|

市场调查报告书

商品编码

1689817

电动商用车:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Electric Commercial Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

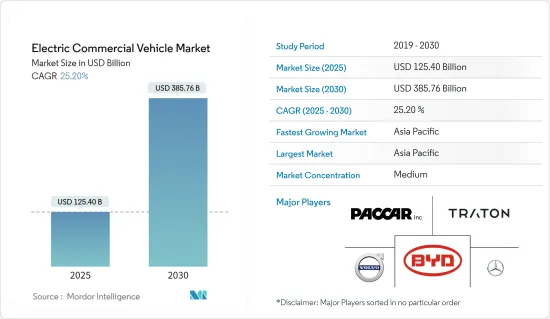

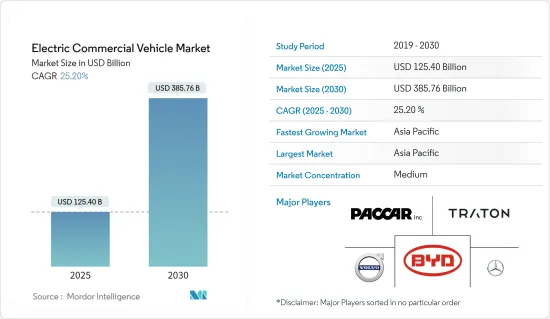

2025 年电动商用车市场规模预估为 1,254 亿美元,预计到 2030 年将达到 3,857.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 25.2%。

从中期来看,预计电动车的使用将在许多新兴国家普及,尤其是在物流和供应链领域。全球各地严格的环境法规迫使许多公司转向电动车,进一步推动市场成长。

汽车製造商面临来自世界各国政府的压力,要求其解决温室气体排放。其中包括减少燃烧柴油产生的碳排放和投资于电动车的发展。

全球对绿色交通和清洁能源的兴趣日益浓厚,使得电动商用车的吸引力飙升。然而,消费者面临的挑战包括范围有限、价格高、可用型号不足以及缺乏知识。这些问题正透过促销宣传活动和政府法规逐步解决。

电动商用车市场的主要驱动力是减少都市区污染和对石化燃料的依赖。电动商用车市场目前是世界上最大的市场。中国、印度和日本是未来几年对电动商用车市场做出贡献的主要国家。

电动商用车市场趋势

公车占很大市场占有率

燃料成本对于任何车辆来说都是一项主要开支。随着燃料价格持续上涨,选择电动公车进行大众运输将降低燃料成本,降低前期公共和整体拥有成本。到2030年,电动公车的价格预计将降至与柴油公车的价格相当。与柴油公车相比,电动公车可减少81-83%的维护和营运成本。

民众对空气污染和气候变迁的认识不断增强,加上柴油价格稳步上涨,促使许多州和市交通官员优先将清洁公共交通解决方案纳入当地发展策略。

与汽油和柴油公车相比,电动公车为乘客提供了更高的舒适度。与传统柴油公车不同,电动公车最大限度地降低了噪音、振动和声振粗糙度 (NVH) 水平,提升了乘客的整体出行体验。

在美国,美国环保署(EPA)和国家公路交通安全管理局(NHTSA)实施了SAFE(更安全、更实惠的省油车)规则。该法规对乘用车和商用车的平均燃油经济性和温室气体排放製定了要求。

零排放汽车(ZEV)计画要求汽车製造商销售一定数量的环保、零排放汽车,包括商用和乘用电动、混合动力汽车和燃料电池汽车。 ZEV 计画的目标是到 2030 年,全国道路上将有 1,200 万辆零排放汽车(包括巴士)。

全球汽车製造商不断打造创新汽车来满足客户的多样化需求。例如

- 2023年9月,印度与美国将在印度联合推出多达1万辆电动公车,为该国公共交通系统带来重大变革。

随着这些以及世界各地的其他发展,未来几年对电动公车的需求可能会成长。

亚太地区可望引领市场

中国政府正在推广使用电动车,并宣布了逐步淘汰拖拉机和施工机械柴油的计画。 2035年,中国境内销售的新车全部须为新能源动力来源。其中一半的车辆必须是电动车、燃料电池汽车或插混合动力汽车。

随着中国各地纷纷安装电动车充电站,重点地区对电动公车的需求可能会增加。预测期内,全国各地的电动公车製造商的扩张可能会推动市场的发展。

在中国,比亚迪、上汽等商用车製造商拥有庞大的市场份额,并在全国拥有强大的研发设施。这一趋势很可能在预测期内创造有利可图的市场机会。例如

- 2023年10月,由一汽集团有限公司与壳牌中国有限公司联合研发的星舰中国概念卡车正式上市。

印度各邦政府正在将电动公车纳入其车队,以改装内燃机公车并降低营运成本,同时减少二氧化碳排放并改善空气品质。例如

- 2024年5月,印度政府宣布计画奖励引进电动公车用于城际和州际旅行,以在全国推广零排放交通。

日本拥有全球最先进的电动车生态系统。丰田、日产等大公司已采取令人瞩目的倡议,在国内开发生产电动车。

电动车充电站的数量超过了汽油和柴油充电站的数量,显示混合动力汽车和电动车市场的发展。这些有利条件预计将刺激日本商用电动车的市场和需求。此外,政府资金也支持日本商用电动车市场的成长。

随着全部区域此类发展,未来几年对电动商用车的需求可能会成长。

电动商用车产业概况

电动商用车市场由几家主要企业,包括比亚迪汽车公司、沃尔沃集团、戴姆勒卡车股份公司和帕卡公司。全国范围内的电动商用车製造商的快速扩张和主要国家新车型的推出预计将在预测期内推动市场显着增长。例如

- 2024年4月,戴姆勒卡车股份公司旗下品牌Rizon在加拿大推出了4-5级电动卡车。该公司提供四种电池电动卡车型号 - e16L、e16M、e18L 和 e18M - 总重量从 7.25 吨到 8.55 吨不等。

- 2023年10月,该公司在湖南长沙举行的品牌更新及新产品发表会上,首次亮相下一代轻卡「欧马可」和下一代微卡「万得」。

- 2023 年 6 月,巴伐利亚州政府核准了MAN Truck & Bus 的五个资金筹措计划中的四个。该笔资金将用于支持电动卡车和巴士高压电池的开发。纽伦堡工厂将获得2684万美元的政府补助。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 严格的排放法规推动市场成长

- 市场限制

- 电动商用车的高成本可能会阻碍成长

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔(以金额为准)

- 按车型

- 公车

- 追踪

- 皮卡车

- 范

- 透过促销

- 纯电动车

- 插电式混合动力汽车

- 燃料电池电动车

- 按产量

- 小于150kW

- 150~250 kW

- 250kW以上

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- BYD Motors Inc.

- AB Volvo

- Traton SE

- Daimler Truck AG

- Zhengzhou Yutong Bus Co. Ltd

- Ford Motor Company

- Tesla Inc.

- Proterra Inc.

- Rivian Automotive Inc.

- Tata Motor Limited

- Olectra Greentech Limited

- Paccar Inc.

第七章 市场机会与未来趋势

8. 各地区电动车充电基础设施发展概况

The Electric Commercial Vehicle Market size is estimated at USD 125.40 billion in 2025, and is expected to reach USD 385.76 billion by 2030, at a CAGR of 25.2% during the forecast period (2025-2030).

Over the medium term, the use of electric vehicles is expected to become more popular in many developing countries, especially in the logistics and supply chain sectors. Strict environmental regulations worldwide are compelling many companies to switch to electric vehicles, further driving the market's growth.

Automakers face growing pressure from governments worldwide to tackle greenhouse gas emissions. This involves cutting carbon emissions from diesel fuel combustion and investing in the advancement of electric vehicles.

The growing worldwide interest in eco-friendly transportation and cleaner energy has caused a surge in the appeal of electric commercial vehicles. However, consumers have encountered challenges such as limited vehicle range, high prices, a lack of available models, and insufficient knowledge. These issues are slowly being addressed through promotional campaigns and government regulations.

The electric commercial vehicle market is mainly driven by the need to reduce urban pollution and dependence on fossil fuels. It is currently the world's largest market for such vehicles. China, India, and Japan are the leading countries contributing to the electric commercial vehicle market in the years to come.

Electric Commercial Vehicle Market Trends

Buses Hold a Major Market Share

The cost of fuel is a significant expense for any vehicle. As fuel prices continue to rise, opting for an electric bus for public transportation decreases fuel expenses and reduces initial costs and overall ownership expenses. By 2030, the prices for electric buses are expected to come down to that of diesel fuel buses. Electric buses help reduce 81-83% of the maintenance and operating costs compared to a diesel-engine bus.

The growing public consciousness of air pollution and climate change, along with the steady rise in diesel prices, has motivated many state and city transportation authorities to prioritize the integration of clean public transportation solutions into their regional development strategies.

Electric buses provide a superior level of comfort for passengers compared to gasoline or diesel buses. Unlike traditional diesel buses, electric buses have minimal levels of noise, vibration, and harshness (NVH), enhancing the overall travel experience for passengers.

In the United States, the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) introduced the Safer Affordable Fuel-Efficient (SAFE) vehicles rule. This regulation establishes the requirements for the average fuel efficiency and emissions of greenhouse gases for both passenger and commercial vehicles.

The Zero-emission Vehicles (ZEV) Program mandates that vehicle manufacturers must sell a certain number of eco-friendly and zero-emission vehicles, which include electric, hybrid, and fuel cell-powered commercial and passenger vehicles. The ZEV program's goal is to have 12 million zero-emission vehicles, including buses, on the roads in the country by 2030.

Worldwide, automobile manufacturers have created innovative vehicles to meet the diverse needs of their customers. For instance:

- In September 2023, India and the United States joined forces to launch up to 10,000 electric buses in India, creating a significant transformation in the country's public transportation system.

With the above-mentioned developments across the world, the demand for electric buses is likely to grow in the coming years.

Asia-Pacific is Expected to Lead the Market

The Chinese government is promoting the use of electric vehicles and has announced plans to phase out diesel fuel used in tractors and construction equipment. By 2035, all new vehicles sold in China must be powered by new energy. Half of these vehicles must be electric, fuel cell, or plug-in hybrid, with the other half being hybrid vehicles.

The increasing installation of EV charging stations throughout China may lead to a higher demand for electric buses in major regions. The expansion of electric bus manufacturers across the country will likely drive the market during the forecast period.

China has a major presence of commercial vehicle manufacturers, such as BYD Co. Ltd and SAIC, with strong R&D facilities nationwide. This trend will likely create lucrative market opportunities during the forecast period. For instance:

- In October 2023, the Starship China concept truck was co-developed and officially launched by FAW Jiefang Group Co. and Shell China Ltd.

The state governments in India are including electric buses in their fleets to convert their ICE fleet of buses and reduce operational costs while reducing carbon emissions and improving air quality. For instance:

- In May 2024, the government of India announced its plans to incentivize the adoption of electric buses for intercity and interstate travel to promote zero-emission transportation across the country.

Japan is home to one of the planet's most cutting-edge electric vehicle ecosystems. Major companies like Toyota and Nissan are taking impressive steps to develop and manufacture electric vehicles within the country.

The abundance of EV charging stations, surpassing the number of petrol and diesel outlets, indicates progress in the hybrid and electric vehicle market. These favorable conditions are expected to fuel Japan's market and demand for commercial electric vehicles. Additionally, government funding supports the growth of Japan's electric commercial vehicle market.

With such developments across the region, the demand for electric commercial vehicles will likely grow in the coming years.

Electric Commercial Vehicle Industry Overview

The electric commercial vehicle market is dominated by several key players, including BYD Motors Inc., AB Volvo, Daimler Truck AG, and Paccar Inc. The rapid expansion of electric commercial vehicle manufacturers across the country and the introduction of new models across major countries are expected to witness major growth for the market during the forecast period. For instance:

- In April 2024, Rizon, a brand of Daimler Truck AG, introduced class 4-5 electric trucks in Canada. The company will offer four variants of its battery-electric trucks, including the e16L, e16M, e18L, and the e18M, with GVW ratings ranging from 7.25 tons to 8.55 tons.

- In October 2023, Foton Motor introduced the Aumark next-generation light-duty truck and the Wonder next-generation micro-truck during a brand renewal and new product launch in Changsha, Hunan.

- In June 2023, the Bavarian State Government approved four out of five funding projects of MAN Truck & Bus. This funding supports the advancement of high-voltage batteries for electric trucks and buses. The government subsidy of USD 26.84 million at the Nuremberg site.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Stringent Emission Regulations are Fueling Market Growth

- 4.2 Market Restraints

- 4.2.1 High Cost of Electric Commercial Vehicles May Hamper Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Value in USD)

- 5.1 By Vehicle Type

- 5.1.1 Bus

- 5.1.2 Trucks

- 5.1.3 Pick-up Trucks

- 5.1.4 Vans

- 5.2 By Propulsion

- 5.2.1 Battery Electric Vehicles

- 5.2.2 Plug-in Hybrid Electric Vehicles

- 5.2.3 Fuel Cell Electric Vehicles

- 5.3 By Power Output

- 5.3.1 Less than 150 kW

- 5.3.2 150-250 kW

- 5.3.3 Above 250 kW

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BYD Motors Inc.

- 6.2.2 AB Volvo

- 6.2.3 Traton SE

- 6.2.4 Daimler Truck AG

- 6.2.5 Zhengzhou Yutong Bus Co. Ltd

- 6.2.6 Ford Motor Company

- 6.2.7 Tesla Inc.

- 6.2.8 Proterra Inc.

- 6.2.9 Rivian Automotive Inc.

- 6.2.10 Tata Motor Limited

- 6.2.11 Olectra Greentech Limited

- 6.2.12 Paccar Inc.