|

市场调查报告书

商品编码

1687919

扩增实境(XR) - 市场占有率分析、产业趋势与统计、成长预测(2024-2029)Extended Reality (XR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

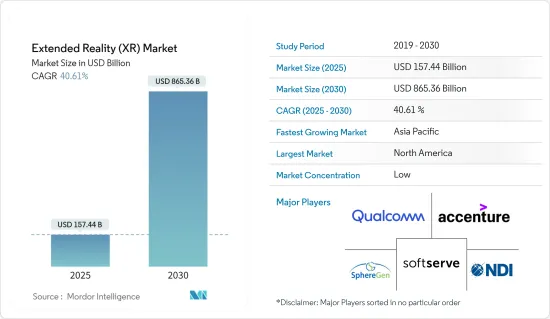

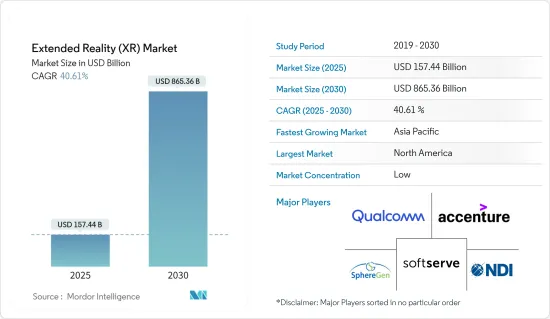

扩增实境市场规模预计在 2024 年为 1,119.7 亿美元,预计到 2029 年将达到 6,154.9 亿美元,预测期内(2024-2029 年)的复合年增长率为 40.61%。

关键亮点

- 扩增实境(XR)是身临其境型技术的总称,包括虚拟实境(VR)、扩增实境(AR)和混合实境(MR),以及这些技术有望带来的未来现实。市场需求是由对更近的个人距离和更好的视觉讯息日益增长的需求所驱动的。

- 虚拟实境是电脑技术的应用,主要目的是产生模拟环境。与传统使用者介面相比,VR 允许使用者完全参与沉浸式体验,而不是简单地观察监视器萤幕。这项技术透过提供视觉、触觉、听觉和嗅觉的多感官模拟,无疑在许多方面彻底改变了世界。

- 基于手势的计算是指使用人体与数位资源互动的介面,而不是游戏控制器、滑鼠、键盘或语音输入等传统输入设备。基于滑鼠的电脑输入的出现见证了小键盘从线性尺寸向二维尺寸的演变,下一步是基于手势的技术,描述了将人类带入计算过程的三维输入。

- 智慧型设备的小型化和改进趋势预计将导致能够整合到人体中的感测器和电子系统越来越小。智慧型装置和许多其他物联网 (IoT) 趋势正在推动小型化趋势。

- XR 技术面临的最大挑战之一是培训更广泛的受众。目前正在开发的应用程式(可在平板电脑、智慧型手机和穿戴式装置上使用)仅限于单一使用者使用。为了让 XR 更容易访问,我们必须创造多用户、一致且简化的体验。在目前的市场情况下,此类解决方案的可用性有限,对产业发展构成了重大障碍。

- 此外,2023 年 6 月,苹果在年度开发者大会 (WWDC) 上发布了一款名为 Vision Pro 的扩增实境(AR) 耳机。苹果称 Vision Pro 是一款提供空间运算功能的新型计算机,起价为 3,499 美元。

扩增实境(XR)市场趋势

媒体和娱乐终端用户领域占据主要市场占有率

- 过去几年,媒体公司一直在探索 XR 技术作为讲故事的新前沿和潜在的广告媒介。我们正在与VR头戴装置开发人员和广播 VR 活动的软体开发人员伙伴关係,探索创造最佳 VR 内容的方法。此外,企业也开始投资VR公司。

- XR 最大的行销潜力在于其参与功能,使企业能够与其产品和服务建立情感连结。 XR 技术使媒体公司能够更有效地接触目标受众。透过模拟真实生活体验,XR 应用程式使客户体验更具互动性和吸引力。因此,数位代理商和媒体购买者可以对您的品牌建立情感依恋。

- 根据 2023 年游戏开发者大会的调查,全球整体36% 的游戏开发者正积极为 Meta Quest虚拟实境头戴装置开发游戏。

- 对身临其境型内容创作、虚拟製作、虚拟空间实况活动、增强广告、空间运算、穿戴式混合实境设备和协作体验的需求不断增长,正在推动市场的成长机会。

- 2024 年 1 月,在高通发布 XR2+ Gen 2 晶片组后,VR 和 MR 设备供应商歌尔与手部侦测提供商 Ultraleap 合作发布了 VR/MR 耳机的参考设计。该设计旨在支援OEM透过 Ultraleap 的 Gemini 框架创建具有高品质手部侦测功能的 MR/VR 设备。 Ultraleap 的电脑视觉和机器学习模型为企业终端用户提供了低成本的手部侦测整合。

- 2024 年 1 月,高通科技公司发表了骁龙 XR2+ Gen 2 平台。这款单晶片结构以每秒 90 帧的速度提供 4.3K 空间运算,为工作和娱乐提供更清晰的视觉效果。搭载 Snapdragon XR2+ Gen 2 的装置支援同时使用 12 个或更多镜头,并配备强大的装置内建 AI,可轻鬆追踪使用者、他们的动作以及周围的世界,从而实现更轻鬆的导航和融合实体和数位空间的无与伦比的体验。 Snapdragon XR2+ Gen 2 提供 4.3K 分辨率,透过为房间规模萤幕、真人大小迭加和虚拟桌面等使用案例提供令人惊嘆的视觉清晰度,将生产力和娱乐提升到一个新的水平。

- 总体而言,由于这些发展、技术进步和产品发布的增加,预计该领域在整个预测期内将见证充足的成长机会。

北美占据主要市场占有率

- 在全球范围内,美国是扩增实境(AR)、虚拟实境 (VR) 和混合实境(MR) 领域最具创新性的市场之一。大多数推广该技术的公司都位于美国。该地区对技术的高曝光度和智慧型设备的易用性正在创造强劲的需求。微软的AR产品HoloLens率先在美国和加拿大地区推出,并获得了当地用户的一致好评。

- 此外,美国政府正在寻找直接和间接的方式来利用这些技术来促进创新和繁荣,预计该地区将拥有相当大的市场占有率。此外,美国国务院外交学院正在将 VR 作为体验式学习工具融入某些培训课程中。

- 此外,还正在实施各种 AR 和 VR 培训计划,以培养当地劳动力和管理污水。该地区也以技术普及率高和资源易得为主,对扩增实境设备的需求强劲。该地区的许多公司正在引入 AR/VR 穿戴式装置的创新技术。

- 区域电信业者也积极吸引客户使用其 5G 网路。因此,这些地区的供应商正在投资和创新软体和平台,以开发利用即将到来的 5G 技术的 AR 应用程式。

- 根据GSMA预测,到2025年,北美智慧型手机用户数量预计将达到3.28亿。此外,到2025年,该地区的行动普及率预计将达到86%,网路普及率预计将达到80%,位居全球第二。由于智慧型设备(尤其是智慧型手机)在 AR 技术发展中发挥重要作用,该地区为预测期内研究市场的成长提供了巨大的机会。

- 扩增实境正在彻底改变零售购物体验。零售中的 AR 可以让顾客更好地客製化、互动和使用产品。许多企业正在投资 AR 来改善客户体验并创造更无缝的参与。例如,2023年10月,沃尔玛宣布将投资服装和家居用品的AR工具。体验最初将提供 300 件家具和家居装饰。透过结合生成式人工智慧和扩增实境的力量,沃尔玛旨在为客户提供个人化的设计帮助。

扩增实境(XR) 产业概览

扩增实境市场较分散,主要参与者包括 Qualcomm Technologies Inc.、Accenture PLC、SoftServe Inc.、SphereGen Technologies LLC 和 Northern Digital Inc.。该市场中的参与企业正在采用伙伴关係、创新、投资、併购等策略来增强其产品供应并获得可持续的竞争优势。

- 2024 年 1 月:高通推出用于扩增实境(XR) 耳机的 Snapdragon XR2+ Gen 2 晶片。由于较高的 GPU 和 CPU 频率,该晶片可以支援每秒 90 帧 (fps) 的 4.3K 空间运算。该解决方案可与苹果的 Apple Vision Pro 相竞争,后者可支援 12 个以上相机同时运行,并配备装置内建 AI 来追踪使用者的动作和周围的事物。

- 2023 年 11 月:Varjo Technologies Oy 宣布推出其新一代高保真混合实境头戴装置 XR-4 系列。该系列包括高解析度显示器、自动对焦相机以及适用于工业和企业用途的新功能。 XR-4 系列是「混合实境」头戴式装置系列,它提供逼真的沉浸式体验,将电脑生成的模拟物件与现实世界融为一体。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- COVID-19 和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 手势计算的采用率不断提高

- 智慧型装置越来越小型化

- 市场限制

- 实施过程在技术和成本方面的复杂性

- 实施成本高且易受网路攻击

第六章市场区隔

- 按解决方案

- 消费者参与

- 商业参与

- 按应用

- 虚拟实境(VR)

- 扩增实境(AR)

- 混合实境

- 按最终用户产业

- 教育

- 零售

- 工业/製造业

- 医疗保健

- 媒体与娱乐

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Qualcomm Technologies Inc.

- Accenture PLC

- SoftServe Inc.

- SphereGen Technologies LLC

- Northern Digital Inc.(Roper Technologies Inc.)

- Microsoft Corporation

- Softweb Solutions Inc.(Avnet Inc.)

- Tata Elxsi Limited

- Varjo Technologies Oy

- Talespin Reality Labs Inc.

第八章投资分析

第九章:市场的未来

The Extended Reality Market size is estimated at USD 111.97 billion in 2024, and is expected to reach USD 615.49 billion by 2029, growing at a CAGR of 40.61% during the forecast period (2024-2029).

Key Highlights

- Extended reality (XR) is an umbrella word for immersive technologies, including virtual reality (VR), augmented reality (AR), mixed reality (MR), and additional future realities that these technologies are expected to bring. The market need is driven by increased demand for shorter distances between individuals and better visual information.

- Virtual reality is the utilization of computer technology primarily aimed at generating a simulated environment. In contrast to the conventional user interface, VR enables users to fully engage in an immersive experience rather than merely observe a monitor screen. This technology has undoubtedly revolutionized various aspects globally by providing a multi-sensory simulation encompassing aspects like vision, touch, hearing, and even smell.

- Gesture-based computing refers to interfaces that employ the human body to communicate with digital resources rather than traditional input devices such as a game controller, a mouse, a keyboard, or a voice-entry method. The advent of the mouse-enabled computer input is set to evolve beyond the linear dimension of the keypad to two dimensions, with gesture-based technology emerging as the next stage in that development, providing three-dimensional input that incorporates people in the computing process.

- The miniaturization trend and improvements in smart devices are expected to result in ever smaller sensors and electronic systems that can be integrated into the human body. Smart gadgets and many other Internet of Things (IoT) applications are driving the miniaturization trend.

- One of the most challenging difficulties confronting XR technology is training a larger audience. The current applications in development (for usage on tablets, smartphones, and wearables) are restricted to a single user. To make XR more accessible, multi-user, consistent, and simplified experiences must be created. The availability of such solutions in the present market scenario is restricted, posing a substantial impediment to the growth of the industry.

- Furthermore, in June 2023, Apple unveiled an augmented reality (AR) headset called Vision Pro at its annual Worldwide Developers Conference (WWDC). Apple called Vision Pro a new kind of computer that offers spatial computing with a starting price of USD 3,499.

Extended Reality (XR) Market Trends

Media & Entertainment End-user Segment Holds a Significant Market Share

- Over the last few years, media companies have examined XR technology as a new frontier for storytelling and a possible advertising outlet. They have formed partnerships with companies developing VR headsets and software developers broadcasting VR events in order to determine how to build the best VR content. Furthermore, some firms are also beginning to invest in VR companies.

- The XR's greatest marketing potential lies in its engagement capabilities, which allow companies to build emotional connections to their products and services. With XR-powered technology, media companies can reach their target audience more effectively. By simulating real-world experience, XR applications make the customer experience more interactive, engaging, and appealing. As a result, digital agencies and media buyers can build an emotional attachment to their brands.

- According to the Game Developers Conference 2023, 36% of responding game developers globally are actively developing games for the Meta Quest virtual reality headset.

- The growing demand for immersive content creation, virtual production, live events in virtual spaces, augmented advertising, spatial computing, wearable MR devices, and collaborative experiences drives growth opportunities for the market.

- In January 2024, VR and MR device vendor Goertek partnered with hand-tracking provider Ultraleap to announce a VR/MR headset reference design that followed Qualcomm's XR2+ Gen 2 chipset revealment, where Qualcomm also revealed the new reference design. The design intends to support OEMs creating MR/VR devices with high-quality hand-tracking features from Ultraleap's Gemini framework. Ultraleap's computer vision and machine learning models enable low-cost hand-tracking integration for enterprise end users.

- In January 2024, Qualcomm Technologies Inc. launched the Snapdragon XR2+ Gen 2 Platform, a single-chip architecture that provides 4.3K spatial computing at 90 frames per second for better visual clarity throughout work and plays. Supporting 12 or more concurrent cameras with powerful on-device AI, Snapdragon XR2+ Gen 2-powered devices can also effortlessly track the user, their movements, and the world around them for effortless navigation and unparalleled experiences that merge physical and digital spaces. Snapdragon XR2+ Gen 2 unlocks 4.3K resolution, taking productivity and entertainment to the next level by bringing spectacularly clear visuals to use cases such as room-scale screens, life-size overlays, and virtual desktops.

- Overall, due to the rise in such developments, technological advancements, and product launches, the segment studied is anticipated to witness ample growth opportunities throughout the forecast period.

North America Holds a Significant Market Share

- Globally, the United States has been one of the most highly innovative augmented reality (AR), virtual reality (VR), and mixed reality (MR) markets. Most of the companies advancing this technology are based in the United States. The region's high technology exposure and the ease of use of smart devices have created strong demand. Microsoft's AR product, Hololens, was first released in the United States and Canada, and it received a positive response from users in the country.

- The region is also expected to hold a significant market share, as the US government has been finding both direct and indirect ways to use these technologies to facilitate innovations and promote prosperity. Moreover, the Foreign Service Institute at the State Department has introduced VR as an experiential learning tool in specific training.

- Moreover, various AR and VR training programs have been implemented to develop local workforces and manage wastewater. The region also dominates the market owing to the high technology exposure and the easy availability of resources, creating robust demand for extended reality devices. Many companies in the region are deploying innovative technology into their AR/VR wearables.

- Regional telecom companies are also aggressively attracting customers to use their 5G networks. Hence, these regional vendors are investing and innovating software and platforms for the development of AR applications by leveraging the upcoming 5G technology.

- According to GSMA, the number of smartphone subscribers across North American countries is expected to reach 328 million by 2025. Moreover, by 2025, the region is also expected to witness an increase in the penetration rates of mobile (86%) and internet (80%), recording the second-highest rates globally. As smart devices, especially smartphones, play a major role in the development of AR technology, the region offers a huge opportunity for the growth of the market studied over the forecast period.

- Augmented reality is revolutionizing retail shopping experiences; with AR in retail, customers can customize, interact, and engage with products better. Several companies are investing in AR to enhance their customers' experience and create a more seamless engagement. For instance, in October 2023, Walmart announced that it was investing in AR tools for apparel and home products. This experience will initially be available for 300 furniture and home decor items. By combining the power of generative AI and AR, Walmart aims to provide customers with personalized design assistance.

Extended Reality (XR) Industry Overview

The extended reality market is fragmented, with major players like Qualcomm Technologies Inc., Accenture PLC, SoftServe Inc., SphereGen Technologies LLC, and Northern Digital Inc. Players in the market are adopting strategies such as partnerships, innovations, investments, mergers, and acquisitions to enhance their product offerings and gain a sustainable competitive advantage.

- January 2024: Qualcomm launched a Snapdragon XR2+ Gen 2 chip for extended reality (XR) headsets that can support 4.3K spatial computing at 90 frames per second (fps) with higher GPU and CPU frequencies. This is the competing solution for Apple's Apple Vision Pro, which can support 12 or more concurrent cameras with on-device AI to track user movements and things around them.

- November 2023: Varjo Technologies Oy introduced the next generation of its high-fidelity mixed reality headsets, the XR-4 series. This series includes high-resolution displays, auto-focus cameras, and new capabilities for industrial and enterprise applications. The XR-4 series is a family of "mixed reality" headsets that deliver photorealistic immersive experiences that blend computer-generated simulated objects with the real world.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces' Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Gesture-based Computing

- 5.1.2 Growing Trend of Miniaturization in Smart Devices

- 5.2 Market Restraints

- 5.2.1 Complexity in the Implementation Process in Terms of Technology and Cost

- 5.2.2 Vulnerability for Cyber Attacks, Along with the High Cost of Implementation

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Consumer Engagement

- 6.1.2 Business Engagement

- 6.2 By Application

- 6.2.1 Virtual Reality (VR)

- 6.2.2 Augmented Reality (AR)

- 6.2.3 Mixed Reality (MR)

- 6.3 By End-user Industry

- 6.3.1 Education

- 6.3.2 Retail

- 6.3.3 Industrial & Manufacturing

- 6.3.4 Healthcare

- 6.3.5 Media & Entertainment

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qualcomm Technologies Inc.

- 7.1.2 Accenture PLC

- 7.1.3 SoftServe Inc.

- 7.1.4 SphereGen Technologies LLC

- 7.1.5 Northern Digital Inc. (Roper Technologies Inc.)

- 7.1.6 Microsoft Corporation

- 7.1.7 Softweb Solutions Inc. (Avnet Inc.)

- 7.1.8 Tata Elxsi Limited

- 7.1.9 Varjo Technologies Oy

- 7.1.10 Talespin Reality Labs Inc.