|

市场调查报告书

商品编码

1690787

印尼煤炭:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Indonesia Coal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

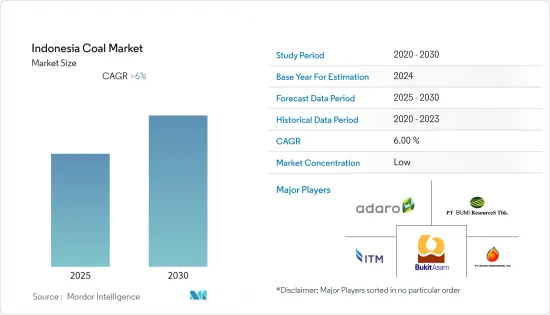

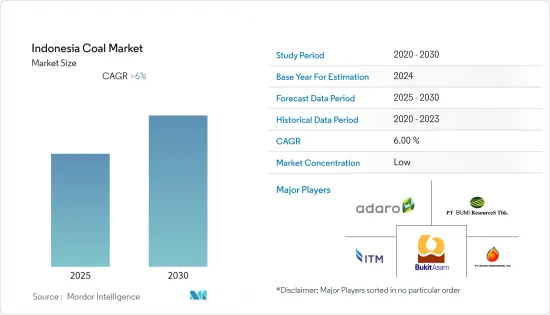

预计预测期内印尼煤炭市场的复合年增长率将超过 6%。

从长远来看,预计电力需求增加和政府支持政策等因素将推动市场发展。

另一方面,人们对煤炭使用环境的担忧日益加剧,这是阻碍市场成长的一个主要因素。

然而,随着开采和利用煤炭价值的方法越来越多,例如使用捕碳封存等技术,预计印尼煤炭市场将提供庞大的商机。

印尼煤炭市场趋势

电力产业占据市场主导地位

- 根据2021年的数据,印尼持有世界煤炭蕴藏量的3.2%,蕴藏量约为348.69亿吨。截至 2021 年,印尼煤炭总蕴藏量中 66% 为无烟煤和烟煤,其余 34% 为亚烟煤和褐煤。

- 作为减少温室气体排放策略的一部分,使用煤炭发电的发电厂更愿意购买能源效率更高、价格更便宜、含硫量更低的燃料。印尼的煤炭生产倾向于低能耗、廉价的亚烟煤。

- 近年来,印尼经济不断扩张。随着都市化加快,需要使用能源的商业和工业建筑数量不断增加,导致电力消耗量增加。

- 2021年,印尼发电量为309.4 TWh。其中,煤炭发电量1,900亿度,占总发电量的60%。由于活动活性化,预计短期内不断增长的电力需求将由煤炭来满足。

- 印尼政府计划从 2023 年起停止新建设的燃煤电厂,但将继续建造已经获核准的电厂,以协助扩大煤炭市场。

- 因此,基于上述情况,预计印尼煤炭市场将由电力产业主导。

可再生能源的日益普及正在限制市场

- 国家对于电力的需求不断增加,导致各种发电设施的安装增加。该国大部分电力来自石化燃料。由于排放法规越来越严格,印度政府已启动从传统能源转型再生能源来源。因此,预计未来几年大多数发电设施将可再生能源发电。

- 2017年至2021年间,可再生能源装置容量成长近18%。 2021 年可再生能源总设备容量将达到 11,157 兆瓦,而 2017 年为 9,459 兆瓦。预计预测期内成长率将进一步提高。

- 印尼政府设定的目标为,2025年可再生能源发电%,2050年达到31%。目前,该国约13%的电力来自可再生能源发电,主要是水力发电和地热发电。

- 据印尼能源和矿产资源部 (MEMR) 称,印尼拥有约 207GW 的太阳能潜力。印尼政府优先发展可再生能源。因此,印尼越来越多地采用可再生能源来满足其电力需求并减少排放。

- 此外,印尼于2022年9月宣布,计划在未来30年内关闭15GW的燃煤发电厂,以减少二氧化碳排放。预计这不仅可以减少二氧化碳排放,还可以增加该国的可再生能源装置容量。

- 例如,2022 年 11 月,沙乌地阿拉伯能源公司 ACWA Power 宣布已赢得印尼国有电力公司 PT Perusahaan Listrik Negara (PLN) 的合同,将建造两个浮体式太阳能光伏 (PV)计划。该合约涵盖60MWac Saguling计划和50MWac浮体式太阳能发电工程Singkarak。这两个计划的总合容量为110兆瓦交流电,总投资为1.05亿美元。

- 同样,还有更多的可再生能源发电工厂处于不同阶段的开发中,这将减少煤炭发电的份额,并抑製印尼煤炭市场的成长。

印尼煤炭产业概况

印尼的煤炭市场比较分散。市场上的主要企业(排名不分先后)包括 PT Adaro Energy Tbk、PT Bumi Resources Tbk、PT Indo Tambangraya Megah Tbk、PT Bukit Asam Tbk 和 PT Bayan Resources Tbk。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2028 年市场规模与需求预测

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- PESTLE分析

第五章 市场区隔

- 应用

- 电

- 钢

- 其他用途

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- PT Adaro Energy Tbk

- PT Bumi Resources Tbk

- PT Indo Tambangraya Megah Tbk

- PT Bukit Asam Tbk

- PT Bayan Resources Tbk

- BlackGold Group

- Golden Energy and Resources Limited

- PT Bhakti Energi Persada

- Adani Group

第七章 市场机会与未来趋势

The Indonesia Coal Market is expected to register a CAGR of greater than 6% during the forecast period.

Over the long term, factors like increasing electricity demand and supportive government policies are expected to drive the market.

On the other hand, increasing environmental concern over the use of coal is a significant restraint hindering the market's growth.

Nevertheless, the increasing ways to mine coal and extract value from coal using technologies like carbon capture and storage technologies are expected to create enormous opportunities for the Indonesia Coal Market.

Indonesia Coal Market Trends

Electricity Industry to Dominate the Market

- According to 2021 figures, Indonesia possesses 3.2% of the global coal reserves, with around 34,869 million tons of coal reserves. As of 2021, 66% of Indonesia's total coal reserves were Anthracite and Bituminous coal, with the remaining 34% sub-bituminous coal and lignite.

- Power plants that utilize coal for electricity prefer to purchase fuel that is energy-efficient, inexpensive, and has less sulfur as part of a strategy to minimize greenhouse gas emissions. Indonesian coal output is tilted toward lower-energy, less-expensive sub-bituminous coal.

- The Indonesian economy has been expanding in recent years. As a result of increased urbanization and the increased number of commercial and industrial buildings requiring greater access to energy, demand and electricity consumption have also increased.

- In 2021, Indonesia generated 309.4 TWh of electricity. Out of that, 190 TWh was generated through coal, constituting 60% of the total electricity generation. Due to increased activities, the demand for increased electricity is expected to be met by coal in the short term.

- Even though the Indonesian government plans to stop building new coal power plants from 2023, the already approved power plants will be built to aid in the growth of the coal market.

- Thus, owing to the above points, the electricity industry is expected to dominate the coal market in Indonesia.

Increasing Adoption of Renewable Energy to Restrain the Market

- The electricity demand in the country is increasing, leading to an increase in the installation of different electricity generation. The majority of power generation in the country is from fossil fuels. Due to increasing regulations on emissions control, the government of India has started its energy transition from conventional sources to renewable energy sources. Thus, it is estimated that most power generation installations will be derived from renewable energy sources in the coming years.

- Between 2017 and 2021, the renewable energy installed capacity increased by almost 18%. The total renewable energy installed capacity was 11,157 MW in 2021 compared to 9459 MW in 2017. The growth rate is expected to increase furthermore during the forecasted period.

- The Indonesian government set a renewable energy target of 23% and 31% of the total electricity generation by 2025 and 2050, respectively. Currently, around 13% of power generation nationwide comes from renewable energy resources, mainly hydroelectric and geothermal power production.

- Indonesia is rich in solar power, with a potential of around 207 GW, according to the Ministry of Energy and Mineral Resources (MEMR). The Indonesian government is prioritizing the development of renewable energy sources. Therefore, Indonesia is witnessing an increasing adoption of renewable energy sources to fulfill its electricity demand and lower its emissions.

- Moreover, in September 2022, Indonesia announced plans to shut down 15 GW of coal-powered plants in the next three decades to reduce their carbon emission. It is expected that this will not only reduce carbon emissions but also increase the renewable energy installations in the country.

- For instance, in November 2022, Saudi energy firm ACWA Power announced that they had secured a contract from the Indonesian state-owned utility PT Perusahaan Listrik Negara (PLN) to build two floating solar photovoltaic (PV) power projects. The contract covers the 60MWac Saguling project and Singkarak, a floating solar project with 50MWac capacity. The two projects will have a combined capacity of 110MWac and be built with a total investment of USD 105 million.

- Similarly, many more renewable energy-based power plants are in various stages of development, which will shave off the share of predominant coal-based electricity generation and, therefore, restrain the growth of the coal market in the country.

Indonesia Coal Industry Overview

The Indonesian coal market is fragmented. Some of the major players in the market (in no particular) include PT Adaro Energy Tbk, PT Bumi Resources Tbk, PT Indo Tambangraya Megah Tbk, PT Bukit Asam Tbk, and PT Bayan Resources Tbk.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Electricity

- 5.1.2 Iron and Steel Industry

- 5.1.3 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 PT Adaro Energy Tbk

- 6.3.2 PT Bumi Resources Tbk

- 6.3.3 PT Indo Tambangraya Megah Tbk

- 6.3.4 PT Bukit Asam Tbk

- 6.3.5 PT Bayan Resources Tbk

- 6.3.6 BlackGold Group

- 6.3.7 Golden Energy and Resources Limited

- 6.3.8 PT Bhakti Energi Persada

- 6.3.9 Adani Group