|

市场调查报告书

商品编码

1689731

中东汽车租赁:市场占有率分析、行业趋势、统计数据和成长预测(2025-2030 年)Middle East Car Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

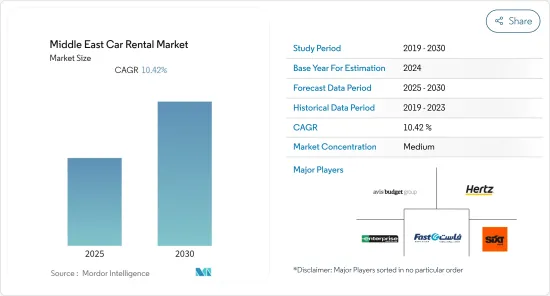

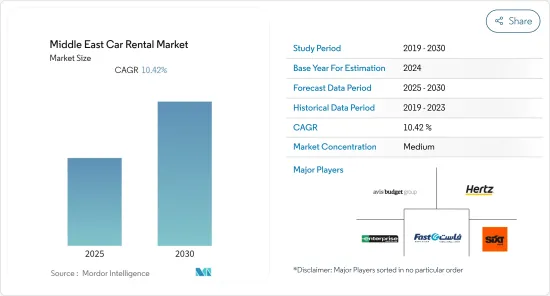

预计预测期内中东汽车租赁市场的复合年增长率为 10.42%。

汽车租赁市场受到新冠疫情的严重影响。由于交通突然完全停止,新冠疫情彻底减缓了该地区的汽车租赁市场。然而,疫情过后,游客数量大幅增加,导致中东国家对汽车租赁的需求大幅增加,预计这种趋势将在整个预测期内持续下去。

从长远来看,由于政府对在该国购买和驾驶汽车的严格法律,汽车租赁市场的成长是有利的。使用公共运输可能很耗时,而且难以预测。此外,公共运输无法从一端到达另一端,这对游客来说尤其不利。

在中东,阿曼和阿拉伯联合大公国等经济体的扩张正在刺激汽车租赁市场的发展。在中东国家中,沙乌地阿拉伯的汽车租赁收益最高。商务旅行、活动、自动驾驶、员工交通、机场接送和本地使用只是汽车租赁的众多用途的一部分。此外,我们还提供保险、娱乐系统和附加服务。中东新兴经济体也开始注意到电动车的兴起,电动车具有相同的功能,但也具有对环境影响较小的额外好处。

在整个中东地区,阿曼和阿拉伯联合大公国等不断扩张的经济体正在刺激汽车租赁市场的发展。在中东国家中,沙乌地阿拉伯的汽车租赁收益最高。他们还提供保险、娱乐系统和其他服务。中东已开发国家也开始注意到电动车的兴起,电动车具有相同的功能,但还具有对环境影响较小的额外好处。

中东汽车租赁市场趋势

网上租赁预订需求依然旺盛

大多数租车客户在旺季都喜欢线上租车。假日高峰期,汽车租赁市场需求增加,因此人们倾向于提前预订汽车。线上预订服务包括透过网路网站和行动应用程式进行的租车预订,其中网站预订是最常用的方式。全部区域网路用户的增加可能会增加线上预订服务的使用率。 2022年,网路使用者将占沙乌地阿拉伯人口的91.4%,到2030年这一比例将上升至95.3%。

如今,线上预订还可以用于各种目的,例如验证租车人的文件、向租车人提供车辆资讯、确定还车细节、在特定地点取车、电子签章合约、无现金交易等。这些使得租车公司在过去几年中比同业更具竞争优势。

汽车租赁服务提供多种经济实惠的选择,客户可以根据自己的需求进行选择。中东国家的汽车租赁产业也正在经历数位转型,线上服务、可用性和用户满意度不断提高。此外,最低限度的维护和维修责任以及全天候可用性的优势也推动了线上汽车租赁预订的成长。

此外,随着应用程式开发人员设计具有更高级预订功能的行动租赁应用程序,透过应用程式进行线上租车的趋势正在随着时间的推移而改善。它在单一平台上提供更大的车辆可用性和可比的租赁价格。随着市场竞争加剧,各大租车公司纷纷采取合作、收购等策略,加强在当地的线上租车业务。例如

- 2022 年 1 月:中东首家也是最大的个人行动旅游公司 Ekar 与该国最大的汽车租赁公司合作,在沙乌地阿拉伯的 Self-drive Super 应用程式内提供汽车租赁服务。

旅游活动增加

中东是一个充满奇蹟的地区,特别是在过去的二十年里,该地区经历了巨大的发展。如今,当地经济的各个领域都受到了这种扩张的影响,包括旅游业。中东正在成为国际观光的下一个主要枢纽,并且该领域正在实现成长。

中东国家位于欧洲、北非、印度和中国等重要地理区域的中部。这使得世界各地建立经济联繫变得更加容易,并长期支持了各国经济。阿拉伯半岛丰富的能源资源,尤其是石油,也促进了这一发展,并开始了与中东新的贸易伙伴关係。

总体而言,中东一直处于都市化和其他发展倡议的前沿,为该地区提供了开始提供旅行和旅游服务所需的基础设施和目的地。中东国家也因此逐渐开始欢迎游客,并建立了旅游产业作为经济基础。这种对游客的欢迎态度导致了从杜拜到利雅德再到安曼的特大城市和国际大都市的发展。庞大的人口、先进的基础设施和一流的交通系统是这些城市具有吸引力的通用因素。

2022 年第四季度,中东入境游客数量增加了 4%,超过了全球 30% 的平均降幅,为国际旅游復苏奠定了基础。沙乌地阿拉伯的国家旅游计画将打造红海第一个郁郁葱葱的岛屿和游艇俱乐部目的地辛达拉。 Sindara 占地 840,000平方公尺,位于未来主义大都市 NEOM,预计 2024 年初向游客开放。该设施预计将为旅游、酒店和休閒产业提供 3,500 名员工。 Schindala 将拥有 333 间豪华服务式公寓、一间拥有 413 间客房的超豪华饭店和一个拥有 86 个泊位的码头。

因此,一些汽车租赁公司正在与当地企业合作进入新市场。例如

- 2022 年 8 月:Finalrentals 计划在全国扩张。该公司宣布已在沙乌地阿拉伯的网路中增加了 39 个新网点。这使得沙乌地阿拉伯的地点和城市总数达到 59 个。 Final Rentals 在新的合作伙伴 Key Car Rental 的帮助下,在沙乌地阿拉伯推出了全国性的租车服务。

中东汽车租赁业概况

中东汽车租赁市场正在适度整合,其中包括 Avis Budget Group Inc、SIXT、Hertz Corp、Theeb Rent A Car 和 Enterprise Holdings Inc. 等国际和区域参与企业。大型汽车租赁公司正在建立合资企业和伙伴关係关係,以推出新产品并在竞争中获得优势。

- 2022 年 12 月,NWTN Inc. 宣布向 M93 Car Rental LLC 位于阿布达比哈利法经济区(「KEZAD」)的新建工厂交付20 辆长距离续航电动车 (R-EV)。此次交付标誌着 NWTN 策略的开始,该策略旨在透过向市场推出一系列尖端产品和服务来加速阿联酋的可持续能源转型。

- 2022 年 11 月:Theeb Rent 再增加 2,000 辆汽车,可供短期租赁的汽车总数达到约 10,500 辆,涵盖现代、丰田、日产、福特、起亚和雪佛兰等品牌的经济型车型。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔(美元)

- 预订类型

- 线上预订

- 线下预订

- 应用

- 休閒/旅游

- 日常公共产业

- 汽车模型

- 经济型轿车

- 豪华轿车

- 最终使用者类型

- 自己

- 与司机

- 国家

- 沙乌地阿拉伯

- 科威特

- 阿拉伯聯合大公国

- 卡达

- 其他中东地区

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Avis Budget Group Inc.

- Hertz Corp.

- Enterprise Holdings Inc.

- Fast Rent a Car

- Sixt SE

- Europcar

- Hanco

- Theeb Rent A Car

- National Rent A Car

第七章 市场机会与未来趋势

The Middle East Car Rental Market is expected to register a CAGR of 10.42% during the forecast period.

The market for car rentals was severely impacted by the COVID-19 pandemic. The COVID-19 pandemic has caused the region's car rental market to slow down completely due to the sudden and complete suspension of transportation. The Middle Eastern countries' rental car demand continued to decline as a result of the region's declining preference for shared mobility.However, in the aftermath of the pandemic, as the number of tourists has significantly increased, the Middle Eastern's demand for car rentals has significantly increased and is anticipated to continue throughout the forecast period.

Over the long term, the car rental market's growth is favorable due to stringent government legislation on purchase and car driving in the country. Using public transportation can become time-consuming and unpredictable. Moreover, public transport doesn't give an end-to-end ride, which is especially unfavorable among tourists.

In every Middle Eastern nation, expanding economies like Oman and the United Arab Emirates have fueled the rental car market.Among the Middle Eastern countries, Saudi Arabia generates the most revenue from car rentals.Outstation, event, self-driving, employee transportation, airport transportation, and local use are just a few examples of the many uses for car rentals.In addition, they are providing insurance, entertainment systems, and additional services.The developed Middle Eastern nations are also starting to take notice of the rise of electric cars, which offer the same functionality with the added benefit of having fewer negative environmental effects.

In every Middle Eastern nation, expanding economies like Oman and the United Arab Emirates have fueled the rental car market.Among the Middle Eastern countries, Saudi Arabia generates the most revenue from car rentals. Outstation, event, self-driving, employee transportation, airport transportation, and local use are just a few examples of the many uses for car rentals.In addition, they are providing insurance, entertainment systems, and additional services.The developed Middle Eastern nations are also starting to take notice of the rise of electric cars, which offer the same functionality with the added benefit of having fewer negative environmental effects.

Middle East Car Rental Market Trends

Online Rental Booking Continues to Witness Major Demand

Most renters prefer renting cars online during peak seasons. As the car rental market witnessed increased demand during peak holiday seasons, people tend to book cars in advance. Online booking services include booking cars through internet sites and mobile applications, among which booking-via-sites is the most common method opted for by renters. The rise in internet users across the region is likely to increase the use of online booking services. In 2022, internet users accounted for 91.4% of Saudi Arabia's population and are expected to increase to 95.3% by 2030.

Currently, booking online also serves various purposes, such as verification of the renter's documents, offering information to the renter regarding the car, determining the details of the drop, and pickup up the rented car at a certain place, e-signing of contracts, and cashless transactions. These helped car rental companies to gain a competitive edge over their peers during the past few years.

Car rental services offer multiple affordable options and can be chosen to suit the customer's needs. The car rental industry in Middle-East nations also sees digital transformation with improved online services, usability, and user satisfaction. Also, the added benefit of minimal responsibility for maintenance, repair, and 24/7 availability is driving the growth of online rental booking.

Furthermore, the trend of online renting a car through apps improved over time as app developers are designing mobile rental applications with more advanced booking features. It offers more vehicle availability and comparable rental costs on a single platform. With growing competition in the market, major companies adopted strategies, such as partnering or acquiring local companies, to boost their online rental operations across the country. For instance,

- January 2022: Ekar, the Middle East's first and largest personal mobility company, activated car subscriptions within its Self-drive Super App across Saudi Arabia in partnership with some of the largest car rental companies in the Kingdom.

Rise in Tourism Activities

The Middle East is a region rich in wonders that grew tremendously, particularly over the last two decades. Today, every part of the local economy is being impacted by this expansion, including the travel and tourism sector. The Middle East is becoming the next major hub for international tourism, and it is in this area that growth is attained.

Middle-Eastern countries are in the middle of important geographical areas, including Europe, North Africa, India, and China. This aspect made it easier to establish global economic connections, which helped the countries' economies over time. The Arabian Peninsula's abundance of energy resources, especially oil, also contributed to this development and the start of new trading partnerships with the Middle East.

Altogether, the Middle East spearheaded urbanization and other development initiatives that provided the region with the infrastructure and tourist destinations required to begin providing travel and tourism services. As a result, the Middle-Eastern countries gradually welcomed tourists and established the travel industry as the foundation of their economy. The development of megacities and international cities resulted from this welcoming attitude toward tourists from Dubai to Amman through Riyadh. Large populations, cutting-edge infrastructure, and first-rate transportation systems are all common elements these cities share and contribute to their appeal.

Inbound arrivals to the Middle East increased by 4% in the fourth quarter of 2022, outpacing the global average decline of 30% and setting the pace for the recovery in international travel. By its national tourism policy, Saudi Arabia will build Sindalah, the first abundant island and yacht club destination in the Red Sea. Sindalah, which spans 840,000 sq m in its futuristic metropolis NEOM, is anticipated to begin hosting visitors in early 2024. 3,500 employees are expected to be created by the facility in the tourist, hospitality, and leisure industries. Sindalah will feature 333 luxury serviced apartments and 413 ultra-premium hotel rooms, and a distinguished 86-berth marina.

Therefore, several car rental companies are partnering with local players to enter new markets. For instance,

- August 2022: Finalrentals had plans to expand throughout the nation. The company announced that it had added 39 new locations to its network in Saudi Arabia. It brings the country's total number of locations and cities to 59. Final Rentals will provide nationwide car rental services in Saudi Arabia, powered by a new partner, Key Car Rental.

Middle East Car Rental Industry Overview

The Middle-East Car Rental Market is moderately consolidated with international and regional players such as Avis Budget Group Inc, SIXT, Hertz Corp, Theeb Rent A Car, Enterprise Holdings Inc, and others. The major rental companies are making joint ventures and partnerships to launch newer products and include an edge over their competitors.

- In December 2022, at its newly constructed facility in the Khalifa Economic Zones Abu Dhabi ("KEZAD"), NWTN Inc. announced that it had delivered 20 range-extended electric vehicles (R-EVs) to M93 Car Rental L.L.C. The delivery marks the beginning of NWTN's strategy to promote the UAE's transition to sustainable energy by offering various cutting-edge products and services to the market.

- November 2022: Theeb Rent added another 2,000 vehicles to its fleet, bringing the number of cars available for short-term rental to about 10,500 with economic models from Hyundai, Toyota, Nissan, Ford, Kia, and Chevrolet.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Value in USD)

- 5.1 Booking type

- 5.1.1 Online booking

- 5.1.2 Offline booking

- 5.2 Application

- 5.2.1 Leisure/Tourism

- 5.2.2 Daily utility

- 5.3 Vehicle Type

- 5.3.1 Economy cars

- 5.3.2 Luxury cars

- 5.4 End-User Type

- 5.4.1 Self-driven

- 5.4.2 Chauffeur

- 5.5 Country

- 5.5.1 Saudi Arabia

- 5.5.2 Kuwait

- 5.5.3 United Arab Emirates

- 5.5.4 Qatar

- 5.5.5 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Avis Budget Group Inc.

- 6.2.2 Hertz Corp.

- 6.2.3 Enterprise Holdings Inc.

- 6.2.4 Fast Rent a Car

- 6.2.5 Sixt SE

- 6.2.6 Europcar

- 6.2.7 Hanco

- 6.2.8 Theeb Rent A Car

- 6.2.9 National Rent A Car