|

市场调查报告书

商品编码

1693610

东协虚拟行动服务业者(MVNO) -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)ASEAN Mobile Virtual Network Operator (MVNO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

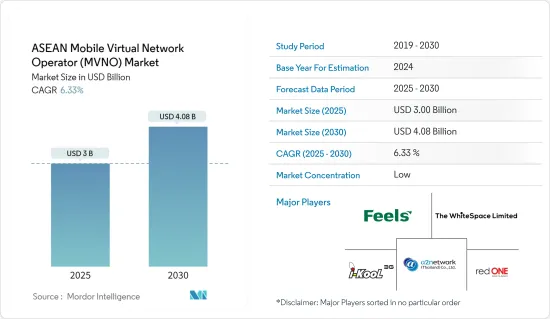

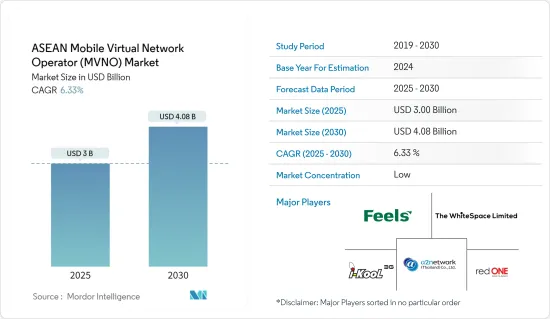

预计东协虚拟行动服务业者市场规模将在 2025 年达到 30 亿美元,到 2030 年达到 40.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.33%。

虚拟行动服务业者(MVNO) 是一家提供行动电话服务但并未拥有提供行动电话服务所需的所有无线电频率分配或基础设施的公司。拥有基础设施和频谱分配的公司被称为「行动网路营运商」。

关键亮点

- 透过专注于针对目标群体的特定价值主张,MVNO 可以在不损害主运营商的重点和品牌形象的情况下在主运营商的网路上扩大用户群。透过这种方式,MVNO 充当运营商的“子品牌”,帮助他们向不同人群提供行动服务。

- 在东协(东南亚国家联盟),泰国、新加坡、马来西亚和越南的网路和智慧型手机普及率很高。这就是 MVNO 在这些国家经历强劲成长的原因。此外,汶莱、缅甸、柬埔寨、印尼和菲律宾等国家正在快速采用数位化,使这些国家的行动虚拟网路营运商产业与通讯业一起加强。

- 虚拟将成为5G网路架构的标誌,并且在大多数情况下,它可能会超越虚拟。一个 MVNO 可以运行所有网络,同时操作每个网络,就像云一样。与4G时代以前一样,5G时代,MVNO将能够利用主运营商的行动网路建立自己的业务。然而,它可能是虚拟核心网路的一个「片段」。在 5G 时代,网路功能虚拟(NFV) 和「切片」对于许多 MVNO 来说可能变得至关重要。

- 该地区 MVNO 市场供应商面临的最大挑战之一是 MNO 不愿意在其网路上託管 MVNO。目前,该国所有主要的 MVNO 营运商均由国有通讯业者国家电信独家託管。

- 除电子商务外,还促进了製造、零售、教育、医疗保健、交通、金融、旅游、媒体和娱乐等领域使用数位技术、通讯和相关服务的业务。这导致疫情期间数据消费量大幅增加,对通讯业产生了积极影响。

东协行动虚拟网路营运商市场趋势

资料区段显着成长

- MVNO 服务的重点已从语音转向数据,有些服务提供以整合服务为中心的独特价值提案,这些整合服务与其母公司提供的其他产品和服务(如游戏和企业云端服务)相连结。

- 印尼的电信业者正在竞相适应不断变化的客户需求。服务供应商专注于提供数据驱动的行动服务,而不是传统的语音和讯息计划,并透过有吸引力的资料通讯费率方案和无限的语音通话来脱颖而出。因此,作为一个以行动为优先的国家,印尼的平均数据价格比邻国低得多也就不足为奇了。

- 此外,寮国、柬埔寨和缅甸等国家日益增长的行动行动电话连接也被认为有助于预测期内的市场成长率。

- 此外,随着 5G 服务在政府和产业推动下开始在该国推出(目前普及率为 30%),未来几年数据消费量可能会增加。预计市场上的供应商将利用这一机会,为游戏玩家、电力用户和企业客户等快速增长的消费者子类别提供具有成本效益的资讯服务。

- 这些国家的网路普及率已相当高。预计这将增加对经济实惠的资料通讯的需求,并有望在预测期内促进 MVNO 市场的成长。

预计新加坡将占很大份额

- 新加坡是世界上最先进的资讯和通讯技术(ICT)市场,也是联繫最紧密的国家之一。根据智慧国家计划,这一领域的成长被视为经济和社会发展的来源。新加坡是世界上第一个在全国推出5G服务的国家,凭藉其发达的通讯基础设施,新加坡拥有该地区最快的行动互联网速度。

- 在新冠疫情和向数位平台转变的推动下,各国政府和其他中东和北非地区参与企业正在加强消除采用数位服务的障碍。例如,新加坡政府成立了新加坡数位办公室(SDO),以推动鼓励数位技术的倡议。

- 此外,许多行动虚拟网路营运商 (MVNO) 正在寻求采用云端方法策略,利用基于公共云端建置的云端原生业务支援服务 (BSS) 的优势。成本将会最小化,并且您可以期待更高的灵活性和更好的客户服务。透过更好地管理资料连接,MVNO 可以提供附加服务和新的收入来源。

- 此外,随着行动通讯业者推出 5G 网络,预计行动宽频市场将受到其提供的更快通讯的推动。物联网 (IoT)、云端游戏、自动驾驶和数位应用都可以受益于更快的行动连线。因此,分析认为,预测期内行动连线数量的增加将对 MVNO 的需求产生重大影响。

东协虚拟行动服务业者概况

东协虚拟行动服务业者(MVNO)市场竞争激烈,众多参与企业竞争激烈。主要参与企业包括 Feels Telecom Corporation Company Limited、Ansar Mobile Sdn Bhd、Gomo 和 The Whitespace Company Ltd (Penguin Sim)。

- 2022年11月,Celcom与Digi履行了MCMC合併后所做的许多承诺。其目的是明确区分 Celcom Digi Berhad 的零售行动业务。其中包括在三年内归还总合70MHz 的频谱、出售 Yoodo 以及设立一个部门来管理行动虚拟网路营运商。

- 2022 年 9 月,Zero1 透过与当地营运商 Singtel 达成协议,在新加坡推出了其 5G MVNO。该 MVNO 依靠新加坡电信的非独立 (NSA) 网路基础设施在新加坡全境提供 5G 服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 东协MVNO市场

- 东协MVNO产业市场概况

- 按组件进行市场区隔分析

- 数据

- 声音的

第五章 5G部署对MVNO的影响

第六章 监理格局洞察

第七章 COVID-19 对通讯业的影响及其对 MVNO 的影响

第八章 国家分析

- 泰国

- 2022 年至 2027 年整个 MVNO 市场的估计与预测

- 主要市场动态和趋势

- 分段分析-数据和语音

- 关键指标:网路普及率、智慧型手机普及率

- 泰国主要行动虚拟网路营运商

- Feels Telecom Corporation Company Limited

- The Whitespace Company Ltd (Penguin Sim)

- Loxley Public Company Limited(i-KOOL 3G)

- a2network (Thailand) Co. Ltd

- Red One Network (Thailand) Co. Ltd

- 泰国MVNO排名

- 新加坡

- 2022 年至 2027 年整个 MVNO 市场的估计与预测

- 主要市场动态和趋势

- 細項分析—资料通讯和通讯

- 关键指标-ARPU、网路普及率、智慧型手机普及率、科技现况(5G、4G等)

- 新加坡领先的行动虚拟网路营运商

- Circles.life

- Gomo

- Geenet Pte Ltd

- RedONE Pte Ltd

- Myrepublic Limited5

- Vivifi

- Zero1 Pte Ltd

- Changi Travel Services Pte Ltd (Changi Mobile)

- StarHub Limited (Giga)

- 新加坡行动虚拟营运商排名

- 马来西亚

- 2022-2027 年 MVNO 市场估计与预测

- 主要市场动态和趋势

- 細項分析—资料通讯和通讯

- 关键指标-ARP、网路普及率、智慧型手机普及率、科技现况(5G、4G等)

- 马来西亚主要行动虚拟网路营运商

- Ansar Mobile Sdn Bhd

- Merchantrade Asia Sdn Bhd

- One XOX Sdn Bhd

- Tune talk Sdn Bhd

- redONE Network Sdn Bhd

- Pavo Communications Sdn Bhd

- Celcom Axiata Berhad (YOODO)

- Altel Communications Sdn Bhd

- MVNO 排名 - 马来西亚

- 越南

- 2022 年至 2027 年整个 MVNO 市场的估计与预测

- 主要市场动态和趋势

- 細項分析—资料通讯和通讯

- 关键指标-ARPU、网路普及率、智慧型手机普及率、科技现况(5G、4G等)

- 越南主要行动虚拟网路营运商

- Indochina Telecom Mobile Join Stock Company

- Masan Group Corporation (Mobicast)

- ASIM电信股份公司(区域)

- 越南MVNO排名

The ASEAN Mobile Virtual Network Operator Market size is estimated at USD 3.00 billion in 2025, and is expected to reach USD 4.08 billion by 2030, at a CAGR of 6.33% during the forecast period (2025-2030).

A mobile virtual network operator (MVNO) is a corporation that provides mobile phone services but does not have its frequency allocation of radio spectrum or all of the infrastructure needed to perform it. A corporation with infrastructure and frequency allocations is called a "mobile network operator."

Key Highlights

- By concentrating on specific value propositions for specialized target customer segments, MVNOs expand the subscriber base on the network of the host operator without compromising the host's focus or brand image. In this way, the MVNO functions as a "sub-brand" for the operator and aids in providing mobile services to various demographics.

- In ASEAN (Association of Southeast Asian Nations), Thailand, Singapore, Malaysia, and Vietnam exhibit high internet and smartphone penetration rates. Hence, the MVNOs are growing significantly in these countries. Moreover, the countries such as Brunei, Myanmar, Cambodia, Indonesia, and the Philippines, are adopting digitalization at a rapid pace and hence are analyzed to bolster the telecom sector and simultaneously the MVNO industry in the countries.

- Virtualization is a 5G network architecture feature, and most may move beyond virtualization. One MVNO may operate all networks metaphorically while concurrently operating none of the networks, much like a cloud. Similar to before 4G, MVNOs could use the host operator's mobile network in the 5G era to establish their own business. However, it might be the "slice" of the virtualized core network. In the 5G era, network functions virtualization (NFV) and "slicing" can be essential for many MVNOs.

- One of the biggest challenges for MVNO market vendors in the region is the reluctance of the MNOs to host MVNOs on their network. Currently, all major MVNO operators in the country are hosted by only the state telecom player National Telecom.

- COVID-19 has led to an acceleration in digital connectivity in ASEAN countries, facilitating not only e-commerce but also businesses using digital technology, communications, and related services in manufacturing, retail, education, healthcare, transportation, finance, tourism, media, and entertainment. This has significantly increased data consumption during the pandemic, thus positively impacting the telecommunications sector.

ASEAN Mobile Virtual Network Operator Market Trends

Data Segment to Witness Significant Growth

- The focus of MVNO service offers has switched from voice to data, and some have developed distinctive value propositions around integrated offerings connected to other products and services provided by the parent company, such as gaming or enterprise cloud services.

- Indonesian telecom firms are racing to adapt to the shifting needs of their customers. The service providers have concentrated more on providing data-oriented mobile services than traditional calling and messaging plans, setting themselves apart from the competition with appealing data pricing plans and unlimited voice conversations. It is, therefore, not unexpected that Indonesia's average data prices are much cheaper than those of its neighbors, given that it is a mobile-first nation.

- Furthermore, mobile cellular connections are expanding in countries such as Laos, Cambodia, Myanmar, and other regions, which are analyzed to contribute to the market growth rate during the forecast period.

- Moreover, as the 5G service started catching up in the country (currently with 30% deployment) with government and industry momentum, the coming years may witness higher volumes of data consumption. Market vendors are expected to capitalize on the opportunity by providing cost-effective data services for actively growing consumer sub-genres in the form of gamers, power users, as well as corporate customers in the country.

- Internet penetration is significantly increasing in these countries. It is analyzed to boost the demand for data requirements at affordable prices, thereby contributing to the growth rate of the MVNO market during the forecast period.

Singapore is Expected to Hold Major Share

- Singapore is one of the most connected countries, as well as one of the most advanced information and communications technology (ICT) marketplaces in the world. According to the smart nation initiative, the sector's growth is considered a source of economic and social development. Singapore, the first nation in the world to attain nationwide 5G service, has the fastest mobile internet speeds in the region, attributed to its well-developed telecom infrastructure.

- Governments and other regional players have increased efforts to eliminate the hurdles to adopting digital services in the context of COVID-19 and the shift to digital platforms. For instance, the Singaporean government developed the Singapore Digital Office (SDO) to promote initiatives that expedite the adoption of digital technology.

- Furthermore, by utilizing the advantages of cloud-native business support services (BSS) built on the public cloud, many MVNOs aim to adopt a cloud approach strategy. Costs are expected to be minimized, with a promise of increased agility and better customer service. MVNOs could provide additional services and new income sources with better data connectivity management.

- Moreover, as mobile operators roll out their 5G networks, the market for mobile broadband is expected to be driven by the ever-faster speeds they offer. The Internet of things (IoT), cloud gaming, autonomous driving, and digital applications can all benefit from faster mobile connections. Therefore, the growing number of mobile connections is analyzed to significantly contribute to the demand for MVNOs during the forecast period.

ASEAN Mobile Virtual Network Operator Industry Overview

The ASEAN mobile virtual network operator (MVNO) market is competitive and consists of significant individual players. Some considerable players include Feels Telecom Corporation Company Limited, Ansar Mobile Sdn Bhd, Gomo, and The Whitespace Company Ltd (Penguin Sim), among other companies.

- In November 2022, Celcom and Digi accepted many commitments made by the MCMC following their merger. It aims to create a clear separation from Celcom Digi Berhad's retail mobile business. This includes returning a total of 70MHz of spectrum over a three-year period, divesting Yoodo, and establishing a separate business unit to manage mobile virtual network operators.

- In September 2022, Zero1 launched 5G MVNO in Singapore via an agreement with local carrier Singtel. The MVNO is relying on Singtel's non-standalone (NSA) network infrastructure for the provision of 5G across the country.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 ASEAN MVNO MARKET

- 4.1 Market Overview of MVNO Industry in ASEAN

- 4.2 Market Segmentation Analysis by Component

- 4.2.1 Data

- 4.2.2 Voice

5 Impact of 5G Deployment on MVNOS

6 Regulatory Landscape Insights

7 Impact of COVID-19 on the Telecom Industry and its Implication on MVNO

8 COUNTRY ANALYSIS

- 8.1 Thailand

- 8.1.1 Overall MVNO Market Estimates and Projections From 2022-2027

- 8.1.2 Key Market Dynamics and Underlying Trends

- 8.1.3 Segmentation Analysis- Data and Voice

- 8.1.4 Key Metrics - Internet Penetration, Smartphone Adoption

- 8.1.5 Key MVNOS - Thailand

- 8.1.5.1 Feels Telecom Corporation Company Limited

- 8.1.5.2 The Whitespace Company Ltd (Penguin Sim)

- 8.1.5.3 Loxley Public Company Limited (I-KOOL 3G)

- 8.1.5.4 a2network (Thailand) Co. Ltd

- 8.1.5.5 Red One Network (Thailand) Co. Ltd

- 8.1.5.6 Ranking of MVNOS - Thailand

- 8.2 Singapore

- 8.2.1 Overall MVNO Market Estimates and Projections from 2022-2027

- 8.2.2 Key Market Dynamics and Underlying Trends

- 8.2.3 Segmentation Analysis-data and Voice

- 8.2.4 Key Metrics-ARPU, Internet Penetration, Smartphone Adoption, Technology Landscape (5G, 4G, Etc.)

- 8.2.5 Key MVNOS - Singapore

- 8.2.5.1 Circles.life

- 8.2.5.2 Gomo

- 8.2.5.3 Geenet Pte Ltd

- 8.2.5.4 RedONE Pte Ltd

- 8.2.5.5 Myrepublic Limited5

- 8.2.5.6 Vivifi

- 8.2.5.7 Zero1 Pte Ltd

- 8.2.5.8 Changi Travel Services Pte Ltd (Changi Mobile)

- 8.2.5.9 StarHub Limited (Giga)

- 8.2.5.10 Ranking of MVNOS - Singapore

- 8.3 Malaysia

- 8.3.1 Overall Mvno Market Estimates and Projections from 2022-2027

- 8.3.2 Key Market Dynamics and Underlying Trends

- 8.3.3 Segmentation Analysis-data and Voice

- 8.3.4 Key Metrics- Arpu, Internet Penetration, Smartphone Adoption, Technology Landscape (5G, 4G, Etc.)

- 8.3.5 Key MVNOS - Malaysia

- 8.3.5.1 Ansar Mobile Sdn Bhd

- 8.3.5.2 Merchantrade Asia Sdn Bhd

- 8.3.5.3 One XOX Sdn Bhd

- 8.3.5.4 Tune talk Sdn Bhd

- 8.3.5.5 redONE Network Sdn Bhd

- 8.3.5.6 Pavo Communications Sdn Bhd

- 8.3.5.7 Celcom Axiata Berhad (YOODO)

- 8.3.5.8 Altel Communications Sdn Bhd

- 8.3.5.9 Ranking of MVNOS - Malaysia

- 8.4 Vietnam

- 8.4.1 Overall MVNO Market Estimates and Projections from 2022-2027

- 8.4.2 Key Market Dynamics and Underlying Trends

- 8.4.3 Segmentation Analysis-data and Voice

- 8.4.4 Key Metrics-ARPU, Internet Penetration, Smartphone Adoption, Technology Landscape (5G, 4G, Etc.)

- 8.4.5 Key MVNOS - Vietnam

- 8.4.5.1 Indochina Telecom Mobile Join Stock Company

- 8.4.5.2 Masan Group Corporation (Mobicast)

- 8.4.5.3 ASIM Telecom Joint Stock Company (Local)

- 8.4.5.4 Ranking of MVNOS - Vietnam