|

市场调查报告书

商品编码

1689872

模塑纸浆包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Molded Pulp Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

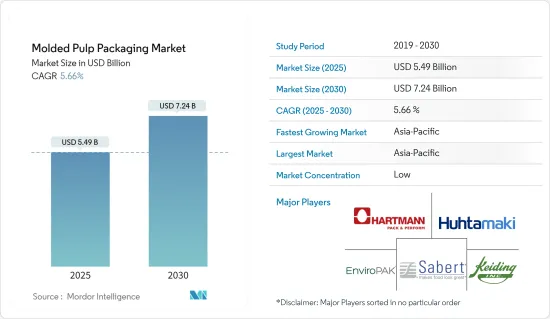

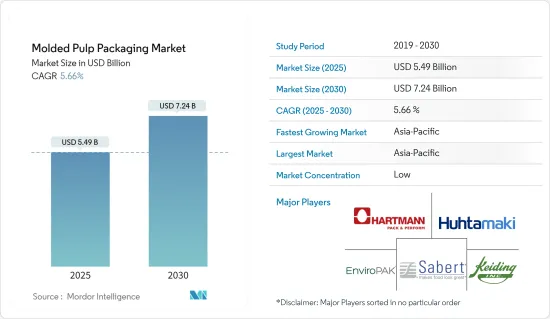

预计 2025 年模塑纸浆包装市场价值将达到 54.9 亿美元,到 2030 年预计将达到 72.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.66%。

对便利性和永续包装替代品的需求快速增长,纤维模塑产品作为塑胶的竞争替代品的不断发展,以及来自电子、食品包装和医疗保健行业的订单不断增加,是模塑纸浆包装市场的主要驱动力。

主要亮点

- 随着消费性电子产品等终端用户产业的需求不断增长,永续包装产品越来越多地被用作运输的保护层,有助于保护环境且不会造成环境破坏。此外,模製纸浆可以製成多种产品,例如端盖,翻盖式容器,托盘,盘子和碗。

- 全球各个经济体鸡蛋消费和生产的扩张正在推动该市场的需求。事实上,根据《PrintWeek》的报道,到 2030年终,全球鸡蛋消费量预计将达到每人近 10.3 公斤。对能够容纳多个鸡蛋的坚固包装托盘的需求最终为纸浆模塑包装铺平了道路。

- 模製纸浆包装可显着节省成本,有助于实现公司的永续性目标。透过使用廉价、可靠的原料,模塑纸浆包装的成本保持在较低水准。大多数塑胶和发泡聚苯乙烯包装材料都来自石油,因此其价格随原油价格的波动而波动。模製纸浆包装采用广泛可用且价格低廉的天然纤维和消费后纸製品製成。

- 整根纤维的可用性是造纸业关注的问题。进口量已增加至300万吨,导致一些政府推出进口法律和限制措施,并提高关税和消费税。近期货柜短缺现象加剧,导致国际班轮公司纷纷调涨价格。用40英尺货柜运输废纸的费用从2800美元上涨到3600美元。此前这一价格不到 1,600 至 1,800 美元。

模塑纸浆包装市场趋势

食品包装占较大的市场占有率

- 模塑纸浆产品越来越多地被应用于食品相关领域,以取代塑胶并满足对环保和永续产品日益增长的需求。食品市场的申请有必须满足的严格标准。除了抗拉强度和耐热性等一些基本的强度规格外,改善的阻隔性性能对于食品市场领域的材料也至关重要。

- 由模製纸浆製成的食品包装产品包括泡壳和外带容器、鸡蛋托盘和纸盒、以及水果、蔬菜、浆果和洋菇托盘。市面上大多数食品包装都采用托盘。模製纸浆包装为鸡蛋等精緻易碎产品提供了最好的保护。由于其可靠性,生产商和零售商遭受的损失或损害较少。鸡蛋托是一种保护性包装,由再生报纸製成。

- 由纸浆和纤维製成的托盘具有良好的透气性和吸湿性,这对于包装和储存鸡蛋至关重要。此外,由于鸡蛋和水果消费量预计增加,且托盘具有重量轻、可回收等优势,因此托盘的需求预计也会增加。鸡蛋包装托盘的需求量很大。鸡蛋消费量的增加表明使用纸浆模塑用于鸡蛋托盘包装是一种趋势。例如,在德国,人均鸡蛋消费量从 2021 年的 14.40 公斤增加到 2023 年的 14.60 公斤。

- 包装需要具有阻隔性,以减少食品与环境之间的气体和水蒸气交换,并减缓食品中的化学、物理和微生物变化。因此,对于用于食品相关产品包装的材料来说,水蒸气和氧气的渗透性是需要考虑的重要特性。

亚太地区经济快速成长

- 根据联合国粮食及农业组织(FAO)统计,近年来中国已成为全球最大木浆进口国。中国食品服务、食品包装、医疗保健、快速消费品和电子产品等领域的终端用户对模塑纸浆包装产品的需求日益增长。有望成为新兴国家纸浆包装市场的进一步推动力量。

- 中国国家发展改革委、生态环境部联合提案,禁止贩售一次性发泡餐具、一次性塑胶棉籤,禁止生产含塑胶珠的日化产品。在全面实施禁塑、限塑的新形势下,纸浆模塑製品具有优良的环保性和可降解性,将成为「限塑令」之后的主要替代品。

- 餐饮抛弃式行业需要原生纸浆来製造与食品密切接触的包装产品,例如泡壳、托盘和杯子,该行业近年来经历了显着的增长。在印度,餐饮业使用的原生纸浆大部分来自非木材来源,例如甘蔗渣和稻草。据 Nirmal Bang 称,到 2025 年,印度有组织的餐饮服务业价值将超过 2.3 兆印度卢比(280.2 亿美元)。

- 向永续包装的重大转变、消费者对环保包装解决方案的偏好以及製造商对产品包装方式的环境和健康关注预计将推动印度模塑纸浆包装市场的成长。

- 网上购物和合作食品宅配是日本最重要的两个食品宅配领域(使用纤维模塑包装来保护食品和杂货免受外部环境和湿气的影响)。然而,由于旅行限制和安全问题导致需求激增,外送外送产业近年来大幅扩张。近年来,随着线上消费的成长,也出现了变化,预计这将推动市场成长。

模塑纸浆包装产业概况

模塑纸浆包装市场较为分散,有多家国内外企业参与。这些公司主要提供客製化解决方案来满足客户的需求。主要参与者正在使用各种策略(例如产品发布、协议和收购)来扩大其在市场上的份额。市场的主要企业包括 Keiding Inc.、EnviroPAK Corporation、Huhtamaki Oyj 等。

- 2023 年 11 月,芬兰包装公司 Huhtamaki 的北美分部推出了由 100% 再生材料製成的模製纸浆鸡蛋盒。这些纸箱是在 Huhtamaki 位于印第安纳州哈蒙德的工厂生产的。

- 2023年6月,Sabert公司推出了最新的纤维共混成型品:Pulp MaxTM和Pulp PlusTM。这些环保包装解决方案由再生纸纤维製成,专为食品应用而设计,为客户提供符合其永续性目标的环保包装选择。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 行业法规和标准

- 生态系分析

第五章 市场动态

- 市场驱动因素

- 消费者对可回收和环保材料的偏好

- 与塑料和 EPS 包装相比大大节省成本

- 市场挑战/限制

- 严格的政府法规

第六章 市场细分

- 依纤维类型

- 再生纤维

- 原生纤维

- 依产品类型

- 托盘

- 碗和杯子

- 泡壳

- 盘子

- 其他产品类型

- 按最终用户

- 食品包装

- 餐饮服务业

- 家电

- 卫生保健

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 澳洲和纽西兰

- 中东和非洲

- 拉丁美洲

- 北美洲

第七章 竞争格局

- 公司简介

- Maspack Ltd

- Enviropak Corporation

- Brodrene Hartmann AS

- Huhtamaki Oyj

- Primeware Solutions(Amercare Royal)

- UFP Technologies Inc.

- Henry Molded Products Inc.

- Keiding Inc.

- Sabert Corporation

- Pacific Pulp Molding Inc.

- Protopak Engineering Corporation

第八章投资分析

第九章:市场的未来

The Molded Pulp Packaging Market size is estimated at USD 5.49 billion in 2025, and is expected to reach USD 7.24 billion by 2030, at a CAGR of 5.66% during the forecast period (2025-2030).

Rapidly growing demand for convenient and sustainable packaging alternatives, ongoing development of molded fiber products that are more competitive as a plastic alternative, and increasing orders from electronics, food packaging, and healthcare sectors are some of the primary drivers of the molded pulp packaging market.

Key Highlights

- As end-user industries such as consumer electronics are witnessing high demand, sustainable packaging products are increasingly used as a protective layer for transporting, benefiting in protection and not causing environmental damage. Moreover, the molded pulp can make several products, such as end caps, clamshell containers, trays, plates, and bowls.

- The expanding egg consumption and production in various economies globally drove the demand for the market studied. In fact, according to PrintWeek, the global consumption of eggs is expected to be nearly 10.3 kg/person by the end of 2030. There is a need to have a sturdy packaging tray that can hold multiple eggs, eventually paving the way for molded pulp packaging.

- Molded pulp packaging offers considerable cost savings that can help corporate sustainability goals. Molded pulp packing costs are kept low using inexpensive and reliable raw materials. As most of the plastic and foam packaging is made from petroleum, the price fluctuates according to changes in oil prices. Natural fibers and post-consumer paper products are used to make molded pulp packaging, which is widely available and affordable.

- Total fiber availability is a concern in the paper industry. Imports increased to 3 million tons, and governments of several countries have adopted import laws and restrictions and increased tariffs and excise levies. Due to a recent container shortage, international liners have raised their prices. The rate for transporting waste papers in a 40-foot container has increased from USD 2,800 to USD 3,600. It was formerly under USD 1,600-1,800.

Molded Pulp Packaging Market Trends

Food Packaging to Hold Significant Market Share

- Molded pulp products are increasingly used in the food-related sector to replace plastics and meet the growing demand for eco-friendly and sustainable products. Applications for the food market are subject to strict standards and must comply with them. In addition to some basic strength specifications, such as tensile and thermal qualities, improved barrier properties are crucial for materials in the food market sector.

- The food packaging products made of molded pulp include clam-shell and takeout meal containers, egg trays and cartons, and fruit, vegetable, berry, and mushroom trays. The majority of the food packaging items on the market utilize trays. Molded paper pulp packing offers the best protection for delicate or fragile goods like eggs. Due to its dependability, the producers and retailers suffer fewer losses and damages. Egg trays are protective packaging and are made using recycled newspapers.

- Molded pulp and fiber trays offer good air permeability and hygroscopic ability, which are essential in egg packaging and storage. Moreover, the demand for trays is predicted to rise due to expected increases in egg and fruit consumption, as well as advantages such as low weight and recyclability. The demand for egg packaging trays is significant. The growing consumption of eggs shows the trend of molded pulp for egg tray packaging. For instance, in Germany, per capita consumption of eggs has increased from 14.40 kilograms in 2021 to 14.60 kilograms in 2023.

- The packaging must have barrier qualities that reduce the exchanges of gases and water vapor between the food and the environment to slow down food's chemical, physical, and microbiological changes. As a result, for materials intended for food-related product packaging, the permeability to water vapor and oxygen are crucial properties to consider.

Asia-Pacific to Witness Significant Growth

- China has been the world's largest importer of wood pulp in recent years, according to the Food and Agriculture Organization (FAO). The country is witnessing a growing demand for molded pulp packaged products for end-users, such as food service, food packaging, healthcare, FMCG, and electronics. It is further expected to drive the developed pulp packaging market.

- The joint proposal from the Reform Commission of China's National Development and the Ministry of Ecology and Environment prohibits the sale of disposable foam tableware, disposable plastic cotton swabs, and the production of daily chemical products containing plastic beads. Under the new situation of widespread implementation of the plastic ban and restriction, pulp molded products will become the main substitute after the "plastic restriction order" due to their excellent environmental protection and degradability.

- The food service disposable industry, which demands virgin pulp for manufacturing packaging products, such as clamshells, trays, cups, etc., that come in close contact with food items, has been experiencing substantial growth over the last few years. In India, most virgin pulp used in food service is derived from non-wood sources, such as bagasse and rice straw. According to Nirmal Bang, India's organized food services industry will reach a market value of over INR 2.3 trillion (USD 28.02 billion) in 2025.

- The significant shift to sustainable packaging, consumer preference for eco-friendly packaging solutions, and environmental and health concerns over how manufacturers pack their products are expected to fuel the growth of the molded pulp packaging market in India.

- Online grocery shopping and co-op food deliveries are Japan's two most significant food delivery segments (which use molded fiber packaging to protect food and groceries from external environment and moisture). However, the restaurant food delivery segment has expanded considerably in recent years as demand soared in response to mobility restrictions and safety concerns. The increase in online spending has seen a shift in recent years, which is expected to aid the market's growth.

Molded Pulp Packaging Industry Overview

The molded pulp packaging market is fragmented due to the presence of several domestic and global players. The companies mainly offer customized solutions to meet customer requirements. Significant players use various strategies, such as product launches, agreements, and acquisitions, to increase their footprints in the market. The key players in the market are Keiding Inc., EnviroPAK Corporation, Huhtamaki Oyj, etc.

- In November 2023, The Huhtamaki North America business unit of Finland-based packaging company Huhtamaki launched molded pulp egg cartons made from 100% recycled materials. The cartons are being made at a Huhtamaki facility in Hammond, Indiana.

- In June 2023, Sabert Corporation unveiled its latest offerings in molded fiber blends: Pulp MaxTM and Pulp PlusTM. These eco-friendly packaging solutions are crafted from recycled paper fibers and designed for food applications, aligning with sustainability goals and providing customers with environmentally responsible packaging choices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Regulations and Standards

- 4.4 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Consumer Preference Toward Recyclable and Eco-friendly Materials

- 5.1.2 Better Benefit of Cost Saving Compared to Plastic and EPS Packaging

- 5.2 Market Challenges/Restraints

- 5.2.1 Stringent Government Rules and Regulations

6 MARKET SEGMENTATION

- 6.1 By Fiber Type

- 6.1.1 Recycled Fiber

- 6.1.2 Virgin Fiber

- 6.2 By Product Type

- 6.2.1 Trays

- 6.2.2 Bowls and Cups

- 6.2.3 Clamshells

- 6.2.4 Plates

- 6.2.5 Other Product Types

- 6.3 By End User

- 6.3.1 Food Packaging

- 6.3.2 Foodservice

- 6.3.3 Consumer Electronics

- 6.3.4 Healthcare

- 6.3.5 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Middle East and Africa

- 6.4.6 Latin America

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Maspack Ltd

- 7.1.2 Enviropak Corporation

- 7.1.3 Brodrene Hartmann AS

- 7.1.4 Huhtamaki Oyj

- 7.1.5 Primeware Solutions (Amercare Royal)

- 7.1.6 UFP Technologies Inc.

- 7.1.7 Henry Molded Products Inc.

- 7.1.8 Keiding Inc.

- 7.1.9 Sabert Corporation

- 7.1.10 Pacific Pulp Molding Inc.

- 7.1.11 Protopak Engineering Corporation