|

市场调查报告书

商品编码

1690799

印度纸和纸板包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)India Paper And Paperboard Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

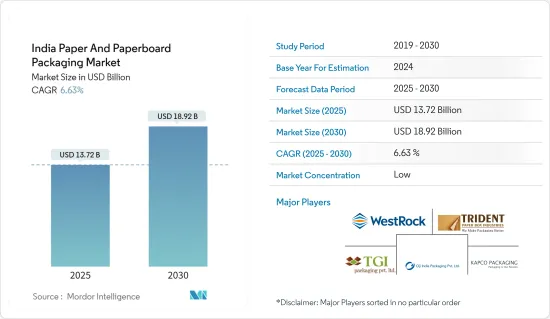

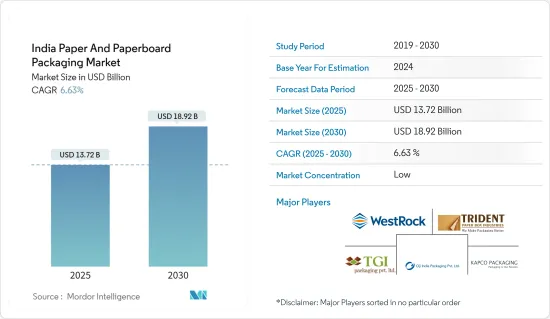

印度纸和纸板包装市场规模预计在 2025 年为 137.2 亿美元,预计到 2030 年将达到 189.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.63%。

主要亮点

- 过去十年,由于基材选择的转变、全球市场的扩大、所有权动态的演变以及政府主导的摆脱塑胶的倡议,纸包装产业经历了显着的成长。随着对永续性和环境友好的日益重视,印度准备透过纸张和纸板包装领域的各种创新来塑造行业趋势。

- 纸质包装,尤其是食品储存包装的最新进展值得关注。一个典型的例子就是瓦楞包装,它在运输生鲜食品方面越来越受欢迎。为了有效去除细菌,必须在高温下将纸板层黏合在一起。而且,这种瓦楞纸板是可回收的,因此可以重复使用,同时最大限度地降低交叉污染的风险。

- 近年来,许多厂商都采用了无菌纸包装。该过程包括将食物及其包装放入热的过氧化氢浴中进行消毒。使用这种无菌纸,牛奶、咖啡、生鲜食品等就不会受到污染,并且能长时间保持新鲜。为体现这一趋势,产业参与者正在加大对可堆肥包装开发的投资。

主要亮点

- 例如,2023 年 10 月,Pakka 与共用永续性愿景的枣类食品製造商 Brawny Bear 合作推出了印度首款可堆肥软包装。此次发布标誌着 Packer 取得的一项重大成就,也标誌着印度庞大包装产业(价值超过 700 亿美元)的一个转捩点。

- 此外,随着该地区倾向于环保,永续包装正在成为减少包装材料对环境影响的关键因素。永续包装透过利用生物分解性、可回收和可堆肥的材料,显着减少废弃物并加强循环经济。此外,采取此类环保做法的公司往往会获得更高的客户忠诚度。这些趋势正在推动印度对纸质包装的需求激增。

- 随着纸质包装越来越受欢迎,印度造纸厂纷纷增加资本投资,转向生产手提袋和草纸等小众产品。 2023 年 12 月,安得拉纸业生产阻隔涂布产品,并投资对其设施进行现代化改造。 APL发挥自身优势,调整产品结构以满足市场需求。我们积极开发和推出手提袋和草纸等小众产品,同时提供杯纸、药品印刷和高 BF 原生牛皮纸等增值产品。

- 纸包装有许多优点:它完全可回收、经济高效,而且通常比许多塑胶更环保。产业资料突显了一个显着的转变,多家企业从塑胶包装转向更永续的包装,如纸本和袋子包装产品。然而,我们必须意识到纸质包装所带来的环境挑战,例如其易受潮湿影响、生产过程中消费量高、运输过程中占地面积大等。

印度纸和纸板包装市场趋势

瓦楞包装可望占据主要市场占有率

- 瓦楞纸箱因其耐用性和灵活性而成为电子商务包装必不可少的材料。这些盒子具有凹槽内部结构,可吸收衝击并抵抗压缩,从而提供卓越的产品保护。因此,我们保证您的产品将完好无损地送达,无论您的产品尺寸或精緻程度如何。不同尺寸、颜色和重量的瓦楞纸箱用于电子商务包装。

- 瓦楞纸箱大大减少了电子商务领域因包装损坏而造成的退货。其坚固的结构和保护性缓衝最大限度地降低了运输过程中损坏的风险,确保产品完好无损地到达您的客户手中。透过保护产品免受误操作和环境因素的影响,瓦楞纸箱可以改善整体客户体验,从而减少退货和换货。

- 据印度品牌股权基金会(IBFC)称,电子商务行业的成长已经改变了印度商业,并开闢了 B2B、D2C、C2C 和 C2B 等多个领域。近年来,D2C、B2B、C2C等领域都出现了显着成长。预计到 2027 年,印度 D2C 市场规模将达到 600 亿美元。

- 瓦楞纸箱的可回收性符合永续性目标,吸引了有环保意识的消费者并提高了品牌声誉。瓦楞包装是印度电子商务供应链的重要组成部分,它提供了经济高效的解决方案,同时也解决了与产品退货相关的挑战。

- 根据EBANX的报告,到2023年,印度的线上零售额将达到1,030亿美元。随着该国电子商务产业的蓬勃发展,瓦楞纸箱满足了人们对高效可靠包装解决方案日益增长的需求。

- 这些瓦楞纸箱可以订製以容纳从电子产品到服饰等各种产品,并确保安全运输。可堆迭的设计也优化了仓库和运输车辆的储存空间,增强了电子商务公司的物流业务。

食品和饮料预计将大幅成长

- 纸和纸板包装在印度食品产业的各个领域发挥着至关重要的作用,包括烘焙和零嘴零食。纸板管有几个优点,特别是在包装香辛料、茶和零嘴零食等干货时。其圆柱形状便于高效存放和运输,最大限度地利用货架空间并最大限度地减少浪费。

- 纸板管可以采用鲜艳的印刷和标籤进行定制,以提高品牌知名度和消费者吸引力。这些包装解决方案具有环保和可回收的特点,符合现代企业的永续性目标,并吸引了有环保意识的消费者。

- 食品製造商,尤其是知名的快速消费品品牌,已经设定了雄心勃勃的目标,减少食品包装中的塑胶使用,并采用新的、更环保的材料。因此,纸质包装在印度越来越受欢迎。

- 纸和纸板包装可满足餐厅和速食连锁店等餐饮服务机构的需求。印度年轻人对快餐的兴趣日益浓厚,导致对有效包装解决方案的需求激增,尤其是针对披萨和蛋糕等潮湿和油腻的食品。

- 截至 2023 年 3 月 31 日,达美乐披萨在印度 393 个城市拥有 1,816分店。纸板,包括白衬纸板和实心漂白表面纸板,具有防油性,这对于包装披萨等产品至关重要。这些材料可以保护披萨免受潮湿和油脂的影响,确保披萨在运输和储存过程中保持新鲜。

- 根据加拿大农业及食品部的新闻稿,到 2023 年,印度的高纤维早餐产品的市场价值可能达到 3 亿美元。早餐用麦片谷类和高纤维零嘴零食等健康包装食品受益于纸和纸板包装,既能确保新鲜度,又能保留营养价值,同时也是环保的解决方案。

- Bikaji 预计,2022 年印度包装食品的市值将达到 513.5 亿美元。与前一年相比,这一数字有所增加。预计到 2026 年包装食品市场价值将成长并达到 702.2 亿美元。

- 对包装食品的需求不断增长,也推动了对永续、可回收和环保的包装解决方案的需求。纸和纸板是生物分解性和可再生的材料,因此由于人们对永续性的日益关注,它们比塑胶越来越受到青睐。

- 这种向环保包装的转变预计将推动食品业用于纸盒、纸箱和软质包装的纸板消费量增加。

印度纸和纸板包装产业概况

印度纸和纸板包装产业分散,参与者众多。随着包装应用需求的不断增长,许多公司透过增加生产设施和产品系列来扩大其市场占有率。该市场的一些主要参与者包括 WestRock Company、Trident Paper Box Industries、TGI Packaging Pvt。 Ltd、Kapco Packaging 和 Avon Pacfo Services LLP。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 注重循环经济的产业价值链分析

- 印度纸和纸板包装市场 - PESTEL 分析

- 印度包装产业现状及主要趋势

- 印度的包装法规和政策、补贴和影响包装业务的关键变化

第五章 市场动态

- 市场驱动因素与限制因素分析

- 需求分析及产业趋势

- 软包装需求构成比(%)

- 组织与非组织

- 直接销售与间接/经销商销售

- 纸和纸板包装印刷技术趋势

- 主要纸和纸板包装形式的三年生产趋势

- 纸与纸板原料分析

- 纸和纸板包装贸易 -瓦楞纸箱、折迭纸盒、其他

第六章 印度造纸业统计

- 国内纸张需求

- 瓦楞纸及再生瓦楞纸产能

- 原纸板和再生纸板进口量

- 瓦楞纸和纸板

- 进口额及数量

- 出口额及数量

- 箱板

- 箱板纸 - 产值及产量

- 箱板纸 - 进口数量和金额

- 箱板纸出口量及金额

第 7 章 依论文类型进行定性分析

- 纸板 - 按等级

- WLC-白板(GD/UD 和 GT/UT)

- FBB - 折迭纸板 (GC1/UC1 和 GC2/UC2)

- SBB-未漂白硫酸盐板(SBS)

- SUB-未漂白硫酸盐固态板(SUS)

- 瓦楞纸板原纸 - 按等级

- 白色牛皮纸

- 未漂白牛皮纸

- 白色顶部测试衬垫

- 未漂白测试衬垫

- 废弃物製瓦楞纸

- 半化学凹槽

第 8 章市场细分

- 按最终用户产业

- 瓦楞纸板包装

- 加工食品

- 生鲜食品

- 饮料

- 个人护理及化妆品

- 家居用品

- 电子商务

- 其他终端用户产业(运输及物流、医疗保健、耐用消费品等)

- 折迭式纸盒

- 饮食

- 个人护理及化妆品

- 医疗保健和製药

- 烟草

- 电气和金属製品

- 其他终端使用者产业(玩具、服饰、汽车、家居用品等)

- 液体包装

- 牛奶

- 汁

- 能量饮料

- 其他终端用户产业(乳製品,如酪乳、奶油、冰沙等)

- 瓦楞纸板包装

- 按地区

- 东方

- 西方

- 北

- 南

第九章 竞争格局

- 公司简介

- TCPL Packaging Ltd

- KCL Limited

- Borkar Packaging Pvt. Ltd

- Canpac Trends Pvt. Ltd

- Trident Paper Box Industries

- Westrock India(Westrock Company)

- TGI Packaging Pvt. Ltd

- Asepto(Uflex)

- Tetra-pak India Private Limited

- Parksons Packaging Ltd

- Kapco Packaging

- OJI India Packaging Pvt. Ltd

- List of Customers by Region in India

- List of Major Unorganized Market Players in India by Region

第十章印度包装产业的永续性趋势

第十一章 市场展望

The India Paper And Paperboard Packaging Market size is estimated at USD 13.72 billion in 2025, and is expected to reach USD 18.92 billion by 2030, at a CAGR of 6.63% during the forecast period (2025-2030).

Key Highlights

- Over the past decade, the paper packaging industry has witnessed significant growth, driven by shifts in substrate choices, global market expansions, evolving ownership dynamics, and government-led initiatives to phase out plastics. With an ongoing emphasis on sustainability and environmental concerns, India is poised to see industry trends shaped by various innovations in paper and paperboard packaging.

- Recent advancements in paper-based packaging, especially for food preservation, have been noteworthy. A prime example is the rising popularity of corrugated board packaging for transporting fresh produce. To effectively eliminate bacteria, the layers of the corrugated board must bond at elevated temperatures. Furthermore, the recyclability of these grooved boards allows for repeated use while minimizing the risk of cross-contamination.

- In recent years, many manufacturers have adopted aseptic paper packaging. This process involves sterilizing the food product and its packaging through a hot hydrogen peroxide bath. Such aseptic paper ensures that items like milk, coffee, and fresh produce remain uncontaminated and fresh for extended periods. Reflecting this trend, industry players are increasingly investing in the development of compostable packaging.

- For instance, in October 2023, Pakka teamed up with Brawny Bear, a date-based food producer sharing Pakka's sustainability vision, to unveil India's inaugural compostable flexible packaging. This launch underscores a significant achievement for Pakka and marks a pivotal moment for India's expansive packaging industry, which boasts a valuation exceeding USD 70 billion.

- Moreover, as the region leans more toward eco-friendliness, sustainable packaging emerges as a crucial player in mitigating the environmental repercussions of packaging materials. Sustainable packaging significantly curtails waste and bolsters the circular economy by utilizing biodegradable, recyclable, and compostable materials. Furthermore, businesses adopting these eco-conscious practices often enjoy heightened customer loyalty, as consumers favor brands that resonate with their environmental beliefs. Such dynamics are fueling the surging demand for paper packaging in India.

- As paper packaging gains traction, Indian paper mills are responding by increasing capital expenditures to diversify into niche products like carry bags and straw paper. In December 2023, Andhra Paper produced barrier-coated products and invested in modernizing its facilities. APL capitalized on its strengths, adjusting its product mix to meet market demands. The company proactively developed and introduced niche offerings, including carry bags and straw paper, alongside value-added products like cup stock, pharma print, and high BF virgin kraft.

- Paper packaging boasts numerous advantages: it's fully recyclable, cost-effective, and generally more eco-friendly than many plastics. Industry data highlights a notable shift, with multiple organizations moving away from plastic-based packaging in favor of sustainable options like paper and sack-based products. Yet, it's crucial to acknowledge the environmental challenges associated with paper packaging, including susceptibility to moisture, higher energy consumption during production, and a larger transportation footprint.

Key Highlights

India Paper and Paperboard Packaging Market Trends

Corrugated Packaging is Expected to Hold a Significant Market Share

- Corrugated boxes are essential in e-commerce packaging due to their durability and flexibility. These boxes offer superior product protection through their fluted, structured interior that absorbs impact and resists compression. This ensures products arrive intact, regardless of size or sensitivity. E-commerce packaging utilizes corrugated boxes in various sizes, colors, and weight capacities.

- Due to damaged packaging, corrugated boxes significantly reduce product returns in the e-commerce sector. Their robust construction and protective cushioning minimize the risk of damage during shipping, ensuring products arrive at customers' doorsteps intact. By safeguarding items against mishandling and environmental factors, corrugated boxes improve the overall customer experience, leading to fewer returns and exchanges.

- According to the India Brand Equity Foundation (IBFC), the growth of the e-commerce industry has transformed business in India, opening up various segments such as B2B, D2C, C2C, and C2B. Segments like D2C, B2B, and C2C have experienced significant growth in recent years. The D2C market in India is projected to reach USD 60 billion by 2027.

- The recyclability of corrugated boxes aligns with sustainability goals, appealing to environmentally conscious consumers and enhancing brand reputation. Corrugated boxes are integral components of the e-commerce supply chain in India, providing cost-effective solutions while addressing challenges associated with product returns.

- EBANX reports that online retail sales in India generated USD 103 billion in 2023. As the country's e-commerce industry grows rapidly, corrugated boxes have adapted to meet the increasing demand for efficient and reliable packaging solutions.

- These boxes can be customized to accommodate a wide range of products, from electronics to clothing, ensuring secure transit. Their stackable design also optimizes storage space in warehouses and delivery vehicles, enhancing logistics operations for e-commerce companies.

Food and Beverage is Expected to Show Significant Growth

- Paper and paperboard packaging has become crucial in various sectors of India's food industry, including bakeries and snacks. Paperboard tubes offer several advantages, particularly in packaging dry goods such as spices, tea, and snacks. Their cylindrical shape provides efficient storage and transportation, maximizing shelf space and minimizing waste.

- Paperboard tubes can be customized with vibrant printing and labeling, enhancing brand visibility and consumer appeal. With their eco-friendly and recyclable properties, these packaging solutions align with modern businesses' sustainability goals and appeal to environmentally conscious consumers.

- Food producers, especially prominent FMCG brands, have set ambitious targets to reduce the use of plastics in food packaging and adopt new eco-friendly materials. Consequently, paper-based packaging materials are gaining popularity in India.

- Paper and paperboard packaging aligns with the needs of food service outlets, such as restaurants and fast-food chains. The increasing demand for fast food among India's youth has driven a surge in demand for effective packaging solutions, especially for moist or greasy items like pizza and cakes.

- As of March 31, 2023, India reported 1,816 Domino's Pizza stores across 393 cities. Paperboards, including white line chipboard and solid bleached surface board, provide essential grease-resistant properties for packaging products like pizza. These materials protect against moisture and grease, ensuring the pizza remains fresh and intact during transportation and storage.

- According to Agriculture and Agri-Food Canada news, high-fiber breakfast products in India generated a market value of USD 0.3 billion in 2023. Healthy packaged foods like breakfast cereals and high-fiber snacks benefit from paper and paperboard packaging, which ensures freshness and preserves nutritional value while offering eco-friendly solutions.

- According to Bikaji, in 2022, the estimated market value of packaged food was USD 51.35 billion in India. This was an increase as compared to the previous year. Packaged food's market value will likely increase and reach USD 70.22 billion in 2026.

- The increasing demand for packaged food is driving a parallel need for sustainable, recyclable, and eco-friendly packaging solutions. Paper and paperboard, being biodegradable and renewable materials, are gaining preference over plastic due to growing sustainability concerns.

- TThis shift toward more environmentally friendly packaging is expected to drive higher consumption of paperboard for boxes, cartons, and flexible packaging in the food industry.

India Paper and Paperboard Packaging Industry Overview

India's paper packaging industry is fragmented and has many players. With the rising demand for packaging applications, many companies are expanding their market presence by increasing their production facilities and product portfolio. The largest companies in this market include WestRock Company, Trident Paper Box Industries, TGI Packaging Pvt. Ltd, Kapco Packaging, and Avon Pacfo Services LLP.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Defintion

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis with Emphasis on Circular Economy

- 4.3 India Paper & Paperboard Packaging Market - PESTEL Analysis

- 4.4 Packaging Industry Landscape in India and Key Trends

- 4.5 Packaging Regulations, Policies, and Subsidies in India and Key Changes Impacting the Packaging Operations

5 MARKET DYNAMICS

- 5.1 Market Drivers & Restraints Analysis

- 5.2 Demand Analysis and Industry Trends

- 5.3 Demand Split for Flexible Packaging (%)

- 5.3.1 Organized vs. Unorganized

- 5.3.2 Direct vs. Indirect/Dealers Sales

- 5.4 Printing Technology Trends for Paper & Paperboard Packaging

- 5.5 Production Trends over the Past Three Years for Key Paper & Paperboard Packaging Formats

- 5.6 Raw Material Analysis for Paper & Paperboard

- 5.7 Trade Scenario for Paper & Paperboard Packaging - Corrugated Boxes, Folding Cartons, and Others

6 INDIA PAPER INDUSTRY STATISTICS

- 6.1 Domestic Paper Demand

- 6.2 Total Containerboard Capacity (Virgin and Recycled)

- 6.3 Import of Virgin and Recycled Container Board

- 6.4 Corrugated Paper or Paperboard

- 6.4.1 Import Value and Quantity

- 6.4.2 Export Value and Quantity

- 6.5 Cartonboard

- 6.5.1 Carton Board - Production Value and Volume

- 6.5.2 Carton Board - Import Quantity and Value

- 6.5.3 Carton Board - Export Quantity and Value

7 QUALITATIVE ANALYSIS BY PAPER GRADE

- 7.1 Cartonboard - By Grade

- 7.1.1 WLC - White Lined Chipboard (GD/UD and GT/UT)

- 7.1.2 FBB - Folding Boxboard (GC1/UC1 and GC2/UC2)

- 7.1.3 SBB - Solid Bleached Sulphate Board (SBS)

- 7.1.4 SUB - Solid Unbleached Sulphate Board (SUS)

- 7.2 Containerboard - By Grade

- 7.2.1 White Top Kraftliner

- 7.2.2 Unbleached Kraftliner

- 7.2.3 White Top Testliner

- 7.2.4 Unbleached Testliner

- 7.2.5 Waste-based Fluting

- 7.2.6 Semi-chemical Fluting

8 MARKET SEGMENTATION

- 8.1 By End-user Industry

- 8.1.1 Corrugated Packaging

- 8.1.1.1 Processed Food

- 8.1.1.2 Fresh Produce

- 8.1.1.3 Beverage

- 8.1.1.4 Personal Care & Cosmetics

- 8.1.1.5 Household Care

- 8.1.1.6 E-commerce

- 8.1.1.7 Other End-user Industries (Transportation & Logistics, Healthcare, and Consumer Durables, among Others)

- 8.1.2 Folding Cartons

- 8.1.2.1 Food & Beverage

- 8.1.2.2 Personal Care & Cosmetics

- 8.1.2.3 Healthcare & Pharmaceuticals

- 8.1.2.4 Tobacco

- 8.1.2.5 Electrical & Hardware

- 8.1.2.6 Other End-user Industries (Toy, Apparel, Automotive, and Household, among Others)

- 8.1.3 Liquid Cartons

- 8.1.3.1 Milk

- 8.1.3.2 Juices

- 8.1.3.3 Energy Drinks

- 8.1.3.4 Other End-user Industries (Dairy Products such as Buttermilk, Cream, Smoothies, etc.)

- 8.1.1 Corrugated Packaging

- 8.2 By Region

- 8.2.1 East

- 8.2.2 West

- 8.2.3 North

- 8.2.4 South

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 TCPL Packaging Ltd

- 9.1.2 KCL Limited

- 9.1.3 Borkar Packaging Pvt. Ltd

- 9.1.4 Canpac Trends Pvt. Ltd

- 9.1.5 Trident Paper Box Industries

- 9.1.6 Westrock India (Westrock Company)

- 9.1.7 TGI Packaging Pvt. Ltd

- 9.1.8 Asepto (Uflex)

- 9.1.9 Tetra-pak India Private Limited

- 9.1.10 Parksons Packaging Ltd

- 9.1.11 Kapco Packaging

- 9.1.12 OJI India Packaging Pvt. Ltd

- 9.2 List of Customers by Region in India

- 9.3 List of Major Unorganized Market Players in India by Region