|

市场调查报告书

商品编码

1687802

印度壁纸:市场占有率分析、产业趋势与统计、成长预测(2025-2030)India Wallpapers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

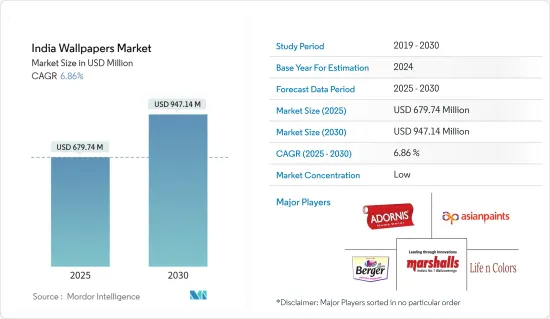

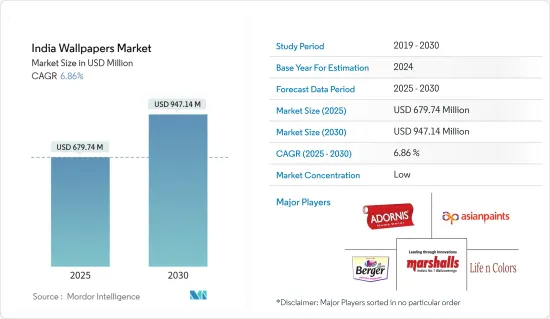

预计 2025 年印度壁纸市场规模为 6.7974 亿美元,到 2030 年将达到 9.4714 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.86%。

印度壁纸产业正经历光明的成长前景和一些值得注意的趋势。印度消费者可支配收入的增加,以及对室内装潢和设计的日益关注,推动了住宅和商业空间对壁纸的需求。

主要亮点

- 室内设计师和家居装饰师在创造时尚、实用的生活空间以满足住宅的需求方面发挥着至关重要的作用。印度的企业格局正在迅速扩张,导致新办公空间建设激增,对室内设计服务的需求也增加。这些设计趋势正在塑造散发风格并提高生产力和创造力的办公空间。住宅和商业环境中对壁纸的需求不断增加,主要是因为设计师希望赋予墙壁清新、现代的美感并改变空间。

- 壁纸越来越受欢迎,因为它具有频谱的设计、图案和纹理。从经典图案到当代抽象风格,壁纸提供了多种客製化选择,满足了不同的美学偏好。这种广泛的多样性使消费者能够个性化他们的空间,使壁纸成为室内装潢的首选。

- 消费者越来越意识到投资高品质、耐用的装饰品的价值。壁纸的长期可靠性意味着更少的重新装修支出,这对于注重预算的住宅来说是一个引人注目的因素。虽然壁纸的初始成本可能高于油漆,但从长远来看,由于减少了频繁重新粉刷和修补的需要,壁纸成为更具成本效益的选择。住宅可以节省材料和人事费用。

- 壁纸材料和印刷技术提高了壁纸的耐用性和可客製化性,增强了我们的产品供应。电子商务平台的兴起使得人们能够获得各种壁纸设计,进一步促进了市场的成长。此外,室内设计师的影响力日益增强以及住宅现代化也鼓励消费者尝试壁纸,从而促进该行业的扩张和成长。

- 提高对传统壁纸替代品的认识需要展示不同的选择及其好处,这可能会限制壁纸市场的扩张。市场拥有各种各样的替代品,从油漆和墙贴到布板、人造板、金属板、壁画和 3D 墙板。这些替代品之所以脱颖而出,是因为它们易于安装、经济高效、外观多样且维护成本低。

印度壁纸市场的趋势

住宅行业正在快速成长

- 在各种独特因素和产业动态的推动下,印度的住宅装饰产业正在经历强劲成长。人们越来越关注室内美学,以提高家居的功能性、舒适性和氛围,对情绪和幸福感产生积极影响,从而推动该行业的重大发展。消费者可支配所得的激增也是促成因素。

- 以不同颜色和纹理装饰的墙壁不仅具有情感衝击力,而且还改善了家居的整体氛围。与西方不同,在西方,壁纸通常用于整个家庭,而在印度,壁纸通常在特色墙上使用。这种美学选择影响了印度壁纸类型的供应、价格和成本效益。

- 例如,印度住宅市场预计将在 2023 年大幅成长,推出的新房住宅将超过 350.75 千套,高于 2021 年的 146.63 千套。儘管需求强劲,但住宅推出量仍维持在较高水平,预计将持续成长。

- 随着住宅产业的现代化和房地产居住空间的扩大,该地区的壁纸製造、分销和销售格局仍然强劲。预计这一成长轨迹将在预测期内为壁纸製造商创造巨大的市场机会。

- 随着虚拟壁纸视觉化的出现,印度的家居壁纸选择将发生重大转变。这项创新技术融合了虚拟实境和扩增实境的优势。该预览器采用尖端扩增实境(AR) 技术,将有助于推动印度市场对壁纸的需求。 AR 技术可以呈现您选择的壁纸设计,并将其缩放到每个选定的墙壁。顾客可以选择适合自己家的壁纸。这进一步支持了壁纸销售的成长。

电子商务领域显着成长

- 电子商务平台具有跨越地理界限的广泛覆盖范围。这将使印度壁纸製造商和零售商能够接触到更广泛的受众,包括无法进入实体店的偏远地区的客户。

- 印度电子商务平台透过提供各种设计、纹理、DIP壁纸、主题选项等壁纸占据了相当大的市场占有率。这些平台为消费者提供了广泛的选择,满足了不同的美学偏好和室内设计需求。网路购物的便利性,加上详细的产品描述和客户评论,进一步推动了这个细分市场的成长。

- 例如,2020 年印度直接面向消费者 (D2C) 领域的线上家居装饰市场价值约为 20 亿美元。预计到 2024 年,该市场规模将达到 38 亿美元。因此,印度家居装饰透过线上模式发展的趋势表明,随着印度家居装饰趋势的增长,壁纸的需求量巨大。

- 印度壁纸製造商透过选择电子商务销售管道将获得巨大收益。透过消除对实体店的需求,您可以减少租金、水电费和人事费用等开支。因此,壁纸的价格更具竞争力,提高了其吸引力和可负担性。製造商可以利用这些资讯来微调他们的产品线,调整他们的行销策略,并专注于特定的客户群。

- 开放数位商务网路 (ONDC) 的扩张及其与庞大商家网路的连结将为印度电子商务壁纸市场的成长创造有利条件,推动更大的市场覆盖率、产品多样性、业务效率、消费者信任度和本土产品采用率的提高。 2023年5月,印度政府开放电子商务网路ONDC扩展到全国236个城市,新增商家超过36,000家。因此,印度壁纸市场可以随着透过电子商务平台提供更广泛的产品而成长。

印度壁纸产业概况

印度壁纸市场的特点是竞争对手之间的竞争非常激烈。市场被各种现有的供应商分割,例如 Asian Paints Ltd、Berger Paints Ltd、Life n Colors Private Limited、Adornis Wallpapers、Marshalls Wallcoverings 等。该行业典型的竞争加剧往往会压低价格并挤压整体盈利。品牌知名度已成为关键因素,反映出消费者对知名品牌的强烈偏好。此外,由于主要企业在成熟市场占据主导地位,市场渗透率也在上升。根据分析,预测期内竞争对手之间的竞争预计仍将十分激烈。

- 2024 年 2 月,印度领先的涂料行业跨国公司亚洲涂料 (Asian Paints) 与着名设计师 Sabyasachi伙伴关係推出了巴黎-加尔各答系列。该系列受到被称为“东方巴黎”的加尔各答的启发,呈现出多样化的阵容。该系列包括 30 多种壁纸和 120 多种织物,分为四卷独特的版本。从华丽的锦缎到重新设计的基里姆地毯和佩斯利涡旋花纹,该系列体现了 Sabyasachi 对北非和波斯充满活力的露天市场和集市的诠释。

- 2024年2月,知名奢华壁纸品牌Life n Colors推出最新系列Suneherii。这款优质系列无缝结合了复杂的细节,为超豪华壁纸设计树立了新标准。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章市场分析

- 市场概况(根据相关HS编码对壁纸进出口趋势进行全面分析)

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场动态

- 市场驱动因素

- 基础建设发展和生活方式的改变

- 越来越多的消费者选择装饰壁纸而不是油漆

- 市场挑战

- 了解替代品的可用性壁纸

- 暴露在高温和潮湿的环境中会缩短其寿命

第六章市场区隔

- 按类型

- 乙烯基塑料

- 不织布

- 纸本/传统壁纸

- 织物

- 按分销管道

- 电子商务

- 零售

- 按最终用户

- 住宅

- 商业的

- 饭店业

- 公司办公室

- 沙龙和水疗中心

- 医院

- 其他商业最终用户

第七章竞争格局

- 公司简介

- Marshalls Wallcoverings

- Elementto Lifestyle Wallcoverings Pvt. Ltd

- Excel Wallcoverings

- Eximus Wallpaper

- Adornis Wallpapers

- Gratex Industries Ltd

- Woltop India Pvt. Ltd

- Ultra Walls(Sonu Art)

- Asian Paints Ltd

- Berger Paints Ltd

- D'Decor Home Fabrics Pvt. Ltd

- Life n Colors Private Limited

- Wallskin(Green Apple Design Pvt. Ltd)

- Jaypore E-Commerce Private Limited(Aditya Birla Fashion & Retail Limited)

- India Circus by Krsnaa Mehta(A Godrej Venture)

第八章 市场机会与未来趋势

The India Wallpapers Market size is estimated at USD 679.74 million in 2025, and is expected to reach USD 947.14 million by 2030, at a CAGR of 6.86% during the forecast period (2025-2030).

The Indian wallpaper industry is experiencing promising growth prospects and several notable trends. The increasing focus on interior decoration and design, along with the growing disposable income of Indian consumers, is driving the demand for wallpapers in residential and commercial spaces.

Key Highlights

- Interior designers and home decorators are pivotal in crafting stylish and functional living spaces that cater to homeowners' needs. India's corporate landscape is witnessing rapid expansion, showing a surge in new office constructions and a heightened demand for interior design services. These designer trends shape office spaces that exude style and enhance productivity and creativity. The increasing demand for wallpaper in residential and commercial settings is predominantly influenced by designers aiming to give walls a fresh, modern aesthetic, transforming the space.

- Wallpapers' rising popularity is due to their broad spectrum of designs, patterns, and textures. From classic motifs to contemporary and abstract styles, wallpapers provide a versatile canvas for customization, catering to a diverse range of aesthetic tastes. This extensive variety allows consumers to personalize their spaces, making wallpapers a preferred choice for interior decoration.

- Consumers increasingly recognize the value of investing in high-quality, long-lasting decor. Wallpaper's long-term reliability means fewer expenditures on redecorating, which can be a compelling factor for budget-conscious homeowners. Although the initial cost of wallpaper may be higher than paint, the reduced need for frequent repainting and touch-ups makes wallpaper a more cost-effective option over time. Homeowners can save on both materials and labor costs.

- Wallpaper materials and printing technologies enhance product offerings, making wallpapers more durable and customizable. The rise of e-commerce platforms facilitates more access to various wallpaper designs, further propelling the market's growth. Furthermore, the growing influence of interior designers and modernizing homes encourage consumers to experiment with wallpapers, thereby contributing to the sector's expansion and growth.

- Boosting awareness of alternatives to conventional wallpaper entails showcasing a range of options and their benefits, potentially constraining the wallpaper market's expansion. The market boasts diverse substitutes, from paint and wall decals to fabric panels, wood paneling, metal sheets, murals, and 3D wall panels. These alternatives stand out for their easy installation, cost-effectiveness, diverse aesthetics, and low maintenance requirements.

India Wallpapers Market Trends

Residential Sector to Grow Rapidly

- The home decor industry is experiencing significant expansion in India, driven by various unique factors and industry dynamics. The escalating focus on interior aesthetics to enhance the home's functionality, comfort, and ambiance, positively impacting mood and well-being, is the driving force behind the industry's remarkable progress. The surge in consumer disposable income is also a factor.

- A well-decorated wall, with its varied colors and textures, not only influences emotions but also improves the home's overall ambiance. Unlike in the West, where wallpaper is often used throughout the house, Indians typically use wallpaper to create accent walls. This aesthetic choice impacts the availability, price, and cost-effectiveness of wallpaper types in India.

- For instance, the Indian residential market witnessed a significant surge in 2023, with the launch of over 350.75 (in thousands) new housing units, an increase from 146.63 (in thousands) in 2021. Despite robust demand, the trend of consistently high residential launches continues and is expected to continue to grow in the coming years.

- With the housing sector undergoing modernization and real estate residential spaces expanding, the stage is set for a robust wallpaper manufacturing, distribution, and selling landscape in the region. This growth trajectory is poised to unlock substantial market opportunities for wallpaper manufacturers during the forecast period.

- The selection of home wallpaper is about to transform India owing to virtual wallpaper visualization significantly. This innovative technology merges the strengths of virtual and augmented reality. Previewers, which uses cutting-edge augmented reality (AR) technology, assists in propelling the demand for wallpapers in the Indian market. AR technology renders and scales the chosen wallpaper design onto each selected wall. Customers are assisted in choosing the suitable wallpaper for their homes. This further supports the growth of wallpaper in terms of value sales.

E-commerce Segment to Witness Significant Growth

- E-commerce platforms provide a vast reach beyond geographical boundaries. This allows Indian wallpaper manufacturers and retailers to showcase their products to a much wider audience, including customers in remote areas who may not have access to physical stores.

- E-commerce platforms in India are capturing a substantial market share by offering a diverse range of wallpapers, including various designs, textures, DIP wallpapers, and theme-based options. These platforms provide consumers with a wide selection, catering to different aesthetic preferences and interior design needs. The convenience of online shopping, coupled with the availability of detailed product descriptions and customer reviews, has further fueled the growth of this market segment.

- For instance, in 2020, the online home decor market in India's direct-to-consumer (D2C) sector was valued at approximately USD 2 billion. In 2024, this market is projected to reach a value of USD 3.8 billion. Thus, the trend of home decor in India through online modes shows a significant demand for wallpaper along with growth in the trend of home decor in India.

- Indian wallpaper manufacturers stand to benefit significantly by opting for e-commerce sales channels. By sidestepping the need for physical stores, they can slash expenses tied to rent, utilities, and staffing. These savings, in turn, enable them to price their wallpapers more competitively, enhancing their appeal and affordability. Manufacturers can harness this information to fine-tune their product lines, align marketing strategies, and focus on specific customer demographics.

- Open Network for Digital Commerce's (ONDC) expansion and collaboration with a vast network of merchants create favorable conditions for the growth of the Indian e-commerce wallpaper market, fostering increased market reach, product variety, operational efficiency, consumer trust, and promotion of domestic products. In May 2023, the Indian government's open e-commerce network, ONDC, expanded to 236 cities nationwide and added over 36,000 new merchants. As a result, the Indian wallpaper market can experience growth due to the availability of a more extensive product range through e-commerce platforms.

India Wallpapers Industry Overview

The Indian wallpaper market is characterized by intense competitive rivalry. The market is fragmented with various established vendors such as Asian Paints Ltd, Berger Paints Ltd, Life n Colors Private Limited, Adornis Wallpapers, Marshalls Wallcoverings, and more. This heightened rivalry, typical of the industry, tends to push prices down, squeezing overall profitability. Brand recognition emerges as a pivotal factor, reflecting consumers' strong preference for well-established brands. Moreover, market penetration is on the rise, bolstered by the dominance of key players in mature markets. The analysis indicates that the competitive rivalry is poised to maintain its intensity during the forecast period.

- February 2024: Asian Paints, a leading Indian multinational in the paint industry, unveiled its Paris-Calcutta Collection in partnership with renowned designer Sabyasachi. Drawing inspiration from Kolkata, often dubbed the 'Paris of the East,' the collection features a diverse range. It includes over 30 distinct wallpapers and a rich selection of more than 120 fabrics, presented across four unique volumes. The collection encapsulates Sabyasachi's interpretation of North Africa and Persia's vibrant souks and bazaars, from grand damasks to reimagined kilims and paisleys.

- February 2024: Life n Colors, a prominent luxury wallpaper brand, launched its latest collection, Suneherii. This exclusive line seamlessly blends intricate detailing, setting a new standard for ultra-luxury wallpaper designs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview (Covers Export Import Trend Analysis of Wallpapers Based on Relevant HS Code)

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Infrastructural Development and Changing Lifestyle

- 5.1.2 Growing Consumer Preference for Decorative Wallpaper Instead of Painting

- 5.2 Market Challenges

- 5.2.1 Awareness for Alternatives Availability of Wallpaper

- 5.2.2 Shorter Life-span on Exposure to Heat and Moisture

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Vinyl-based

- 6.1.2 Non-woven

- 6.1.3 Paper/Traditional Wallpaper

- 6.1.4 Fabric (Textile)

- 6.2 By Distribution Channel

- 6.2.1 E-commerce

- 6.2.2 Retail

- 6.3 By End User

- 6.3.1 Residential

- 6.3.2 Commercial (Covers the Trend Analysis for the Listed Commercial Applications)

- 6.3.2.1 Hospitality

- 6.3.2.2 Corporate Office Space

- 6.3.2.3 Salons and Spas

- 6.3.2.4 Hospitals

- 6.3.2.5 Other Commercial End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Marshalls Wallcoverings

- 7.1.2 Elementto Lifestyle Wallcoverings Pvt. Ltd

- 7.1.3 Excel Wallcoverings

- 7.1.4 Eximus Wallpaper

- 7.1.5 Adornis Wallpapers

- 7.1.6 Gratex Industries Ltd

- 7.1.7 Woltop India Pvt. Ltd

- 7.1.8 Ultra Walls (Sonu Art)

- 7.1.9 Asian Paints Ltd

- 7.1.10 Berger Paints Ltd

- 7.1.11 D'Decor Home Fabrics Pvt. Ltd

- 7.1.12 Life n Colors Private Limited

- 7.1.13 Wallskin (Green Apple Design Pvt. Ltd)

- 7.1.14 Jaypore E-Commerce Private Limited (Aditya Birla Fashion & Retail Limited)

- 7.1.15 India Circus by Krsnaa Mehta (A Godrej Venture)