|

市场调查报告书

商品编码

1689725

撒哈拉以南非洲的汽车:市场占有率分析、行业趋势和成长预测(2025-2030 年)Sub Saharan Africa Automotive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

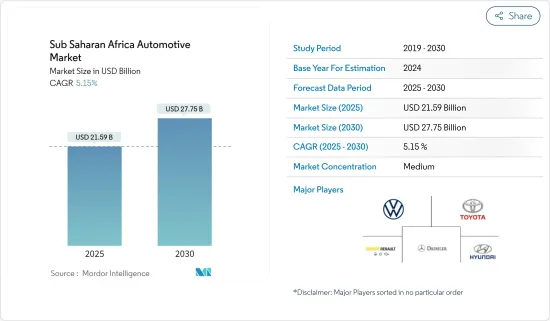

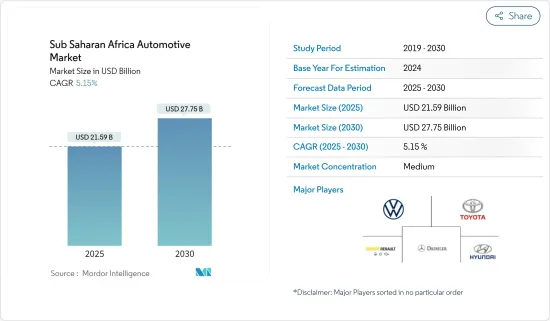

撒哈拉以南非洲汽车市场规模预计在 2025 年为 215.9 亿美元,预计到 2030 年将达到 277.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.15%。

新冠疫情对市场产生了重大影响,需求仍落后于疫情前的水准。 2018年,非洲对新车的需求呈现上升趋势。然而,全部区域政府正努力透过实施进口二手车禁令来促进汽车产业的发展。根据国家汽车设计和发展委员会(NADDC)的资料,尼日利亚每年花费约 2.88 兆奈拉(80 亿美元)进口约 30 万至 40 万辆汽车。

从中期来看,撒哈拉以南非洲的一些政府已开始宣布汽车电气化目标和推广电动车的奖励,例如卢安达对电动车销售实施免税政策。此外,该地区拥有一个专注于电动两轮车的蓬勃发展的电动车新兴企业生态系统。汽车专家表示,截至2021年底,该生态系统拥有超过20家新兴企业,全年总资金筹措超过2,500万美元。

此外,奈及利亚还对进口车征收70%的进口关税和课税,以抑制汽车进口并鼓励当地汽车生产。因此,尼日利亚本地组装和製造的汽车数量增加,大多数当地企业都成功开发了製造流程和能力。例如

关键亮点

- 2019 年,Innoson Vehicles Manufacturing Limited (IVM) 在阿南布拉州内维开设了一家新的自动化公车製造工厂。这家自动化工厂将一辆新型 15-17 座悍马公车的成本从 1,600 万奈拉降至 900 万奈拉。

然而,由于可支配收入低和新车价格过高,二手车在撒哈拉以南非洲国家的汽车零售业中占据主导地位。这些车辆主要从欧洲、日本和美国等地区进口,这些地区的二手车转售价格和残值较低。这可能会在预测期内阻碍目标市场的发展。

非洲汽车市场趋势

其他替代燃料的兴起推动了市场需求

目前,交通运输占非洲温室气体 (GHG) 总排放的 10%,随着撒哈拉以南非洲汽车市场的扩大,这一数字预计还会上升。撒哈拉以南非洲的六个国家——南非、衣索比亚、卢安达、乌干达、肯亚和奈及利亚——占该地区年汽车销量的 70% 左右,占该地区人口的 45% 左右。随着都市化和收入的提高,预计到 2040 年,汽车持有将从目前的 2,500 万辆增加到 5,800 万辆。随着停车场的扩大,撒哈拉以南非洲面临的挑战是促进更永续的交通,同时避免成为全球废弃二手内燃机汽车的倾倒场。

儘管势头正在增强,但撒哈拉以南非洲在向电动车转型的过程中面临着一些独特的挑战,包括有时不可靠的电力供应、低廉的汽车价格以及对二手车的依赖。儘管许多国家在改善电力供应方面取得了长足进步(上述六个国家的都市区电力供应率均超过 70%,有些甚至超过 90%),但电力可靠性仍然令人担忧。此外,据报导,撒哈拉以南非洲 2020 年系统平均中断指数 (SAIDI) 为 39.30,而高所得经合组织国家为 0.87。

非洲的基础设施也在改善,这将促进该地区汽车市场的发展。预计一些国家将在 2023 年之前引领经济成长,其中加纳将发挥关键作用。

- 加纳的目标是到2030年成为已开发国家。如果该国能够实现目标的一半,加纳的汽车市场预计将迅速扩张,因为经济成长和汽车市场成长是成正比的。

此外,多家公司已在该地区推出或计划推出电动车,预计未来几年将占据相当大的市场占有率。例如

- 最近推出的 Eleksa CityBug 是南非道路上最实惠的电动车。新款 Eleksa 的售价为 23 万兰特。 CityBug 的驾驶性能仍有待在南非得到证实。

南非可望成为非洲大陆最大的汽车产业

撒哈拉以南非洲国家的汽车利率每年都在波动,并且高度依赖每个国家的经济成长。南非的汽车产业仍在适应市场力量。进口汽车的成长以及全球经济危机的后遗症,特别是欧洲市场的不确定性及其对国内出口的影响,正在对製造业造成衝击。

这些力量也要求汽车售后市场做出回应。这两个部门都受到电费和原材料价格上涨、人事费用上涨、生产力低和缺乏弹性的影响。为了生存和发展,汽车公司必须不断发展和维护客户关係、实现技术卓越、确保拥有熟练的劳动力并管理重大风险。

2022 年南非汽车销售。 6 月乘用车销量分别为丰田 7,086 辆(占 18.4%)、福斯 5,652 辆(占 14.7%)和铃木 4,622 辆(占 12.0%)。在商用车方面,戴姆勒卡客车销售 387 辆(份额 14.9%),丰田销售 353 辆(份额 13.6%),五十铃销售 322 辆(份额 12.4%)。

非洲汽车产业概况

该地区的汽车产业由大众、丰田、日产、现代和铃木等主要製造商主导。我将介绍一些最新进展。

- 2022 年 7 月南非规格的 Creta 的外观升级与在印尼销售的新车型通用。其中包括新款 Tucson 的「Parametric Jewel」设计格栅和分离式 LED 头灯。除了增加了 8 吋触控萤幕外,内装基本上保持不变。配备多达六个安全气囊、电子稳定控制系统 (ESC) 和带 EBD 的 ABS。

- 2022年8月,玛鲁蒂铃木也在海外市场推出了新款小型SUV Grand Vitara。印度最大的汽车製造商最近在南非提前发布了 Grand Vitara SUV。 Grand Vitara 将取代 S-Cross

- 在尼日利亚签署的谅解备忘录中,大众承诺逐步扩大其製造/生产业务,并将尼日利亚长期定位为非洲西海岸的汽车中心。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 体型类型

- 掀背车

- 轿车

- 运动型多用途车

- 其他(小型货车、MPV等)

- 按车辆类型

- 搭乘用车

- 商用车

- 按燃料类型

- 汽油

- 柴油引擎

- 其他替代燃料

- 国家

- 南非

- 奈及利亚

- 肯亚

- 衣索比亚

- 迦纳

- 其他国家(坦尚尼亚、安哥拉、尚比亚等)

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Toyota Motor Corporation

- Volkswagen AG

- Hyundai Motor Company

- Groupe Renault

- Nissan Motor Co., Ltd.

- Isuzu Motors Ltd

- Ford Motor Company

- Honda Motor Company, Ltd.

- Subaru Corporation

- Suzuki Motor Corporation

第七章 市场机会与未来趋势

The Sub Saharan Africa Automotive Market size is estimated at USD 21.59 billion in 2025, and is expected to reach USD 27.75 billion by 2030, at a CAGR of 5.15% during the forecast period (2025-2030).

The COVID-19 pandemic had a significant impact on the market, and demand is still lagging behind pre-COVID levels. Until 2018, the demand for new vehicles in the African region increased. However, governments across the region are taking initiatives to boost the automotive industry by implementing a ban on imported used vehicles. According to the data from the National Automotive Design and Development Council (NADDC), Nigeria spends about NGN 2.88 trillion (USD 8 billion) on the importation of about 300,000 to 400,000 cars, yearly.

Over the medium term, some governments in Sub-Saharan Africa have begun to announce vehicle electrification targets and incentives for EV adoption, such as Rwanda's tax exemptions for EV sales. Furthermore, a burgeoning start-up ecosystem for EVs, with a focus on electric two-wheelers, is emerging in the region. According to automotive experts, there were more than 20 start-ups in the ecosystem at the end of 2021, with total funding of more than $25 million that year.

Additionally, to discourage the importation of vehicles and encourage local vehicle production, Nigeria slammed 70% import duty and levied on imported vehicles. This resulted in increased volume of locally assembled and manufactured vehicles in the country and most of the local companies have seen developments in their manufacturing process and capacity. For instance,

Key Highlights

- Innoson Vehicles Manufacturing Limited (IVM) opened a new automated plant for manufacturing bus at Nnewi, Anambra State, in 2019. The automated plant reduced the cost of new 15-17-seater Hummer bus from NGN 16 million to NGN 9 million.

However, Due to low disposable income and very high cost associated with new vehicles, used vehicles dominate some of sub-saharan countries automotive retail sector. These vehicles are mainly imported from regions with low resale or residual values of used vehicles like Europe, Japan, and the United States. This might hamper the target market during the forecasted timeperiod.

Africa Automotive Market Trends

Rising Other Alternative Fuel to Drive Demand in the Market

Transport currently accounts for 10% of Africa's total greenhouse gas (GHG) emissions, and this figure is expected to rise as Sub-Saharan Africa's vehicle park expands. The vehicle parc is expected to grow from 25 million vehicles today to an estimated 58 million by 2040 in the six countries that account for roughly 70% of Sub-Saharan Africa's annual vehicle sales and 45 percent of the region's population (South Africa, Ethiopia, Rwanda, Uganda, Kenya, and Nigeria), driven by urbanization and rising incomes. As its vehicle park expands, Sub-Saharan Africa's challenge will be to push for more sustainable mobility while avoiding becoming a dumping ground for the world's unwanted used ICE vehicles.

While momentum is building, Sub-Saharan Africa faces some unique challenges in its electric mobility transition, including unreliable electricity supply in some cases, low vehicle affordability, and reliance on used vehicles. Many countries have made significant progress toward improving electricity access (all six countries mentioned have urban electricity access rates above 70%, with some exceeding 90%); however, electricity reliability remains a concern. Furthermore, the 2020 System Average Interruption Disruption Index (SAIDI) for Sub-Saharan Africa was reported to be 39.30, compared to 0.87 for OECD high-income countries.

Africa's infrastructure is also improving, which will help the region's automotive market. Some countries are expected to drive growth until 2023, with countries such as Ghana playing key roles.

- Ghana aspires to be a developed nation by 2030. If the country meets even half of its target, the Ghanaian automotive market is expected to expand at a rapid pace, as economic growth is directly proportional to the growth of automotive markets.

Various companies are also either launching or planing to launch their electric vehicle in the region to witness a considerable market share in the upcoming years. For instance,

- The recently launched Eleksa CityBug is the most affordable EV to hit South African roads. The new Eleksa costs R230 000 at the point of sale. In the country, the CityBug is still proving its roadworthiness.

South Africa is Expected to be the Continent's Largest Automotive Industry

The vehicle interest rates have been fluctuating across the Sub-Saharan African countries annually and it is highly dependent on the economic growth of the individual country. The South African automotive industry is still adapting to market forces. The increasing number of imported vehicles and the aftereffects of the global economic crisis, particularly the uncertainty regarding European markets and the impact on local exports, are affecting manufacturing.

These forces have also required the automotive aftermarket to respond. Both areas are further impacted by rising electricity and raw material prices, as well as rising labor rates, low productivity, and a lack of flexibility. Automotive companies must continuously develop and maintain customer relationships, achieve technical excellence and retain skilled labor pools, and manage significant risks in order to survive and grow.

Auto sales in South Africa in 2022. Toyota sold 7,086 units (18.4% share) of passenger vehicle sales in June, VW sold 5,652 units (14.7% share), and Suzuki sold 4,622 units (12.0% share). Daimler Trucks and Buses sold 387 units (14.9%), Toyota 353 units (13.6%), and Isuzu 322 units (12.4%) of commercial vehicle sales in June.

Africa Automotive Industry Overview

The automotive industry in the region is dominated by leading manufacturers such as Volkswagen, Toyota, Nissan, Hyundai, and Suzuki. A few of the recent developments include:

- In July 2022, the South African variant of Creta's cosmetic upgrades is shared with the new iteration sold in Indonesia. This includes the new generation Tucson's 'Parametric Jewel' design theme for the grille and split LED headlights. The Interior remains largely unchanged, with the addition of an 8-inch touchscreen. It comes with up to six airbags, electronic stability control (ESC), and ABS with EBD.

- In August 2022, Maruti Suzuki also launched its new compact SUV Grand Vitara in foreign markets. The Grand Vitara SUV was recently showcased in South Africa by India's largest carmaker ahead of its official launch. Grand Vitara, which will take the place of the S-shaped cross.

- In the MoU signed in Nigeria, Volkswagen has committed itself to expanding manufacturing/production operations on a step-by-step basis and to turning Nigeria into an automotive hub on the western coast of Africa, over the long term.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Body Style Type

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 Sports Utility Vehicles

- 5.1.4 Others (Mini-vans, MPV, etc.)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Fuel Type

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.3.3 Other Alternative Fuels

- 5.4 Country

- 5.4.1 South Africa

- 5.4.2 Nigeria

- 5.4.3 Kenya

- 5.4.4 Ethiopia

- 5.4.5 Ghana

- 5.4.6 Other Countries (Tanzania, Angola, Zambia, etc. )

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Toyota Motor Corporation

- 6.2.2 Volkswagen AG

- 6.2.3 Hyundai Motor Company

- 6.2.4 Groupe Renault

- 6.2.5 Nissan Motor Co., Ltd.

- 6.2.6 Isuzu Motors Ltd

- 6.2.7 Ford Motor Company

- 6.2.8 Honda Motor Company, Ltd.

- 6.2.9 Subaru Corporation

- 6.2.10 Suzuki Motor Corporation