|

市场调查报告书

商品编码

1851919

壁纸:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Wallpaper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

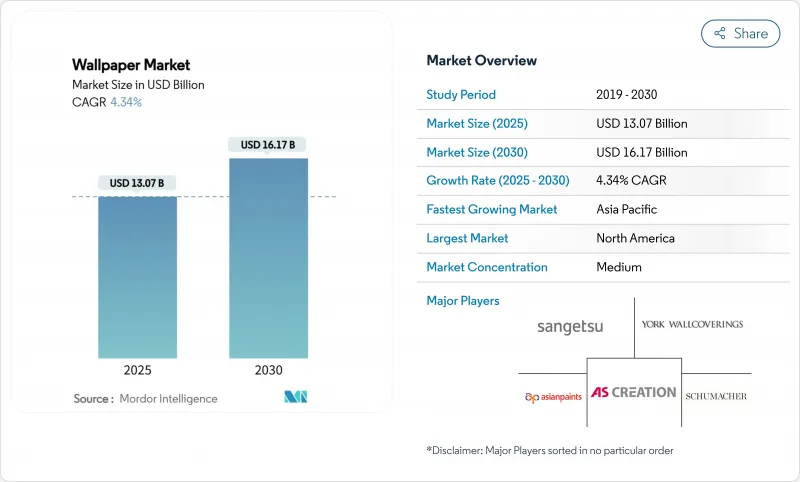

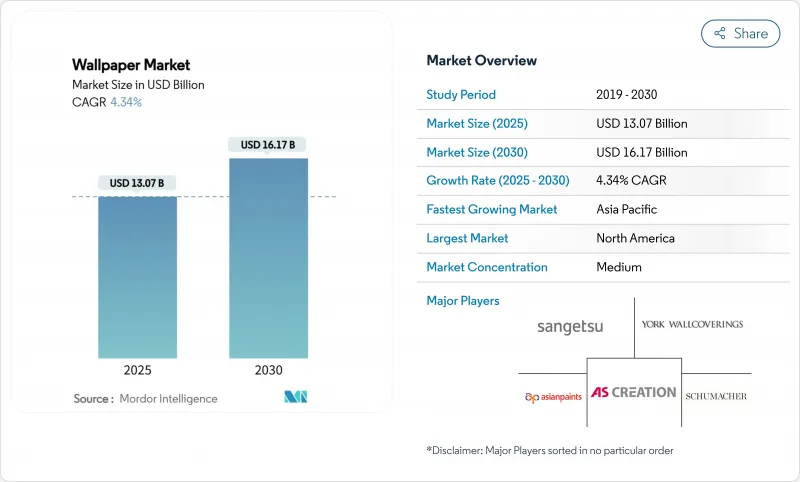

全球壁纸市场预计到 2025 年将达到 130.7 亿美元,到 2030 年将达到 161.7 亿美元,在此期间的复合年增长率为 4.34%。

数位印刷、抗菌涂层和自黏基材的融合,加上家庭装修的激增、饭店翻新週期的加快以及中等收入家庭对室内美学日益增长的期望,将推动市场需求。目前,商业应用引领着这一趋势,海湾合作委员会(GCC)和东协地区的饭店建筑项目持续指定使用能够承受高强度维护的优质耐用壁纸。随着东南亚各国政府补贴经济适用房项目,以及北美房主选择独特的装饰而非例行粉刷,住宅应用正在加速成长。儘管供应链面临PVC价格波动和关税上涨的挑战,製造商正透过垂直整合、长期树脂合约以及非乙烯基基材的创新来确保净利率。竞争优势则依赖全通路分销、永续性认证以及透过客製印刷快速将设计概念转化为成品捲材。

全球壁纸市场趋势与洞察

北美和欧洲对数位印刷个人化配件的需求激增

Roland DG 和Panasonic Housing Solutions(以下简称Panasonic)宣布,按需数位印刷技术使设计师摆脱了製版和最低起订量的限制,能够实现系列化图案、低至 2 毫米的触感 3D 纹理以及快速原型製作,从而缩短从设计到施工的周期。 Roland DG 和Panasonic Housing Solutions 也推出了 DIMENSE 技术,该技术无需额外的压纹工序即可产生雕塑般的表面。高端涂料製造商 Benjamin Moore 与 Alpha 研讨会合作,推出每码售价 125 美元的手工绘製壁纸。欧洲领导企业 Sanderson Design Group 也正积极开拓这个市场,推出融合传统工艺与现代科技的产品,每卷售价在 13,900 日元至 35,100 日元之间,这表明富裕阶层愿意为 Sanderson 独特的品牌故事买单。电子商务加速了普及:Graham & Brown 的 B2B 入口网站在短短 12 週内就实现了 90% 的客户采用率,减少了订购摩擦和库存风险,提高了製造商的利润率,并使数位化工作流程成为客製化住宅和精品商业计划的预设模式。

东南亚城市中等收入住宅的快速成长

2024年第一季,印尼建筑业占GDP的10.23%,而越南在2025年上半年建造了超过60万套社会住宅。印尼的「百万套房屋」计画等政府计画以及卡达支持的融资管道,正在提升首次购屋者的购买力,并鼓励他们选择既注重品牌导向又经济实惠的装修方案。亚洲开发银行预测,2025年区域GDP成长率将达到4.5%,这将支撑家庭装修支出。国际生产商纷纷在区域内设立工厂,以规避关税并缩短前置作业时间,而本土品牌则利用进口替代奖励。千禧世代的线上购物习惯正在推动数位客製化平台的流量成长,并进一步增强对数位印刷产品的需求。

市面上有许多替代品可供选择

涂料、装饰面板和数位显示器不断提升其价值提案,随着易于维护和互动内容的兴起,壁纸的市场份额正在被蚕食。剪切机涂料的PaintShield技术将杀菌保护直接融入涂料中,可在两小时内杀死99.9%的细菌,从而占据了以往专供特种壁纸的预算。纹理涂料、墙贴和植物墙满足了亲生物设计理念,而模组化面板系统则使办公室能够在一夜之间重新配置空间。日益丰富的选择迫使壁纸生产商更加重视触感深度、材料循环利用和安装效率。

细分市场分析

预计到2025年,不织布产品将以6.06%的复合年增长率成长,超过壁纸市场的整体成长速度。透气且尺寸稳定的基材简化了安装和拆卸过程。由于其医用级的耐用性和市场竞争力,预计到2024年,乙烯基材料将保持32.43%的市场份额。然而,环保意识正在推动对生物基PVC、再生PET和无溶剂油墨的需求。纸质产品在传统家居中逐渐减少,但仍蓬勃发展,因为在这些家居环境中,真实性比易于维护更为重要。织物表面覆盖物触感温暖,并具有内建隔音功能,使其成为高端小众空间的理想选择。 Boras Peter的Viared工厂展现了其技术上的多样性,在同一屋檐下运作表面印刷、凹版印刷、丝网印刷和数位印刷机,以匹配每种材料的印刷特性。

不织布的发展动能与永续性法规相交会,促使市场转向FSC认证纤维和水性黏合剂。该领域的灵活性使其能够迅速采用抗菌化学品和自黏黏合剂,从而拓展了终端应用范围,从出租公寓到小儿科诊所均有涵盖。乙烯基创新者正透过不含邻苯二甲酸酯的配方和节能型压花固化剂来应对挑战,以捍卫其市场份额。金属箔和玻璃纤维增强片材等新型复合材料则瞄准了需要阻燃和电磁屏蔽等功能性应用的细分市场。

到2024年,数位技术将占壁纸产量的58.42%,年增长率达7.32%,这将把壁纸市场转变为订单定制的模式。喷墨印表机头与UV固化化学技术的结合,可在各种基材上达到即时固化和鲜艳的色彩饱和度,而乳胶系统则符合低VOC排放标准。Canon指出,数位技术无需製版,因此可以满足从客製化单捲到中型饭店订单的各种批量需求,且无需支付设定费用。丝网印刷凭藉其丰富的油墨覆盖和特殊效果,尤其是在传统大马士革图案方面,仍然无可匹敌。柔版印刷在长期商业领域逐渐占有一席之地,其高精度重复性使得滚筒投资物有所值。混合生产线正在兴起,在传统工作站之前整合单一途径数位单元,以便在批量印刷的底布上迭加定製图案。

高速打样循环和人工智慧色彩匹配软体将概念到上市的时间从数月缩短至数天,使设计师能够跟上潮流趋势。成本效益不仅限于库存。数位印刷的小批量生产能力可减少营运成本,降低报废库存,而UV- LED灯的高效性则可降低能源成本,并帮助印刷企业实现碳中和目标。 Octink 50年的发展历程表明,传统印刷企业无需放弃其印刷技术传统即可维修为数位印刷。

区域分析

北美地区在2024年引领出货量,主要得益于其成熟的整修文化和数位印刷工作流程的早期应用。在美国,儘管原料成本波动较大,但受弹性零售理念推动的自黏墙纸趋势仍将推动市场需求成长。加拿大建筑材料市场预计到2026年将成长4.5%至5.5%,这将为其潜在市场带来更多新建计划。墨西哥正在崛起为近岸外包中心,为寻求降低亚洲货运波动风险的美国高端品牌提供成本效益高的生产方案。约克墙纸公司透过收购一家独立的表面印刷企业,进一步巩固了其区域领先地位,并强化了其本地供应链。

受设计传统和严格环保法规的驱动,欧洲市场维持较高的价格溢价。德国和义大利强制要求使用无溶剂印刷,并加速推广水性油墨。英国室内设计正迎来手工艺的復兴,桑德森(Sanderson)推出的羊毛风格「奥威尔编织」(Orwell Weaves)和「乡村林地」(Country Woodland)系列便是例证。西班牙等南部市场则专注于抗紫外线墙壁材料,以配合饭店露台的设计。东欧市场的需求受外汇波动影响较大,但波兰和捷克的翻新津贴正在缓解销售下滑。循环经济指令允许生产商对「从摇篮到摇篮」的基材进行认证,并试行回收计画。

亚太地区销量成长最为迅猛。印尼计划每年交付300万套住房,越南的社会住宅建设目标也将新增数十万套。中国国内生产雄心与出口生产同步成长,维持受益于规模经济的超大规模生产线。印度装饰涂料领导企业亚洲涂料(Asian Paints)正利用全通路技术,透过其服务部门交叉销售壁纸套装。日本和韩国等成熟市场青睐高性能产品:三月(Sangetsu)的再生PET玻璃薄膜符合低碳建筑标准,同时提供紫外线和隔热保护。澳洲正专注于为易受山火侵袭的地区提供阻燃墙面织物,从而拓展其功能性细分市场。该地区到2025年第一季已有2,074笔饭店业交易,确保了合约量的持续成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北美和欧洲对数位印刷个人化装饰品的需求激增

- 东南亚城市中等收入住宅的快速成长

- 酒店业更新周期推动海湾合作委员会和东协地区的高端商业产品发展

- 美国零售商品行销正转向使用自黏乙烯基材料。

- 医疗维修采用抗菌涂层壁纸

- 市场限制

- 市面上有许多替代品可供选择

- PVC价格波动对利润率带来压力

- 暴露在高温高湿的环境中会缩短寿命

- 供应链分析

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 乙烯基塑料

- 不织布

- 纸本

- 织物(丝绸、亚麻布等)

- 其他壁纸类型

- 透过印刷技术

- 数位(喷墨/EP)

- 萤幕

- 柔版印刷

- 其他印刷技术

- 最终用户

- 住宅

- 商业的

- -饭店业

- 公司总部

- -美容美髮水疗中心

- - 医院

- 其他最终用户

- 透过分销管道

- 直销

- 间接销售

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲、纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Sangetsu Corporation

- York Wall Coverings Inc.

- AS Creation Tapeten AG

- Brewster Home Fashion LLC

- Grandeco Wallfashion Group

- Erismann & Cie. GmbH

- Sanderson Design Group PLC

- Tapetenfabrik Gebr. Rasch GmbH & Co. KG

- Marshalls Wallcoverings

- Asian Paints Ltd(Nilaya)

- Eximus Wallpaper

- Gratex Industries Ltd

- Graham & Brown Ltd

- Wallquest Inc.

- Adornis Wallpapers

- Arte International

- 4walls

- Omexco NV

- Life n Colors Private Limited

- Komar Products GmbH

- Houfling GmbH(Hohenberger)

第七章 市场机会与未来展望

The global wallpaper market size reached USD 13.07 billion in 2025 and is forecast to touch USD 16.17 billion by 2030, advancing at a 4.34% CAGR during the period.

Demand expands as digital printing, antimicrobial coatings, and peel-and-stick substrates converge with surging residential renovation activity, intensified hospitality refresh cycles, and rising interior-aesthetic expectations among mid-income households. Commercial installations currently lead because hotel construction pipelines in the GCC and ASEAN continue to specify premium, durable wallcoverings that withstand rigorous maintenance schedules. Residential adoption accelerates as Southeast Asian governments subsidize affordable housing programs and North American homeowners opt for personalized decor over routine repainting. Supply chains face vinyl-chloride price swings and tariff hikes, yet manufacturers defend margins through vertical integration, long-term resin contracts, and innovation in non-vinyl substrates. Competitive differentiation now hinges on omnichannel distribution, sustainability credentials, and the speed with which on-demand printing can translate design concepts into finished rolls.

Global Wallpaper Market Trends and Insights

Surge in Demand for Digitally-Printed Personalised Decor in North America and Europe

On-demand digital printing liberates designers from plate-making and minimum-run constraints, enabling serialized patterns, tactile 3D textures up to 2 mm, and fast prototyping that shortens design-to-installation cycles. Roland DG and Panasonic Housing Solutions unveiled DIMENSE technology that produces sculpted surfaces without extra embossing passes, widening creative scope and cost efficiency. Luxury paint maker Benjamin Moore collaborated with The Alpha Workshops to hand-paint wallpapers retailing at USD 125 per yard, proof that customization supports 40-60% price premiums. European stalwarts such as Sanderson Design Group chase this segment with heritage-meets-digital launches that sell for ¥13,900-¥35,100 per roll, validating affluent willingness to pay for unique stories Sanderson. Ecommerce accelerates uptake: Graham & Brown's B2B portal reached 90% client adoption in just 12 weeks, cutting order friction and inventory risk. These gains lift manufacturer margins and position digital workflows as the default mode for bespoke residential and boutique commercial projects.

Rapid Mid-Income Urban Housing Boom in Southeast Asia

Indonesia reported construction representing 10.23% of GDP in Q1 2024 while Vietnam initiated over 600,000 social housing units during H1 2025, setting a long-tail demand curve for mid-priced wallcoverings that balance aesthetics with affordability. Government programs such as Indonesia's One Million House plan and Qatar-backed financing channels lift first-time buyers' purchasing power, steering them toward branded yet cost-effective decor choices. Asian Development Bank forecasts 4.5% regional GDP growth for 2025, underpinning discretionary renovation spending. International producers answer with regional plants that dodge tariffs and shorten lead times, while local brands exploit import substitution incentives. Millennials' online buying habits drive traffic to digital customization platforms, further intensifying the pull on digitally printed offerings.

Easy Availability of Substitutes in the Market

Paints, decorative panels, and digital displays constantly upgrade value propositions, eroding wallpaper's share where maintenance simplicity or interactive content holds sway. Sherwin-Williams Paint Shield introduces microbicidal functions directly into paint, killing 99.9% of bacteria in 2 hours and capturing budgets once reserved for specialty wallcoverings. Textured paints, wall decals, and living-plant walls fulfil biophilic design briefs, while modular panel systems allow offices to reconfigure spaces overnight. The broadening substitute set compels wallpaper producers to stress tactile depth, material circularity, and installation efficiency.

Other drivers and restraints analyzed in the detailed report include:

- Hospitality Refresh Cycles Driving Premium Commercial Wallpaper in GCC and ASEAN

- Retail Visual-Merchandising Shift to Peel-and-Stick Vinyl in the U.S.

- Vinyl-Chloride Price Volatility Compressing Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-woven products opened 2025 with a 6.06% CAGR outlook, eclipsing overall wallpaper market growth as breathable, dimensionally stable substrates simplify installation and removal tasks. Premium installers champion the category because dry-strippable properties cut labour by up to 30%. Vinyl retained 32.43% wallpaper market share in 2024 thanks to hospital-grade durability and cost competitiveness, yet environmental scrutiny intensifies calls for bio-PVC, recycled PET, and solvent-free inks. Paper-based lines contract, surviving mostly in heritage residences where authenticity tops maintenance ease. Fabric surface coverings serve niche luxury spaces, offering tactile warmth and built-in acoustic dampening. Borastapeter's Viared facility illustrates technical diversity, running surface, gravure, screen, and digital presses under one roof to match each material's printability.

Non-woven momentum intersects sustainability regulation, prompting marketing pivots toward FSC-certified fibres and water-based adhesives. The segment's agility allows quick adoption of antimicrobial chemistries or peel-and-stick adhesives, widening end-use scope from rental apartments to pediatric clinics. Vinyl innovators respond with phthalate-free formulations and energy-saving emboss cures to defend share. Emerging composites such as metallic foils or glass fibre reinforced sheets target functional niches demanding fire retardancy or electromagnetic shielding.

Digital technologies captured 58.42% of production in 2024 and are adding 7.32% annually, transforming the wallpaper market into a make-to-order paradigm. Inkjet heads paired with UV-curable chemistries deliver immediate curing and vibrant colour saturation on diverse substrates, while latex systems comply with low-VOC codes. Canon's guidance confirms that digital eliminates plates, enabling batch sizes from a single customised roll to mid-volume hospitality orders without setup penalties. Screen printing retains pockets where rich ink laydown and special effects are still unrivalled, particularly for heritage damasks. Flexography holds ground in long-run commercial corridors where precision repeatability justifies cylinder investments. Hybrid lines emerge, integrating single-pass digital units ahead of conventional stations so bespoke motifs overlay mass-printed bases.

Rapid proofing loops and AI colour-matching software compress concept-to-market timelines from months to days, letting designers react to viral trends. Cost advantages extend beyond inventory: digital short-run capabilities reduce working capital and shrink obsolete stock write-offs. Meanwhile, UV-LED lamp efficiencies drop energy bills, helping printers meet carbon-neutral targets. Octink's 50-year trajectory shows legacy shops can retrofit for digital without surrendering printcraft heritage.

The Wallpaper Market Report is Segmented by Wallpaper Type (Vinyl, Non-Woven, Paper-Based, Fabric, Other), Printing Technology (Digital, Screen, Flexographic, Other), End User (Residential, Commercial), Distribution Channel (Direct Sales, Indirect Sales), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led 2024 shipments on the back of established renovation culture and early adoption of digital-print workflows. The U.S. peel-and-stick craze, fuelled by flexible retail concepts, bolsters forecast demand despite raw-material cost swings. Canada's construction-materials market expects 4.5-5.5% growth through 2026, adding institutional projects to the addressable base. Mexico emerges as a near-shoring hub, providing cost-efficient production for premium U.S. brands looking to mitigate Asian freight volatility. York Wallcoverings consolidates regional leadership after acquiring independent surface-print operations, strengthening local supply chains.

Europe preserves a strong pricing premium through design heritage and stringent eco-regulation. Germany and Italy push solvent-free print mandates, prompting accelerated adoption of water-based inks. United Kingdom interiors celebrate artisanal revival, evident in Sanderson's wool-inspired Orwell Weaves and Country Woodland launches. Southern markets such as Spain emphasise UV-stable outdoor wall applications to complement hospitality terraces. Eastern Europe's demand fluctuates with currency swings, though renovation subsidies in Poland and Czechia cushion volume declines. Circular-economy directives drive producers to certify cradle-to-cradle substrates and pilot take-back schemes.

Asia-Pacific records the steepest volume climb; Indonesia plans to deliver three million homes yearly while Vietnam's social housing targets add hundreds of thousands of units. China's domestic appetite strengthens alongside export output, sustaining mega-scale lines that benefit from economies of scope. India's decorative coatings leader Asian Paints leverages omnichannel reach to cross-sell wallpaper bundles under its services arm. Mature markets Japan and South Korea favour high-function products: Sangetsu's recycled-PET glass films meet low-carbon building codes while offering UV heat-shielding. Australia pivots to fire-retardant wall fabrics for bushfire-vulnerable regions, enriching the functional niche. Collectively, the region's 2,074-project hospitality pipeline through Q1 2025 guarantees sustained contract volumes.

- Sangetsu Corporation

- York Wall Coverings Inc.

- A.S. Creation Tapeten AG

- Brewster Home Fashion LLC

- Grandeco Wallfashion Group

- Erismann & Cie. GmbH

- Sanderson Design Group PLC

- Tapetenfabrik Gebr. Rasch GmbH & Co. KG

- Marshalls Wallcoverings

- Asian Paints Ltd (Nilaya)

- Eximus Wallpaper

- Gratex Industries Ltd

- Graham & Brown Ltd

- Wallquest Inc.

- Adornis Wallpapers

- Arte International

- 4walls

- Omexco NV

- Life n Colors Private Limited

- Komar Products GmbH

- Houfling GmbH (Hohenberger)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Demand for Digitally-Printed Personalised Decor in North America and Europe

- 4.2.2 Rapid Mid-Income Urban Housing Boom in Southeast Asia

- 4.2.3 Hospitality Refresh Cycles Driving Premium Commercial products in GCC and ASEAN

- 4.2.4 Retail Visual-Merchandising Shift to Peel-and-Stick Vinyl in the U.S.

- 4.2.5 Adoption of Antimicrobial Coated Wallcoverings in Healthcare Renovations

- 4.3 Market Restraints

- 4.3.1 Easy Availability of Substitues in the Market

- 4.3.2 Vinyl-Chloride Price Volatility Compressing Margins

- 4.3.3 Shorter Life-span on Exposure to Heat and Moisture

- 4.4 Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Vinyl

- 5.1.2 Non-woven

- 5.1.3 Paper-based

- 5.1.4 Fabric (Silk, Linen, etc.)

- 5.1.5 Other wallapaper Type

- 5.2 By Printing Technology

- 5.2.1 Digital (Inkjet/EP)

- 5.2.2 Screen

- 5.2.3 Flexographic

- 5.2.4 Other Printing Technology

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 -Hospitality

- 5.3.4 - Corporate Office Space

- 5.3.5 -Salons and Spas

- 5.3.6 - Hospitals

- 5.3.7 -Other End User

- 5.4 By Distribution Channel

- 5.4.1 Direct Sales

- 5.4.2 Indirect Sales

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Sangetsu Corporation

- 6.4.2 York Wall Coverings Inc.

- 6.4.3 A.S. Creation Tapeten AG

- 6.4.4 Brewster Home Fashion LLC

- 6.4.5 Grandeco Wallfashion Group

- 6.4.6 Erismann & Cie. GmbH

- 6.4.7 Sanderson Design Group PLC

- 6.4.8 Tapetenfabrik Gebr. Rasch GmbH & Co. KG

- 6.4.9 Marshalls Wallcoverings

- 6.4.10 Asian Paints Ltd (Nilaya)

- 6.4.11 Eximus Wallpaper

- 6.4.12 Gratex Industries Ltd

- 6.4.13 Graham & Brown Ltd

- 6.4.14 Wallquest Inc.

- 6.4.15 Adornis Wallpapers

- 6.4.16 Arte International

- 6.4.17 4walls

- 6.4.18 Omexco NV

- 6.4.19 Life n Colors Private Limited

- 6.4.20 Komar Products GmbH

- 6.4.21 Houfling GmbH (Hohenberger)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment