|

市场调查报告书

商品编码

1690935

碳化硅 (SiC) 晶片:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Silicon Carbide (SiC) Wafer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

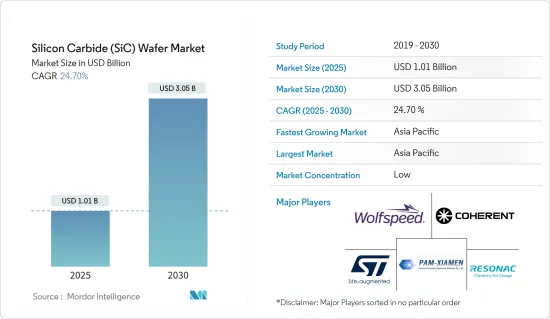

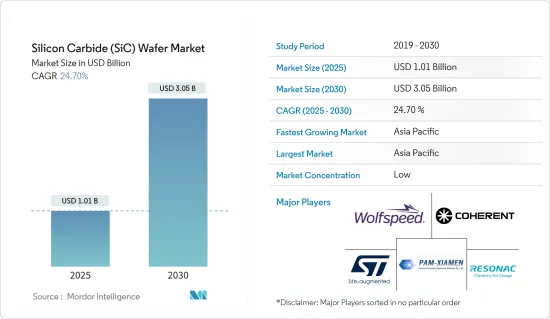

碳化硅 (SiC) 晶圆市场规模预计在 2025 年为 10.1 亿美元,预计到 2030 年将达到 30.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 24.7%。

SiC晶片是一种以其优异的性能而闻名的特殊半导体材料。这些晶片由硅和碳组成,与传统硅晶片相比具有显着的优势,在各种高性能应用中具有重要价值。

主要亮点

- 丹麦奥尔堡大学最近发布的报告预测,到2030年,功率半导体装置的年收益将增加一倍以上。这一预期成长源于这些先进的电子元件在迈向节能社会的道路上至关重要,特别是在应对脱碳数位化的关键挑战方面。与半导体积体电路(IC)在计算、资料储存和通讯的重要作用类似,功率半导体对于现代电力电子至关重要。应用包括可再生能源发电和输电、电动车、自动化工厂、节能资料中心、智慧城市和智慧家庭。

- 作为高压、低损耗、高速开关功率元件的有前途的材料,WBG 半导体正受到越来越多的关注。在WBG半导体中,SiC、GaN、Ga2O3、氮化铝(AIN)和钻石被认为是下一代功率半导体的潜在材料。近年来,材料品质的显着提高、装置设计的创新以及工艺能力的提升推动了 SiC 的进步,从而导致市场上出现了各种各样的技术演示和商业产品。

- 全球汽车产业正在经历重大变革时期,这对能源产业也产生了影响,因为预计到 2030 年电气化将减少每天 500 万桶石油的需求。主要汽车市场的市场趋势和政策努力支持电动车销售的积极前景。根据国际能源总署的战略情境(STEPS),基于现有政策和强有力的目标,到 2030 年,电动车销售的全球份额预计将从先前预测的不到 25% 增加到 35%。

- 在生产流程中,专用的SiC晶片和基板在晶圆厂开发和加工,以生产SiC基功率半导体。许多 SiC 功率半导体用于电力电子,用于转换和控制系统内的电力。

- 晶圆尺寸越大意味着单位面积上的晶粒越多。製造更多晶粒的额外空间使得半导体代工厂或 OSAT(外包半导体组装和测试)能够在给定的时间内製造、测试或组装更多晶粒。这提高了製造或组装新产品的速度。从某种程度上来说,晶圆尺寸的提升也将对供应链带来正面影响。

碳化硅(SiC)晶圆市场趋势

最大的终端用户是汽车和电动车(EV)产业

- SiC 具有比硅更好的热导率,无需复杂的冷却控制即可实现高温功能。它们还具有明显更高的临界电场强度,这意味着它们可以承受快速充电所需的高电压。这些特性使得SiC晶片在汽车工业中得到广泛的应用。

- 随着碳化硅(SiC)晶圆在各种汽车晶片中的使用越来越多,大多数晶片製造商现在都到了关键时刻,认识到SiC晶圆是一项相当安全的投资。 SiC 在许多汽车应用中显示出巨大的潜力,尤其是电池电动车。与硅相比,SiC 可以提高每次充电的行驶里程,减少电池充电时间,并以更低的电池容量和重量实现相同的行驶里程,从而对整体效率做出重大贡献。

- SiC 已成为一种新兴技术,在许多应用中被用来取代硅。将 SiC 晶片引入电动车可提高效率、扩大行驶里程、减轻重量并降低车辆整体成本,从而提高控制电子设备的功率密度。为了提高电动车(EV)的效率和续航里程,我们一直努力降低车辆的总重量和成本。因此,在电动车中使用 SiC 的概念应运而生,这与控制电子设备功率密度的不断增加相吻合。

- SiC 的主要应用之一是在电动车 (EV) 中,它被用作主逆变器。该逆变器在将电池的高直流电压转换为驱动牵引马达所需的交流电压方面起着至关重要的作用。与基于相同结构的IGBT技术的逆变器相比,SiC实现了6~10%的效率提升。主逆变器极大地受益于 SiC 的低传导损耗,尤其是在部分负载条件下运作时。效率的提高意味着更长的续航里程和更小的电池,从而节省空间和成本。

- 电动车需求的不断增长以及销量和投资的增加将使该市场受益匪浅。国际能源总署(IEA)强调,全球汽车产业正经历重大变革时期,对能源产业有重大影响。

- 电动车在市场上越来越受欢迎,其行驶里程也越来越长。根据国际能源总署的数据,电动车市场将呈指数级增长,2023 年全球将註册近 1,400 万辆新电动车,使道路上的电动车总数达到 4,000 万辆。 2023年电动车销量将比2022年增加350万辆,与前一年同期比较增长35%。 2023 年,电动车将占所有汽车销量的约 18%,高于 2022 年的 14%。这些趋势表明,随着电动车市场的成熟,成长仍将保持强劲。至2023年,电池式电动车将占电动车保有量的70%。

亚太地区将经历强劲成长

- 亚太地区是全球领先的碳化硅(SiC)晶片市场,并且由于其在全球半导体市场的主导地位,也受到政府政策的推动。台湾、印度、中国、日本和韩国引领该地区的半导体产业,占据全球半导体市场的相当一部分。相较之下,泰国、越南、新加坡和马来西亚等其他地区也为该地区的主导地位做出了重大贡献。

- 市场显着成长的原因是,包括中国在内的多个国家对节能混合动力电动车的需求不断增加,以减轻日益严重的环境污染的影响。此外,中国汽车年销量和产量均位居世界第一,并继续保持全球主要汽车市场之一的地位。 2025年将迎来国产汽车产量3,500万辆的里程碑。

- 例如,中国汽车产业发展迅速,在全球汽车工业中发挥越来越重要的作用。中国是全球推广电动车最多的国家之一,电动车正变得越来越受欢迎。 2023年8月中国新能源车销量达84.6万辆,其中搭乘用电动车80.8万辆,商用电动车3.9万辆。其中,纯电动车(BEV)乘用车销量55.9万辆,插电式混合动力车(PHEV)乘用车销量24.8万辆。

- 根据国际能源总署预测,2023年中国新电动车註册量将达810万辆,与前一年同期比较成长35%。汽车电池管理系统通常用于电动车和卡车等电动车。电池平衡 IC 等半导体可确保此类应用中的关键安全性和功能性。

- 中国不仅是亚洲,也是世界上最大的半导体市场。它还吸引了许多主要晶片製造商的大量投资,用于建立新工厂和扩大晶片生产。中国公司的全球晶片销售额正在上升,这主要归因于美国和中国之间的紧张关係加剧,以及全国范围内发展中国晶片行业的努力,包括政府补贴、购买优惠和其他激励措施。

碳化硅(SiC)晶圆市场概览

预测期内,市场竞争仍高度分散。所研究的市场由几家全球和地区参与者组成,他们在相当激烈的竞争中争夺市场关注。市场现有企业透过专注于市场扩张、技术创新和收购来继续扩大规模。现有企业包括 Wolfspeed Inc.、II-VI Incorporated、SK Siltron 和 Showa Denko K.K.对整体市场产生重大影响。这些公司透过注重市场扩张和收购来不断扩大业务规模。

- 2024 年 1 月 - 电源系统和物联网半导体领域的全球领导者英飞凌科技股份公司与以碳化硅技术专业知识而闻名的 WaferSpeed, Inc. 宣布延长和扩展其针对 150 毫米碳化硅 (SiC) 晶片的长期协议。该协议最初于 2018 年 2 月签署,现已加强多年产能预留。此次扩大合作将增强英飞凌供应链的稳定性,以满足汽车、太阳能和电动车应用、能源储存系统等领域对碳化硅半导体产品快速成长的需求。

- 2024 年 1 月-英飞凌科技股份公司与碳化硅 (SiC) 供应商 SK Siltron CSS 签署协议。透过该协议,SK Siltron CSS 将向英飞凌提供最高品质、价格具有竞争力的 150 毫米 SiC 晶圆,以提高其 SiC 半导体产量。展望未来,SK Siltron CSS 将在支援英飞凌过渡到 200 毫米晶圆直径方面发挥作用。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术见解

- COVID-19 和其他宏观经济因素的副作用将如何影响市场

第五章 市场动态

- 市场驱动因素

- 电动车普及率上升和 800V 高压电动车架构趋势将推动对 SIC 晶圆的需求

- 高热导率推动电力电子开关和 LED 照明设备对 SiC 晶片的需求

- 市场限制

- 可扩展性、散热和封装限制对晶粒和基板供应造成压力

第六章 市场细分

- 按晶圆尺寸

- 2 英寸、3 英寸、4 英寸

- 6吋

- 8吋、12吋

- 按应用

- 力量

- 射频 (RF)

- 其他用途

- 按最终用户产业

- 电讯

- 汽车和电动车 (EV)

- 太阳能发电/供电/能源储存

- 工业(UPS、马达驱动器等)

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Wolfspeed Inc.

- Coherent Corp.(II-VI Incorporated)

- Xiamen Powerway Advanced Material Co.

- STMicroelectronics(Norstel AB)

- Resonac Holdings Corporation

- Atecom Technology Co. Ltd

- SK Siltron Co. Ltd

- SiCrystal GmbH

- TankeBlue Co. Ltd

- Semiconductor Wafer Inc.

第八章市场占有率分析

第九章投资分析

第十章:市场的未来

The Silicon Carbide Wafer Market size is estimated at USD 1.01 billion in 2025, and is expected to reach USD 3.05 billion by 2030, at a CAGR of 24.7% during the forecast period (2025-2030).

SiC wafers are specialized semiconductor materials known for their exceptional properties. Composed of silicon and carbon, these wafers offer significant advantages over traditional silicon wafers, making them invaluable for a range of high-performance applications.

Key Highlights

- A recent report from Aalborg University in Denmark forecasts that annual revenues from power semiconductor devices will more than double by 2030. This growth is expected, as these advanced electronic components are crucial in addressing significant challenges on the path to an energy-efficient society, particularly decarbonization and digitization. Similar to the essential role of semiconductor integrated circuits (ICs) in computers, data storage, and communication, power semiconductors are integral to modern power electronics. Their applications include renewable power generation and transmission, electromobility, automated factories, energy-efficient data centers, smart cities, smart homes, and more.

- WBG semiconductors have received increasing attention as promising materials for high-voltage, low-loss, and fast-switching power devices. Among the WBG semiconductors, SiC, GaN, Ga2O3, aluminum nitride (AIN), and diamond are considered to be potential materials for the next generations of power semiconductors. In recent years, significant advancements in material quality, innovative device designs, and improved process capabilities have driven the progress of SiCs, resulting in a broad range of technology demonstrators and commercial products now available in the market.

- The global auto industry is undergoing a sea change, with implications for the energy sector, as electrification is set to avoid the need for 5 million barrels of oil a day by 2030. Market trends and policy efforts in major car markets support a bright outlook for EV sales. Under the IEA Stated Policies Scenario (STEPS), the global outlook for the share of electric car sales based on existing policies and firm objectives has increased to 35% in 2030, up from less than 25% in the previous outlook.

- In the production flow, specialized SiC wafers and substrates are developed and processed in a fab, resulting in SiC-based power semiconductors. Many SiC-based power semiconductors are used in power electronics, where the devices convert and control the electricity in systems.

- A larger wafer size offers more dies per unit area. The extra space to fabricate more dies enables semiconductor fabrication plants and OSATs (outsourced semiconductor assembly and test) to manufacture, test, or assemble more dies in a specific time. This increases the rate at which new products can be fabricated or assembled. To some extent, increasing wafer size also impacts the supply chain positively.

Silicon Carbide (SiC) Wafer Market Trends

Automotive and Electric Vehicles (EVs) Industry to be the Largest End User

- SiC possesses superior thermal conductivity to silicon, facilitating high-temperature functionality with uncomplicated cooling regulation. It exhibits a significantly higher critical electric field strength, enabling it to endure the elevated voltages required for rapid battery charging. These attributes have paved the way for extensive utilization of SiC wafers within the Automotive industry.

- The increasing utilization of silicon carbide (SiC) wafers in various automotive chips has reached a critical juncture where most chipmakers now perceive it as a reasonably secure investment. SiC exhibits immense potential for numerous automotive applications, especially in battery electric vehicles. It can enhance the driving range per charge compared to silicon, decrease the battery charging time, and significantly contribute to the overall efficiency equation by delivering the same range with reduced battery capacity and weight.

- SiC has become an advanced technology that is employed as a substitute for silicon in numerous applications. Integrating SiC wafers in electric vehicles has enhanced efficiency, extended range, reduced weight, and lowered costs for the entire vehicle, consequently amplifying the power density of control electronics. Endeavors were undertaken to boost the efficiency and range of electric cars (EVs) by minimizing the weight and cost of the overall vehicle. As a result, the concept of utilizing SiC for EVs emerged, aligning with the escalating power density of control electronics.

- SiC finds one of its primary uses in electric vehicles (EVs) as the main inverter. This inverter plays a crucial role in converting the high DC voltage from the batteries into the necessary AC voltage to drive the traction electric motor. Compared to inverters based on IGBT technology and having the same structure, SiC provides an efficiency enhancement ranging from 6-10%. The main inverter benefits significantly from SiC's lower conduction losses, mainly when operating under partial load conditions. This increased effectiveness results in extended range or reduced battery size, saving space and cost.

- The market is set to benefit significantly from the rising demand for battery electric vehicles, as well as the increasing sales and investments. The global automotive industry is undergoing a significant transformation, as highlighted by the International Energy Agency (IEA), with profound implications for the energy sector.

- EVs are gaining traction in the market, which has also increased the range. According to IEA, electric car markets are seeing exponential growth as almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million. Electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase. Electric cars accounted for around 18% of all cars sold in 2023, up from 14% in 2022. These trends indicate that growth remains robust as electric car markets mature. Battery electric cars accounted for 70% of the electric car stock in 2023.

Asia Pacific to Register Major Growth

- The Asia-Pacific is a major market for silicon carbide wafers worldwide, which government policies have also helped because of its dominating position in the global semiconductor market. Taiwan, India, China, Japan, and South Korea have driven the region's semiconductor industry, which comprises a considerable share of the global semiconductor market. In contrast, other regions such as Thailand, Vietnam, Singapore, and Malaysia have also contributed significantly to its dominance.

- Significant market growth can be attributed to the rising demand for energy-efficient hybrid electric vehicles in several nations, including China, to reduce the effects of rising environmental pollution. In addition, China retains its status as the leading vehicle market globally, boasting the highest annual sales and manufacturing output. By 2025, the nation is poised to reach a milestone, producing an estimated 35 million vehicles domestically.

- For instance, China's automotive sector is proliferating, and the region plays a more significant role in the global auto industry. China is one of the top countries that have adopted electric vehicles, which are becoming increasingly popular. In August 2023, China's new energy vehicle sales reached 846,000 units, with passenger electric vehicles accounting for 808,000 units and commercial electric vehicles for 39,000 units. Specifically, sales figures for passenger battery electric vehicles (BEVs) stood at 559,000 units, while passenger plug-in hybrid electric vehicles (PHEVs) saw sales of 248,000 units.

- According to the IEA, new electric car registrations in China hit 8.1 million in 2023, marking a 35% increase from the previous year as consumers switched from gas-guzzler models due to government subsidies and high oil prices. Automotive battery management systems are commonly used in electric vehicles, including electric cars, trucks, etc. Semiconductors, such as battery-balancing ICs, are crucial safety and functionality enablers in such applications.

- China is the largest semiconductor market, not just in Asia but also in the world. The country is also attracting large investments from many major chip manufacturers to expand chip production by setting up new factories. Chinese companies' global chip sales are rising, largely due to rising US-China tensions and nationwide efforts to develop China's chip sector, including government subsidies, purchasing preferences, and other preferential measures.

Silicon Carbide (SiC) Wafer Market Overview

The degree of competition in the market studied is highly fragmented over the forecast period. The market studied comprises several global and regional players vying for attention in a fairly contested market space. Market incumbents have been continuously expanding their scales of operation by focusing on market expansions, innovations, and acquisitions. Market incumbents, such as Wolfspeed Inc., II-VI Incorporated, SK Siltron Co. Ltd, and Showa Denko KK, considerably influence the overall market. These firms have been continuously expanding their scales of operation by focusing on market expansions and acquisitions.

- January 2024 - Infineon Technologies AG, a global leader in power systems and IoT semiconductors, and Wolfspeed Inc., renowned for its expertise in silicon carbide technology, announced an extension and expansion of their long-term agreement for 150 mm silicon carbide wafers. Initially inked in February 2018, this agreement has now been bolstered with a multi-year capacity reservation. This enhanced collaboration fortifies Infineon's supply chain stability and addresses the surging demand for silicon carbide semiconductor products across automotive, solar, EV applications, and energy storage systems.

- January 2024 - Infineon Technologies AG inked a deal with silicon carbide (SiC) supplier SK Siltron CSS. As per the terms, SK Siltron CSS will supply Infineon with top-notch, competitively-priced 150-millimeter SiC wafers, bolstering the production of SiC semiconductors. Moving forward, SK Siltron CSS is set to be instrumental in aiding Infineon's shift to a 200-millimeter wafer diameter.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Insights

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of EV and the Inclination Toward High-voltage 800V EV Architectures Propelling the Demand for SIC Wafers

- 5.1.2 Increasing Demand for SiC Wafers in Power Electronic Switches and LED Lighting Devices due to its High Thermal Conductivity

- 5.2 Market Restraints

- 5.2.1 Limiting Constraints Such as Scalability, Heat Dissipation, and Packaging-related Pressure on the Die and Substrate Supply

6 MARKET SEGMENTATION

- 6.1 By Wafer Size

- 6.1.1 2-, 3-, and 4-inch

- 6.1.2 6-inch

- 6.1.3 8- and 12-inch

- 6.2 By Application

- 6.2.1 Power

- 6.2.2 Radio Frequency (RF)

- 6.2.3 Other Applications

- 6.3 By End-user Industry

- 6.3.1 Telecom and Communications

- 6.3.2 Automotive and Electric Vehicles (EVs)

- 6.3.3 Photovoltaic/Power Supply/Energy Storage

- 6.3.4 Industrial (UPS and Motor Drives, etc.)

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Wolfspeed Inc.

- 7.1.2 Coherent Corp. (II-VI Incorporated)

- 7.1.3 Xiamen Powerway Advanced Material Co.

- 7.1.4 STMicroelectronics (Norstel AB)

- 7.1.5 Resonac Holdings Corporation

- 7.1.6 Atecom Technology Co. Ltd

- 7.1.7 SK Siltron Co. Ltd

- 7.1.8 SiCrystal GmbH

- 7.1.9 TankeBlue Co. Ltd

- 7.1.10 Semiconductor Wafer Inc.