|

市场调查报告书

商品编码

1687775

氢气:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Hydrogen Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

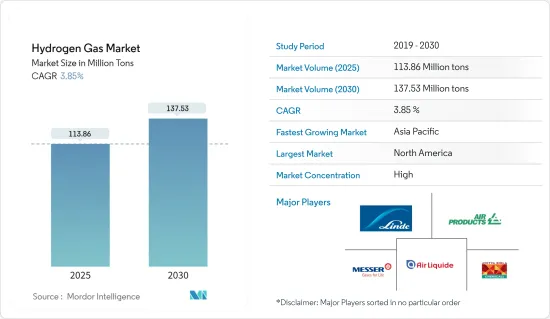

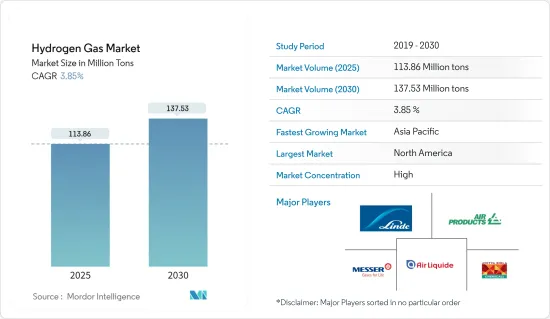

预计2025年氢气市场规模为1.1386亿吨,2030年将达到1.3753亿吨,市场估计和预测期(2025-2030年)的复合年增长率为3.85%。

随着政府和产业投资氢气作为清洁能源解决方案,推动对燃料电池和基础设施发展的需求,氢气市场预计将扩大。

主要亮点

- 从中期来看,化学工业需求增加以及炼油厂氢气使用增加等因素预计将推动市场发展。

- 另一方面,蓝氢氢和绿色氢生产成本高、运输和储存成本上升等因素可能会抑制市场成长。

- 然而,太空探勘和航空领域的应用不断增加、燃料电池电动车的需求不断增长以及低碳经济中氢能产业的准备等因素可能会成为预测期内市场成长的机会。

- 亚太地区在氢气市场占据主导地位,由于中国和印度的巨大需求,预计未来将继续保持这一地位。

氢气市场趋势

预计氨生产将主导市场需求

- 氨是世界上最重要的化学物质之一。工业界主要使用哈伯-博施法(也称为非生物或人工固氮)来生产氨。

- 哈伯-博施法是工业氨生产的基础,它促进了大气中氮和氢的化学反应。这是在高温高压下使用铁或钼等金属基催化剂完成的。

- 通常,哈伯-博施法所需的氢气来自石化燃料。生产氢气的主要方法是透过蒸气重组天然气与蒸汽发生反应。

- 考虑到储存和运输氢气的挑战,氨和化肥生产设施通常会整合氢气发生器(HGU)。这些装置利用石化燃料(包括天然气)和其他进料重整器。

- 根据美国地质调查局(USGS)的资料,预计2023年全球合成氨产量将达到1.5亿吨,与前一年同期比较增加3.45%。

- 2023 年全球氨产量以东亚为主导,产量约 6,460 万吨。尤其是中国,已成为世界上最大的氨生产国,产量约 4,300 万吨。

- 美国地质调查局预测,未来四年全球氨产能将成长 6%。

- 美国是世界第三大氨生产国,拥有 16 家公司营运的 35 个生产设施,产量达 1,400 万吨。

- 鑑于这些动态,未来几年市场可能会发生重大变化。

亚太地区可望主导氢气市场

- 亚太地区对氢气的需求庞大。亚太地区是全球市场容量成长最快的地区,预计将在全球氢气市场保持主导地位。

- 中国和印度是世界上最大的氢气需求国之一,这得益于两国在世界各地实施的支持政策和各种计划。

- 2022年3月,中国政府公布了首个涵盖2021年至2035年的长期氢能规划。此综合战略着重于分阶段加速国内氢能产业的发展,重点在于技术进步和製造能力。该计画的目标是到2025年实现每年利用可再生能源生产10万至20万吨氢气的目标,并在2035年推动可再生氢能对经济的渗透,以支持中国的绿色能源转型。该计画也鼓励在未来15年内大幅扩大利用各种可再生能源生产氢气的规模,并提倡采用多样化的技术路径,而不是依赖单一的方法。

- 据中国氢能联盟称,中国预计氢气需求将激增,到 2030 年将达到 3,500 万吨,占全国能源供应的至少 5%。预计这项需求将进一步成长,到2050年将达到6,000万吨(占能源供应的10%),到2060年最终将达到1亿吨(占能源供应的20%)。预计到2025年,氢能产业的产值将达到1兆元(1,574.4亿美元)。

- 2023年1月,印度政府宣布了国家氢能计画。这是一项战略倡议,旨在使该国成为绿色氢气的主要生产国和出口国。该项目预算为 19,744 亿印度卢比(约 23 亿美元),目标是到 2030 年实现绿色氢气年产量达到 500 万吨(MMT),并增加约 125 吉瓦的可再生能源产能。

- 此外,中国和印度分别是世界上最大的氨生产国和消费量,这使得这些国家成为氢气的主要市场。

- 预计在预测期内,该地区氢市场的成长将受到所有这些因素的推动。

氢气产业概况

氢气市场本质上是整合的。主要企业(不分先后顺序)包括液化空气集团、林德集团、空气产品及化学品公司、Aditya Birla Chemicals 和 Messer SE &Co.KGaA。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 化学工业需求增加

- 扩大炼油厂氢气的使用

- 其他的

- 市场限制

- 蓝氢和绿氢生产成本高

- 运输和仓储成本高

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按通路

- 管道

- 高压管拖车

- 圆柱

- 按应用

- 氨

- 甲醇

- 精製

- 直接还原铁(DRI)

- 燃料电池汽车(FCV)

- 其他用途(玻璃、焊接、发电等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Aditya Birla Chemicals

- Air Liquide

- Air Products and Chemicals Inc.

- BASF SE

- Equinor ASA

- Gujarat Alkalies and Chemicals Limited

- Gulf Cryo

- Linde PLC

- Lords Chloro Alkali Limited

- Matheson Tri-Gas Inc.

- Messer SE & Co. KGaA

- PAO NOVATEK

- Taiyo Nippon Sanso Corporation

- Universal Industrial Gases Inc.

第七章 市场机会与未来趋势

- 增加航太航空业的就业机会

- 燃料电池电动车需求不断成长

- 低碳经济中的氢能产业

The Hydrogen Gas Market size is estimated at 113.86 million tons in 2025, and is expected to reach 137.53 million tons by 2030, at a CAGR of 3.85% during the forecast period (2025-2030).

The hydrogen gas market is expected to proliferate as governments and industries invest in hydrogen as a clean energy solution, driving demand for fuel cells and infrastructure development.

Key Highlights

- Over the medium term, factors such as increasing demand from the chemical industry and expanding usage of hydrogen in refineries are likely to drive the market studied.

- On the flip side, factors such as the high production cost of blue and green hydrogen and increased transportation and storage costs are likely to restrain the market's growth.

- However, factors such as increased space exploration and aviation adoption, increasing demand for fuel-cell electric vehicles, and industry readiness of hydrogen in a low-carbon economy are likely to act as growth opportunities for the market over the forecast period.

- Asia-Pacific dominates the market for hydrogen gas and is expected to remain so, owing to massive demand from China and India.

Hydrogen Gas Market Trends

Ammonia Production Expected to Dominate Market Demand

- Ammonia ranks among the world's most vital chemicals. Industries predominantly utilize the Haber-Bosch process, also referred to as abiotic or artificial nitrogen fixation, for ammonia production.

- The Haber-Bosch method, a cornerstone of industrial ammonia production, facilitates chemical reactions between atmospheric nitrogen and hydrogen. This occurs under elevated temperatures and pressures, employing metal-based catalysts like iron and molybdenum.

- Typically, hydrogen in the Haber-Bosch process is sourced from fossil fuel feedstocks. The predominant method for hydrogen generation involves reacting natural gas with steam in a steam reforming unit.

- Given the challenges associated with storing and transporting hydrogen gas, ammonia and fertilizer production facilities often integrate hydrogen generation units (HGUs). These units utilize fossil fuels (including natural gas) and other feed reformers.

- Data from the United States Geological Survey (USGS) revealed that in 2023, global ammonia production reached 150 million metric tons, marking a 3.45% increase from the previous year.

- East Asia led global ammonia production in 2023, churning out approximately 64.6 million metric tons. Notably, China emerged as the world's top ammonia producer, contributing around 43 million metric tons.

- USGS forecasts indicate a projected 6% rise in global ammonia capacity over the next four years.

- The United States, holding the position of the third-largest global ammonia producer, generated 14 million metric tons across 35 facilities operated by 16 companies.

- Given these dynamics, the market is poised for significant shifts in the coming years.

Asia-Pacific Expected to Dominate Hydrogen Gas Market

- Enormous demand for hydrogen gas exists in the Asia-Pacific region. It is expected to be the fastest-growing region in the world in terms of market volume and maintain its dominant position in the global hydrogen gas market.

- China and India are among the world's largest countries in terms of demand for hydrogen gas due to supportive policies and various projects undertaken by these countries worldwide.

- In March 2022, the Chinese government unveiled its first long-term hydrogen plan for the period of 2021-2035. This comprehensive strategy focuses on a phased approach to foster the development of a domestic hydrogen industry, emphasizing technological advancements and manufacturing capabilities. The plan aims to achieve an annual hydrogen production target of 100,000 to 200,000 tonnes from renewable sources by 2025 and facilitate the widespread adoption of renewable hydrogen in the economy to support China's transition toward green energy by 2035. Furthermore, the plan encourages the significant expansion of hydrogen production from various renewable sources over the next 15 years, promoting a diversified approach to technology pathways rather than relying on a single method.

- According to the China Hydrogen Alliance, China anticipates a surge in hydrogen demand, reaching 35 million tons by 2030, constituting at least 5% of the country's energy supply. This demand is projected to rise further to 60 million tons (10% of energy supply) by 2050, eventually reaching 100 million tons (20% of energy supply) by 2060. The hydrogen industry is expected to generate an output value of CNY 1 trillion (USD 157.44 billion) as early as 2025.

- In January 2023, the Government of India unveiled the National Hydrogen Mission, a strategic initiative to establish the country as a prominent producer and exporter of green hydrogen. With a budget of INR 19,744 crore (~USD 2.3 billion) approved by the Union Cabinet, the mission aims to have an annual production capacity of 5 million metric tonnes (MMT) of green hydrogen by 2030, accompanied by a renewable energy capacity addition of approximately 125 GW.

- In addition, the global production and consumption of ammonia are at their highest in China and India, with these countries becoming major markets for hydrogen gases.

- The growth of the hydrogen market in the region is likely to be driven by all these factors over the forecast period.

Hydrogen Gas Industry Overview

The hydrogen gas market is consolidated in nature. The major players (not in any particular order) include Air Liquide, Linde PLC, Air Products and Chemicals Inc., Aditya Birla Chemicals, and Messer SE & Co. KGaA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand From Chemical Industry

- 4.1.2 Expanding Usage of Hydrogen in Refineries

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 High Production Cost of Blue and Green Hydrogen

- 4.2.2 High Transportation and Storage Cost

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Distribution

- 5.1.1 Pipelines

- 5.1.2 High-pressure Tube Trailers

- 5.1.3 Cylinders

- 5.2 By Application

- 5.2.1 Ammonia

- 5.2.2 Methanol

- 5.2.3 Refining

- 5.2.4 Direct Reduced Iron (DRI)

- 5.2.5 Fuel Cell Vehicles (FCV)

- 5.2.6 Other Applications (Glass, Welding, Power Generation, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aditya Birla Chemicals

- 6.4.2 Air Liquide

- 6.4.3 Air Products and Chemicals Inc.

- 6.4.4 BASF SE

- 6.4.5 Equinor ASA

- 6.4.6 Gujarat Alkalies and Chemicals Limited

- 6.4.7 Gulf Cryo

- 6.4.8 Linde PLC

- 6.4.9 Lords Chloro Alkali Limited

- 6.4.10 Matheson Tri-Gas Inc.

- 6.4.11 Messer SE & Co. KGaA

- 6.4.12 PAO NOVATEK

- 6.4.13 Taiyo Nippon Sanso Corporation

- 6.4.14 Universal Industrial Gases Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Adoption in Space Exploration and Aviation Industry

- 7.2 Increasing Demand for Fuel Cell Electric Vehicles

- 7.3 Industry Readiness of Hydrogen in Low Carbon Economy