|

市场调查报告书

商品编码

1689841

P2G(电转气) -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Power to Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

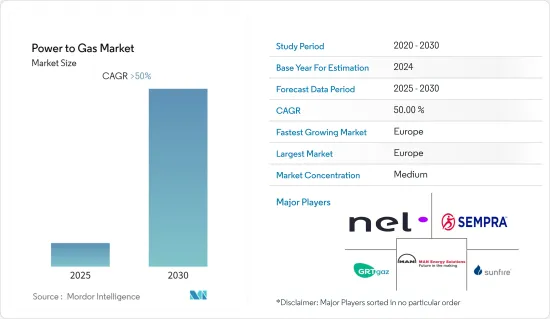

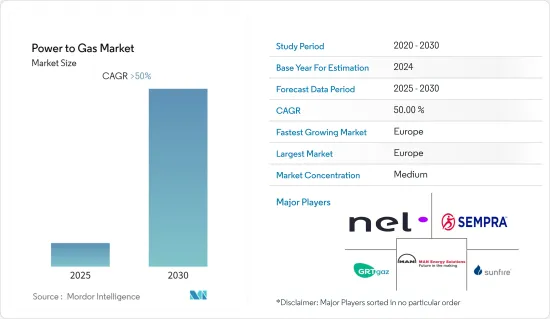

预计预测期内 P2G(电转气)市场复合年增长率将超过 50%。

2020 年,新冠疫情对市场产生了负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从长远来看,脱碳进程的进展以减少温室气体对气候的影响以及再生能源来源的出现导致电力成本的下降是推动市场发展的关键因素。

- 然而,建立电转气 (P2G) 工厂的高初始成本以及发展中经济体和已开发经济体对甲烷和氢气额外运输管道基础设施的需求预计将减缓市场成长。

- 预计市场上开发绿色氢基础设施的倡议将很快为电转气市场的参与企业创造重大机会。

- 预计欧洲将主导电力天然气市场,需求来自德国、法国和西班牙等国家。

燃气发电市场趋势

电力-氢能是成长最快的领域

- 氢能发电包括一系列利用电力进行电解将水分解为氢气和氧气的技术。利用可再生能源生产的氢气称为绿色氢气,可用于储存、运输和利用可再生能源。这有助于最大限度地减少风能和太阳能等可再生能源的变化,透过电解槽提供长期储存和电网平衡服务,并利用现有的天然气输送基础设施以绿色氢气的形式远距输送能源。

- 此外,目前有近350个计划正在开发中,总容量达54吉瓦,预计2030年开始运作。如果所有计画中的计划都能按时运作,预计到2030年,全球电解槽生产的绿色氢气供应量将达到每年800万吨。

- 电解槽产生的绿色氢气也可以直接用作运输燃料,取代轻型车辆、铁路和船舶应用中的石油,或用作工业应用的原料。绿色氢燃料电池还可以用于能源储存。

- 该技术较目前的能源储存技术具有储能容量大、放电时间长等优点。氢气也可以直接注入天然气系统。然而,出于安全和技术的考虑,氢气注入受到各国不同法规的约束。例如,英国天然气管网对氢气的限制为0.1%,而荷兰则为12%。

- 随着太阳能和风能等可再生能源技术成本的下降,电转气(P2G)等能源储存技术变得越来越有吸引力。过去几年,商用电解槽系统的装置容量一直在稳定增加。目前只有少数几种具有商业性可行性的水电电解技术,其中应用最广泛的两种是碱性水电电解(AWE) 和质子交换膜 (PEM)电解。

- 因此,由于上述因素,预计预测期内氢能发电领域将成长最快。

欧洲主导市场

- 截至 2021 年,欧洲是电转气市场最大的地区之一。该地区政府不断增加的投资和津贴正在推动市场的发展。

- 根据欧盟委员会预测,2021年炼油业将占氢气消费量的48%,其次是化肥和化工产业。

- 德国是欧洲电力和天然气转换市场领先的国家之一。截至 2020 年,德国约有 40 个小型电转发电工程,这些项目利用主要来自风能和太阳能先导计画的剩余绿色电力进行电解,将水分解为氧气和氢气,以生产零碳燃料。

- 据德国天然气和水务协会 (DVGW) 称,德国旨在为家庭、工厂和汽车开发零碳燃料,并计划在 2023 年建成 5GW 的发电能力,到 2050 年建成 40GW 的发电能力。因此,在预测期内,此类政府目标可能会推动该地区电转气市场的发展。

- 2022年1月,蒂森克虏伯伍德氯气工程公司与壳牌公司签署了荷兰鹿特丹港「Hydrogen Holland I」大型计划供货合约。根据合约,蒂森克虏伯伍德将基于其 20 兆瓦大型碱性水力发电电解模组设计、采购和建造一座 200 兆瓦的电解厂。壳牌已做出最终投资计划(FID),第一座电解槽的建设预计将于 2022 年底开始,并于 2024 年开始生产。

- 作为俄乌战争爆发后 2022 年 5 月通过的一项协议的一部分,欧盟旨在透过增加可再生能源发电来减少对俄罗斯天然气进口的过度依赖。该计画的关键支柱之一是「氢能加速器」战略,旨在到2030年生产1000万吨可再生氢能,并向欧盟进口1000万吨。由于绿色氢能是可再生的,该计划旨在支持欧盟的能源转型,并为大部分重工业的脱碳做出贡献。

- 同样,欧盟于2022年5月与欧洲电解槽製造商设定了目标,设定了一个全行业目标,即到2025年将欧洲电解槽製造能力提高近十倍,从1.75吉瓦/年增加到17.5吉瓦/年。

- 因此,由于上述因素,预计欧洲将在预测期内占据市场主导地位。

P2G(电转气)产业概览

从本质上来说,电转气(P2G)市场处于适度整合状态。市场的主要企业(不分先后顺序)包括 Nel ASA、Sempra Energy、GRT Gaz SA、MAN Energy Solutions 和 Sunfire GmbH。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 研究假设和市场定义

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2027 年市场规模与需求预测(百万美元)

- 现有发电厂按地区和容量列表

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 依技术

- P2H(Power to Hydrogen)

- P2M(Power to Methane)

- 以体积(仅定性分析)

- 超过1000千瓦

- 100~1,000KW

- 100KW以下

- 最终用户

- 公共产业

- 工业的

- 商业的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Nel ASA

- Sempra Energy

- GRT Gaz SA

- MAN Energy Solutions

- Sunfire GmbH

- Ineratec GmbH

- Electrochaea GmbH

- MicroPyros BioEnerTec GmbH

- Siemens Energy AG

- Hitachi Zosen Inova AG

- AquahydreX Inc.

第七章 市场机会与未来趋势

简介目录

Product Code: 68840

The Power to Gas Market is expected to register a CAGR of greater than 50% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, the major driving factors of the market were increasing decarbonization to reduce the impact of greenhouse gases on the climate and reduction in the cost of electricity with the advent of renewable energy sources.

- On the flip side, high initial costs to set up power-to-gas plants and the need for additional transportation pipeline infrastructure in underdeveloped and developed economies for methane or hydrogen is expected to slow down the market growth.

- Increasing initiatives in developing the infrastructure of green hydrogen in the emerging markets are expected to create vital opportunities for the power-to-gas market players soon.

- Europe is expected to dominate the power to gas market, with most of the demand coming from countries like Germany, France, and Spain.

Power to Gas Market Trends

Power-to-hydrogen to be the Fastest-growing Segment

- Power-to-hydrogen includes a range of technologies that utilize electricity to perform electrolysis and split water into hydrogen and oxygen. When hydrogen is manufactured using renewable energy, it is called green hydrogen and can be used to store, transport, and utilize renewable energy. This helps minimize variable renewable energy curtailment from sources such as wind and solar, provides long-term storage and grid-balancing services via electrolyzers, and uses existing gas transmission infrastructure for transporting energy in the form of green hydrogen over long distances.

- Additionally, nearly 350 projects with an aggregate capacity of 54 GW are currently under development and expected to come online by 2030; 40 other projects accounting for almost 35 GW capacity are in the early stages of development. If all planned projects are commissioned within time, it is expected that by 2030, the global green hydrogen supply from electrolyzers could reach 8 million tons per year.

- The green hydrogen produced by electrolyzers can also be used directly as a fuel for transport, replacing oil in light vehicles, railways, and marine applications, or as a feedstock for industrial applications. Green hydrogen fuel cells can also be used for energy storage.

- The technology offers advantages over current energy storage technologies, such as higher power storage capacity and longer discharge times. Hydrogen can also be injected directly into natural gas grids. However, due to safety and technical concerns, hydrogen injection is subject to regulations and varies from country to country. For instance, the limit of hydrogen in natural gas grids in the United Kingdom is 0.1%, while it is 12% in the Netherlands.

- Due to the falling costs of renewable energy technologies like solar and wind, energy storage technologies like power-to-gas (PtG) technology are becoming increasingly attractive. The installed capacity of commercial electrolyzer systems has been growing steadily over the past few years. There are only a few commercially viable water electrolysis technologies, and the two most widely used technologies are alkaline water electrolysis (AWE) and proton exchange membrane (PEM) electrolysis.

- Therefore, owing to the above factors, the power-to-hydrogen segment is expected to be the fastest-growing segment over the forecast period.

Europe to Dominate the Market

- As of 2021, Europe was one of the largest regions in the power-to-gas market. Increasing investments and funding grants by governments in the region are driving the market.

- In 2021, according to the European Commission, the refinery sector accounted for 48% of the hydrogen consumption, followed by the fertilizers and chemical sectors.

- Germany is one of the major countries in the European power-to-gas market. As of 2020, Germany was home to around 40 small power-to-gas pilot projects that harnessed surplus green power, mainly from wind and solar projects, to carry out electrolysis by splitting water into oxygen and hydrogen to produce zero-carbon fuel.

- According to Deutscher Verein des Gas- und Wasserfaches (DVGW), Germany is planning to build a power-to-gas capacity of 5 GW by 2023 and 40 GW by 2050 as it seeks to develop zero-carbon fuels for homes, factories, and vehicles. Thus, such government targets are likely to boost the power-to-gas market in the region during the forecast period.

- In January 2022, ThyssenKrupp Uhde Chlorine Engineers signed a supply contract with Shell for the large-scale project Hydrogen Holland I in Rotterdam, Netherlands port. Under the agreement, ThyssenKrupp Uhde will engineer, procure, and fabricate a 200 MW electrolysis plant based on their large-scale 20 MW alkaline water electrolysis module. The first construction work for the electrolysers that has begun with Shell's final investment decision (FID) to build the project is expected at the end of 2022, after which the intended start of production will be in 2024.

- After the commencement of the Russian-Ukraine war, as a part of the passed in May 2022, the EU aims to reduce overreliance on Russian gas imports by increasing renewable energy generation. One of the primary tenets of the plan is the 'hydrogen accelerator' strategy, which aims to produce 10 million tonnes and import 10 million tonnes of renewable hydrogen into the EU by 2030. As green hydrogen is renewable, the plan aims to support the EU's energy transition and help in the decarbonisation of many heavy industries.

- SImilarly, in May 2022, the EU set up a target with European electrolyzer manufacturers and set up an industry-wide target of increasing Europe's electrolyser manufacturing capacity from 1.75 GW/year to nearly ten times to 17.5 GW per year by 2025.

- Thus, owing to the above factors, Europe is expected to dominate the market during the forecast period.

Power to Gas Industry Overview

The power-to-gas market is moderately consolidated in nature. Some of the major players in the market (in no particular order) include Nel ASA, Sempra Energy, GRT Gaz SA, MAN Energy Solutions, and Sunfire GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions and Market Definition

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million till 2027

- 4.3 List of Existing Power-to-gas Plants by Region and Capacity

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Power-to-Hydrogen

- 5.1.2 Power-to-Methane

- 5.2 By Capacity (Qualitative Analysis Only)

- 5.2.1 More than 1000 KW

- 5.2.2 100 to 1000 KW

- 5.2.3 Less than 100 KW

- 5.3 y End-User

- 5.3.1 Utilities

- 5.3.2 Industrial

- 5.3.3 Commercial

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nel ASA

- 6.3.2 Sempra Energy

- 6.3.3 GRT Gaz SA

- 6.3.4 MAN Energy Solutions

- 6.3.5 Sunfire GmbH

- 6.3.6 Ineratec GmbH

- 6.3.7 Electrochaea GmbH

- 6.3.8 MicroPyros BioEnerTec GmbH

- 6.3.9 Siemens Energy AG

- 6.3.10 Hitachi Zosen Inova AG

- 6.3.11 AquahydreX Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219