|

市场调查报告书

商品编码

1690107

泰国软包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)Thailand Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

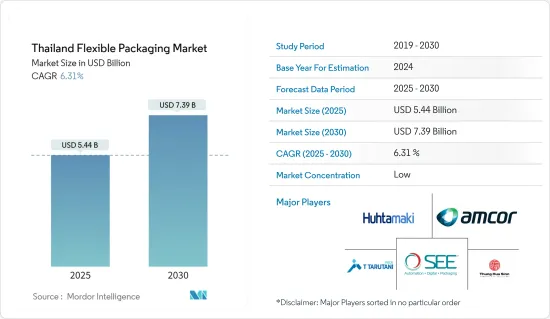

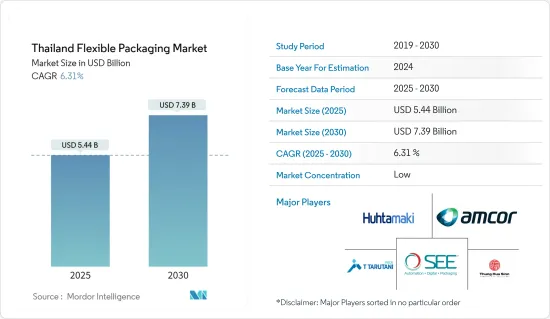

泰国软包装市场规模预计在 2025 年为 54.4 亿美元,预计到 2030 年将达到 73.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.31%。

软包装由纸、塑胶、薄膜、铝箔或这些材料的组合製成。市场上有各种各样的软包装产品,包括小袋、袋子、小包和包装纸,适用于食品饮料、药品和个人护理等行业,有助于推动泰国市场的成长。

据美国农业部称,泰国是东南亚第二大经济体,也是罐头鲔鱼、凤梨和冷冻虾的主要出口国。预计到 2024 年,泰国食品产业收益将成长至 717.9 亿美元,其中饮料产业的扩张预计将成为市场成长的驱动力。

泰国旅游业的成长促进了该国食品和饮料消费的成长。根据亚太旅游理事会预测,2023年到访泰国的国际观光人数将超过1,800万人。在泰国,消费者在碳酸饮料、已调理食品和烘焙点心上的支出不断增加,推动市场的成长。

此外,泰国每年都会举办各种包装展览和活动,企业展示新的创新包装解决方案以及包装器材和加工技术的进步,帮助製造商在竞争中保持领先地位。亚洲国际包装博览会将于2024年6月在曼谷举办,展示食品和饮料包装的先进自动化和技术。

然而,软包装市场随着製造技术的进步而不断发展。强大的消费群和高市场成长的市场竞争可能会阻碍泰国市场的成长。

泰式软包装市场趋势

食品业预计将显着成长

- 软包装广泛用于食品,因为它可以保持新鲜度、延长保质期并防止污染。软质塑胶包装用于各种食品,包括生鲜食品、肉类和家禽、乳製品、零嘴零食和已调理食品。泰国的食品和饮料产业正在蓬勃发展,对软质塑胶包装的需求也随之增加

- 除了餐厅的食品配送外,泰国的网路杂货服务也正在兴起。近年来,由于网上订餐需求的不断增长以及对食品宅配速度和便利性的需求,泰国的食品宅配行业经历了显着增长。根据美国农业部预测,2023年泰国食品服务收入预计将年增12.6 %,推动市场成长。

- 泰国对加工食品的需求不断增加以及消费者对简便食品的支出不断增加是软包装需求成长要素。根据美国农业部的资料,泰国食品零售业的成长是由于生活成本上升影响了消费者的消费能力。

- 根据美国农业部的资料,2023年泰国加工食品出口将占出口总额的54%,有助于扩大市场。

- 在泰国,软包装在食品和饮料行业中变得越来越重要,人们开始转向使用液体含量更高的包装袋。此外,使用永续包装选择及其材料的折旧免税额有助于产品吸引那些喜欢从具有环保做法的公司购买产品的消费者。

BOPP 成长强劲

- 双轴延伸聚丙烯(BOPP)是一种热塑性聚合物,其性能与 PET(聚对苯二甲酸乙二醇酯)相似。双轴延伸聚丙烯(BOPP)是一种在生产过程中透过双向拉伸聚丙烯而产生的具有高拉伸强度的材料。

- BOPP薄膜产品因其阻隔性广泛应用于软包装,可保护产品免受潮湿、紫外线和各种外部挑战的影响。在食品包装中使用 BOPP 薄膜可以延长易腐食品的保质期,例如烘焙食品和糖果零食、咸味小吃和已调理食品食品。

- Kingchaun Packaging 等公司在泰国生产 BOPP 薄膜。我们提供适用于各种应用的先进多功能薄膜,包括雾面、光泽、防雾、全像和珠光饰面。

- BOPP袋广泛应用于药品包装。提供可靠的防潮和防外部环境保护有助于维持製药的生产效率和可靠性。泰国製药业的成长和消费者医疗保健支出的增加进一步推动了市场的成长。

泰国软包装市场概况

泰国的软包装市场分散且竞争激烈,市场参与企业众多,包括 Thug Hua Sinn Group (TPN FlexPak)、Amcor PLC、T Tarutani Pack、Sealed Air Corporation 和 Huhtamaki OYJ。该市场的特征是产品差异化有限、产品渗透率高、竞争激烈。设计、技术和应用方面的创新可以提供长期的竞争力。

2023 年 12 月,泰国花王工业与泰国化学品製造商 SCG Chemicals 和陶氏泰国集团合作,使用 INNATE、ELITE 和陶氏 PCR 等创新塑胶开发永续包装。透过此次伙伴关係,花王将开发新材料并采用创新製造技术来提供刚性和柔性的可持续包装,从而减少其碳足迹并满足消费者的需求。

2023年7月,TPBI推出线上分销服务“LifeHakStore by TPBI”,为想要随时从TPBI及其合作伙伴订购各种包装的客户提供便利。这种扩张方式使公司能够接触到更广泛的客户群,同时创造新的收益来源。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 当前地缘政治情势如何影响市场

- 主要行业的供应商层级存在

第五章市场动态

- 市场驱动因素

- 终端用户产业需求不断成长

- 对便利包装的需求不断增加

- 市场限制

- 环境和回收问题

第六章市场区隔

- 依产品类型

- 小袋

- 类型

- 支架类型

- 平板型

- 最终用户

- 食物

- 饮料

- 宠物食品

- 其他的

- 包包

- 薄膜和包装

- 类型

- BOPP(双轴延伸聚丙烯)

- BOPET(双向拉伸聚对苯二甲酸乙二酯)

- CPP(流延聚丙烯)

- PVC(聚氯乙烯)

- PE(聚乙烯)

- 其他的

- 最终用户

- 食物

- 消费品

- 医疗保健

- 其他的

- 其他的

- 小袋

第七章竞争格局

- 公司简介

- Huhtamaki OYJ

- Sealed Air Corporation

- T Tarutani Pack Co. Ltd

- Amcor PLC

- Thug Hua Sinn Group(TPN FlexPak)

- JR Pack Co. Ltd

- Thai Artec Co. Ltd

- Innopack industry co. ltd

- TPBI Public Company Limited

- Mondi Group

- SCG Packaging Public Company Limited

- Scientex Packaging(Ayer Keroh)Berhad

- Kim Pai Co. Ltd

- Print Master Co. Ltd

- South East Packaging Industry Co. Ltd

- LLH Printing & Packaging

- Majend Macks Co. Ltd

- Fuji Seal Inc.

- Royal Meiwa Pax Co. Ltd

- Craftz Co. Ltd

第八章投资分析

第九章:市场的未来

The Thailand Flexible Packaging Market size is estimated at USD 5.44 billion in 2025, and is expected to reach USD 7.39 billion by 2030, at a CAGR of 6.31% during the forecast period (2025-2030).

Flexible packaging is produced from paper, plastic, film, aluminum foil, or a combination of those materials. The wide variety of flexible packaging products, such as pouches, bags, sachets, and wraps, available in the market for industries like food and beverages, pharmaceuticals, and personal care boosts the market growth in Thailand.

According to the US Department of Agriculture, Thailand is Southeast Asia's second-largest economy and a major exporter of canned tuna, canned pineapple, and frozen shrimp. Thailand's food industry's revenue is projected to grow to USD 71.79 billion in 2024, driven by the expanding beverage industry, which is estimated to propel the market growth.

The growing tourism in Thailand has contributed to the country's increased food and beverage consumption. According to the Pacific Asia Travel Association, International tourist arrivals in Thailand exceeded 18 million in 2023. Growing consumer expenditure on carbonated drinks, ready-to-eat meals, and baked goods in Thailand drives the market growth.

Also, various packaging expos and events are organized in Thailand every year, where companies showcase new and innovative packaging solutions and advancements in packaging machinery and processing technologies, which helps manufacturers stay ahead of the competition. In June 2024, the International Processing and Packaging Exhibition for Asia will be held in Bangkok, showcasing advanced automation and technology in food and beverage processing and packaging.

However, flexible packaging is a constantly evolving market with changing technological advancements in manufacturing. High competition in the market to enhance the consumer base and high market growth can hamper the market growth in Thailand.

Thailand Flexible Packaging Market Trends

The Food Segment is Expected to Witness Significant Growth

- Flexible packaging is widely used for food products because it can preserve freshness, enhance shelf life, and protect against contamination. Flexible plastic packaging is used for various food products, including fresh produce, meat and poultry, dairy products, snacks, and ready-to-eat meals. Thailand's growing food and beverage industry drives the segment's need for flexible plastic packaging.

- Besides food delivery from restaurants, online grocery services are also rising in Thailand. The food delivery industry in Thailand has seen tremendous growth in recent years due to the rising demand for online ordering and the need for speed and convenience in food delivery. According to the US Department of Agriculture, Thailand's foodservice value grew by 12.6% in 2023 compared to the previous year, boosting the market growth.

- Increasing demand for processed food products and growing consumer spending on convenience food products in Thailand are significant growth factors for the demand for flexible packaging. According to data from the US Department of Agriculture, growth in Thailand's food retail industry is attributable to rising living costs impacting consumers' spending power.

- According to data from the US Department of Agriculture, Thailand's exports of processed foods constituted 54% of the total exports in 2023, propelling market expansion.

- The increasing importance of flexible packaging in Thailand for food and beverage industries is experiencing a major shift to pouches that contain high liquid contents. Also, using sustainable packaging options and their depreciation of materials boost product appeal to consumers who prefer buying from companies with eco-friendly practices.

BOPP to Witness Robust Growth

- Biaxially oriented polypropylene (BOPP) is a thermoplastic polymer with properties similar to PET (polyethylene terephthalate). Biaxially oriented polypropylene (BOPP) is a polypropylene film stretched in both directions during manufacturing to create a material with high tensile strength.

- BOPP film products are widely used in flexible packaging as they have high barrier properties that protect products from moisture, UV, and any external challenge. Using BOPP film in food packaging helps extend the shelf life of perishable food items, including bakery and confectionery, savory snacks, and ready-to-eat food.

- Companies such as Kingchaun Packaging manufacture BOPP films in Thailand. They provide advanced, multi-functional films in matte, glossy, anti-fog, holographic, and pearlized formats suitable for various applications.

- BOPP pouches are extensively used for pharmaceutical packaging. They help preserve the productivity and reliability of medicines by ensuring protection from moisture and external environmental situations. The growing pharmaceutical industry in Thailand and increased consumer healthcare spending further boost the market growth.

Thailand Flexible Packaging Market Overview

The Thai flexible packaging market is fragmented and competitive, with a high number of market players such as Thug Hua Sinn Group (TPN FlexPak), Amcor PLC, T Tarutani Pack Co. Ltd, Sealed Air Corporation, and Huhtamaki OYJ. This market is distinguished by limited product differentiation, increasing product penetration, and intense competition. Design, technology, and application innovation can provide a long-term competitive edge.

In December 2023, Kao Industrial Co. Ltd, a Thai-based company, partnered with SCG Chemicals, a Thai-based chemical manufacturer, and Dow Thailand Group to develop sustainable packaging using innovative plastics such as INNATE, ELITE, and Dow PCR. This partnership will develop new materials and use innovative manufacturing technologies to provide rigid and flexible sustainable packaging, enabling Kao to lower its carbon footprint and meet consumer demand.

In July 2023, TPBI launched the "LifeHakStore by TPBI" to provide online distribution services, providing convenience to customers who wish to order various packaging from TPBI and its partners anytime. Such business expansion approaches enable the company to reach a broader customer base while generating new revenue streams.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Current Geo-political Scenarios on the Market

- 4.5 Vendor Level Presence in Major Verticals

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from End-user Industries

- 5.1.2 Increased Demand for Convenient Packaging

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding the Environment and Recycling

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Pouches

- 6.1.1.1 Type

- 6.1.1.1.1 Stand-up

- 6.1.1.1.2 Flat

- 6.1.1.2 End User

- 6.1.1.2.1 Food

- 6.1.1.2.2 Beverage

- 6.1.1.2.3 Pet Food

- 6.1.1.2.4 Other End Users

- 6.1.2 Bags

- 6.1.3 Films and Wraps

- 6.1.3.1 Type

- 6.1.3.1.1 BOPP (Biaxially Oriented Polypropylene)

- 6.1.3.1.2 BOPET (Biaxially-oriented Polyethylene Terephthalate)

- 6.1.3.1.3 CPP (Cast Polypropylene)

- 6.1.3.1.4 PVC (Polyvinyl Chloride)

- 6.1.3.1.5 PE (Polyethene)

- 6.1.3.1.6 Other Types

- 6.1.3.2 End User

- 6.1.3.2.1 Food

- 6.1.3.2.2 Consumer Goods

- 6.1.3.2.3 Medical

- 6.1.3.2.4 Other End Users

- 6.1.4 Other Product Types

- 6.1.1 Pouches

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huhtamaki OYJ

- 7.1.2 Sealed Air Corporation

- 7.1.3 T Tarutani Pack Co. Ltd

- 7.1.4 Amcor PLC

- 7.1.5 Thug Hua Sinn Group (TPN FlexPak)

- 7.1.6 JR Pack Co. Ltd

- 7.1.7 Thai Artec Co. Ltd

- 7.1.8 Innopack industry co. ltd

- 7.1.9 TPBI Public Company Limited

- 7.1.10 Mondi Group

- 7.1.11 SCG Packaging Public Company Limited

- 7.1.12 Scientex Packaging (Ayer Keroh) Berhad

- 7.1.13 Kim Pai Co. Ltd

- 7.1.14 Print Master Co. Ltd

- 7.1.15 South East Packaging Industry Co. Ltd

- 7.1.16 LLH Printing & Packaging

- 7.1.17 Majend Macks Co. Ltd

- 7.1.18 Fuji Seal Inc.

- 7.1.19 Royal Meiwa Pax Co. Ltd

- 7.1.20 Craftz Co. Ltd