|

市场调查报告书

商品编码

1683803

亚洲内部货运:市场占有率分析、产业趋势与成长预测(2025-2030 年)Intra-Asia Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

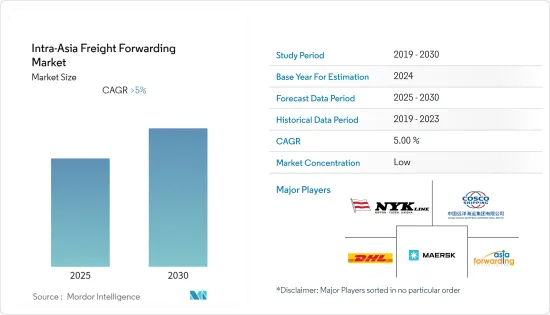

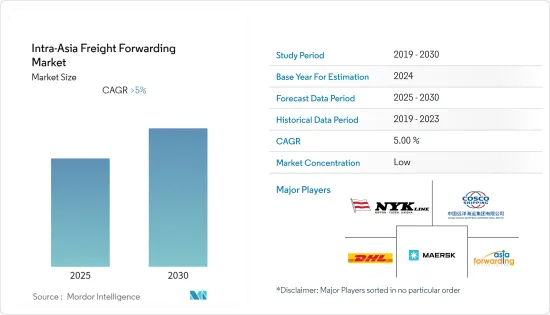

预测期内,亚洲内部货运市场预计将以超过 5% 的复合年增长率成长

主要亮点

- COVID-19 疫情导致全球封锁,商业活动停止,对经济造成挑战,并对营运、供应链、法规和劳动力要求造成巨大变化,扰乱了货运市场。 2020 年空运和海运量均大幅下降,2020 年前几个月中国港口处理的海运货柜总量下降了 10.1%。随后,随着限制措施的放宽,全部区域的货物运输量大幅增加。

- 各国也正在进行联合计划以促进跨境贸易。例如,2023年1月,印度公路运输和公路部与日本代表团举行会议,共同研究智慧交通系统和绿色交通领域的数位转型计划。该委员会还计划在印度和日本之间建造一条公路,以方便人员和货物的流通。

- 同时,瑞士国际空港航空公司将于 2022 年 10 月在中部国际机场开设一个新的航空货运中心,以满足日益增长的货运需求。

- 同时,亚洲正成为世界的物流中心,预计到2030年亚洲将占全球贸易成长的一半左右。此外,2021 年第一季,更多的新兴企业和併购为亚洲带来了超过 250 亿美元的收入。因此,该地区的货运商可以期待从不断增加的计划和贸易活动中获得大量业务。

亚洲内部货运市场的趋势

电子商务产业蓬勃发展推动市场

2022 年,亚太地区的电子商务经历了显着增长,主要得益于快速的都市化、中阶的不断壮大、数位付款的日益普及以及电子商务生态系统的不断扩大。此外,疫情的爆发也促进了该地区网路零售的发展。电商生态系统的扩张需要货运和物流的支持,以确保货物的顺畅流通。

此外,电子商务的成长正在推动零售业走向全通路,到2021年,该地区仍将是零售电子商务的最大市场,数位销售额将超过2.9兆美元,是北美的三倍,西欧的近五倍。此外,到 2022 年,预计中国将大幅成为最大的电子商务市场。

同时,到2022年,快速消费品(FMCG)电子商务将成为继传统贸易之后的第二大零售通路,占该地区销售额的19%以上。然而,业内专家估计,在韩国(34%)和中国(31%),电子商务占快速消费品销售额的近30%。此外,到 2022 年,中国将在该地区的线上消费领域领先,其次是印尼和印度。因此,电子商务销售额的成长将促进系统化的供应链和物流服务,提供顺畅的端到端货物运输,进一步扩大货运市场。

日本市场正在经历显着的成长。

日本的货运业务正在快速成长。 2022年12月,日本出口年增超过17%,进口则成长近41%。此外,日本2021年出口总额超过7,500亿美元,与前一年同期比较增加18%。

此外,2021年日本的主要出口目的地是中国(1,600亿美元),出口份额接近21%;韩国(520亿美元),出口份额接近6.9%;香港和泰国的出口份额分别为4.6%和4.3%。中国也是最大的进口国之一,份额超过24%(1.875兆美元)。澳洲和其他亚洲国家也是主要进口国。

此外,该国的航空货运量正在大幅成长。这主要是由于贸易扩大、卡车驾驶人短缺和港口交通恶化。 2021年,日本最大的航空货运机场成田机场的航空货运量将超过260万吨,与前一年同期比较增加32%。此外,2021年日本机场的航空货物处理量将超过499万吨,与前一年同期比较增加18%。因此,该国对货运代理的需求可能会受到货运量成长的推动。

亚洲货运业概况

亚洲内部货运代理市场是一个分散的市场,由全球、区域和本地参与者组成。当地小型企业透过小型车队和储存空间服务市场。货运市场正在稳步成长,充满商机,迫使参与者拥抱技术,推动数位化,并扩大营运规模和效率。对于任何企业来说,拥有一个遍布全球的强大网路都很重要。市场上其他主要企业包括 Asia Forwarding Private Limited、DHL、UPS 和日本邮船。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场洞察

- 当前市场状况

- 价值链/供应链分析

- 洞察投资场景

- 深入了解政府法规和倡议

- 线上货运和数位平台技术发展概述

- 货运市场的数位化

- 电子商务物流与货运概述

- COVID-19 市场影响

第五章 市场动态

- 驱动程式

- 限制因素

- 机会

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第六章 市场细分

- 按运输方式

- 海运

- 空运

- 公路货物运输

- 铁路货物运输

- 依客户类型

- 企业对企业 (B2B)

- 企业对客户 (B2C)

- 按应用

- 工业/製造业

- 零售

- 卫生保健

- 石油和天然气

- 食品和饮料

- 其他用途

- 按地区

- 中国

- 日本

- 韩国

- 印度

- 亚洲其他地区

第七章 竞争格局

- 市场集中度概览

- 公司简介

- Maersk

- DB Schenker

- DHL

- FedEx

- CHINA COSCO SHIPPING

- NYK Line

- Yamato Transport Co., Ltd.

- Hitachi Transport System, Ltd.

- CEVA Logistics

- Kuehne+Nagel

- Asia Forwarding Private Limited.

- XPO, Inc.

- UPS*

第八章:货运市场的未来

第 9 章 附录

The Intra-Asia Freight Forwarding Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- The COVID-19 pandemic led to global lockdowns, and commercial activities were halted, challenging the economy and disrupting the freight forwarding market with massive changes in operations, supply chains, regulations, and workforce requirements. Air and ocean freight volumes fell significantly in 2020; total ocean freight container volumes handled at Chinese ports dropped by 10.1% in the first few months of 2020. Later, as restrictions eased, cargo movement increased significantly across the region.

- Countries are also working on joint projects to boost cross-border trade. For example, in January 2023, the Indian Ministry of Road Transportation and Highways and the Japanese Delegation met to work on projects for digital transformation in the areas of intelligent transportation systems and eco-friendly mobility.The committee also planned to build roads between India and Japan so that people and goods could move more easily.

- In the meantime, Swissport, an aviation company, opened a new air cargo center at Central Japan International Airport in October 2022 to meet the growing demand for freight transport.

- Asia, on the other hand, is becoming a global logistics hub right now, and it is expected that the region will be responsible for about half of the world's trade growth by 2030. Also, more start-ups, mergers, and acquisitions brought more than USD 25 billion to Asia in the first quarter of 2021. So, the region's freight forwarders can expect a lot of business from the growing number of projects and trade activities.

Intra-Asia Freight Forwarding Market Trends

Booming E-commerce Sector is Driving the Market

In 2022, e-commerce in the Asia Pacific region witnessed significant growth, primarily driven by rapid urbanization, the growing middle class, the increasing penetration of digital payments, and the expansion of the e-commerce ecosystem. In addition, the pandemic outbreak also acted as a catalyst for accelerating online retail sales in the region. The growing e-commerce ecosystem requires freight and logistics support for the smooth movement of shipments.

Moreover, e-commerce growth is driving the retail industry toward omnichannel, and in 2021, the region remained the largest market for retail e-commerce, with digital sales amounting to more than USD 2.9 trillion, whereas these sales were three times greater than those in North America and nearly five times greater than those in Western Europe. In addition, in 2022, China will have outperformed the e-commerce market by a large margin.

Meanwhile, in 2022, fast-moving consumer goods (FMCG) e-commerce emerged as the second-biggest retail channel next to traditional trade, which accounted for more than 19% of sales in the region. However, as per industry experts' estimates, e-commerce accounts for nearly 30% of FMCG sales in South Korea (34%), and China (31%). Moreover, in 2022, China topped online spending in the region, followed by Indonesia and India. Thus, the growing e-commerce sales boost the systematic supply chain and logistics services to provide smooth end-to-end transfers of goods, further resulting in the expansion of the freight forwarding market.

Japan is Experiencing Significant Growth in the Market

Japan's freight forwarding business is growing quickly. This is mostly due to more trade activities like importing and exporting.In December 2022, exports from the country reached a growth rate of more than 17%, and imports reached nearly 41% when compared to the same period in the previous year. Also, Japan's total exports of goods were worth more than USD 750 billion in 2021, which was an increase of 18% from the year before.

Moreover, in 2021, the major export destinations of Japan will be China with an export share of nearly 21% (USD 160 billion), Korea with an export share of nearly 6.9% (USD 52 billion), and Hong Kong and Thailand with an export share of 4.6% and 4.3%, respectively. Also, China is one of the biggest importers, with a share of more than 24% (1875 billion USD). Australia and other Asian countries are also big importers.

Also, air cargo transportation is growing a lot in the country. This is mostly because trade is growing, there aren't enough truck drivers, port traffic is getting worse, etc. In 2021, Japan's Narita Airport, the country's largest airport for air freight, will handle more than 2.6 million tons of air cargo, an increase of 32% when compared to the previous year. In addition, in 2021, the volume of air freight handled at Japanese airports amounted to more than 4.99 million tons, which was up by 18% when compared to the previous year. So, the demand for freight forwarders in the country is likely to be driven by the growth of freight forwarding.

Intra-Asia Freight Forwarding Industry Overview

The intra-Asia freight forwarding market's landscape is fragmented by nature, with a mix of global, regional, and local players. Small- and medium-sized local players still serve the market with small fleets and storage spaces. As the freight forwarding market is growing steadily and there is abundant opportunity, the players need to embrace technologies, become more digitized, and increase the scale and efficiency of their operations. Having a strong network spanning the globe is important for companies. In addition, some of the major players in the market include Asia Forwarding Private Limited, DHL, UPS, NYK Line, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Insights on Investment Scenarios

- 4.4 Insights on Government Regulations and Initiatives

- 4.5 Brief on Technology Development in Online Freight Forwarding and Digital Platforms

- 4.6 Digitalisation of Freight Forwarding Market

- 4.7 Overview on E-commerce Logistics and Freight Forwarding

- 4.8 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Mode of Transportation

- 6.1.1 Ocean Freight Forwarding

- 6.1.2 Air Freight Forwarding

- 6.1.3 Road Freight Forwarding

- 6.1.4 Rail Freight Forwarding

- 6.2 By Customer Type

- 6.2.1 Business to Business (B2B)

- 6.2.2 Business to Customer (B2C)

- 6.3 By Application

- 6.3.1 Industrial and Manufacturing

- 6.3.2 Retail

- 6.3.3 Healthcare

- 6.3.4 Oil And Gas

- 6.3.5 Food And Beverages

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 South Korea

- 6.4.4 India

- 6.4.5 Rest of Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Maersk

- 7.2.2 DB Schenker

- 7.2.3 DHL

- 7.2.4 FedEx

- 7.2.5 CHINA COSCO SHIPPING

- 7.2.6 NYK Line

- 7.2.7 Yamato Transport Co., Ltd.

- 7.2.8 Hitachi Transport System, Ltd.

- 7.2.9 CEVA Logistics

- 7.2.10 Kuehne+Nagel

- 7.2.11 Asia Forwarding Private Limited.

- 7.2.12 XPO, Inc.

- 7.2.13 UPS*