|

市场调查报告书

商品编码

1690927

亚太虚拟行动服务业者(MVNO) -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia Pacific Mobile Virtual Network Operator (MVNO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

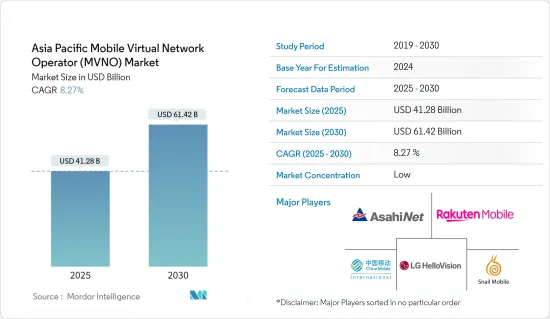

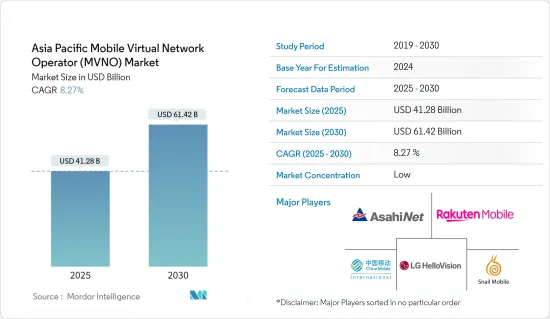

亚太虚拟行动服务业者市场规模预计在 2025 年为 412.8 亿美元,预计到 2030 年将达到 614.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.27%。

关键亮点

- 对低成本资料和语音服务的不断增长的需求正在推动市场成长。这导致服务供应商以批发价从行动网路营运商(MNO)购买网路服务,然后以低于 MNO 服务的价格将其作为配套服务出售。这种低成本的资讯服务使行动虚拟网路营运商(MVNO)能够吸引本地消费者和企业以具有成本效益的价格从 MVNO 购买资料方案。

- 智慧型手机的普及和行动用户数量的增加预计将对该行业的成长做出重大贡献。例如,根据GSMA的资料,预计2025年南亚的行动用户将达到10.89亿,其次是东南亚,用户将达到5.1亿人。

- 此外,GSMA预测东北亚地区的行动用户数量将达到1.62亿人。行动用户的增加为亚太地区的行动虚拟网路营运商创造了增加市场占有率的成长机会。

- 亚太虚拟行动服务业者市场因依赖主机行动通讯业者而面临重大挑战。这种依赖性影响了行动虚拟网路营运商的营运和策略能力,抑制了其成长和市场潜力。 MVNO 依赖 MNO 进行网路存取,因此对服务品质和网路覆盖的控制有限。主机网路的任何缺陷都会直接影响MVNO的服务品质。

- 新冠疫情增加了消费者和企业对线上连线的依赖,这在疫情期间大幅增加了对虚拟网路营运商 (MVNO) 具有成本效益的资料和语音服务的需求。此外,疫情过后亚太地区企业数位转型浪潮席捲,进一步拉动了资讯服务的需求,从而对亚太地区MVNO市场的成长产生了正面影响。

- 在后疫情时代,亚太地区的虚拟业者将推出创新的新服务,以满足消费者和企业不断变化的需求。从增强的资料产品到创新的费率方案,MVNO 预计将利用数位技术、机器学习和人工智慧来提供个人化和无缝的客户体验。预计这些发展将对未来几年亚太地区 MVNO 市场的成长产生积极影响。

亚太地区MVNO市场趋势

企业用户群预计将显着成长

- 未来几年,企业部门将见证亚太地区 MVNO 市场的显着增长,这得益于亚太地区各国各行业正在进行的数位转型、MVNO 营运商因该地区 5G 服务的不断推广而将重点转向 B2B 模式,以及该地区企业对经济实惠的互联网连接的需求不断增加。

- 对于 MVNO 营运商来说,企业市场正变得越来越有利可图,因为与传统的消费者市场相比,连接到其网路的许多设备流失的可能性较小。灵活的收费、创新的定价、BYOD(自带设备)、安全性和易于管理是推动亚太地区 MVNO 市场企业部门成长的一些关键因素和趋势。

- 此外,随着印度等亚太国家的 5G 部署不断扩大,5G 独立和物联网等 5G 用例预计将为企业领域的 MVNO 提供巨大的成长机会。随着物联网生态系统在亚太国家/地区不断发展和演变,许多市场供应商将重点转向 B2B 客户,因为企业寻求跨一系列设备的即时连接。

- 从国家层级来看,由于韩国拥有大量提供企业连接解决方案的行动虚拟网路营运商、其有利的监管政策、5G 服务的不断扩展以及企业正在进行的数位转型,预计韩国将推动企业领域的成长。此外,新参与企业正在进入企业领域,以有效满足某些细分市场对经济实惠的通讯服务的需求。

- 例如,2024年6月,友利银行与LG Uplus在友利银行首尔总部签署了谅解备忘录,以巩固在行动虚拟网路营运商领域的合作。两家银行计划在年内推出MVNO服务,重点在于确定银行业的特定通讯需求。随着谅解备忘录的签署,两家公司将建立长期伙伴关係关係,并加速创造独特的产品和服务。

- 总体而言,随着亚太地区各行各业的不断发展和数位转型,虚拟网路营运商将利用从行动银行到物联网的新机会来塑造连接的未来。随着企业寻求透过客製化的企业解决方案来简化行动业务、降低成本并提高生产力,企业语音和资讯服务的需求预计将获得显着成长。

- 智慧型手机的普及和行动用户的增加预计将对该行业的成长做出重大贡献。例如,根据GSMA的资料,预计2025年南亚的行动用户将达到10.89亿,其次是东南亚,用户将达到5.1亿人。此外,GSMA预测东北亚地区的行动用户数量将达到1.62亿人。行动用户的增加为行动虚拟网路营运商增加了市场占有率,提供了成长机会。

中国当地占较大市场占有率

- 中国在亚太地区MVNO市场占有较大的份额。该国在采用技术进步方面一直处于领先地位,包括 5G 技术、连网行动装置和智慧型手机的广泛普及。

- 5G网路的部署为MVNO提供高速资料、物联网、智慧解决方案等先进服务开启了新的机会。 eSIM 技术的采用使 MVNO 能够提供更灵活、更便捷的服务激活,从而吸引更多精通技术的客户。

- GSMA 的 2024 年报告《中国移动经济》显示,中国将拥有超过 8 亿个 5G行动连线。据预测,今年5G连线份额将超过50%,巩固其在中国领先行动技术的地位。到2024年底,5G连接总数预计将超过10亿人。此外,中国目前拥有12.8亿独立行动用户,普及率高达88%。

- 中国继续扩大其行动电话基地台台网路。值得一提的是,中国移动计画在 2024 年新增 41 万个基地台,使基地台总数达到 240 万个,以加强其 5G 基础设施。此次扩张也正值该公司寻求减少资本支出之际。截至2023年底,中国移动已加大5G布局,当年基地台数量达190万个,较前一年大幅成长。值得注意的是,其中62万个站点是与中国宽频网路合作建立的,主要使用700MHz频段。

- 中国政府正在推动中国5G产业的发展,并支持华为和中兴等生产5G技术所需设备的公司。预计到2025年,中国将成为全球5G连线数最多的国家。

亚太地区MVNO产业概览

亚太地区MVNO市场高度细分,主要参与者包括朝日网路株式会社、乐天移动株式会社(乐天集团)、LG Hello Vision株式会社、中国移动国际有限公司(中国移动主要企业)和世纪蜗牛通讯科技等。所研究市场的参与企业正在采取联盟和收购等策略来增强其产品供应并获得可持续的竞争优势。

- 2024 年 5 月:Giga 推出 5G eSIM 计划,可在五个主要城市免费漫游资料。这些计划是 Giga 三项新服务的一部分,让客户享受快速、安全且无忧的 5G 连线。增强型 Giga Mobile 计画提供了 Giga 广泛的 5G 覆盖范围,并凸显了 eSIM 技术的便利性。此外,用户还可享受印尼、泰国、韩国和印度等热门目的地的免费月度资料漫游优惠。

- 2024年3月,中国移动国际公司(CMI)与新加坡电信有限公司(Singtel)在2024世界行动通讯大会上签署谅解备忘录。根据备忘录,CMI和Singtel将共同为企业客户打造创新的连接解决方案,进军中国和新加坡市场,并拓展亚太地区业务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 影响市场的宏观经济因素 COVID-19 的影响

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- MVNO渗透率及特性与欧洲主要国家相似

- 大多数亚洲国家的法规环境对 MVNO 非常有利

- 网路普及率和 e-SIM 解决方案推动该地区 MVNO 市场的发展

- 市场限制

- 依赖主机行动网路营运商 (MNO)

第六章市场区隔

- 依管理类型

- 经销商

- 服务提供者

- 完整的行动虚拟网路营运商

- 其他业务类型

- 用户

- 企业

- 消费者

- 按国家

- 中国

- 日本

- 印度

- 韩国

第七章竞争格局

- 公司简介

- Asahi Net Inc.

- Rakuten Mobile Inc.(Rakuten Group, Inc.)

- LG Hello Vision Corporation

- China Mobile International Limited(China Mobile Limited)

- Century Snail Communication Technology Co. Ltd

- Exetel Pty Ltd

- Circles.life

- Tune Talk Sdn Bhd

- SK Telink Co. Ltd(SK Telecom Co. Ltd)

- Japan Communications Inc

- EG Mobile Co. Ltd

- Sakura Mobile

- Mobal Communications Inc.

- BIGLOBE Inc.(KDDI Corporation)

- Giga(Starhub)

- Feels Telecom Corporation Co. Ltd

- Tangerine Telecom

- Amaysim Mobile Pty Ltd

- Altel Communications Sdn Bhd

- reDone Network Sdn Bhd

- Geenet Pte Ltd

- 主要市场供应商的市场占有率分析

第八章投资分析

第九章 市场潜力

The Asia Pacific Mobile Virtual Network Operator Market size is estimated at USD 41.28 billion in 2025, and is expected to reach USD 61.42 billion by 2030, at a CAGR of 8.27% during the forecast period (2025-2030).

Key Highlights

- The constantly growing need for low-cost data and voice services is boosting market growth. This encourages service providers to purchase network services from mobile network operators (MNOs) at wholesale rates and sell them as bundled services at lower rates than those of MNOs. Such low-cost data services allow mobile virtual network operators (MVNOs) to attract consumers and enterprises in the region to purchase data plans from MVNOs at cost-effective rates.

- The increasing smartphone adoption and mobile subscriber base are expected to contribute significantly to industry growth. For instance, according to the data from GSMA, the number of mobile subscribers in South Asia is anticipated to reach 1,089 million by 2025, followed by 510 million subscribers in Southeast Asia.

- In addition, according to the GSMA forecast, the number of mobile subscribers in Northeast Asia is expected to reach 162 million. Such increasing growth of mobile subscribers presents growth opportunities for mobile virtual network operators to expand their market share in the Asia-Pacific region.

- The Asia-Pacific mobile virtual network operators market faces significant challenges due to its dependency on host mobile network operators. This dependency impacts MVNOs' operational and strategic capabilities, restraining their growth and market potential. MVNOs rely on MNOs for network access, which means they have limited control over the quality of service and network coverage. Any shortcomings in the host network directly affect the MVNO's service quality.

- The COVID-19 pandemic has positively fueled the demand for MVNOs' cost-effective data and voice services during the pandemic due to the increased reliance of consumers and businesses on online connectivity. In addition, the digital transformation among businesses in the region spiked post-pandemic, which has further fueled the demand for data services, thus positively impacting the growth of the MVNO market in the Asia-Pacific region.

- In the post-pandemic era, MVNOs in Asia-Pacific countries are analyzed to innovate and introduce new services to meet consumers' and enterprises' evolving needs. From enhanced data offerings to innovative pricing plans, MVNOs are expected to leverage digital technologies, machine learning, and artificial intelligence to deliver personalized and seamless customer experiences. Such developments are expected to positively support the growth of the Asia-Pacific MVNO market in the coming years.

Asia-Pacific MVNOs Market Trends

Enterprise Subscriber Segment is Expected to Witness Significant Growth

- The enterprise segment is analyzed to witness significant growth in the Asia-Pacific MVNO market in the coming years owing to the rising digital transformation among various sectors in Asia-Pacific countries, the growing focus of MVNO operators toward the B2B model considering the growth in the rollout of 5G services in the region, and the rising demand for affordable internet connectivity in businesses across the region.

- The enterprise market is becoming lucrative for MVNO companies, as so many devices connected to a network are less likely to churn compared with the traditional consumer segment. Flexible billing, novel pricing, Bring Your Own Device (BYOD), security, and easy administration are some of the major factors and trends driving the growth of the enterprise segment in the Asia-Pacific MVNO market.

- Moreover, with growing 5G rollouts in Asia-Pacific countries such as India, 5G use cases such as 5G stand-alone and IoT are analyzed to create significant growth opportunities for MVNOs in the enterprise segment. As the IoT ecosystem continues to develop and evolve in Asia-Pacific countries, most of the market vendors are shifting their focus to B2B customers as enterprises increasingly seek real-time connectivity via an array of devices.

- By country, South Korea is analyzed to drive the growth of the enterprise segment owing to the significant presence of MVNOs offering enterprise connectivity solutions, favorable regulatory policies, the growing rollout of 5G services, and digital transformation of businesses in the country. Moreover, new players are entering the enterprise segment to effectively serve the needs of affordable telecommunication services in particular sectors.

- For instance, in June 2024, Woori Bank and LG Uplus signed a memorandum of understanding (MoU) at Woori Bank's Seoul headquarters, solidifying their collaboration in the mobile virtual network operator sector. Their joint focus lies in identifying the specific telecommunication needs within the banking industry, with plans to roll out their MVNO service within the year. With the MoU in place, both entities are set to expedite the creation of unique products and services, fostering a long-term partnership.

- Overall, as industries in the Asia-Pacific region continue to evolve and leverage digital transformation, MVNOs are analyzed to capitalize on new opportunities, from mobile banking to IoT, shaping the future of connectivity. The demand for enterprise voice and data services is analyzed to gain significant traction in businesses to streamline their mobile operations, reduce costs, and improve productivity through customized enterprise solutions.

- The increasing smartphone adoption and mobile subscriber base are expected to contribute significantly to industry growth. For instance, according to the data from GSMA, the number of mobile subscribers in South Asia is anticipated to reach 1,089 million by 2025, followed by 510 million subscribers in Southeast Asia. In addition, according to the GSMA forecast, the number of mobile subscribers in Northeast Asia is expected to reach 162 million. Such increasing growth of mobile subscribers presents growth opportunities for mobile virtual network operators to expand their market share in the Asia-Pacific region.

Mainland China Holds Significant Market Share

- China holds a significant share of the Asia-Pacific MVNO market. The country has always remained at the forefront in the adoption of technological advancements, like 5G technology, connected mobile devices, and smartphone penetration.

- The rollout of 5G networks has opened new opportunities for MVNOs to offer advanced services such as high-speed data, IoT, and smart solutions. The adoption of eSIM technology allows MVNOs to offer more flexible and convenient service activation, attracting tech-savvy customers.

- GSMA's 2024 report, "The Mobile Economy China," reveals that China boasts over 800 million 5G mobile connections. Projections indicate that this year, the share of 5G connections will surpass 50%, solidifying its position as the primary mobile technology in the nation. By the close of 2024, the total number of 5 G connections is expected to exceed 1 billion. In addition, China currently hosts 1.28 billion unique mobile subscribers, showcasing an impressive 88% penetration rate.

- China has been on a consistent trajectory of expanding its mobile phone base station network. In a notable move, China Mobile plans to bolster its 5G infrastructure by adding 410,000 new base stations in 2024, pushing its total count to 2.4 million. This expansion comes even as the company looks to trim its capital expenditure. By the close of 2023, China Mobile had already ramped up its 5G presence, ending the year with 1.9 million stations, a significant jump from the previous year, with an addition of 480,000 sites. Notably, within this count, 620,000 sites were established in collaboration with China Broadnet, focusing on the 700 MHz spectrum.

- The Government of China is pushing the development of the Chinese 5G industry, favoring companies such as Huawei and ZTE, which manufacture the equipment necessary for the technology to work. China is expected to account for the most 5G connections globally in 2025.

Asia-Pacific MVNOs Industry Overview

The Asia-Pacific MVNOs market is highly fragmented, with the presence of major players like Asahi Net Inc., Rakuten Mobile Inc. (Rakuten Group, Inc.), LG Hello Vision Corporation, China Mobile International Limited (China Mobile Limited), and Century Snail Communication Technology Co. Ltd. Players in the market studied are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2024: Giga launched 5G eSIM plans featuring complimentary data roaming to five top destinations. These plans, part of Giga's trio of new offerings, ensure customers enjoy swift, secure, and hassle-free 5G connectivity. The enhanced giga! Mobile plans provided Giga's expansive 5G coverage and highlighted the convenience of eSIM technology. Moreover, subscribers got the benefit of free monthly data roaming in popular spots like Indonesia, Thailand, South Korea, and India.

- March 2024: China Mobile International (CMI) and Singapore Telecommunications Limited (Singtel) signed an MoU during the Mobile World Congress 2024. According to the MoU, CMI and Singtel will jointly build innovative connectivity solutions for enterprise customers to cultivate China and Singapore markets and expand business across the wider Asia-Pacific region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Factors on the Market COVID-19 Impact

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 MVNO Penetration and Characteristics Similar to Major European Countries

- 5.1.2 Regulatory Environment in Most Asian Countries Became Much More Supportive of MVNOs

- 5.1.3 Internet Penetration and e-SIM Solutions Driving the MVNO Market in the Region

- 5.2 Market Restraints

- 5.2.1 Dependency on Host Mobile Network Operators (MNO)

6 MARKET SEGMENTATION

- 6.1 By Operational Mode

- 6.1.1 Reseller

- 6.1.2 Service Operator

- 6.1.3 Full MVNO

- 6.1.4 Other Operational Modes

- 6.2 By Subscriber

- 6.2.1 Enterprise

- 6.2.2 Consumer

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Asahi Net Inc.

- 7.1.2 Rakuten Mobile Inc. (Rakuten Group, Inc.)

- 7.1.3 LG Hello Vision Corporation

- 7.1.4 China Mobile International Limited (China Mobile Limited)

- 7.1.5 Century Snail Communication Technology Co. Ltd

- 7.1.6 Exetel Pty Ltd

- 7.1.7 Circles.life

- 7.1.8 Tune Talk Sdn Bhd

- 7.1.9 SK Telink Co. Ltd (SK Telecom Co. Ltd)

- 7.1.10 Japan Communications Inc

- 7.1.11 EG Mobile Co. Ltd

- 7.1.12 Sakura Mobile

- 7.1.13 Mobal Communications Inc.

- 7.1.14 BIGLOBE Inc. (KDDI Corporation)

- 7.1.15 Giga (Starhub)

- 7.1.16 Feels Telecom Corporation Co. Ltd

- 7.1.17 Tangerine Telecom

- 7.1.18 Amaysim Mobile Pty Ltd

- 7.1.19 Altel Communications Sdn Bhd

- 7.1.20 reDone Network Sdn Bhd

- 7.1.21 Geenet Pte Ltd

- 7.2 Market Share Analysis for Major Market Vendors