|

市场调查报告书

商品编码

1690062

欧洲电动卡车:市场占有率分析、行业趋势和成长预测(2025-2030 年)Europe Electric Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

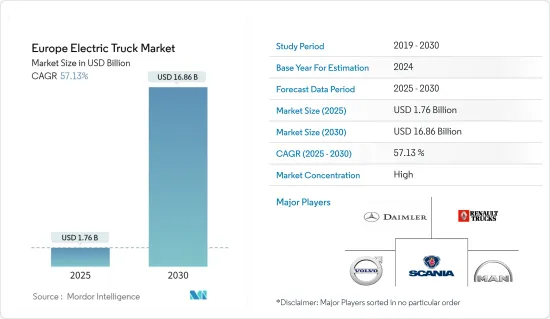

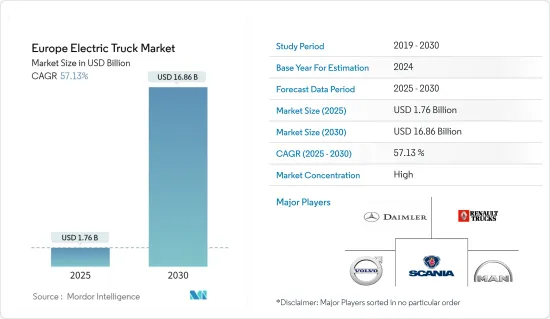

预计2025年欧洲电动卡车市场规模为17.6亿美元,2030年将达到168.6亿美元,预测期间(2025-2030年)的复合年增长率为57.13%。

由于全部区域政府实施的贸易和旅行限制,COVID-19 疫情阻碍了电动卡车市场的成长。不过,2020年上半年电动卡车销售量大幅下滑,下半年强劲反弹。

从中期来看,电动卡车有望成为比柴油卡车更受欢迎的选择,因为它具有扭矩大、噪音污染小、维护成本低等显着优势。

然而,随着法规的放宽,电子商务和物流供应商对电动卡车的需求增加,收益也随之成长。预计,在显着的环境目标的推动下,全部区域替代燃料卡车(尤其是商用电池电动卡车)的发展将进一步推动当前的情况。例如,瑞士透过对柴油卡车征收道路税来鼓励燃料电池电动卡车的发展,使替代燃料对瑞士大型零售商协会更具吸引力。

主要亮点

- 欧盟委员会于2021年10月推出了替代燃料基础设施基金。该基金规模为15亿美元,将支持兴建零排放基础设施,包括快速充电站和加氢站。该基金将协助欧洲国家实现2025年安装100万个充电站、2030年安装350万个充电站的目标。

- 德国政府也承诺额外投入 66 亿美元,鼓励商业车队更换或升级柴油车辆。这笔资金将用于购买 N1(相当于美国2 级)、N2(相当于美国3-6 级)和 N3(相当于美国7-8 级)零排放汽车,以及将 N2 和 N3 汽车改装为零排放汽车。该计划还包括扩大为新车提供动力所需的零排放基础设施的资金。预计未来比利时、丹麦、法国、西班牙等国家也将效法德国的做法。

预计在预测期内,制定针对内燃机汽车的严格排放法规以及增加政府奖励和补贴以增加商用电动车(尤其是卡车)的普及率将推动市场发展。自动驾驶技术、轻量化零件和材料的发展将为市场企业提供新的机会。

除此之外,主要市场参与者对研发的投资增加以及自动驾驶卡车的显着发展也是未来推动整个欧洲电动卡车市场向前发展的其他因素。

欧洲电动卡车市场趋势

纯电动卡车发展势头强劲

由于对环境问题的担忧日益加剧,政府和环境机构正在製定严格的排放法规和立法,这可能会在预测期内增加电力传动系统和节油柴油引擎的製造成本。

此外,预计在预测期内,旨在推动电动卡车广泛应用的创新政府立法政策将推动市场需求。例如,2022年2月,欧盟成员国通过了新的立法,要求所有欧盟成员国在2023年实施新的道路收费制度,为零排放卡车提供重大奖励。

- 到 2023 年 5 月,营运零排放卡车(即电池电动或氢动力汽车)的运输商将享受至少 50% 的基于距离的道路通行费折扣。成员国可以选择对石化燃料卡车征收基于二氧化碳的附加费,或同时实施这两项措施。每辆卡车每年的道路通行费为 25,000 欧元,改用零排放汽车可大幅降低运输成本。

- 新法也要求各国从2026年起对卡车征收空气污染费。从2024年起,新的基于时间的卡车道路使用费可能仅限于有限情况,因为它们不如基于距离的收费公平。如果2024年4月之后要在主要高速公路上实施计时收费,则必须根据卡车的二氧化碳排放调整收费标准。拥有收费公路并签订了特许经营协议的国家可以免除二氧化碳排放和空气污染收费,但仅限于合约续约或进行重大修改之前。

绿色交通正在全球迅速扩张,因此货运公司也将现有车队转换为电力驱动车辆。随着电动卡车需求的成长,汽车製造商正计划推出更多的电动卡车。例如

- 2022 年 6 月,瑞典斯堪尼亚推出了所谓的「下一代电池电动卡车 (BEV)」。配备 R 或 S 卧舖驾驶室的新型电动卡车的充电容量高达 375kW,这意味着充电一小时可增加约 270-300 公里的续航里程,而 Scania 45 R 或 S 的功率水平为 410kW(相当于约 560 马力)。

此外,随着电子商务和物流活动的扩展,这些领域的多家公司广泛依赖卡车运输业在全国范围内运输货物。亚马逊等大型线上竞争对手以及使用卡车和司机作为其电子商务供应链一部分的零售商正在推动对更快送货速度的需求。例如,

- 2021年,欧洲电子商务规模成长13%,达7,180亿欧元。增速较2020年略有上升,但维持稳定。根据2022年欧洲电子商务和欧元商务报告,西欧是迄今为止B2C电子商务领域最强劲的地区,占2021年总销售额的63%。排名第二的是南欧,仅占总销售额的16%,第三和第四是中欧和北欧(分别为10%和9%),最后是东欧(2%)。

基于上述因素,新型电动卡车的持续推出、电动卡车製造投资的增加以及世界各国政府的电动车支援政策可能会在预测期内推动电池电动卡车市场的发展。

英国在预测期内将实现显着成长

预计预测期内英国将占据电动卡车总销量的很大份额。英国正在大力投资开发电动车基础设施。该国已开通一条新的电动高速公路,供架空线路驱动的混合动力电动卡车使用。该国坚持不懈地致力于鼓励电动车的发展,并推出政策推动电动卡车进入该国,预计将刺激市场需求。

该国的污染法规不断变化,未来柴油卡车可能会被彻底淘汰。柴油卡车将被电动车取代,从而推动电动工程车辆产业的发展。

此外,英国政府将电动货车和卡车补贴计画延长两年,至2025年。新的重量级别将从4月起有资格获得补助。政府表示,这项补贴旨在帮助企业转型其车辆,并使其在 2030 年逐步淘汰内燃机之前「领先一步」。自 2012 年推出以来,插电式货车和卡车补贴已帮助英国购买了超过 26,000 辆电动货车和卡车。

- 截至2021年底,政府已降低电动车补贴率。自 2022 年 4 月 1 日起,大型货车和小型电动卡车也属于此变更范围。电动卡车的最低重量要求将从 3.5 吨增加到 4.25 吨,但上限仍为 12 吨。这些汽车将获得购买价格 20% 的补贴,每辆车最高补贴额为 16,000 英镑。此外,重量不超过16,000磅的轻型电动卡车的补贴门槛将从3.5吨提高到4.25吨。重量不超过 4.25 吨的电动卡车将获得 5,000 英镑的补助。

随着电子商务领域的扩张,日本对物流和配送公司的需求日益增长。为了实现市场占有率的商业化,这些公司已经开始製定计划,在未来几年在其车队中部署更多的电动商用车。例如

- 2022年5月,沃尔沃卡车与德国邮政敦豪集团同意合作,加速零排放汽车转型。 DHL 计划在其欧洲航线上部署 44 辆新型沃尔沃电动卡车,加速向重型电动车的转变。计划中的订单包括 40 辆沃尔沃 FE 和沃尔沃 FL 电动卡车,用于都市区的包裹递送。 DHL 已选择使用沃尔沃卡车进行区域运输,首先在英国使用四辆沃尔沃 FM 电动卡车。

- 2021 年 12 月,乐购宣布计划将英国首辆全电动式重型货车投入其位于威尔斯的配送中心商业使用。这些车辆一次充电可行驶约 100 英里,两辆 37 吨重的卡车将把货物从卡迪夫的铁路货运站运送到该公司位于马戈尔的枢纽。

因此,随着上述案例以及该国与电动卡车相关的发展,英国电动卡车市场有望占据整体市场的巨大份额。

欧洲电动卡车产业概况

欧洲电动卡车市场以戴姆勒、斯堪尼亚、曼恩、雷诺卡车和沃尔沃卡车等主要企业为特征。市场竞争非常激烈,大型企业和本地企业都在争夺更大的市场占有率。公司正在进行合併、收购、合资和合作协议以加强其市场地位。例如

2022 年 5 月,沃尔沃卡车与 Bücher Municipal 合作,将下水道清洁卡车电动化。 Bücher Municipal 的目标是到 2023 年底向欧洲社区提供多达 80 辆全电动下水道清洁车。到 2023 年底,Bücher Municipal 预计多达 80 辆下水道清洁车将是零排放沃尔沃卡车,占其产量的 50%。

2022 年 3 月,雷诺卡车宣布与 Geodis推出新计划:Oxygen 16 吨电动卡车。雷诺卡车推出了其 E-Tech 产品组合,这是一系列重要服务,旨在支持客户转型为电动车。用于区域运输的雷诺卡车 T E-Tech 和用于建设业的雷诺卡车 C E-Tech 将于 2023 年推出。

2021 年 6 月,Volta Trucks 推出了 Volta Zero 的首个运行原型底盘。 Volta Zero 将成为欧洲第一款采用创新 e-Axle 的商用车,可提高效率和续航里程。客户客製化车辆的全面生产预计将于 2022 年底开始。

2021 年 6 月,Proton 马达 Fuel Cell GmbH 与英国公司 Electra Commercial Vehicles 签署了一份谅解备忘录 (MoU),以开发英国和爱尔兰的零排放燃料电池卡车市场。根据谅解备忘录,Electra 将作为系统整合,将 Proton 马达 Fuel Cell 的燃料电池系统整合到其现有的电动卡车产品组合中。

因此,基于上述案例和该地区的发展,市场公司正在探索新的机会,以占领欧洲电动卡车市场的大部分市场占有率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 依推进类型

- 插电式混合动力

- 燃料电池电动

- 电池电动

- 按卡车类型

- 小型货车

- 中型卡车

- 大型卡车

- 按应用

- 后勤

- 地方政府

- 其他用途

- 按国家

- 德国

- 英国

- 法国

- 义大利

- 荷兰

- 西班牙

- 其他欧洲国家

第六章竞争格局

- 供应商市场占有率

- 公司简介

- AB Volvo

- Volta Trucks

- Daimler Trucks(Mercedes Benz Group AG)

- DAF Trucks NV(PACCAR Inc.)

- E-Trucks Europe BE

- Renault Trucks

- Tesla Motors Inc.

- Einride AB

- Tevva Motors Limited

- BYD Co. Ltd

- Scania AG

- MAN SE(Volkaswagen AG)

- IVECO SpA

- E-Force One AG

第七章 市场机会与未来趋势

The Europe Electric Truck Market size is estimated at USD 1.76 billion in 2025, and is expected to reach USD 16.86 billion by 2030, at a CAGR of 57.13% during the forecast period (2025-2030).

The COVID-19 pandemic hindered the growth of the electric truck market due to trade and travel restrictions imposed by governments across the region. However, the sales of electric trucks decreased notably in the first half of 2020 and recovered significantly in the latter half.

Over the medium-term, electric trucks are expected to become the preferred choice over diesel trucks owing to their remarkable advantages such as gobs of torque, noise pollution, lower maintenance cost, and others.

However, as restrictions eased, e-commerce and logistic providers witnessed revenue growth, increasing demand for electric trucks. The current situation is further expected to be driven by the development of alternative-fueled trucks, specifically commercial battery-electric trucks, across the European region, in the wake of its notable environmental targets. For instance, Switzerland is encouraging fuel cell electric truck growth through its road tax on diesel truck operations, making alternative fuels more attractive for large Swiss retail associations.

Key Highlights

- The European Commission launched the 'Alternative Fuels Infrastructure Facility' in October 2021. The USD 1.5 billion funds support building zero-emission infrastructure such as fast charging and hydrogen refueling stations. The fund brings European countries closer to reaching their goal of 1 million recharging stations by 2025 and 3.5 million by 2030.

- The German government also pledged an additional USD 6.6 billion to incentivize commercial fleets to replace or upfit their diesel vehicles. The funding covers the purchase of N1 (similar to US class 2), N2 (similar to US class 3-6), and N3 (similar to US class 7-8) zero-emissions vehicles, as well as the conversion to zero-emission drives in N2 and N3 vehicles. The program also includes funding for expanding the zero-emission infrastructure required to power the new vehicles. Countries such as Belgium, Denmark, France, and Spain are expected to follow Germany's example in the future.

Enactment of stringent emission norms on the use of IC engine-powered vehicles and rising government incentives and subsidies focusing on improving the penetration rate of commercial electric vehicles, especially trucks, are expected to drive the market during the forecast period. Development of self-driving technology, lightweight components, and materials to offer new opportunities for players in the market.

Besides these, increasing investments in research and development efforts by key market players and notable developments across autonomous trucks/self-driving trucks are other factors expected to drive the overall Europe electric truck market forward in the future.

Electric Trucks Europe Market Trends

Battery Electric Truck Gaining Momentum

With the growing environmental concerns, governments and environmental agencies are enacting stringent emission norms and laws that may increase the manufacturing cost of electric drivetrains and fuel-efficient diesel engines during the forecast period.

Further, innovative government legislative policies focusing on spurring the penetration of electric trucks are expected to propel demand in the market during the forecast period. For instance, in February 2022, EU member states adopted new legislation which states that all EU member states have until 2023 to implement a new road toll system that gives big incentives for zero-emissions trucks.

- By May 2023, haulers operating zero-emissions trucks, i.e., battery electric or hydrogen, must be given at least 50% discounts on distance-based road tolls. Member states could opt to levy extra CO2-based charges on fossil fuel lorries instead or implement both measures. With road tolls costing haulers up to EUR 25,000 per truck annually, switching to zero-emissions vehicles may cut their overheads considerably.

- The new law also requires countries to apply truck air pollution charges from 2026. From 2024, new time-based road charges for trucks, less fair than distance-based tolling, may be restricted to limited circumstances. If time-based charges remain on major highways after April 2024, they must be varied according to the truck's CO2 emissions. Countries with toll roads under concession contracts may exempt these tolls from both CO2- and air pollution-based charging, but only until these contracts are renewed or substantially amended.

Green transportation is swiftly growing around the world, owing to which the goods transportation companies are also converting their existing fleet into electric propulsion-based vehicles. As the demand for electric trucks is growing, vehicle manufacturers are planning to launch more electric trucks. For instance,

- In June 2022, Swedish Company Scania introduced the "next level of battery-electric trucks (BEV)." With R or S sleeper cabs, the charging capability of the new e-trucks could be up to 375 kW, which means that an hour of charging will add some 270 to 300 km of range, and the power output level for a Scania 45 R or S is 410 kW (equivalent to some 560 hp).

Furthermore, in the wake of growing e-commerce and logistic activities, several companies operating across these sectors are widely depending on the trucking industry to transport goods across the nation. The demand for increases in shipping speed is fueled by huge online competitors, such as Amazon and other retailers that use their trucks and drivers as part of their e-commerce supply chain. For instance,

- In 2021, European e-commerce increased by 13 % to EUR 718 billion. The growth rate has remained stable, though it has risen slightly compared to 2020. According to the e-commerce Europe and euro commerce report 2022, Western Europe is, by far, the strongest region in B2C e-commerce turnover, holding 63% of the total turnover for 2021. Southern Europe follows in second place with just 16% of total turnover, Central Europe and Northern Europe come in third and fourth (10% and 9% respectively), and Eastern Europe (2%) in last place.

Based on the aforementioned factors, consistent launches of new electric trucks, growing investment in electric truck manufacturing, and the government's EV-supporting policies around the world are likely to drive the battery-electric truck market over the forecast period.

United Kingdom to Exhibit a Significant Growth Rate During the Forecast Period

The United Kingdom is expected to account for a significant share of the total sales of electric trucks during the forecast period. The United Kingdom is investing heavily in infrastructure development for electric mobility. It opened a new electric highway for hybrid electric trucks that overhead electric lines will power. It is constantly focusing on encouraging electric mobility and its policies are intended to push electric trucks into the country, expected to drive demand in the market.

Country's pollution laws are constantly changing, and diesel-powered trucks may be phased out entirely in the future. They would be replaced by electric counterparts, taking advantage of the electric construction vehicle industry.

Additionally, the British government has extended its electric van and truck subsidy scheme for another two years until 2025. New weight classes will be eligible for the subsidy beginning in April. According to the government, the subsidy is designed to help businesses convert their fleets in time and be "one step ahead" of the combustion engine's demise in 2030. Since the scheme's inception in 2012, plug-in van and truck grants have aided in the purchase of over 26,000 electric vans and trucks in the United Kingdom.

- By the end of 2021, the government had already cut the subsidy rates for electric vehicles. The large vans and small electric trucks were also subject to changes from April 1, 2022. The lower weight requirement for electric trucks rises from 3.5 to 4.25 tones, while the highest limit remains at 12 tones. These automobiles will be subsidized by 20% of the purchase price, up to a maximum of £16,000 per vehicle. Furthermore, the grant threshold for small electric trucks up to 16,000 pounds would be lifted from 3.5 tons to 4.25 tons. Electric trucks weighing up to 4.25 tons will be eligible for a £5,000 subsidy.

With the growing e-commerce sector, the demand from Logistics and delivery companies in the country has increased. To commercialize the market share, these companies started designing plans to deploy more electric commercial vehicles in their fleet in the coming years. For instance,

- In May 2022, Volvo Trucks and Deutsche Post DHL Group have agreed to collaborate to expedite the transition to zero-emission vehicles. DHL plans to accelerate its shift to big electric vehicles by deploying 44 new electric Volvo trucks on European routes. The planned order includes 40 Volvo FE and Volvo FL electric trucks, which will be utilized for package deliveries in urban areas. Electric trucks for longer routes are also included in the scope, and DHL has opted to start employing Volvo trucks for regional haulage, beginning with four Volvo FM Electric trucks in the United Kingdom.

- In December 2021, Tesco announced its plans to launch the first fully-electric HGVs used commercially in Britain to serve its distribution center in Wales. The vehicles can travel about 100 miles on a single charge, and these two 37-tonne trucks will transport goods from a rail freight terminal in Cardiff to the company's hub in Magor.

Therefore, in line with the abovementioned instances and developments associated with electric trucks in the country, the UK electric truck market is expected to capture a significant share in the overall market.

Electric Trucks Europe Industry Overview

The European electric truck market is characterized by major players, such as Daimler, Scania, MAN, Renault Trucks, Volvo Trucks, etc. The market is highly competitive, as major and local players compete to gain a larger market share. Companies are entering into mergers, acquisitions, joint ventures, and collaboration agreements to strengthen their position in the market. For instance,

In May 2022, Volvo Trucks and Bucher Municipal joined in electrifying sewer cleaner trucks. Bucher Municipal aims to provide up to 80 fully electric sewer cleaner vehicles to European communities by the end of 2023. By the end of 2023, Bucher Municipal anticipates that up to 80 sewer trucks, or 50% of their cleaning vehicle production, maybe Volvo zero-emission trucks.

In March 2022, Renault Trucks announced the launch of a new project with Geodis, the Oxygen 16-ton e-truck. Renault Trucks announced its E-Tech portfolio, which includes some critical services that may assist customers in their transition to electric vehicles. The Renault Trucks T E-Tech for regional transport and the Renault Trucks C E-Tech for the construction industry will be available in 2023.

In June 2021, Volta Trucks revealed the first running prototype chassis of the Volta Zero - the world's first purpose-built full electric 16-tonne commercial vehicle designed specifically for inner-city logistics. The Volta Zero will be Europe's first commercial vehicle to use an innovative e-Axle for increased efficiency and vehicle range. Full-scale production of customer-specification vehicles will then follow at the end of 2022.

In June 2021, Proton Motor Fuel Cell GmbH signed a "Memorandum of Understanding" (MoU) with UK company "Electra Commercial Vehicles Limited" to develop the zero-emission fuel cell truck market in the UK and Ireland. Under the MoU, Electra will act as a system integrator to integrate Proton Motor Fuel Cell's fuel cell systems into their existing electric truck portfolio.

Thus, based on the abovementioned instances and developments in the region, market players anticipated exploring new opportunities to capture the majority market share in the Europe electric truck market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Million)

- 5.1 By Propulsion Type

- 5.1.1 Plug-In Hybrid

- 5.1.2 Fuel Cell Electric

- 5.1.3 Battery-Electric

- 5.2 By Truck Type

- 5.2.1 Light Truck

- 5.2.2 Medium-Duty Truck

- 5.2.3 Heavy-Duty Truck

- 5.3 By Application

- 5.3.1 Logistics

- 5.3.2 Municipal

- 5.3.3 Other Applications

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Netherland

- 5.4.6 Spain

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 AB Volvo

- 6.2.2 Volta Trucks

- 6.2.3 Daimler Trucks (Mercedes Benz Group AG )

- 6.2.4 DAF Trucks NV (PACCAR Inc.)

- 6.2.5 E-Trucks Europe BE

- 6.2.6 Renault Trucks

- 6.2.7 Tesla Motors Inc.

- 6.2.8 Einride AB

- 6.2.9 Tevva Motors Limited

- 6.2.10 BYD Co. Ltd

- 6.2.11 Scania AG

- 6.2.12 MAN SE (Volkaswagen AG)

- 6.2.13 IVECO SpA

- 6.2.14 E-Force One AG