中国,工业、住宅和发电领域对小型液化天然气的需求正在成长,其中运输领域的潜力最大。柴油价格相对于天然气的高企,推动了道路上液化天然气卡车数量的增加,预计将成为中国小型液化天然气设施兴起的主要原因。

- 在印度,小规模液化天然气尚处于起步阶段。不过,LNG站有好几座,而且LNG是用LNG卡车运输的。为了在2030年将天然气在其能源结构中的比例提高到15%,印度可能会建造小型液化天然气设施,向没有管道基础设施的偏远地区供应天然气。例如,2022 年 6 月,国有天然气勘探和生产公司 GAIL Limited 宣布,其计划在未连接液化天然气管道的地区建立小型液化设施。

- 2024年3月,印度石油和天然气部长为印度首个小型液化天然气装置推出,该装置由印度天然气公司在中央邦维贾伊普尔设立。

- 新加坡港的液化天然气燃料库设施正在推动新加坡小规模液化天然气业务。新加坡是一个主要的贸易港口,在国际航运领域中处于世界领先地位。

- 因此,鑑于上述情况,预计亚太地区将在预测期内主导小型市场的成长。

小型液化天然气产业概况

小型液化天然气市场较为分散。市场的主要企业(不分先后顺序)包括林德集团 (Linde PLC)、瓦锡兰集团 (Wartsila Oyj ABP)、壳牌集团 (Shell PLC)、Engie SA 和 PJSC Gazprom。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 至2029年的市场规模及需求预测(单位:美元)

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 增加对液化天然气基础设施的投资

- 燃料库、道路运输和离网电力对液化天然气的需求不断增加

- 限制因素

- 中东和非洲等地区缺乏基础设施

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 类型

- 液化终端

- 再气化终端

- 供货形式

- 追踪

- 转运和燃料库

- 管道和铁路

- 应用

- 运输

- 工业原料

- 发电

- 其他的

- 市场分析:按地区分類的市场规模和到 2028 年的需求预测(按地区划分)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 俄罗斯

- 西班牙

- 北欧的

- 义大利

- 土耳其

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 越南

- 马来西亚

- 印尼

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 卡达

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- 小型液化天然气技术供应商

- Linde PLC

- Wartsila Oyj ABP

- Baker Hughes Company

- Honeywell UoP

- Chart Industries Inc.

- Black & Veatch Holding Company

- 小型液化天然气海运公司

- Anthony Veder Group NV

- Engie SA

- Evergas AS

- 小型液化天然气营运商

- Shell PLC

- Eni SpA

- PJSC Gazprom

- TotalEnergies SE

- Gasum Oy

- 市场排名/份额(%)分析

- 小型液化天然气技术供应商

第七章 市场机会与未来趋势

- 开发具有成本效益的小型液化天然气基础设施

简介目录

Product Code: 55955

The Small-scale LNG Market size is estimated at USD 11.81 billion in 2025, and is expected to reach USD 19.35 billion by 2030, at a CAGR of 10.38% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as increasing demand for LNG in bunkering, road transportation, and off-grid power will drive the small-scale LNG market in the coming years.

- On the other hand, factors such as the high operation cost of small-scale LNG, lack of supporting infrastructure in regions such as the Middle East and Africa, and high CAPEX requirements, along with a long payback period of more than 12 years, are expected to hinder the growth of the market.

- However, owing to the high capital expenditure required for a small-scale LNG infrastructure, developing cost-efficient small-scale LNG infrastructure is expected to provide significant opportunities to small-scale LNG technology providers and transporters.

- The Asia-Pacific region dominates the market and will likely witness a significant CAGR during the forecast period.

Small-scale LNG Market Trends

The Transportation Segment Expected to Dominate the Market

- LNG is primarily used to fuel trucks and ships, mainly due to its economic and environmental benefits, compared to diesel and fuel oil. Since LNG is non-corrosive and non-toxic, it can extend the life of a vehicle by up to three times. Moreover, since LNG has an extremely low boiling point, very little heat is required to convert it into a gaseous form at high pressure, with negligible mechanical energy. This makes LNG an efficient fuel for transportation.

- Handling LNG is an immense task since even a slight difference in the temperature can lead to the boiling and vaporization of fuel, which, in turn, leads to fuel wastage. Therefore, it makes passenger cars far less viable than heavy vehicles, such as commercial trucks. This has limited the application of LNG in the transportation segment.

- The use of LNG as a transportation fuel is gaining momentum across the world. China, the United States, and Europe have already started deploying LNG-powered trucks, mainly for long-distance freight carriage. This is mainly due to the government policies and regulations on decarbonizing and emission control, such as China VI and the European Green Deal.

- Formed in 2019 by the European Commission, the European Green Deal is a set of policy initiatives to make Europe carbon-neutral by 2050. The policies briefly underline the importance of LNG in reaching the aim, and they emphasize the usage of LNG as fuel for trucks and marine vessels.

- According to Shell LNG Outlook 2024, as of 2023, there were 469 LNG-fueled vessels in operation, and 537 LNG-fueled vessels were on order. The rapidly growing order book for LNG-fuelled vessels has witnessed rapid growth compared to previous years, and increasing numbers of ship owners and operators understand LNG's environmental and climate benefits.

- New emerging economies are also planning to lay the foundation for the future of LNG for transportation. For instance, in March 2024, Venture Global LNG started the construction of a new large fleet of LNG-powered vessels. The fleet includes nine vessels (Six vessels having a cargo capacity of 174,000 m3 and three with a cargo capacity of 200,000 m3) currently under construction in South Korea.

- Hence, owing to the above-mentioned factors, the demand for small-scale LNG infrastructure for the transportation segment will likely grow and significantly dominate the market during the forecast period.

Asia-Pacific to Dominate the Market

- In recent years, Asia-Pacific has been a pioneer in implementing small-scale LNG projects globally. Interest in using small-scale LNG (SSLNG) has increased in recent years as the demand for natural gas increases in countries like China, India, Singapore, and Japan.

- China is one of the world's major countries, which led to the growth in LNG demand. LNG imports totaled around 64.4 million tons in 2022. Due to this surge in demand, China became one of the world's largest LNG importers. The increased demand is due to Chinese LNG buyers signing long-term contracts for more than 20 million tons annually.

- China's natural gas market includes domestic production and import via pipelines and LNG terminals. In China, the rising demand for small-scale LNG is from the industrial, residential, and power generation sectors, with the highest potential being in the transportation sector. Growth in the number of LNG trucks due to the higher price of diesel, compared to natural gas, is expected to be the prime reason small LNG facilities are growing in China.

- In India, small-scale LNG is in a very nascent stage. However, there are a few LNG stations where LNG transportation through LNG trucks is taking place. To increase the share of natural gas to 15% in its energy mix by 2030, India will likely construct small-scale LNG facilities for natural gas supply to remote places with no pipeline infrastructure. For instance, in June 2022, GAIL Limited, a government-owned natural gas explorer and producer company, aimed to set up small liquefaction facilities for areas not connected to LNG pipelines.

- In March 2024, the Union Minister of Petroleum and Natural Gas of India launched the country's first small-scale LNG unit set up by GAIL at Vijaipur in Madhya Pradesh.

- The LNG bunkering facilities in the ports of Singapore majorly drive small-scale LNG business in Singapore. Singapore has one of the leading trade ports and is one of the global leaders in international marine shipping.

- Therefore, owing to the above points, Asia-Pacific is expected to dominate the growth of the small-scale market during the forecast period.

Small-scale LNG Industry Overview

The small-scale LNG market is semi-fragmented. Some of the major players in the market (in no particular order) include Linde PLC, Wartsila Oyj ABP, Shell PLC, Engie SA, and PJSC Gazprom.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Investment in LNG Infrastructure

- 4.5.1.2 Rising Demand for LNG in Bunkering, Road Transportation, and Off-grid Power

- 4.5.2 Restraints

- 4.5.2.1 Lack of Supporting Infrastructure in the Regions such as the Middle East and Africa

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Liquefaction Terminal

- 5.1.2 Regasification Terminal

- 5.2 Mode of Supply

- 5.2.1 Truck

- 5.2.2 Transshipment and Bunkering

- 5.2.3 Pipeline and Rail

- 5.3 Application

- 5.3.1 Transportation

- 5.3.2 Industrial Feedstock

- 5.3.3 Power Generation

- 5.3.4 Other Applications

- 5.4 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 NORDIC

- 5.4.2.7 Italy

- 5.4.2.8 Turkey

- 5.4.2.9 Rest of the Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Vietnam

- 5.4.3.6 Malaysia

- 5.4.3.7 Indonesia

- 5.4.3.8 Australia

- 5.4.3.9 Rest of the Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Qatar

- 5.4.5.6 Nigeria

- 5.4.5.7 Rest of the Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Small-scale LNG Technology Providers

- 6.3.1.1 Linde PLC

- 6.3.1.2 Wartsila Oyj ABP

- 6.3.1.3 Baker Hughes Company

- 6.3.1.4 Honeywell UoP

- 6.3.1.5 Chart Industries Inc.

- 6.3.1.6 Black & Veatch Holding Company

- 6.3.2 Small-scale LNG Marine Transporter

- 6.3.2.1 Anthony Veder Group NV

- 6.3.2.2 Engie SA

- 6.3.2.3 Evergas AS

- 6.3.3 Small-scale LNG Operators

- 6.3.3.1 Shell PLC

- 6.3.3.2 Eni SpA

- 6.3.3.3 PJSC Gazprom

- 6.3.3.4 TotalEnergies SE

- 6.3.3.5 Gasum Oy

- 6.3.4 Market Ranking/Share (%) Analysis

- 6.3.1 Small-scale LNG Technology Providers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Development of Cost-efficient Small-scale LNG Infrastructure

02-2729-4219

+886-2-2729-4219