|

市场调查报告书

商品编码

1690189

美国数位货运:市场占有率分析、行业趋势和成长预测(2025-2030 年)United States Digital Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

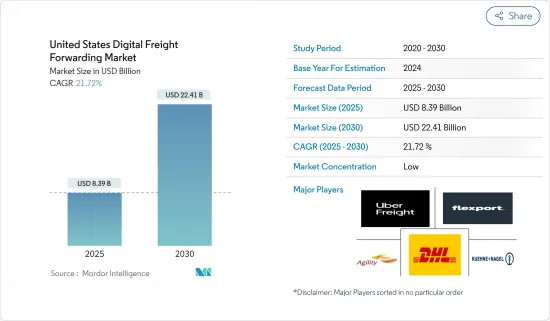

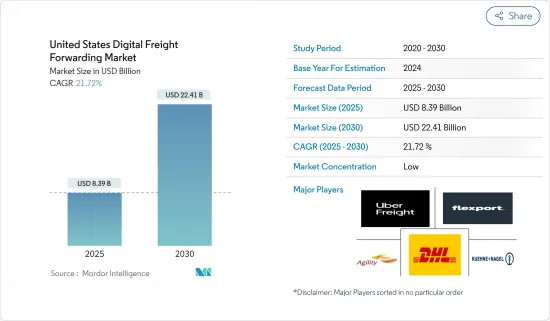

预计 2025 年美国数位货运代理市场规模为 83.9 亿美元,到 2030 年将达到 224.1 亿美元,预测期间(2025-2030 年)的复合年增长率为 21.72%。

主要亮点

- 各行业业务成长的主要驱动力之一是手动流程的自动化。此外,由于电子商务的普及和自由贸易协定的增加,数位货运代理市场正在成长和扩大。

- 大多数产业正在进行数位转型,货运也不例外。数位货运代理商使用科技来规划和管理他们的货运。

- 数位货运代理使行业相关人员能够利用当前的技术进步来简化参与航运计划的相关人员之间的沟通。为了向客户提供最优惠的价格,Digital Freight Forwarding 还使用完全透明的云端基础的系统,可以轻鬆比较多种货运价格。

- 数位化仍然是美国经济成长的主要驱动力之一。 Convoy、Uber Freight 和 uShip 等公司正在开发新平台来填补物流行业的空白。数位货运减少了手动流程。数位货运代理的一些主要优势包括即时报价、透明定价、费率和承运人比较、追踪和简单的文件记录。物流业正在发展成为无纸化、数位化的产业,支持了市场的成长。

- 现在许多企业都开始采用数位货运服务。截至 2021 年 4 月的六个月内,Uber Freight 业主营运商的启动量几乎翻了一番,截至 2021 年 5 月,新授权承运人的数量与前一年同期比较增长了 300% 以上。 2021 年第一季,该公司密切关注了这一驱动供应转变以及影响该行业的其他宏观趋势,包括美国劳动力趋势和供应链瓶颈。

美国数位货运市场的趋势

电子商务正在推动市场

2021年上半年,美国零售电商销售额达约4,380亿美元。 2021年4月至6月的销售额超过2,220亿美元,高于第一季的2,150亿美元。整体而言,零售电商销售额超过了2020年创下的季度销售记录。根据美国商务部的资料,十多年来电商销售额一直在逐步成长,过去两年成长显着。美国电子商务总销售额从 2020 年的 8,116 亿美元成长 18.3% 至 2021 年的 9,599 亿美元。

根据Digital Commerce 360对美国商务部资料的分析,继疫情第一年增长45%-50%之后,2022年第二季度是美国电子商务支出连续第四个季度实现个位数增长。不过,2021年初以来,线上销售与前一年同期比较首次超过了实体店。

美国商务部数据显示,第二季数位销售额达到 2,521.4 亿美元,较去年同期的 2,348.9 亿美元成长 7.3%。这还不到2021年第二季美国电子商务成长率15.4%的一半,也远低于2020年第二季封锁和商店关闭期间53.4%的增幅。

线上客户期望订单准确、当天或当天送达以及免费退货。电子商务公司正在寻找减少订单交付时间和营运成本的方法。电子商务产业正在推动对透明度、可负担性、便利性、交货速度和无摩擦退货的需求。为了满足这些需求,必须透过数位化物流业务和自动化物料输送系统、仓库管理系统和交付管理系统来创建新的经营模式和解决方案。这使得履约服务更快、更灵活,特别是在最后一哩交付和简化退货程序方面。

海运业呈现强劲成长

海运业需要创新。这个市场开始被物流科技公司填补。由于世界要求商品能够像 Uber 或亚马逊完成订单那样快速地送达,我们将看到电子商务公司转向第三方物流,而第三方物流又转向电子商务公司。

一旦产品进口到美国,零售商和品牌就会停止追踪。亚马逊效应及其创造的由总週期时间驱动的仓库直通意味着更多的卖家在货物到达原产港后立即接受库存订单。这将海运货柜转变为未来仓库的现代化版本,提高消费者和供应链专业人士对海运的认识。

大多数产业正在进行数位转型,货运也不例外。数位货运代理使用科技来规划和管理货运。根据波罗的海货运指数 (Freightos Baltic Index) 的数据,目前从中国运送一个 40 英尺货柜到美国西海岸的价格约为每箱 5,400 美元,较 2022 年 1 月下降了 60%。

目前,从亚洲到欧洲运输一个货柜的成本为 9,000 美元,比 2022 年初下降了约 42%。这两条航线的运费在 2021 年 9 月的高峰都超过了 2 万美元,超过了疫情前的水准。

沃尔玛和其他大型零售商由于预计会出现运输延误和最终未能实现的需求,争先恐后地比平时更早进口商品,导致 2022 年库存过剩。

美国数位货运产业概况

美国数位货运代理市场竞争激烈且分散,参与者众多。主要参与者包括 Flexport、Uber Freight、DHL Group、Agility Logistics Pvt。 Ltd 和 Kuehne+Nagel International。

数位货运代理 (DFF) 使用数位平台提供比市场和连接提供者更广泛的物流服务。 DFF 的核心价值提案是围绕无缝用户体验,即将货物从一个地点运送到另一个地点,透过单一用户介面在一个平台上汇总资讯。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场洞察

- 当前市场状况

- 价值链/供应链分析

- 投资前景

- 政府法规和倡议

- 线上货运和数位平台的技术发展

- 美国电子商务物流及货运概况

- 电子平台价值提案与竞争力

- COVID-19 市场影响

第五章 市场动态

- 驱动程式

- 限制因素

- 机会

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第六章 市场细分

- 按运输方式

- 海洋

- 航空

- 土地

- 按公司类型

- 中小型企业

- 大企业和政府

第七章 竞争格局

- 市场集中度概览

- 公司简介

- Flexport

- Twill

- Forto

- Expeditors International

- InstaFreight

- Transporteca

- Kontainers

- Kuehne+Nagel International(KN Freight Net)

- Turvo

- iContainers

- DHL Group

- NYSHEX

- Agility Logistics Pvt. Ltd

- Convoy

- Uber Freight

- uShip*

第八章 市场机会与未来趋势

第九章 免责声明

The United States Digital Freight Forwarding Market size is estimated at USD 8.39 billion in 2025, and is expected to reach USD 22.41 billion by 2030, at a CAGR of 21.72% during the forecast period (2025-2030).

Key Highlights

- One of the main factors propelling the expansion of businesses across all industries is the automation of manual processes. Additionally, the market for digital freight forwarding is growing and expanding due to the spread of e-commerce and the rise in free trade agreements.

- The majority of sectors are undergoing digital transformations, and freight forwarding is no exception. Technology is used by digital freight forwarders to plan and manage cargo transit.

- Through the use of digital freight forwarding, industry participants can take advantage of current technological advancements to streamline contact between all parties involved in a shipping project. In order to give customers the best deal, digital freight forwarding also involves the use of a totally transparent cloud-based system that makes it simple to compare multiple shipping prices.

- Digitization continues to be one of the key drivers supporting the growth of the US economy. Companies like Convoy, Uber Freight, and uShip are developing new platforms to fill in the gaps in the logistics industry. With digital freight forwarding, the manual process will be reduced. The major benefits of digital freight forwarding include instant quotes, transparent pricing, comparison of rates and carriers, tracking, easy documentation, and others. The logistics industry is developing into a paperless digitized industry, supporting the market's growth.

- Many companies are now embracing digital freight services. In the six months before April 2021, Uber Freight's owner-operator activation nearly doubled, and by May 2021, the number of new authority carriers had increased by more than 300% year over year. In the first quarter of 2021, the company closely monitored this driver supply shift as well as other macro developments affecting the industry, such as the US labor trends and supply-chain bottlenecks.

US Digital Freight Forwarding Market Trends

E- Commerce is driving the market

In the first half of 2021, US retail e-commerce sales amounted to almost USD 438 billion. Sales revenue from April to June of 2021 exceeded USD 222 billion, up from USD 215 billion in the first quarter. Overall, retail e-commerce sales outdid the quarterly sales records registered in 2020. According to data from the US Department of Commerce, e-commerce sales have increased gradually for more than ten years, with a notable rise in the last two years. Total US e-commerce sales increased by 18.3% from USD 811.6 billion in 2020 to USD 959.9 billion in 2021.

According to a Digital Commerce 360 analysis of the US Department of Commerce data, following the 45%-50% increases during the first year of the pandemic, US e-commerce spending in Q2 2022 recorded its fourth consecutive quarter of single-digit growth. But for the first time since early 2021, the year-over-year increase in online sales also topped that of physical locations.

According to figures from the Commerce Department, digital revenue reached USD 252.14 billion in the second quarter, an increase of 7.3% from USD 234.89 billion for the same period in the previous year. This was less than half of the 15.4% US e-commerce growth in Q2 2021 and far less than the 53.4% increase that occurred amid lockdowns and store closings in Q2 2020.

Online customers expect order accuracy, same-day or same-hour delivery, and free returns. E-commerce companies are exploring ways to reduce order delivery times and operational costs. The e-commerce industry drives the demand for transparency, affordability, convenience, speed in delivery, and compelling frictionless returns. To cater to this need, it is essential to create new business models and solutions by digitalizing logistics operations and automating material handling systems, warehouse management systems, and distribution management systems. This has made fulfilment services speedier and more diverse, especially in terms of last-mile delivery alternatives and simple return procedures.

The Ocean freight segment showing significant growth

Innovation in the area of ocean freight is required. The market is starting to be filled by logistics technology companies. It is anticipated that e-commerce firms will transition to being 3PLs, and 3PLs will transition to become e-commerce companies, as the world wants things to be delivered as rapidly as Uber and Amazon can fulfill orders.

Once a product is imported into the United States, retailers and brands stop tracking it. More sellers accept inventory orders as soon as it ships at the port of origin, thanks to the Amazon effect and the warehouse pull-through it generates, which emphasizes total cycle times. This transforms ocean containers into the modern and future-day equivalent of warehouses, increasing consumer and supply chain experts' awareness of maritime freight.'

The majority of sectors are undergoing digital transformations, and freight forwarding is no exception. Technology is used by digital freight forwarders to plan and manage cargo transit. According to Freightos Baltic Index, the price to transport a 40-foot container from China to the US West Coast is currently around $5,400 per box, down 60% from January 2022.

Currently, the cost of shipping a container to Europe from Asia is $9,000, which is roughly 42% less than what was seen in early 2022. The rate for both routes peaked in September 2021 at more than $20,000, above pre-pandemic values.

Walmart and other large retailers in 2022 ended up with excess inventory as a result of almost rushing to import their products earlier than normal in anticipation of shipping delays and demand that ultimately did not materialize.

US Digital Freight Forwarding Industry Overview

The US digital freight forwarding market is competitive and fragmented, with many players. Some major players are Flexport, Uber Freight, DHL Group, and Agility Logistics Pvt. Ltd, Kuehne + Nagel International, and many more.

Digital freight forwarders (DFFs) use a digital platform to offer a broader range of logistics services than marketplaces and connectivity providers. DFFs build their core value proposition around a seamless user experience of shipping goods from one point to another while aggregating information on one platform with a single user interface.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Investment Scenarios

- 4.4 Government Regulations and Initiatives

- 4.5 Technology Development in Online Freight Forwarding and Digital Platforms

- 4.6 Overview on E-commerce Logistics and Freight Forwarding in the United States

- 4.7 Value Propositions of E-platforms Vs Competitors

- 4.8 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION (Market Size By Value)

- 6.1 By Mode of Transportation

- 6.1.1 Ocean

- 6.1.2 Air

- 6.1.3 Land

- 6.2 By Firm Type

- 6.2.1 SMEs

- 6.2.2 Large Enterprises and Governments

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Flexport

- 7.2.2 Twill

- 7.2.3 Forto

- 7.2.4 Expeditors International

- 7.2.5 InstaFreight

- 7.2.6 Transporteca

- 7.2.7 Kontainers

- 7.2.8 Kuehne + Nagel International (KN Freight Net)

- 7.2.9 Turvo

- 7.2.10 iContainers

- 7.2.11 DHL Group

- 7.2.12 NYSHEX

- 7.2.13 Agility Logistics Pvt. Ltd

- 7.2.14 Convoy

- 7.2.15 Uber Freight

- 7.2.16 uShip*