|

市场调查报告书

商品编码

1692104

氢气生成-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Hydrogen Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

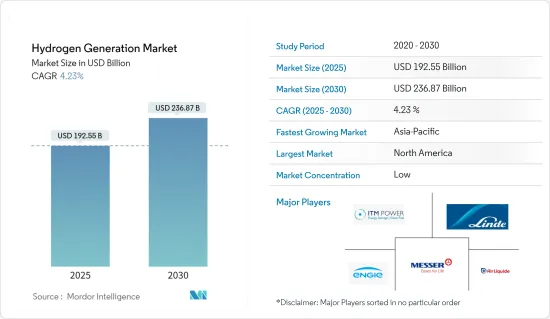

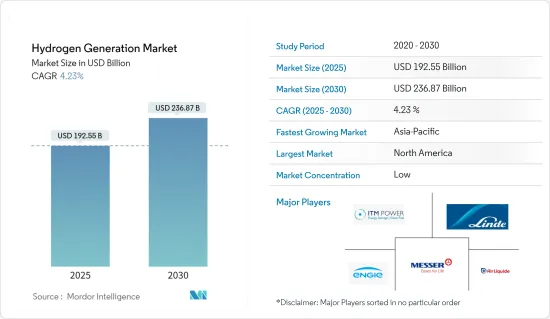

预计 2025 年氢气市场规模为 1,925.5 亿美元,到 2030 年将达到 2,368.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.23%。

从中期来看,预计政府支持政策以及炼油厂和工业部门不断增长的需求等因素将在预测期内推动氢气生产市场的发展。

主要亮点

- 同时,能源储存的高製造成本预计将抑制制氢市场的发展。

- 然而,从可再生能源中提取氢气的技术的进步以及氢气作为燃料的使用增加可能会在预测期内为氢气生成市场提供有利的成长机会。

- 由于对氢的需求不断增加,亚太地区是预测期内成长最快的市场。这一增长归因于印度、中国和日本等国家的投资增加以及政府的支持政策。

氢气生产市场趋势

预计精製业将主导市场

- 在石油精製中使用氢气至关重要。精製使用一种称为加氢脱硫的化学分离製程来去除其生产的燃料中的硫。它也用于精製的加氢裂解和重整过程。重整是从石油中去除含硫化合物以获得高等级燃料的过程,从而减少空气污染。将氢气添加到原油和氧气中,以提供精製产品(柴油、液化石油气、汽油等)。

- 根据能源研究所的《世界能源统计评论》,2021年至2022年石油精製能力成长率为0.5%,但过去十年的年增长率为0.7%。随着亚太地区各种计划的即将实施,预计未来几年精製能力将持续成长。预计市场成长也将受到对清洁燃料的需求、政府对石油产品脱硫的规定以及原油品质整体下降的推动。随着原油品质下降,精製过程中需要更多的氢气来维持最终产品的品质。

- 根据美国能源资讯署提供的信息,亚洲和中东地区至少有 9 个炼油厂计划已经运作或计划于 2023 年底投入运作。一旦这些炼油计划达到运作,预计将以其预期生产能力计算,将为全球炼油产能额外贡献290万桶/日。预计这将在预测期内推动对氢气生产的需求。

- 随着石油需求的增加,炼油厂的建设步伐和投资也持续成长。国际能源总署(IEA)在2022年6月的《石油市场报告》中预测,2022年全球净精製能力将增加100万桶/日,2023年将进一步增加160万桶/日,预计这将在预测期内增加氢气生产需求。

- 此外,透过投资减少氢气生产碳排放的技术,例如碳捕获和利用,精製产业可以与全球永续性目标保持一致,并对氢气作为绿色能源来源的作用产生积极影响。

- 例如,2023年2月,主要企业印度石油公司(IOC)启动了一项价值2兆印度卢比的绿色转型策略,目标是2046年实现其营运的净零排放。作为这项倡议的一部分,印度石油公司计划在其所有炼油厂建立绿色氢气设施。

- 因此,鑑于上述情况,预计炼油厂部门将在预测期内占据市场主导地位。

亚太地区快速成长

- 亚太地区正在成为全球氢气生产市场的关键参与者,中国、印度、日本和韩国等国家处于这个快速发展的产业的前沿。这种动态变化背后有几个因素,包括对清洁和永续能源来源的需求不断增长,以及该地区致力于减少碳排放和实现雄心勃勃的气候变迁目标。

- 这些国家的战略倡议、综合研究和协作努力使亚太制氢市场成为创新和投资的中心。亚太氢能市场的特点是拥有多种多样的技术和计划,旨在利用氢作为清洁能源的潜力。

- 2022年,中国政府发布了2021年至2035年的氢能长期蓝图。根据最新的政府蓝图,中国的目标是到2025年每年生产10万至20万吨可再生氢能,并有5万辆氢能汽车上路。

- 同样,印度政府和私营部门也采取了一系列措施来追求绿色氢能。政府推出了多项政策措施和奖励来鼓励绿氢能计划和基础设施发展。印度政府推出的国家氢能计画(NHEM)概述了氢气生产、储存和利用的蓝图。

- 多家公司和研究机构正在进行先导计画和伙伴关係,以评估氢气生产的可行性。该国采取的综合方针结合了绿色和蓝氢倡议,这与该国致力于在整个氢能供应链中减少碳排放的承诺相一致。

- 例如,2023年5月,东京工业大学资讯能源研究教育联盟与东京工业大学能源资讯学院合作,推出了一种燃料电池,可以透过将废弃塑胶材料中提取的氢气与氢气结合来发电。

- 因此,鑑于上述情况,预计亚太地区在预测期内将显着增长。

氢气生产产业概况

氢气生产市场相当分散。市场的主要企业(不分先后顺序)包括 ITM Power plc、Linde plc、Engie SA、The Messer Group GmbH 和 Air Liquide SA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2028 年市场规模与需求预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 政府优惠政策

- 炼油厂和工业部门的需求增加

- 限制因素

- 製造成本上升

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 起源

- 蓝氢

- 绿色氢气

- 灰氢

- 科技

- 蒸汽甲烷重整(SMR)

- 煤炭气化

- 其他技术

- 应用

- 精製

- 化学处理

- 钢铁生产

- 其他用途

- 区域市场分析

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 义大利

- 英国

- 俄罗斯联邦

- 其他欧洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章竞争格局

- 合併、收购、合作及合资

- 主要企业策略

- 公司简介

- Linde plc

- Air Liquide

- Messer Group GmbH

- ITM Power plc

- Engie SA

- Cummins

- Air Products & Chemicals

- Fuel Cell Energy

- Taiyo Nippon

- McPhy Energy

- Enapter

第七章 市场机会与未来趋势

- 技术进步

The Hydrogen Generation Market size is estimated at USD 192.55 billion in 2025, and is expected to reach USD 236.87 billion by 2030, at a CAGR of 4.23% during the forecast period (2025-2030).

Over the medium term, factors such as supportive government policies coupled with the increasing demand from refineries and the industrial sector are likely to drive the hydrogen generation market during the forecast period.

Key Highlights

- On the other hand, high production costs of hydrogen energy storage are expected to restrain the hydrogen generation market.

- Nevertheless, technological advancements in extracting hydrogen from renewable sources and increased applications of hydrogen as a fuel are likely to create lucrative growth opportunities for the hydrogen generation market during the forecast period.

- Asia-Pacific is the fastest-growing market during the forecast period due to the rising hydrogen demand. This growth is attributed to increasing investments, coupled with supportive government policies in the countries such as India, China, and Japan.

Hydrogen Generation Market Trends

Oil Refining Segment Expected to Dominate the Market

- The use of hydrogen in oil refining is indispensable. Oil refineries are used to remove sulfur from the fuels they produce in a chemical separation process called hydro desulphurization. It is also used for hydro-cracking and reforming processes in oil refineries. Reforming is the process of removal of sulfur compounds from petroleum to obtain high-grade fuel, thus reducing air pollution. Hydrogen is added to crude oil and oxygen to deliver refined petroleum products (e.g., diesel, LPG, and gasoline).

- According to the Energy Institute Statistical Review of World Energy, the oil refining capacity witnessed a growth rate of 0.5% between 2021 and 2022, whereas the annual growth rate in the last decade was 0.7%. The oil refining capacity is expected to follow the growth trend in the coming years due to various upcoming projects in the Asia-Pacific region. The market's growth is also expected to be driven by the demand for cleaner fuels, government regulations for the desulfurization of petroleum products, and the general decline in crude oil quality. As the rate of crude decreases, the volume of hydrogen required for the refinement process increases to maintain the quality of end products.

- As per the information provided by the US Energy Information Administration, there are at least nine refinery projects in Asia and the Middle East that are in the process of commencing operations or were slated to become operational by the conclusion of 2023. These projects, based on their intended capacities, are expected to contribute an additional 2.9 million barrels per day (b/d) to the global refinery capacity when they reach full operational status. Thus, this is anticipated to drive the demand for hydrogen generation during the forecast period.

- The pace and refinery investments continue to follow the increase in the oil demand. In the International Energy Agency's (IEA) June 2022 Oil Market Report, the IEA expects net global refining capacity to expand by one million BPD in 2022 and by an additional 1.6 million BPD in 2023, which is expected to increase the demand for hydrogen generation during the forecast period.

- Moreover, by investing in technologies that reduce the carbon footprint of hydrogen production, such as carbon capture and utilization, the oil refining segment can align with global sustainability objectives and proactively influence the role of hydrogen as a green energy source.

- For instance, in February 2023, the leading Indian oil company, Indian Oil Corporation (IOC), embarked on a green transformation strategy worth INR 2 trillion, with the aim of achieving net-zero emissions from its operational activities by 2046. As part of this initiative, Indian Oil Corporation plans to establish green hydrogen facilities at all of its refineries.

- Therefore, as per the points mentioned above, the refinery segment is expected to dominate the market during the forecast period.

Asia-Pacific Region Fastest Growing Market

- The Asia-Pacific region has emerged as a pivotal player in the global hydrogen generation market, with countries like China, India, Japan, and South Korea at the forefront of this rapidly evolving industry. This dynamic shift can be attributed to several factors, including the increasing demand for clean and sustainable energy sources and the region's commitment to reducing carbon emissions and achieving ambitious climate goals.

- These countries' strategic initiatives, comprehensive research, and concerted efforts make the Asia-Pacific hydrogen generation market a hub for innovation and investment. The Asia-Pacific hydrogen generation market is characterized by a diverse range of technologies and projects aimed at harnessing the potential of hydrogen as a clean energy carrier.

- In 2022, the Chinese government unveiled its inaugural long-range blueprint for hydrogen, outlining the period spanning from 2021 to 2035. As per the most recent government blueprint, China aims to manufacture between 100,000 and 200,000 tons of renewable hydrogen each year and establish a fleet of 50,000 hydrogen-powered vehicles by 2025.

- Similarly, India's pursuit of green hydrogen is marked by various initiatives, both at the governmental and private sector levels. The government has introduced several policy measures and incentives to encourage green hydrogen projects and infrastructure development. The National Hydrogen Energy Mission (NHEM), launched by the Indian government, outlines a roadmap for hydrogen production, storage, and utilization.

- Several companies and research institutions are engaged in pilot projects and partnerships to assess the viability of hydrogen production. The country's comprehensive approach, combining green and blue hydrogen initiatives, aligns with its commitment to lowering carbon emissions throughout the hydrogen supply chain.

- For instance, in May 2023, the Tokyo Tech InfoSyEnergy Research and Education Consortium, in collaboration with the Tokyo Tech Academy of Energy and Informatics, introduced a fuel cell capable of producing electricity using a combination of hydrogen and hydrogen derived from waste plastic materials.

- Therefore, as per the points mentioned above, the Asia-Pacific region is expected to witness significant growth during the forecast period.

Hydrogen Generation Industry Overview

The hydrogen generation market is moderately fragmented. Some of the major players in the market (in no particular order) include ITM Power plc, Linde plc, Engie SA, The Messer Group GmbH, and Air Liquide SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Favorable Government Policies

- 4.5.1.2 Increasing Demand From Refinery and Industrial Sector

- 4.5.2 Restraints

- 4.5.2.1 Higher Production Cost

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Blue hydrogen

- 5.1.2 Green hydrogen

- 5.1.3 Grey Hydrogen

- 5.2 Technology

- 5.2.1 Steam Methane Reforming (SMR)

- 5.2.2 Coal Gasification

- 5.2.3 Other Technologies

- 5.3 Application

- 5.3.1 Oil Refining

- 5.3.2 Chemical Processing

- 5.3.3 Iron & Steel Production

- 5.3.4 Other Applications

- 5.4 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 Italy

- 5.4.2.4 United Kingdom

- 5.4.2.5 Russian Federation

- 5.4.2.6 Rest of Europe

- 5.4.3 Middle East & Africa

- 5.4.3.1 Saudi Arabia

- 5.4.3.2 United Arab Emirates

- 5.4.3.3 South Africa

- 5.4.3.4 Rest of Middle East and Africa

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Linde plc

- 6.3.2 Air Liquide

- 6.3.3 Messer Group GmbH

- 6.3.4 ITM Power plc

- 6.3.5 Engie SA

- 6.3.6 Cummins

- 6.3.7 Air Products & Chemicals

- 6.3.8 Fuel Cell Energy

- 6.3.9 Taiyo Nippon

- 6.3.10 McPhy Energy

- 6.3.11 Enapter

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements