|

市场调查报告书

商品编码

1689716

模塑纤维包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Molded Fiber Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

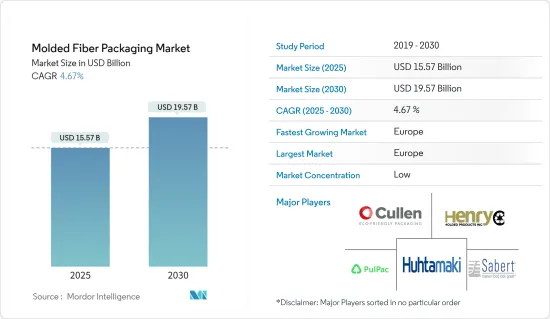

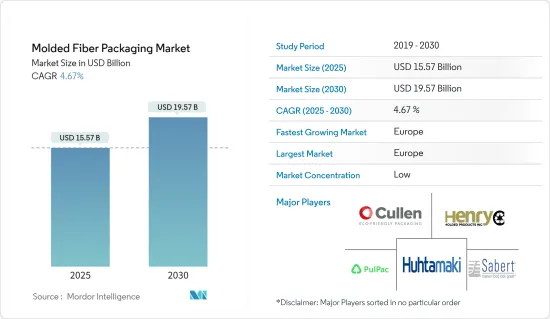

模塑纤维包装市场规模预计在 2025 年为 155.7 亿美元,预计到 2030 年将达到 195.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.67%。

由于对由可再生和可回收材料製成的可持续包装的需求不断增加,纤维模塑包装市场正受到越来越多的关注。

终端用户产业需求不断增长以及采用环保保护包装解决方案等因素正在推动市场向前发展。小麦和甘蔗渣等非木质废弃物越来越多地被用于生产纸浆。模塑纤维包装以其保护性和永续性而闻名,常见于鸡蛋盒、饮料托盘、电子保护包装和食品容器等应用。

关键亮点

- 与十年前相比,今天的消费者更加意识到他们的购买选择的长期影响。随着环保意识的不断增强,现今的消费者非常重视包装的永续性。 Trivium Packaging 的最新报告《全球绿色采购报告》强调,超过 82% 的年轻消费者(44 岁以下)愿意为永续包装的产品支付溢价。此外,到 2023 年,40% 的饮料产品将采用永续包装,其次是 30% 的食品产品。

- 为了应对日益严重的环境问题,世界各国政府正在实施严格的法规,限制一次性塑胶的使用,并支持环保替代品。尤其是在欧洲,这些法规不仅仅是合规;他们正在重塑该行业的包装方式。欧盟委员会的包装废弃物指令强调了这一紧迫性,并设定了雄心勃勃的目标:到 2025 年 12 月实现 65% 的回收率,到 2030 年 12 月实现 70% 的回收率。政府的这项措施正在推动对纤维模塑包装的需求。

- 此外,外带、已调理食品和送货宅配的需求激增,推动了符合严格卫生和永续性标准的纺织模塑泡壳、托盘和碗的兴起。根据沙乌地阿拉伯统计总局的资料,食品和饮料服务活动的收益预计将在 2023 年达到 157.6 亿美元,在 2025 年达到 160.3 亿美元。

- 纤维模塑包装市场的一个主要限制因素是确保原材料(包括天然纤维和再生纸浆)的稳定和永续供应。这些原材料的可用性和品质的变化可能会扰乱生产过程并影响产品品质。为了应对这项挑战,生产商正致力于建立有弹性的供应链,尤其是在模製纤维产品需求激增的情况下。

- 该市场的另一个挑战是高昂的初始製造成本。儘管模製纤维具有环保优势,推出和维护製造过程的成本却很高。这样的成本可能会阻碍一些公司转向纤维模塑包装。随着技术的进步和规模经济的实现,预计这一经济障碍将随着时间的推移而减少。

- 总体而言,纤维模塑包装市场对于推动全球包装产业的永续发展至关重要。儘管面临挑战,但对环境目标的承诺和各个领域不断增长的需求使市场具有巨大的成长潜力。此外,市场还将不断发展,尤其是在增加对具有成本效益、高品质和多功能解决方案的研发投资的基础上。此外,循环经济原则,尤其是回收和减少废弃物,可能会在引导市场成长轨迹方面发挥关键作用。

模塑纤维包装市场趋势

食品饮料将成为最大的终端使用者产业

- 随着对环保和永续解决方案的需求不断增长,模塑纤维产品正在食品领域逐渐取代塑胶。食品市场对包装有严格的标准并要求遵守。对于食品领域的材料,除了拉伸性能和热性能等基本强度规格外,增强的阻隔性也至关重要。

- 模製纸浆用于各种食品包装,包括翻盖式容器、外带餐容器、鸡蛋托盘、纸盒以及水果、蔬菜、浆果和蘑菇托盘。托盘尤其占据了食品包装市场的绝大部分。

- 这些鸡蛋也被包装在模製纸浆托盘或泡壳中,然后出售给餐厅、餐饮服务经营者和私人买家。世界人均鸡蛋消费量每年持续增加。根据美国劳工统计局的数据,美国西部家庭的鸡蛋消费量位居全国首位,平均每位消费者的鸡蛋消费量为 109 美元。由于人口增长、人们对鸡蛋健康益处的认识不断提高以及对蛋白质的需求激增,鸡蛋消费量正在上升。这一趋势将刺激对模塑纸浆包装产品的需求,并推动市场成长。

- 据加拿大农业和食品部称,包装食品销售额预计到 2023 年将达到 20.2 亿美元,到 2026 年将成长到 24.3 亿美元。食品业的成长将加强该地区的纤维模塑包装市场。

- 线上零售的快速成长推动了对保护性、轻质和永续包装材料的需求。模塑纤维因其减震性能而成为最佳选择。根据电子通讯办公室的分析,波兰的电子商务市场正在经历令人瞩目的成长,目标是到 2023 年达到 1,240 亿兹罗提(311.7 亿美元),到 2027 年达到 1,870 亿兹罗提(470 亿美元)。此外,波兰中央统计局的资料显示,网路购物购物者数量持续增加,预计到 2023 年,超过 64% 的受访者将网路购物,比过去五年增加了近 20%。

- 随着网路购物的兴起,企业正在寻找耐用、经济高效的包装解决方案来保护运输过程中的产品。根据国际货币基金组织(IMF)的预测,2024年沙乌地阿拉伯的整体零售额将达到1,556亿美元。预计到2026年将增至约1765亿美元。电子商务和食品宅配行业的快速成长预计将进一步推动对纤维模塑包装解决方案的需求。

预计欧洲将主导市场

- 欧洲是模塑纤维包装的一个非常重要的市场。工业国家,尤其是英国,拥有大量城市人口和高可支配收入。根据英国包装联合会的报告,英国包装製造业年营业额达140亿英镑(178.5亿美元),僱用员工约8万人。此外,包装产业正在经历显着成长,各产业投资的增加可望刺激市场需求。

- 在英国,日益增强的环保意识、监管压力、技术进步和企业永续性目标正在推动人们转向替代材料,尤其是纤维模塑包装。食品服务业是模塑纤维市场的主要推动力,占有相当大的份额。如今,模塑纤维包装常见于鸡蛋盒和其他食品包装等产品。根据GOV.UK的数据,2024年第三季食用鸡蛋产量与去年同期相比成长了7.2%。这些成长要素可能会推动市场扩张。

- 预计法国食品业的投资增加和成长也将推动市场成长。最近,法国消费者对永续和道德食品消费的兴趣日益浓厚。因此,对本地生产和有机产品的需求正在飙升,同时人们对环保包装的偏好越来越强烈。此外,人们明显转向以植物和素食为主的饮食习惯,证明人们对健康和环境问题的认识不断提高。这一发展趋势将对市场动态产生重大影响。

- 德国的包装产业很大程度上受到食品业的服务。消费者优先考虑产品的便利性、保护性和易于运输,这推动了对多样化包装解决方案的需求。对于乳製品、肉类和预製家常小菜等食品中的塑胶替代品尤其如此。此外,对一次性塑胶的严格监管和对永续包装的不断增长的需求进一步推动了市场成长。

- 此外,义大利电子产业的强劲成长将推动对市场解决方案的需求。义大利的半导体生产和销售正在蓬勃发展,为模製纤维封装公司提供了丰厚的利润机会。 2024年,义大利电子产业将在全球市场创新和需求的推动下快速发展。义大利旨在透过策略推动巩固在欧洲半导体产业的地位,并计划今年在该领域投资约 100 亿欧元(107 亿美元)。这项重要措施将扩大市场机会。

模塑纤维包装产业概况

市场呈现细分化,许多全球和地区参与企业争夺主导地位。这些参与企业正努力透过创新、客製化和改进包装美观脱颖而出。例如,2024 年 4 月,干模纤维技术先驱 PulPac 加入了印刷和造纸行业领先的倡导组织 Two Sides。 Palpac 为包装生产商提供先进的製造技术,推广永续包装,满足产业对可扩展性、快速生产和成本效益的需求。 PulPac 价格具有竞争力的基于纤维的解决方案使生产商能够响应行业和地球对负责任包装的呼吁,从而使他们成为其领域的领导者。

不断变化的立法和消费者对永续性的偏好正在重塑包装行业。随着人们越来越认识到环保包装的环境效益,对金属、玻璃、塑胶和纸张等传统材料的需求正在发生变化,人们明显转向更环保的替代品。

模塑纤维因其环保特性而成为包装的首选。这种可堆肥包装由可回收材料製成,最大限度地减少了我们对环境的影响。纸浆模塑包装不仅具有生态效益,而且还有降低运输成本、减少仓库空间等经济优势。总体而言,竞争对手之间的竞争非常激烈,预计在预测期内将保持不变。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 按上市国家/地区分類的模塑纤维进出口分析

- 美国- 进出口分析

- 英国—进出口分析

- 法国——进出口分析

- 德国——进出口分析

- 义大利进出口分析

- 西班牙—进出口分析

- 中国进出口分析

- 日本——进出口分析

- 印度—进出口分析

- 巴西——进出口分析

- 墨西哥——进出口分析

- 阿拉伯联合大公国—进出口分析

- 沙乌地阿拉伯—进出口分析

第五章市场动态

- 市场驱动因素

- 消费者偏好转向可回收和环保材料

- 可支配所得增加

- 最终用户对可重复使用和可持续包装的需求不断增加

- 市场问题

- 严格的政府法规

- 原料成本波动

第六章市场区隔

- 按类型

- 厚壁

- 转移

- 热成型

- 加工

- 按类型

- 湿的

- 干燥

- 按最终用户产业

- 饮食

- 电子产品

- 医疗保健

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 西班牙

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章竞争格局

- 公司简介

- Huhtamaki Oyj

- Henry Molded Products Inc.

- Omni-PAC Group UK

- Cullen Packaging

- Brodrene Hartmann A/S

- Enviropak Corporation

- Heracles Packaging Company SA

- Sabert Corporation

- Keiding, Inc.

- International Paper

- PulPac AB

第八章 投资展望

第九章:市场的未来

The Molded Fiber Packaging Market size is estimated at USD 15.57 billion in 2025, and is expected to reach USD 19.57 billion by 2030, at a CAGR of 4.67% during the forecast period (2025-2030).

The molded fiber packaging market is witnessing heightened interest, driven by the increasing demand for sustainable packaging made from renewable and recyclable materials.

Factors such as a growing demand in end-user industries and the adoption of eco-friendly protective packaging solutions are propelling the market forward. Non-wood waste products, including wheat and bagasse, are increasingly used to produce pulp. Molded fiber packaging, known for its protective and sustainable attributes, is commonly found in applications like egg cartons, drink trays, electronic protective packaging, and food containers.

Key Highlights

- Today's consumers are more aware of the long-term implications of their purchasing choices than a decade ago. With heightened environmental concerns, modern consumers are emphasizing package sustainability significantly. A recent report by Trivium Packaging, the Global Buying Green Report, highlights that over 82% of younger consumers (aged 44 and under) are willing to pay a premium for sustainable packaging products. In addition, as of 2023, 40% of beverage products were bought in sustainable packaging, followed by 30% of food products.

- In response to rising environmental concerns, governments globally are implementing stringent regulations to curb single-use plastics and champion eco-friendly alternatives. These regulations, especially in Europe, are not just about compliance but are reshaping the industry's approach to packaging. The European Union (EU) Commission's Packaging and Packaging Waste Directive, with its ambitious recycling targets of 65% by December 2025 and 70% by December 2030, underscores the urgency. Such governmental pushes are bolstering the demand for molded fiber packaging.

- Furthermore, surging demand for takeout, ready-to-eat meals, and food delivery has driven the rise of molded fiber clamshells, trays, and bowls, all of which adhere to stringent hygiene and sustainability standards. Data from the General Authority for Statistics (Saudi Arabia) reveals that revenue from food and beverage service activities hit USD 15.76 billion in 2023, with projections reaching USD 16.03 billion by 2025.

- A significant limitation in the molded fiber packaging market is ensuring a steady and sustainable supply of raw materials, including natural fibers and recycled paper pulp. Variations in the availability and quality of these materials can disrupt production processes and compromise product quality. Producers are focusing on building resilient supply chains to address this challenge, especially given the surging demand for molded fiber packaging.

- Another challenge in this market is the high initial production costs. While molded fibers boast environmental benefits, the expenses associated with setting up and maintaining manufacturing processes can be substantial. Such costs might dissuade certain companies from transitioning to molded fiber packaging. Nevertheless, with technological advancements and the realization of economies of scale, this financial barrier is expected to diminish over time.

- Overall, the molded fiber packaging market is pivotal in promoting sustainable development within the global packaging industry. Despite facing challenges, its commitment to environmental objectives and a surging demand across various sectors position it as a market with immense growth potential. Further, the market is poised for evolution, driven by heightened investments in research and development, especially in crafting cost-effective, high-quality, and versatile solutions. In addition, principles of the circular economy, notably recycling and waste reduction, will be instrumental in steering the market's growth trajectory.

Molded Fiber Packaging Market Trends

Food and Beverages to be the Largest End-user Industry

- Molded fiber products are increasingly replacing plastics in the food sector, driven by a rising demand for eco-friendly and sustainable solutions. The food market imposes stringent standards on its packaging, necessitating compliance. Beyond basic strength specifications like tensile and thermal qualities, enhanced barrier properties are paramount for materials in the food sector.

- Molded pulp is used for various food packaging items, including clamshell containers, takeout meal containers, egg trays, cartons, and trays for fruits, vegetables, berries, and mushrooms. Notably, trays dominate the food packaging market.

- In addition, eggs are sold to restaurants, food service operators, and individual buyers after being packaged in molded pulp trays and clamshells. Global per capita egg consumption continues to rise annually. The Bureau of Labor Statistics reports that households in the Western U.S. lead the nation in egg spending, averaging USD 109 per consumer unit. With a growing population, heightened awareness of health benefits, and a surge in demand for protein, egg consumption is on the rise. This trend is set to boost the demand for molded pulp packaging products, driving market growth.

- According to Agriculture and Agri-Food Canada, the sales value of packaged foods was USD 2.02 billion in 2023 and is projected to grow to USD 2.43 billion by 2026. This growth in the food industry is set to bolster the market for molded fiber packaging in the region.

- The swift ascent of online retailing amplifies the demand for protective, lightweight, and sustainable packaging materials. Molded fiber stands out as an optimal choice due to its shock-absorption properties. Insights from the Office of Electronic Communications spotlight the Polish e-commerce market's impressive growth, achieving PLN 124 billion (USD 31.17 billion) in 2023 and eyeing a target of PLN 187 billion (USD 47 billion) by 2027. Moreover, data from the Central Statistical Office of Poland reveals a consistent uptick in online shoppers, with over 64% of those surveyed making online purchases in 2023, a nearly 20% surge over the past five years.

- With online shopping on the rise, businesses are looking for durable, cost-effective packaging solutions to safeguard products during transit. According to the International Monetary Fund (IMF), retail sales across Saudi Arabia were projected at USD 155.6 billion in 2024. Looking ahead, 2026 forecasts an uptick to approximately USD 176.5 billion. This burgeoning growth in the E-Commerce and Food Delivery Sectors is set to amplify the demand for molded fiber packaging solutions.

Europe is Expected to Dominate the Market

- Europe stands out as a pivotal market for molded fiber packaging. Industrialized nations, notably the United Kingdom, boast larger urban populations and elevated disposable incomes. The UK Packaging Manufacturing Industry, as reported by the Packaging Federation of the United Kingdom, generates annual sales of GBP 14 billion (USD 17.85 billion) and employs around 80,000 individuals, accounting for 3% of the nation's manufacturing workforce. Furthermore, with the packaging sector witnessing significant growth, heightened investments across various industries are poised to bolster market demand.

- In the UK, rising environmental awareness, regulatory pressures, technological advancements, and corporate sustainability goals are driving a shift towards alternative materials, notably molded fiber packaging. The food service industry is the primary driver of the molded fiber market, holding a significant share. Today, molded fiber packaging is commonly seen in products like egg cartons and other food packaging. According to GOV.UK, egg production for human consumption in Q3 2024 saw a 7.2% increase compared to the same quarter last year. Such growth factors could bolster the market's expansion.

- The increasing investments and growth in France's food sector are also expected to drive the market's growth. Recently, French consumers have shown an increasing interest in sustainable and ethical food consumption. Consequently, there's been a surge in demand for locally sourced and organic products, alongside a preference for eco-friendly packaging. Furthermore, a notable shift toward plant-based and vegetarian diets underscores a heightened awareness of health and environmental issues. This evolving trend is poised to influence market dynamics significantly.

- Germany's packaging industry is heavily utilized by the food sector. Consumers prioritize convenience, protection, and transport ease in products, fueling the demand for diverse packaging solutions. This is especially true for plastic alternatives in food items, notably in dairy, meat, and prepared meals. Additionally, stringent regulations on single-use plastics and a rising demand for sustainable packaging further propel the market's growth.

- Moreover, robust growth in Italy's electronics industry will drive the demand for market solutions. As Italy witnesses a surge in semiconductor production and sales, molded fiber packaging companies stand to gain lucrative opportunities. In 2024, Italy's electronics sector is rapidly evolving, spurred by global market innovations and demands. With a strategic push, Italy aims to cement its position in Europe's semiconductor landscape, channeling an investment of approximately EUR 10 billion (USD 10.7 billion) into the sector this year. These pivotal moves are set to amplify market opportunities.

Molded Fiber Packaging Industry Overview

The market is fragmented, with numerous global and regional players vying for dominance. These players strive to stand out through innovation, customization, and enhanced packaging aesthetics. For instance, in April 2024, PulPac, the trailblazers of Dry molded fiber technology, joined Two Sides, a leading advocacy group for the print and paper sector. PulPac empowers packaging producers with advanced manufacturing technology, promoting sustainable packaging that meets industry demands for scalability, swift production, and cost-effectiveness. With PulPac's competitively priced, fiber-based solutions, producers respond to the industry's and planet's call for responsible packaging and establish themselves as leaders in the field.

Legislative changes and a rising consumer inclination towards sustainability are reshaping the packaging sector. As the environmental benefits of eco-friendly packaging gain recognition, the demand for traditional materials like metal, glass, plastic, and paper is evolving, with a noticeable shift towards greener alternatives.

Molded fiber is a premier packaging choice due to its eco-friendly nature. Crafted from recycled materials, this compostable packaging boasts a minimal environmental footprint. Beyond its ecological advantages, molded pulp packaging offers economic benefits, such as reduced transportation costs and space-saving warehouse designs. Overall, competitive rivalry is expected to be high and to remain the same during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Import Export Analysis of Molded Fiber for Listed Countries

- 4.4.1 United States - Import and Export Analysis

- 4.4.2 United Kingdom - Import And Export Analysis

- 4.4.3 France - Import and Export Analysis

- 4.4.4 Germany - Import and Export Analysis

- 4.4.5 Italy - Import and Export Analysis

- 4.4.6 Spain - Import and Export Analysis

- 4.4.7 China - Import and Export Analysis

- 4.4.8 Japan - Import and Export Analysis

- 4.4.9 India - Import and Export Analysis

- 4.4.10 Brazil - Import and Export Analysis

- 4.4.11 Mexico - Import and Export Analysis

- 4.4.12 United Arab Emirates - Import and Export Analysis

- 4.4.13 Saudi Arabia - Import and Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Shift in Consumer Preferences Toward Recyclable and Eco-friendly Materials

- 5.1.2 Growing Disposable Income

- 5.1.3 Augmented Demand For Reusable and Sustainable Packaging From End-users

- 5.2 Market Challenges

- 5.2.1 Strict Government Rules and Regulations

- 5.2.2 Fluctuations in the Cost of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Thick wall

- 6.1.2 Transfer

- 6.1.3 Thermoformed

- 6.1.4 Processed

- 6.2 By Formal Type

- 6.2.1 Wet

- 6.2.2 Dry

- 6.3 By End-user Industry

- 6.3.1 Food and Beverages

- 6.3.2 Electronics

- 6.3.3 Healthcare

- 6.3.4 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 France

- 6.4.2.3 Germany

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.6.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huhtamaki Oyj

- 7.1.2 Henry Molded Products Inc.

- 7.1.3 Omni-PAC Group UK

- 7.1.4 Cullen Packaging

- 7.1.5 Brodrene Hartmann A/S

- 7.1.6 Enviropak Corporation

- 7.1.7 Heracles Packaging Company SA

- 7.1.8 Sabert Corporation

- 7.1.9 Keiding, Inc.

- 7.1.10 International Paper

- 7.1.11 PulPac AB